The long-term success of an insurance agency is fundamentally dependent on its ability to turn fragmented client data into deeply loyal, long-term relationships and secure recurring renewals. Yet, far too many agencies are still hampered by disconnected spreadsheets, chaotic email threads, and siloed carrier portals. This friction not only slows teams down but actively hides valuable sales and retention opportunities.

The right platform breaks this inefficient cycle by transforming scattered information into a unified, intelligent playbook, giving your entire team the momentum needed to close deals faster and serve clients with total confidence. A flexible, no-code system is specifically built to connect and automate these complex workflows across your entire book of business.

This comprehensive article guides you through precisely how to find the best CRM software for your insurance agents. We will discover the essential features your team needs for high-velocity growth, compares the top platforms on the market side-by-side, and provides a straightforward, strategic framework for selecting a system that not only drives immediate growth but truly empowers your team for the future.

Key Takeaways

- CRM is your operational backbone: a dedicated CRM transforms fragmented client data into a single, strategic asset, enabling proactive growth and better customer retention, rather than just acting as a contact database.

- Flexibility over rigidity: insurance agencies need platforms that can adapt to unique workflows for different lines of business. Highly visual, no-code platforms like monday CRM are ideal for customizing complex policy, claim, and commission tracking software needs without specialized IT support.

- Seamless integration is critical: the best systems serve as the connective tissue for your entire tech stack, ensuring smooth data flow between email, quoting tools, and carrier portals, which eliminates redundant data entry and accelerates the sales cycle.

- The investment is in adoption: the true ROI of a CRM is determined by how quickly and fully your agents use it. Prioritize systems with intuitive, visual interfaces that promote immediate user buy-in over complex systems with steep learning curves.

- Proactive vs. reactive: modern CRM features, including AI-driven insights and automated renewal reminders, shift your team from manually reacting to approaching deadlines to proactively serving clients and securing long-term loyalty.

What is an insurance CRM?

An insurance CRM functions as your team’s central playbook, built specifically for the unique rhythm of policies, renewals, and commissions. It’s a system designed to speak your language, moving beyond the one-size-fits-all approach of generic platforms that don’t understand your world.

This is how the system eliminates the endless spreadsheet chase, pulling every policy detail, renewal date, and client conversation into one organized space. By automating the routine tasks, your agents can finally focus their energy on what they do best: building relationships and advising clients.

Ultimately, this is about giving your team the visibility and control to move faster and with total confidence. When everyone is aligned and the busywork is handled, you create the momentum needed to grow your book of business and serve clients like never before.

Why does your insurance agency needs CRM software?

In a competitive insurance landscape, success often hinges on how well you manage and leverage your data. Relying on scattered spreadsheets creates blind spots, slows your team down, and turns valuable information into operational risk. A dedicated CRM replaces this fragmentation with a single, connected system that strengthens every part of your agency.

A modern CRM helps your team work with greater accuracy and intention by:

- Centralizing every lead, policy, and interaction: Agents get a complete picture of each client, eliminating guesswork and inconsistent follow-up.

- Automating renewal reminders and next steps: The system flags upcoming deadlines, prompting timely outreach that protects retention and prevents missed opportunities.

- Freeing agents from manual admin tasks: Automation clears repetitive work, giving your team more time to deepen client relationships and identify meaningful cross-sell opportunities.

- Aligning your entire team around one source of truth: Everyone has instant access to client history, policy details, and past conversations — creating a consistent, dependable service experience.

This unified approach transforms your CRM into the operational backbone of your agency. With better visibility, stronger collaboration, and more proactive engagement, your team can scale efficiently and build the kind of reliability and trust that sets your agency apart.

Try monday work managementBest insurance CRM software for agents and brokers

| Platform | Best for | Starting price | Key strenght |

|---|---|---|---|

| monday CRM | Most adaptable, all agency sizes | $10/user/month | Visual, customizable, integrated work OS |

| HubSpot CRM | Marketing-focused agencies | Free (paid tiers) | Inbound marketing, integrations, free tier |

| Salesforce Financial Services Cloud | Large/enterprise agencies | $150/user/month | Advanced customization, reporting |

| AgencyBloc | Life & health insurance agencies | $70/user/month | Insurance-specific workflows |

| Applied Epic | Established, multi-line agencies | Custom pricing | Comprehensive agency management |

| Zoho CRM | Small to medium agencies | $14/user/month | Affordable, customizable, business suite |

1. monday CRM

monday CRM transforms how insurance agencies manage their entire sales cycle with a visual, no-code platform that adapts to any workflow. The platform specializes in extreme customization without technical complexity, making it perfect for agencies that need flexibility as they scale. Built on the monday Work OS foundation, it seamlessly connects sales, service, and operations in one unified workspace.

Example:

As a dedicated solution, monday CRM empowers insurance agencies to build custom workflows that match their unique sales processes while automating repetitive tasks and providing real-time visibility into pipeline performance.

Key features:

- Visual pipeline management: with drag-and-drop deal progression and customizable stages.

- No-code automation: recipes for lead assignment, follow-ups, and status updates.

- 360° customer view: with centralized contact management and interaction tracking.

Pricing:

- Free: $0 (up to two seats, three boards, basic features).

- Basic: $9/month per seat (billed annually, unlimited items, 5GB storage).

- Standard: $12/month per seat (billed annually, includes automations and integrations).

- Pro: $19/month per seat (billed annually, advanced features and 25,000 combined automation and integration actions).

- Enterprise: contact sales (enterprise-scale features and 250,000 combined automation and integration actions).

- Minimum user requirement: pricing requires a minimum of three users.

- Billing options: plans are available with monthly billing, or you can save 18% with an annual plan.

Why it stands out:

- Unmatched customization and visual control: allows agencies to build their exact workflow without coding, while the visual interface makes complex sales data instantly digestible for quick decision-making.

- Unified Work OS: seamlessly connects CRM with project management and operations for complete visibility across the entire agency, eliminating data silos.

- Advanced AI features: includes AI action item generation to convert ideas into follow-ups, smart email composition, and natural language formula building for complex pipeline reporting.

- Robust automations: provides one-click automation recipes and pre-built sequences for managing personalized campaigns, with enterprise-scale capacity to support high-volume agencies.

- Targeted insurance workflows and integrations: enables building custom policy renewal tracking, claims management, and commission dashboards, supported by API access and connections with 200+ popular applications for seamless data flow.

2. HubSpot CRM

HubSpot CRM delivers a comprehensive all-in-one platform that unifies marketing, sales, and customer service for insurance agencies. The platform specializes in inbound marketing methodology and offers a powerful free tier, making it particularly attractive for agencies looking to attract and nurture leads through digital channels.

Example:

HubSpot CRM excels for insurance agencies that want to integrate their marketing efforts with sales activities, providing a unified view of the customer journey from initial lead capture through policy renewal.

Key features:

- AI-powered Breeze Assistant: for company research, sales call preparation, and automated CRM record summarization.

- Comprehensive pipeline management: with deal tracking, revenue forecasting, and customizable sales stages.

- Integrated marketing tools: including email campaigns, landing pages, and lead nurturing workflows.

Pricing:

- Free: core CRM features with contact management, deal tracking, and basic reporting.

- Starter: $15/month per seat with required fields, permission sets, and enhanced features.

- Professional: $50/month per seat including AI customer agent and custom reporting capabilities.

- Enterprise: $75/month per seat with custom objects, advanced security features, and premium support.

Considerations:

- Pricing can escalate quickly: as agencies scale and require advanced features, with significant jumps between tiers.

- Limited customization options: compared to more specialized insurance CRM platforms, which may not accommodate complex insurance workflows.

3. Salesforce Financial Services Cloud

Salesforce Financial Services Cloud delivers enterprise-grade CRM capabilities specifically designed for large insurance agencies and brokerages. The platform combines advanced customization options with powerful AI-driven insights, making it ideal for complex operations that need sophisticated reporting and extensive third-party integrations.

Example:

Salesforce Financial Services Cloud serves large insurance agencies and brokerages that require enterprise-level customization, extensive third-party app marketplace access, and robust reporting capabilities to manage complex client relationships and regulatory requirements.

Key features:

- AI-powered customer insights: autonomous AI agents and conversational AI interface provide deep customer analytics and automated lead follow-up plans.

- 360-degree customer view: unified platform integrating sales, service, marketing, and commerce data across all customer touchpoints.

- Extensive customization and integration: scalable platform with MuleSoft integration capabilities and access to the AppExchange marketplace for third-party applications.

Pricing:

- Contact Salesforce sales team: for custom enterprise pricing.

- Pricing varies: based on features, user count, and customization requirements.

- Free 30-day trial: available with no credit card required.

Considerations:

- Higher price point: compared to other CRM solutions, making it less accessible for smaller agencies.

- Requires dedicated IT resources and technical expertise: to fully leverage advanced customization and integration capabilities.

4. AgencyBloc

AgencyBloc delivers a comprehensive insurance agency management system built specifically for life and health insurance professionals. The platform specializes in industry-specific workflows like commission tracking and policy management, making it ideal for agencies that need more than a generic CRM can offer.

Example:

AgencyBloc serves as an all-in-one solution for life and health insurance agencies looking to streamline client management, automate commission processing, and maintain compliance with industry regulations.

Key features:

- Commission tracking and automation: automatically calculates commissions, tracks payments, and identifies missed revenue from carriers.

- Policy management with renewal alerts: centralizes policy information and sends automated notifications for upcoming renewals.

- Industry-specific compliance tools: built-in features for managing Scope of Appointment (SOA) and ACA Consent to Contact requirements.

Pricing:

- Contact sales: for custom pricing based on agency size and requirements.

- Specific pricing tiers: not available publicly.

Considerations:

- Limited customization options: for reporting compared to more flexible CRM platforms.

- Initial setup process: can be time-intensive and requires significant data migration effort.

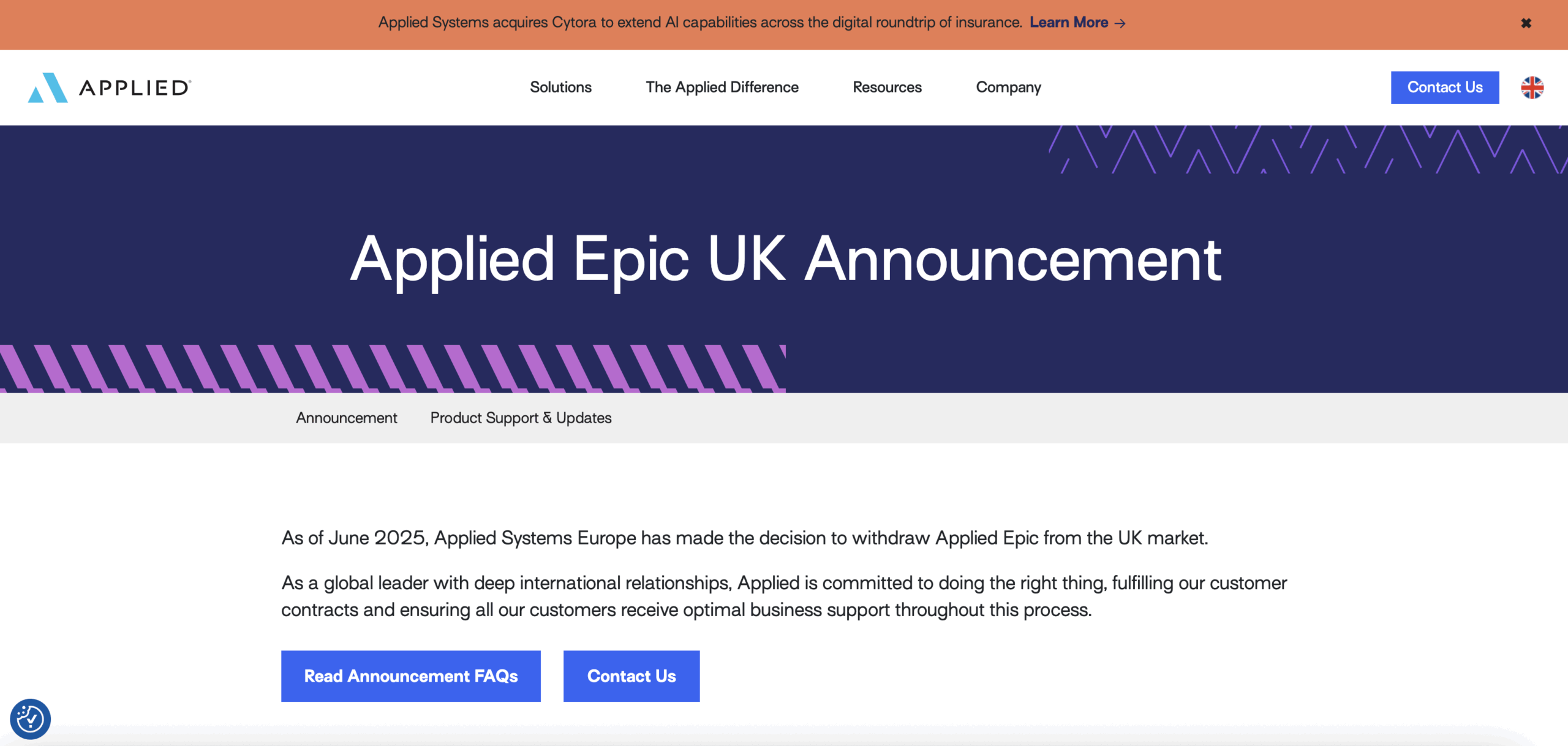

5. Applied Epic

Applied Epic delivers comprehensive agency management specifically designed for established insurance agencies handling complex, multi-line operations. The platform excels at integrating policy management, accounting, and carrier connectivity into one unified system, making it the go-to choice for mid-to-large agencies seeking complete operational control.

Example:

Applied Epic provides a single, integrated platform for managing entire agency operations, from client relationships and policy administration to accounting and commission tracking across both PandC and benefits lines.

Key features:

- Comprehensive agency management system: with embedded CRM functionality for complete client lifecycle management.

- Seamless integration: with Salesforce for advanced sales operations while maintaining back-office automation.

- Robust analytics and reporting capabilities: with over 50 out-of-the-box insurance reports and customizable dashboards.

Pricing:

- Contact sales: for custom pricing based on agency size and requirements.

- Specific pricing tiers: not available publicly.

Considerations:

- Steep learning curve and complex setup process: that can overwhelm new users and require significant training investment.

- “Clicky” interface: requiring multiple steps for simple tasks, which can slow down daily operations compared to more streamlined competitors.

6. Zoho CRM

Zoho CRM delivers comprehensive customer relationship management with deep customization capabilities and AI-powered automation. The platform specializes in providing an all-in-one business solution through its integrated ecosystem of 50+ applications, making it ideal for small to medium-sized insurance agencies seeking cost-effective growth without sacrificing functionality.

Example:

Zoho CRM empowers insurance agencies to manage their entire customer lifecycle from lead capture to policy renewal through customizable workflows and AI-driven insights.

Key features:

- Zia AI assistant: provides predictive lead scoring, email sentiment analysis, and automated task recommendations to help agents prioritize high-value prospects.

- Blueprint process management: ensures consistent policy workflows and compliance tracking across your entire sales team.

- Omnichannel communication hub: centralizes all customer interactions from email, phone, social media, and live chat in one unified dashboard.

Pricing:

- Standard: $14/month per user (billed annually).

- Professional: $23/month per user (billed annually).

- Enterprise: $40/month per user (billed annually).

- Ultimate: $52/month per user (billed annually).

- Free tier: available for up to 3 users with basic CRM functionality.

- Zoho One bundle: includes 50+ business applications for $37/month per user.

Considerations:

- Initial setup and customization: can feel overwhelming due to the extensive feature set and configuration options.

- Inconsistencies: customer support response times and occasional bugs in certain modules.

How to select the right insurance agency CRM

Selecting the right CRM is a strategic decision that hinges on three core principles. First, map your agency’s real-world processes from lead intake to policy renewal. A successful CRM must solve your specific challenges, so a clear understanding of your current workflows—and their friction points—is the essential starting point.

Second, prioritize seamless integration. Your CRM should serve as the connective tissue for your entire tech stack, from email and quoting tools to carrier portals. Platforms like monday CRM excel at automating these handoffs, eliminating redundant data entry and freeing up valuable time for client-facing activities.

Finally, focus on user adoption. The most powerful features are worthless if your team won’t use them. An intuitive, visual system promotes immediate buy-in, giving everyone confidence and complete visibility from day one. The true value of a CRM is measured not by its feature list, but by how quickly your team embraces it to drive results.

Try monday work management

How monday CRM turns your insurance team into a powerhouse

Running an insurance agency often feels like you’re trying to conduct an orchestra where every musician is playing a different song. A great CRM brings everyone onto the same sheet of music, transforming that chaos into a winning performance. It’s about giving your team the visibility and control they need to move faster, stay aligned, and close deals with confidence.

Instead of forcing your team into a rigid, one-size-fits-all system, the right platform moulds to your unique workflows.

monday CRM is built to be that flexible playbook for your agency. It combines the powerful, industry-specific tools you need with the adaptability to grow alongside you, making it a true competitive advantage your team will actually love using.

See the whole picture with unified policy management

Give your team a complete, 360-degree view of every client’s policy portfolio in one clean visual. When they can instantly see all coverage details — from life and health to auto and property — spotting cross-sell opportunities and providing top-tier service becomes second nature. It’s about turning data into stronger relationships.

Automate commissions and celebrate every win

Manual commission tracking and spreadsheet errors drain precious hours and erode team morale. We help you build automated workflows that handle even the most complex splits for agents and teams, creating total transparency. This isn’t just about saving time; it’s about building trust and keeping your top performers motivated.

Make compliance your competitive edge

In an industry built on trust, paperwork and compliance can’t be an afterthought. monday CRM embeds secure document storage, e-signatures, and audit trails directly into your sales process, making compliance an automatic reflex. Your team gets to focus on selling, knowing all the boxes are checked for them.

Deliver quotes instantly and close deals faster

Frustrating back-and-forth communication kills deal momentum. By connecting directly with carriers for real-time quoting, your team can generate multiple options, create professional proposals, and send them to prospects right from the CRM. This is how you get ahead of the competition and turn prospects into clients before they look elsewhere.

Empower your agents on the go

Your agents are rarely tied to a desk, and their most important platform shouldn’t be either. The monday.com mobile app gives your team full access to client info, quoting tools, and task management from anywhere. Whether they’re at a client’s home or between meetings, they stay connected and productive.

Build custom workflows for every insurance line

Your process for selling life insurance is completely different from property and casualty, so why should your CRM treat them the same? We empower you to design unique, automated workflows for each line of business. This is your agency’s playbook, built your way, ensuring your CRM works exactly how your team works best.

The content in this article is provided for informational purposes only and, to the best of monday.com’s knowledge, the information provided in this article is accurate and up-to-date at the time of publication. That said, monday.com encourages readers to verify all information directly.

Try monday work managementFrequently asked questions

What is the difference between general CRM and insurance-specific CRM software?

The difference between a general CRM and an insurance-specific CRM is that an insurance-specific CRM has pre-built features like policy management, while a flexible platform like monday CRM lets you build those same workflows to match exactly how your team works. You get all the power of a specialized tool, with the freedom to adapt and grow without being locked into a rigid system.

How much does CRM software for insurance agents typically cost?

Costs can range from $15 to over $150 per user monthly, but the real value is found in platforms that balance powerful automation and reporting with a fair price. The better question isn't about the monthly cost, but the return you'll get from time saved and opportunities captured.

Can small independent insurance agents benefit from CRM software?

Yes, and they often see the biggest gains because a CRM helps them punch above their weight and compete with larger agencies. It automates the administrative work, freeing up your small-but-mighty team to focus on building client relationships and closing deals.

How do insurance agents migrate data from spreadsheets to a new CRM?

Moving data from spreadsheets is easier than you think, as platforms like monday CRM have simple import tools to guide you. The whole process is much smoother if you take a moment to clean up your data first, ensuring you start fresh with organized, reliable information.

Which CRM works best for life insurance agents specifically?

The best CRM for life insurance agents is one that masters long-term relationship building, which is where a flexible platform shines. With monday CRM, you can build custom pipelines and automated nurturing sequences to stay top-of-mind throughout those longer sales cycles, ensuring no opportunity slips through the cracks.

What ROI can insurance agents expect from implementing CRM software?

Agents often see a clear ROI through higher conversion rates and better client retention, but the real win is the confidence that comes from visibility. You’ll finally see what’s working—from lead sources to follow-ups—so you can stop guessing and start making data-driven decisions that grow your book of business.