Ensuring a seamless and enjoyable customer experience is crucial for banks. With competition rising from cryptocurrencies, borderless bank accounts, and fintech solutions, it’s unsurprising that many banks are feeling the pressure. Not only that, but customers are also expecting a more personalized banking experience.

Banks have a lot to gain by investing in CRM infrastructure. Modern CRMs are helping banks provide a personalized customer journey, automate manual workflows, and leverage data to improve processes and make better decisions. In this article, we’ll dive deeper into the uses of a CRM for banking, including its benefits, features to look for, and our picks of the best CRMs for the banking industry, including monday CRM.

Try monday CRMWhat is a CRM for banking?

A customer relationship management (CRM) platform helps banks track client interactions, automate processes, maintain consistent communication, and analyze data to deliver better service.

Banking CRMs bring together marketing, sales, service, and compliance workflows into one system, giving teams a unified view of every customer relationship — down to the individual level.

In today’s digital-first environment, customers expect faster, more personalized service. To meet those expectations, banks need accurate, real-time data that supports tailored offers, proactive recommendations, and quicker response times than competitors.

How banks use CRM

Banks use CRM systems to centralize client data, personalize service, and automate daily processes that would otherwise slow teams down. A well-implemented CRM allows bankers to:

- Track every client interaction across branches, mobile apps, and call centers in a single view

- Recommend loans, credit cards, or investments based on customer history and preferences

- Automate regulatory documentation and audit trails to stay compliant

- Improve collaboration by giving teams real-time access to customer information

With these capabilities, banks move beyond transactional service to build long-term, trusted client relationships.

The benefits of using a CRM for banking

When implemented correctly, CRMs can help teams thoughtfully approach strategies to nurture customer relationships. Stronger customer relationships lead to happier customers who are more likely to trust your bank and sign on for additional services.

Here are some of the key benefits that come with using a CRM:

- Tailor offerings to upsell products and services at the right time.

- Deliver omnichannel service by unifying client communications across all touchpoints.

- Streamline operations by consolidating data and eliminating silos.

- Boost retention with personalized service that makes customers feel valued.

- Strengthen trust and loyalty through better team collaboration and follow-up.

- Generate insights with reliable data on sales, trends, and customer behavior.

- Safeguard data and ensure compliance with built-in security and audit features.

Features to look for in a banking CRM system

One of the best ways to find the right CRM software for your bank is to consider the features you need to make your work more efficient. CRMs give you access to tons of features, but if you’re not considerate of your specific requirements, you can find yourself purchasing a platform with lots of bells and whistles that still doesn’t fit your needs. Here are features to look for:

- Advanced data insights for real-time performance and customer reporting

- AI-driven automations to eliminate manual tasks like follow-ups and approvals

- Predictive analytics and forecasting to anticipate customer needs and sales opportunities

- Seamless integrations with marketing platforms, core banking systems, and customer service tools

- Cloud and mobile access for bankers working across branches or in the field

- Security certifications and controls to ensure compliance and safeguard sensitive data

- Document management and sharing for contracts, quotes, and regulatory forms

- Generative AI tools to draft personalized emails, proposals, and financial documents

- Lead management features to track, nurture, and convert prospects into long-term clients

The 10 best CRM platforms for the banking industry

Selecting the right CRM involves a few different considerations. First, you need to find a platform with features that align with your top priorities when it comes to building customer relationships. Some banking CRMs may be more focused on customer service, which won’t be a good fit for teams that need to create and nurture more leads.

In the table below, we’ve compared 10 of the top CRMs for banking side-by-side. For a more detailed overview of each, keep reading for the full reviews to see which one best fits your business.

| Platform | Use case | Starting price | Free trial | G2 rating |

|---|---|---|---|---|

| monday CRM | Enhanced visibility and AI-powered customization | $12/month/seat | 14 days | 4.6/5 (G2) |

| Salesforce Financial Services Cloud | Specialized financial services workflows with built-in compliance automation | $325/user/month | 30 days | 4.3/5 (G2) |

| SugarCRM | Predictive insights to improve retention and drive growth | $19/user/month | N/A | 4.0/5 (G2) |

| Creatio | No-code automation for seamless financial workflows | $25/user/month | N/A | 4.7/5 (G2) |

| Microsoft Dynamics 365 | Microsoft ecosystem integration with intelligent data management | $65/user/month | 30 days | 3.8/5 (G2) |

| Zoho CRM | Affordable solution with intelligent sales automation | $14/user/month | 15 days | 4.1/5 (G2) |

| 360view | CRM for banks and credit unions with deep reporting | Custom pricing | N/A | 4.3/5 (G2) |

| HubSpot Smart CRM | Scalable CRM for marketing and sales alignment | $15/month/user | Free Forever plan | 4.4/5 (G2) |

| Affinity CRM | Relationship intelligence to map and strengthen investor connections | $2,000/user/month | N/A | 4.4/5 (G2) |

| Oracle NetSuite | Cloud ERP integration with intelligent lifecycle management | Custom pricing | N/A | 4.1/5 (G2) |

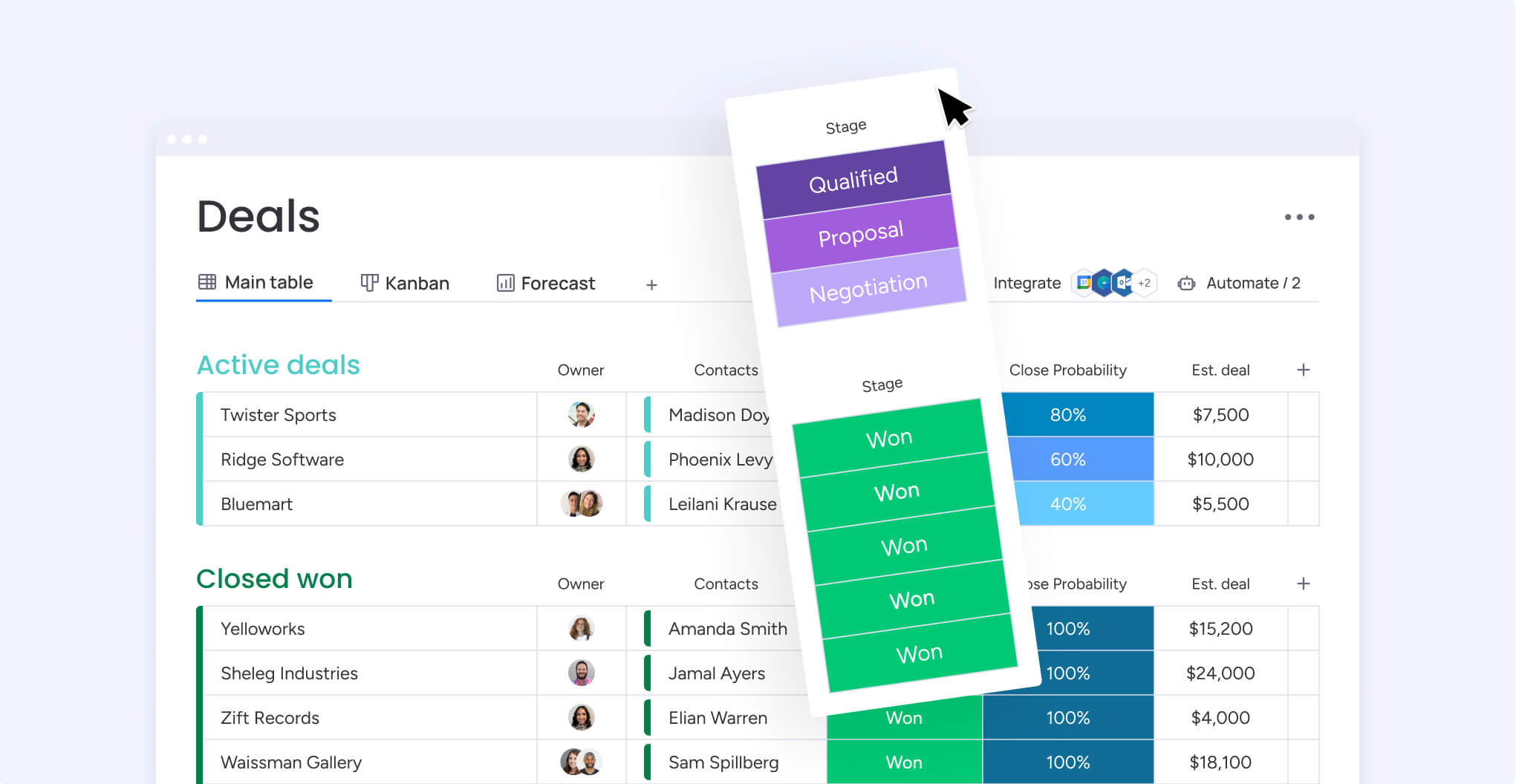

1. monday CRM

For banking teams that want to improve sales and client relationships, monday CRM provides deep visibility into the entire sales process from lead to close. Backed by advanced AI technology, monday CRM facilitates simple customization that allows teams to create tailored boards that reflect how your team manages customers. Its intuitive interface also makes it easy to tailor the platform for any banking need while still staying flexible and easy to use.

monday CRM features

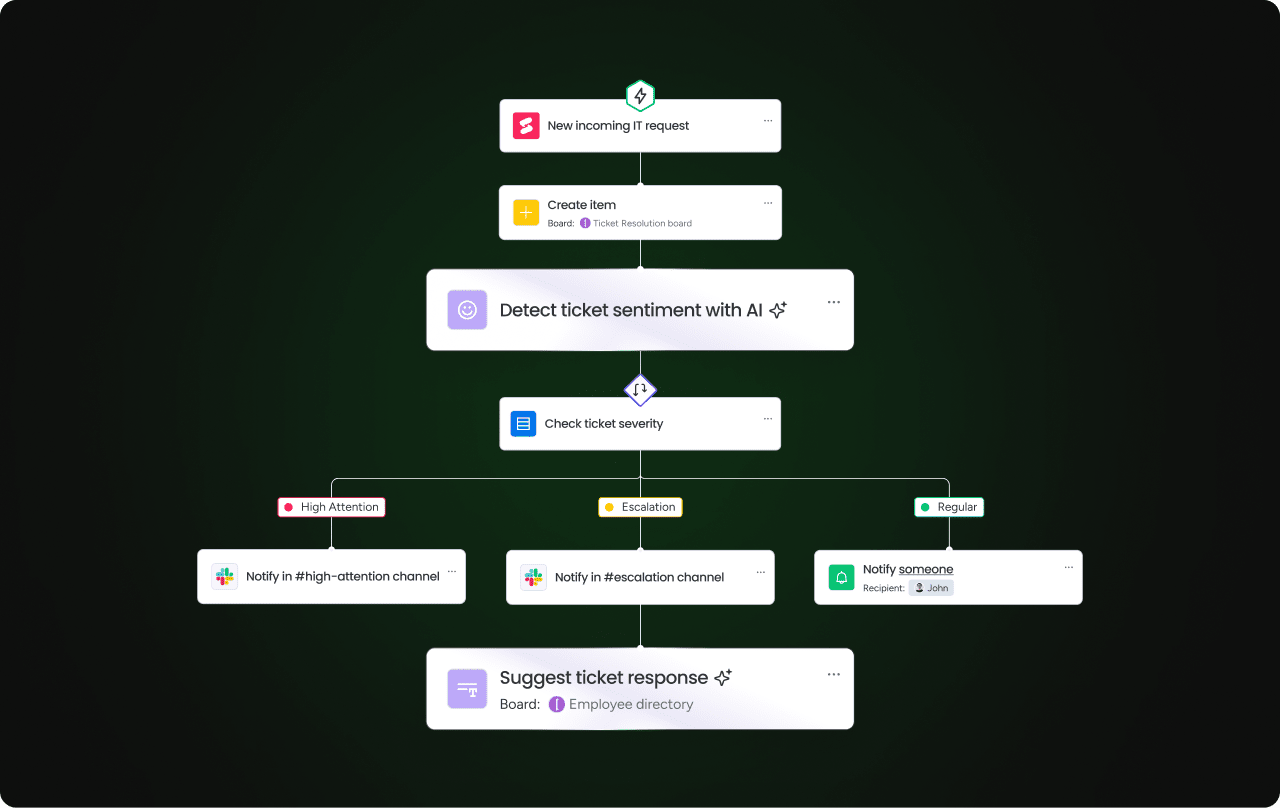

- Automated lead evaluation and finance request workflows

- AI-powered assistant monday sidekick for next-step deal guidance

- Predictive analytics for customer and performance insights

monday CRM pricing

- Plans starting from $12/month/seat

- Free 14-day trial

Learn more about monday CRM plans and pricing.

What users are saying

G2 rating: 4.6/5

“What I like most is how easy it is to use once everything is set up. The interface is clean, intuitive, and makes day-to-day tasks like updating client info or tracking progress straightforward. It’s helped streamline how I manage leads and client communications, and it’s made a noticeable difference in keeping things on track.” — Cynthia F.

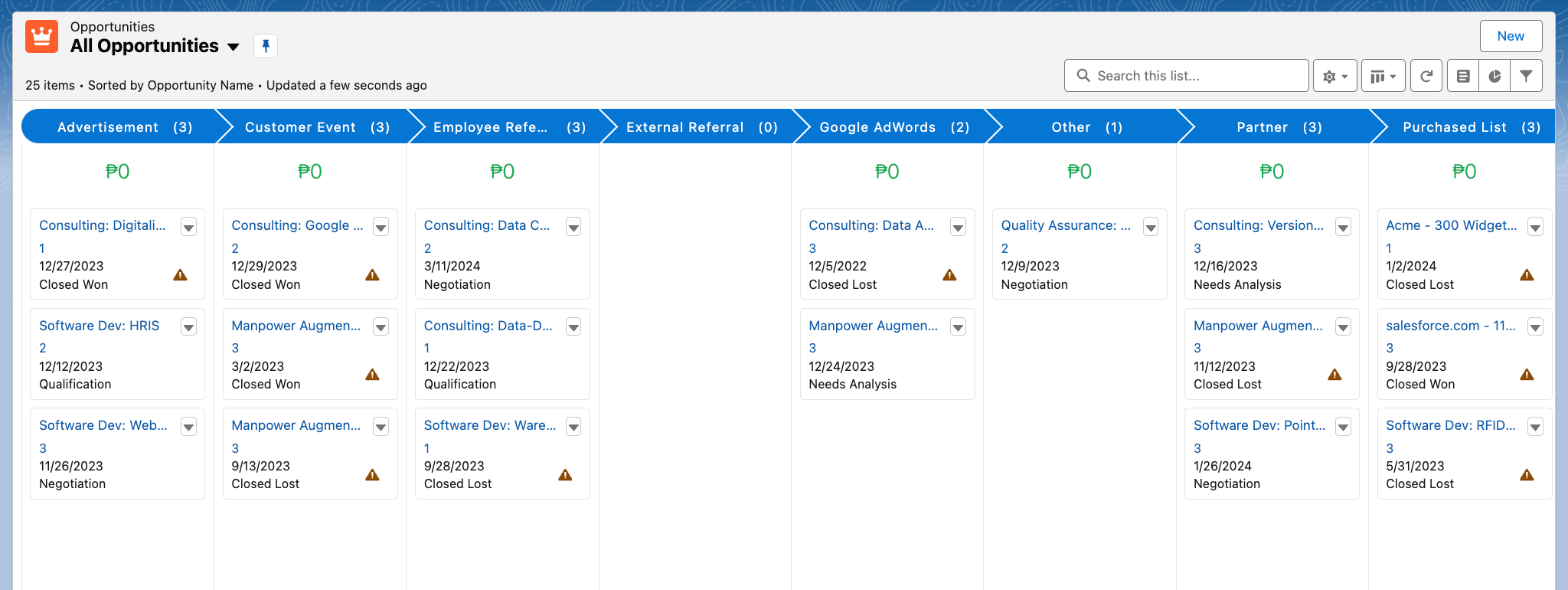

Try monday CRM2. Salesforce Financial Services Cloud

Use case: Specialized financial services workflows with built-in compliance automation

Salesforce Financial Services Cloud is a fully customizable CRM module for sales, marketing, and support, catering to the financial services industry. With it, you can access, store, and collect data for banking, wealth managers, and insurance platforms in one place. This type of finance CRM allows teams to access the tools they need to make smarter customer relationship decisions.

Salesforce Financial Services Cloud features

- AI-driven onboarding for faster client acquisition

- Einstein predictive analytics for cross-sell and risk detection

- Compliance automation with audit-ready workflows

Salesforce Financial Services Cloud pricing

- Plans starting from $325/user/month

- Free 30-day trial

What users are saying

G2 rating: 4.3/5

“What I like best about Salesforce Financial Services Cloud is how it brings together customer information, financial accounts, and interactions in one place. The ability to view a complete, 360-degree profile of each client helps us deliver personalized advice and build stronger relationships. The platform’s flexibility allows us to configure it to fit our specific workflows without compromising on security or compliance requirements.” — Raveendhran M.

3. SugarCRM

Use case: Predictive insights to improve retention and drive growth

SugarCRM prioritizes customer experience by using historical data and artificial intelligence to provide actionable insights into managing customer relationships. This affordable yet powerful platform helps your team support business growth, automate marketing tasks, and improve customer retention.

SugarCRM features

- SugarPredict analytics for customer forecasting

- Intelligent lead scoring and prioritization

- Workflow automation for lead nurturing and qualification

SugarCRM pricing

Plans starting from $19/user/month

What users are saying

G2 rating: 4.0/5

“What I appreciate most about SugarCRM is its incredible customization and flexibility. While many CRMs have a one-size-fits-all feeling, you can truly customize it according to your business needs. We have been able to add and modify fields, screens, and even whole modules to fit our company’s specific workflow. Plus, it has some pretty powerful reporting and forecasting capabilities, which adds value for my team.” — Shubhangi M.

4. Creatio

Use case: No-code automation for seamless financial workflows

Creatio is a no-code platform for both CRM and business processes. Creatio combines marketing, sales, and customer service in one comprehensive solution. It provides a complete view of the entire customer lifecycle and automates complex financial processes.

Creatio features

- AI-based lead scoring for upsell and cross-sell opportunities

- No-code process automation for loans and debt management

- Predictive analytics for portfolio and wealth insights

Creatio pricing

Plans starting from $25/user/month

What users are saying

G2 rating: 4.7/5

“The development and customization is so simple with no-code. We were developing our own CRM in the house, however, it was taking a lot of time and efforts of the whole team. With Creatio we were able to go live in several months and yet have the ability to customize it fully.” — Andrii Z.

5. Microsoft Dynamics 365

Use case: Microsoft ecosystem integration with intelligent data management

A powerful CRM for financial institutions, Microsoft Dynamics 365 also functions as an ERP (enterprise resource planning) product with powerful analytics. The platform puts AI front and center to help teams increase productivity and understand their customer better with deep insights.

Microsoft Dynamics 365 features

- Copilot AI assistant for personalized service

- AI-driven insights for customer relationship decisions

- Intelligent workflow automation for sales sequences

Microsoft Dynamics 365 pricing

- Plans starting from $65/user/month

- Free 30-day trial

What users are saying

G2 rating: 3.8/5

“Dynamics 365 Sales provides us with a powerful set of tools and capabilities to streamline our sales processes, enhance customer relationships, and make data-driven decisions. The comprehensive CRM functionalities, integration with other Microsoft products, intelligent insights, mobile accessibility, and scalability make it an invaluable asset for our sales teams.” — Muhammad Y.

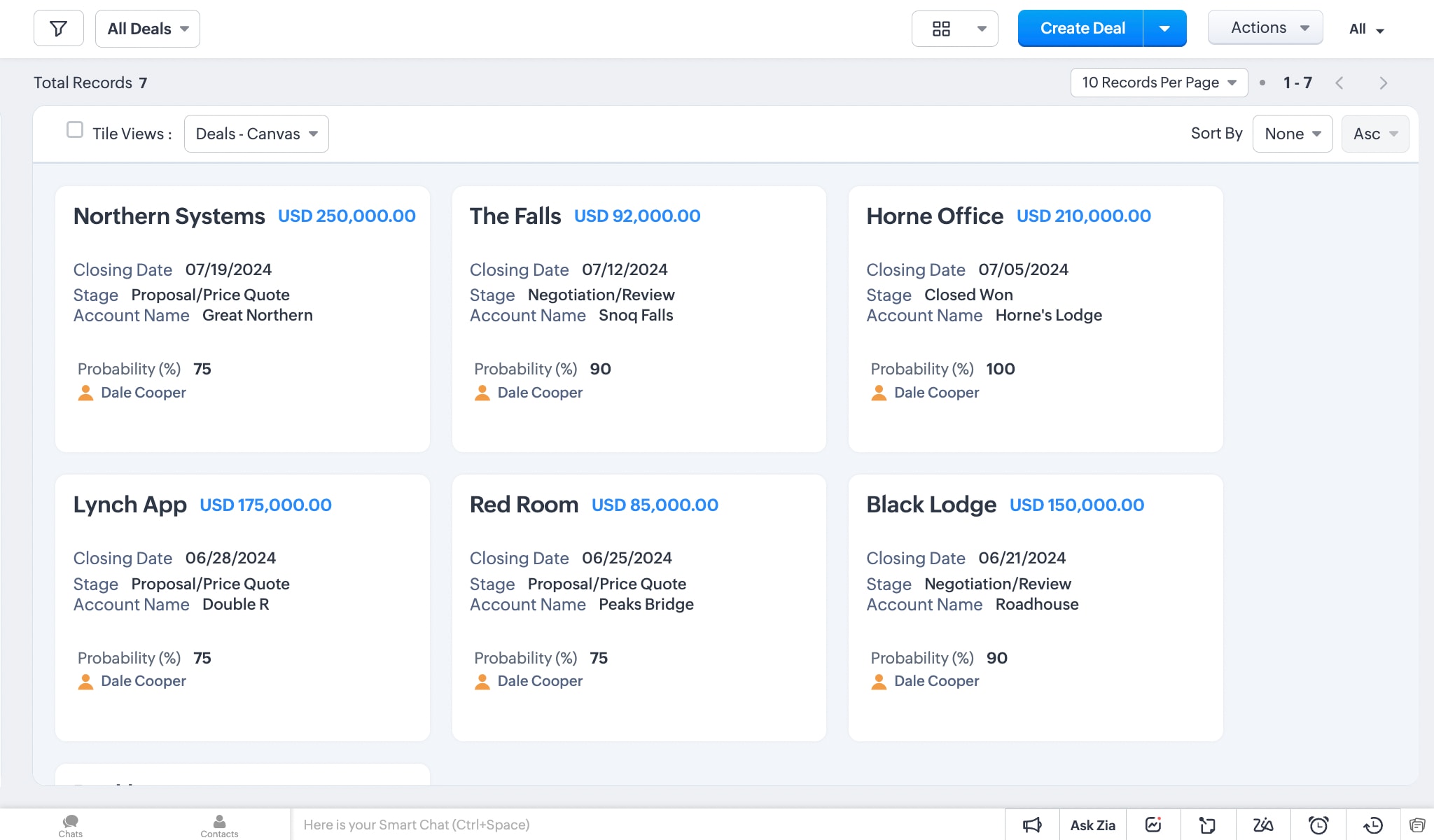

6. Zoho CRM

Use case: Affordable solution with intelligent sales automation

Zoho CRM offers a complete customer relationship management solution with advanced AI capabilities at competitive pricing. Part of the larger Zoho ecosystem, it provides banking teams with intelligent automation, predictive analytics, and seamless integration to streamline client management and improve sales productivity.

Zoho CRM features

- Zia AI assistant for predictive lead scoring

- Workflow automation to speed deal progression

- Built-in compliance with GDPR and security standards

Zoho CRM pricing

- Plans starting from $14/user/month

- Free 15-day trial

What users are saying

G2 rating: 4.1/5

“I like best about Zoho CRM is its flexibility and ease of customization. The platform allows you to tailor modules, workflows, and dashboards to suit your specific business processes without needing extensive coding knowledge. The user interface is clean and intuitive, making it easy for new users to adopt quickly.” — Muhammad J.

7. 360view

Use case: CRM for banks and credit unions with deep reporting

360view is a CRM platform built specifically with banks and credit unions in mind. As the name suggests, its main benefit is to provide a 360-degree view of relationships, products, services, and more. Banks can track unlimited relationship types, such as vendors, customers, and employees. It can also track loans past due and provide robust reporting.

360view features

- Advanced analytics for cross-sell and account growth

- Multichannel touchpoint tracking for client visibility

- Customer journey automation for improved experience

360view pricing

Custom pricing available upon request.

What users are saying

G2 rating: 4.3/5

“The software really helps us to manage our member relationships. We have an almost 360-degree view of our members’ entire relationship. In addition, many of our former manual processes are now automated. It also helps our staff have total visibility regarding member communication.” — Verified user

8. HubSpot Smart CRM

Use case: Scalable CRM for marketing and sales alignment

HubSpot is a reliable platform when it comes to platforms for sales, marketing, and customer service. The HubSpot Smart CRM helps banking teams keep track of leads and customers at different stages in their journey through managing contacts, sales, pipeline, digital marketing, nurturing leads, and more.

HubSpot Smart CRM features

- AI email writer for personalized communication

- Smart meeting scheduler for faster booking

- Predictive lead scoring for prioritizing prospects

HubSpot Smart CRM pricing

- Free Forever plan

- Plans starting from $15/month/user

What users are saying

G2 rating: 4.4/5

“I like HubSpot because the layout is clean and simple, making it easy to navigate. It has all the standard CRM features, like tracking the progress of prospects’ calls and activities, but I particularly appreciate the built-in email assistant, which makes my workflow much easier.” — Alain D.

9. Affinity CRM

Use case: Relationship intelligence to map and strengthen investor connections

Affinity CRM is a private capital platform that combines CRM functionality with advanced data analytics to help investment banks and private equity firms identify and manage deal opportunities. It automatically captures relationship data and uses AI to surface the best paths to prospects, making it particularly powerful for deal sourcing and relationship mapping.

Affinity features

- AI-based relationship scoring for warm introductions

- Automated data capture from meetings and email

- Pipeline management for team-wide deal alignment

Affinity pricing

Plans starting from $2,000/user/month

What users are saying

G2 rating: 4.4/5

“Affinity’s ingestion of email data allows for very efficient capture of our universe of real world interactions. When you combine that with the ability to upload your own data, build lists and capture all interactions with very limited manual work, it was a game changer for us as we launched our fund.” — Zach M.

10. Oracle NetSuite

Use case: Cloud ERP integration with intelligent lifecycle management

Oracle NetSuite is a cloud-based solution that delivers a real-time, 360-degree view of your customers. NetSuite provides a seamless flow of information across the entire customer lifecycle while promising to automate and streamline compliance and manage risk.

Oracle NetSuite features

- Customer behavior analytics for strategy refinement

- Smart segmentation algorithms for upsell targeting

- Predictive insights into client interactions

Oracle NetSuite pricing

Pricing available upon request.

What users are saying

G2 rating: 4.1/5

“I love using NetSuite for revenue management. The way everything flows seamlessly, from sales orders to invoicing to revenue arrangement creation, makes the process efficient and easy to manage. The system is user-friendly, edits are simple to make when needed, and the built-in reports are intuitive and useful. Being able to customize reports to fit specific needs is especially helpful and adds a lot of value to day-to-day tasks.” — Gabriela O.

Build a secure customer experience with monday CRM

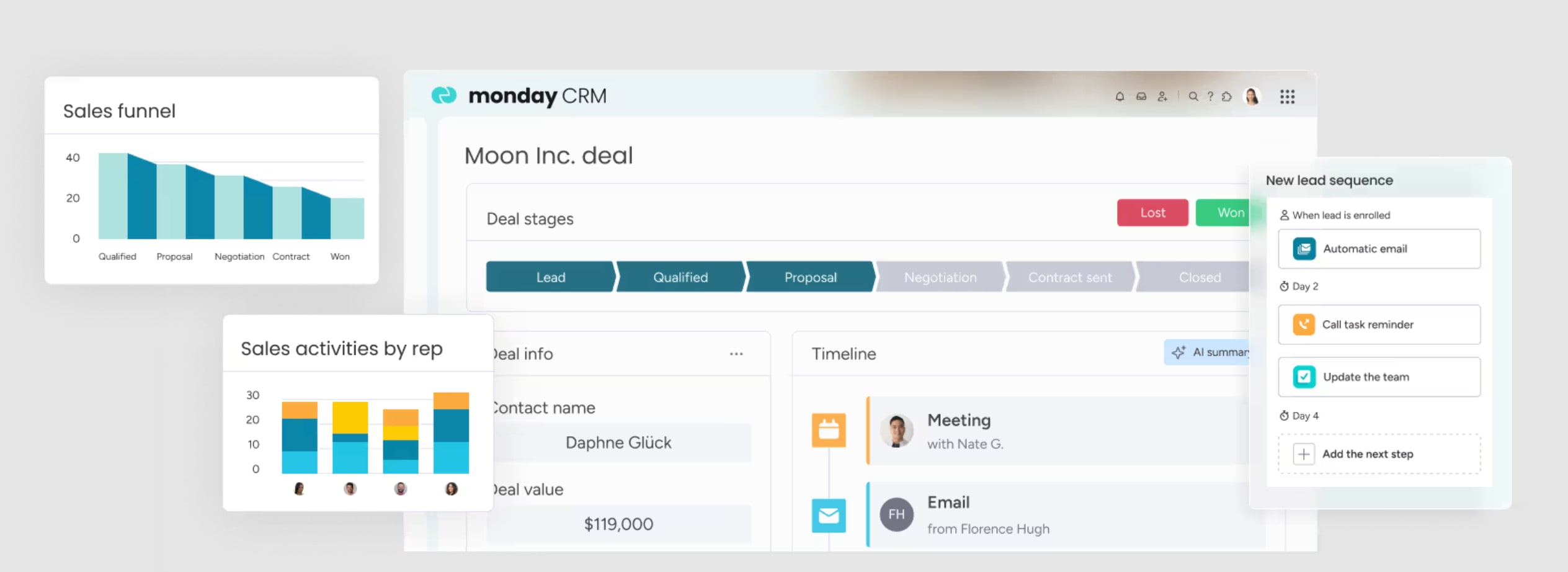

CRMs for banking aren’t one-size-fits-all. Sure, there may be overlapping features and functionality, but not every platform will be suitable for your business. The right CRM makes a big difference when it comes to sales workflows and connecting with your customers. With monday CRM, you can customize all aspects of your platform using AI to fit your unique workflows.

Backed by powerful AI, monday CRM allows banks and financial organizations to create customized sales pipelines, automate deal progression, and manage client portfolios with ease. The intuitive drag-and-drop interface allows bankers to edit boards to reflect customer details, costs and risks, disclosure of fees, proposed strategies, and more.

Here’s a closer look at some of the best monday CRM features for banking institutions:

Smarter pipeline management

With monday CRM, it’s simple to tailor pipelines and data fields to match your bank’s unique financial processes. Additionally, the platform’s built-in AI technology allows firms to automate pipeline activity, like moving through stages, getting reminders on deadlines, and identifying bottlenecks that could delay deal closure or compliance requirements.

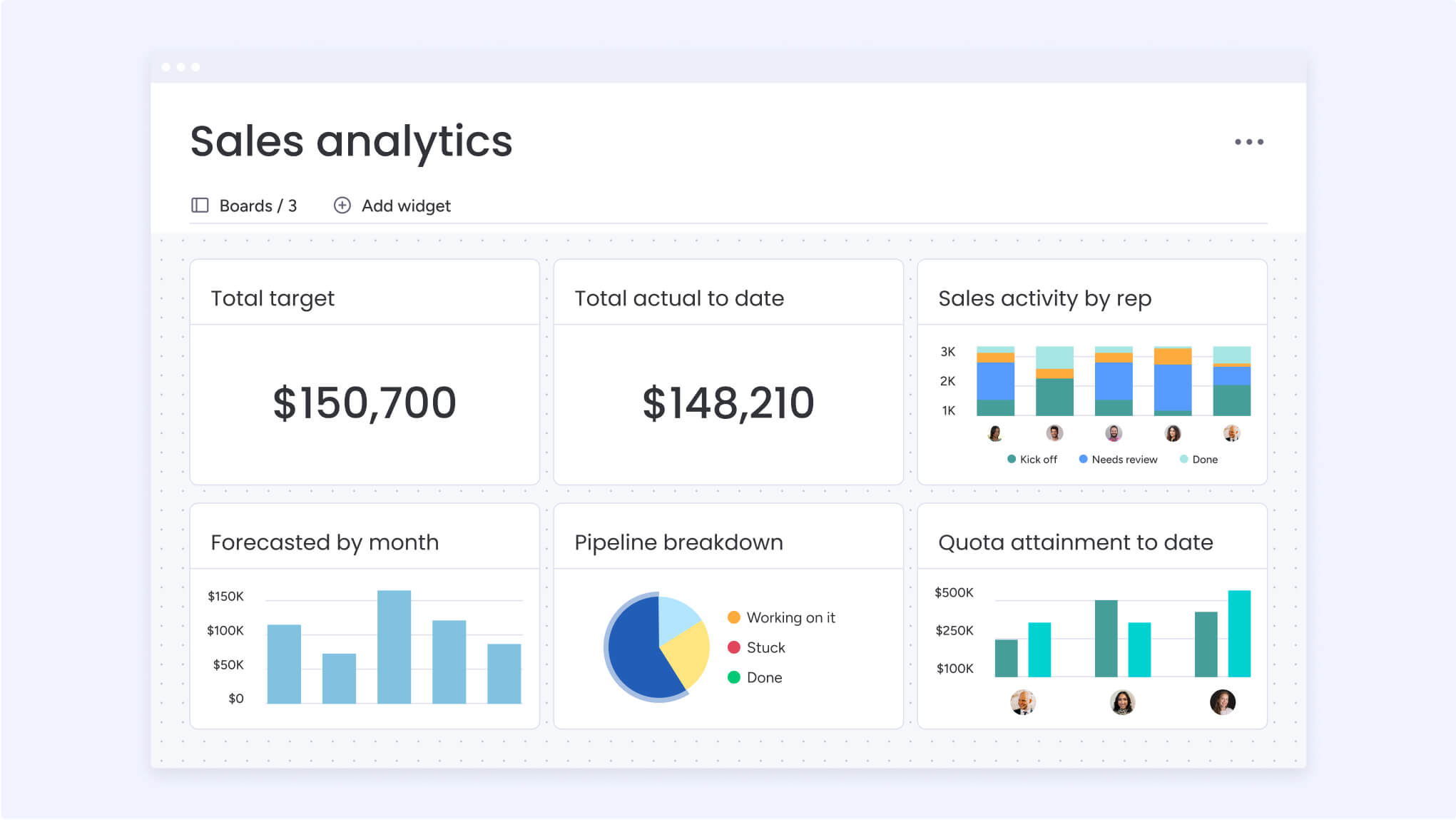

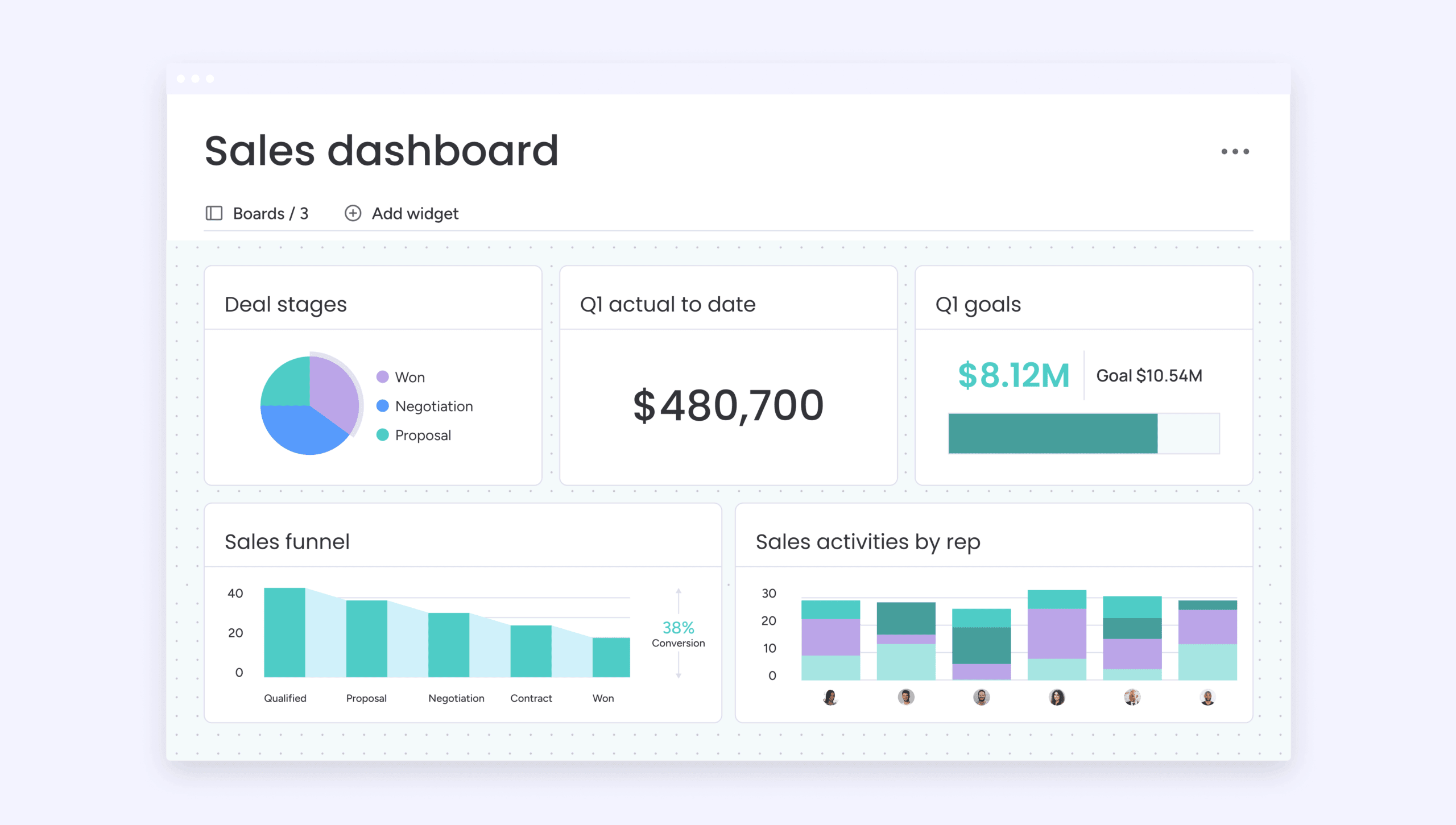

AI-powered analytics and reporting

Get insights you’ll actually use with monday CRM’s predictive analytics, AI-powered dashboards, and forecasting features. Teams can get an idea of deals in the pipeline that are most likely to close so that they know where to focus their efforts, and reports give managers insights into top-performing employees.

Intelligent workflow automations

Automate repetitive processes such as customer and lead follow-ups and engagement, document collection, deal updates, and approval processes. With AI to power automations and workflows, banking staff can spend more time on client accounts to improve satisfaction.

Enhanced security and compliance

With monday CRM, banking teams can rest assured that the solution will protect sensitive client data and meet industry regulations thanks to advanced security features. Teams can also set advanced administrative and access controls as well as implement two-factor, enterprise-grade security and governance, multi-level permissions, and more.

Try monday CRMHow banks apply CRM in different sectors

CRMs are not one-size-fits-all. Different areas of banking — from investment to private to commercial — each have unique requirements. A well-chosen CRM adapts to those needs while providing the shared benefits of automation, data insights, and improved client relationships.

CRM for investment banking

Investment bankers depend on fast, accurate data to serve clients with complex portfolios. A tailored CRM provides:

- Security and compliance tools to protect sensitive financial data and meet strict regulations

- Advanced analytics to spot market trends and assess risks in real time

- Portfolio management features to track multi-million-dollar investments and generate insights

- Automations to handle approvals and follow-ups in high-volume, time-sensitive workflows

CRM for private banking

Private banking is built on trust and personalized service for high-net-worth clients. A CRM in this space enables:

- Comprehensive client profiles with portfolio, family, and advisory histories in one view

- AI-driven recommendations to uncover cross-investment or wealth transfer opportunities

- Secure document management for contracts, disclosures, and reports

- Tailored dashboards to monitor client goals and performance over time

CRM for commercial banking

Commercial banks manage a broad mix of corporate clients and large lending portfolios. A CRM helps by offering:

- Pipeline tracking for loan applications, credit histories, and renewals

- Integrations with ERP and compliance tools to improve reporting accuracy

- Risk monitoring to evaluate exposure across accounts and industries

- Collaboration tools to align relationship managers and credit teams

Real-world use cases

Banks worldwide are already applying CRMs in ways that improve efficiency and client satisfaction:

- A retail bank unifies mobile, online, and branch interactions to deliver personalized product offers.

- A commercial bank uses workflow automations to speed up KYC and AML checks for faster loan approvals.

- A private bank leverages CRM dashboards to generate bespoke portfolio reports for high-net-worth clients.

- An investment bank applies predictive analytics to anticipate client needs and market shifts.

These scenarios demonstrate how flexible CRM platforms can adapt to different banking models. With monday CRM, institutions can bring these outcomes to life through customizable workflows, AI-powered analytics, and secure compliance features.

Integrating CRM with banking systems

Integrating a new CRM into a bank’s existing infrastructure is often one of the biggest challenges. Core banking platforms, loan systems, digital channels, and compliance tools all need to connect seamlessly with the CRM to avoid disruption. Successful integration means teams can work from a single source of truth while maintaining regulatory compliance and data security.

Here are some considerations for integrating CRM with your banking system:

- System compatibility: Ensure the CRM connects with core banking software, loan origination tools, mobile apps, and digital channels.

- Regulatory alignment: Maintain compliance during migration, especially with KYC, AML, and data protection requirements.

- Workflow testing: Validate processes like approvals, requests, and automations before going live.

- Staff training: Provide hands-on onboarding to ensure adoption and collect feedback across departments.

- Data migration: Move records securely and systematically to protect accuracy and confidentiality.

Some vendors provide dedicated support for banking integrations. For example, monday CRM offers migration assistance to ensure sensitive data and existing workflows transfer smoothly into a customized, secure environment.

The future of banking: AI, automation, and CRM trends

The banking sector is evolving quickly, and CRM platforms are at the center of this transformation. Key trends include:

- AI-first banking operations: Banks are using AI within CRMs to forecast customer needs, identify compliance risks, and automatically score leads.

- Open banking integrations: Modern CRMs now connect directly with open banking APIs to give a complete customer financial picture.

- Data-driven personalization: Clients expect banks to anticipate their needs; CRM data analytics make hyper-personalized offers possible at scale.

- Mobile-first CRM access: With more customers engaging through apps, CRMs are prioritizing mobile features for both customers and staff.

- Embedded compliance tools: Regulatory technology (RegTech) built into CRMs reduces the risk of errors and simplifies audits.

Together, these trends are reshaping how financial institutions manage relationships and deliver services.

Choosing the right CRM for banking success

The future of CRM in banking is intelligent, automated, and client-centric. As competition from fintech and digital-only banks grows, traditional institutions must use technology to match customer expectations for speed, transparency, and personalization.

AI-powered CRMs like monday CRM make it possible to automate compliance, personalize every interaction, and deliver actionable insights across departments. By adopting these tools, banks can build trust, improve efficiency, and create meaningful customer experiences — all while staying secure and compliant.

FAQs

How do banks use CRM to improve customer experience?

Banks use CRM systems to create unified customer profiles that provide visibility into account history, preferences, and interactions. This enables personalized service delivery, proactive communication, faster issue resolution, and tailored product recommendations that enhance satisfaction and strengthen customer relationships.

Can a CRM help with regulatory compliance in banking?

Yes, CRM systems support regulatory compliance by automating documentation processes, maintaining detailed audit trails of customer interactions, and ensuring proper disclosure procedures. CRMs help banks track compliance requirements, generate regulatory reports, and maintain data security standards required by regulations.

Why is data cleansing important for a CRM in investment banking?

Data cleansing is crucial in investment banking CRM because accurate, up-to-date information directly impacts deal outcomes and client relationships. Clean data leads to reliable analytics for investment decisions, prevents compliance violations, reduces operational risks, and maintains the integrity needed for high-stakes transactions and regulatory reporting requirements.

How does AI enhance CRM for the banking industry?

AI enhances banking CRM through predictive analytics that identify cross-selling opportunities, automated lead scoring to prioritize prospects, intelligent workflow automation that reduces manual tasks, and personalized customer insights that improve relationship management. AI also enables proactive risk assessment and compliance monitoring for better decision-making.

What are the best practices for implementing a CRM system in a bank?

Best practices for implementing a CRM system in a bank include conducting thorough data migration, establishing robust security and compliance measures, providing comprehensive staff training, and integrating with existing banking systems. Banks should also try and implement in phases to minimize disruption while allowing for continuous feedback and optimization.

What does CRM stand for in banking?

CRM stands for Customer Relationship Management. In banking, it refers to software systems that help financial institutions manage client data, track interactions, and deliver personalized services while ensuring compliance and security.