A financial advisor needs to understand each individual customer to offer them the best advice and services. When you have dozens or even hundreds of clients, this can be tricky to do without any technology as there’s so much data to contend with.

By implementing a CRM, financial advisors can open the door to new data-driven insight, personalized service options, and streamlined compliance. However, selecting the right CRM for financial advisors can also be challenging when there are so many options available.

In this post, we’ll look at seven of the best CRMs for financial advisors on the market. We’ll also discuss why a customizable platform like monday CRM may be your best bet when it comes to choosing a scalable and flexible solution.

Try monday CRMWhat is a CRM for financial advisors?

A CRM is a customer relationship management software businesses use to improve existing client relationships and build new ones. CRM software accomplishes this by helping teams organize and store essential data, follow up with clients, deliver more personalized service, and collaborate better with colleagues. For financial advisors, these tasks, are especially important.

Financial advisors need to guide each client based on a unique portfolio made up of different goals, needs, and financial backgrounds. To be able to offer each client the best possible service, it’s critical to personalize client interactions and store and monitor data that can influence a customer’s decisions.

Using a CRM allows financial advisors to build stronger, long-lasting relationships with each individual client.

The benefits of using a CRM for financial advisors

Implementing a CRM for your financial advising business can help improve the quality of your service, your productivity, as well as customer satisfaction. Here’s a look at some of the key benefits of using CRM software to enhance your work:

- Improve lead and pipeline management: Track your current client requests and nurture incoming leads to turn them into valuable customers and guide them through the sales funnel

- Better documentation and compliance: Maintain more accurate records and avoid errors to comply with regulatory requirements

- Personalize the client experience: Tailor services and communications to offer more personalized financial advice with data gathered through a CRM

- Automate marketing and client communications: Trigger regular messages, reminders, and notifications to help nurture client relationships with custom automations

- Gain data-driven insights: Gain valuable insights with custom reports and analytics on sales, client behaviors, market trends, and more, to make more informed decisions and identify growth opportunities

7 top CRM for financial advisors

Below, we’ve gathered the best CRM platforms for financial advisors so you can see, at a glance, which one might be the closest fit for your business.

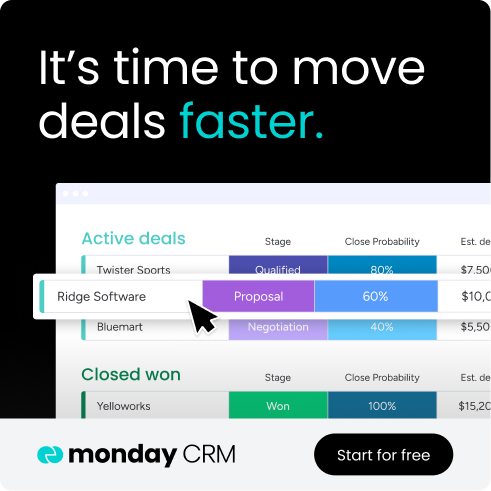

1. monday CRM

Best for: Financial advisors looking for a user-friendly platform that’s both customizable and robust

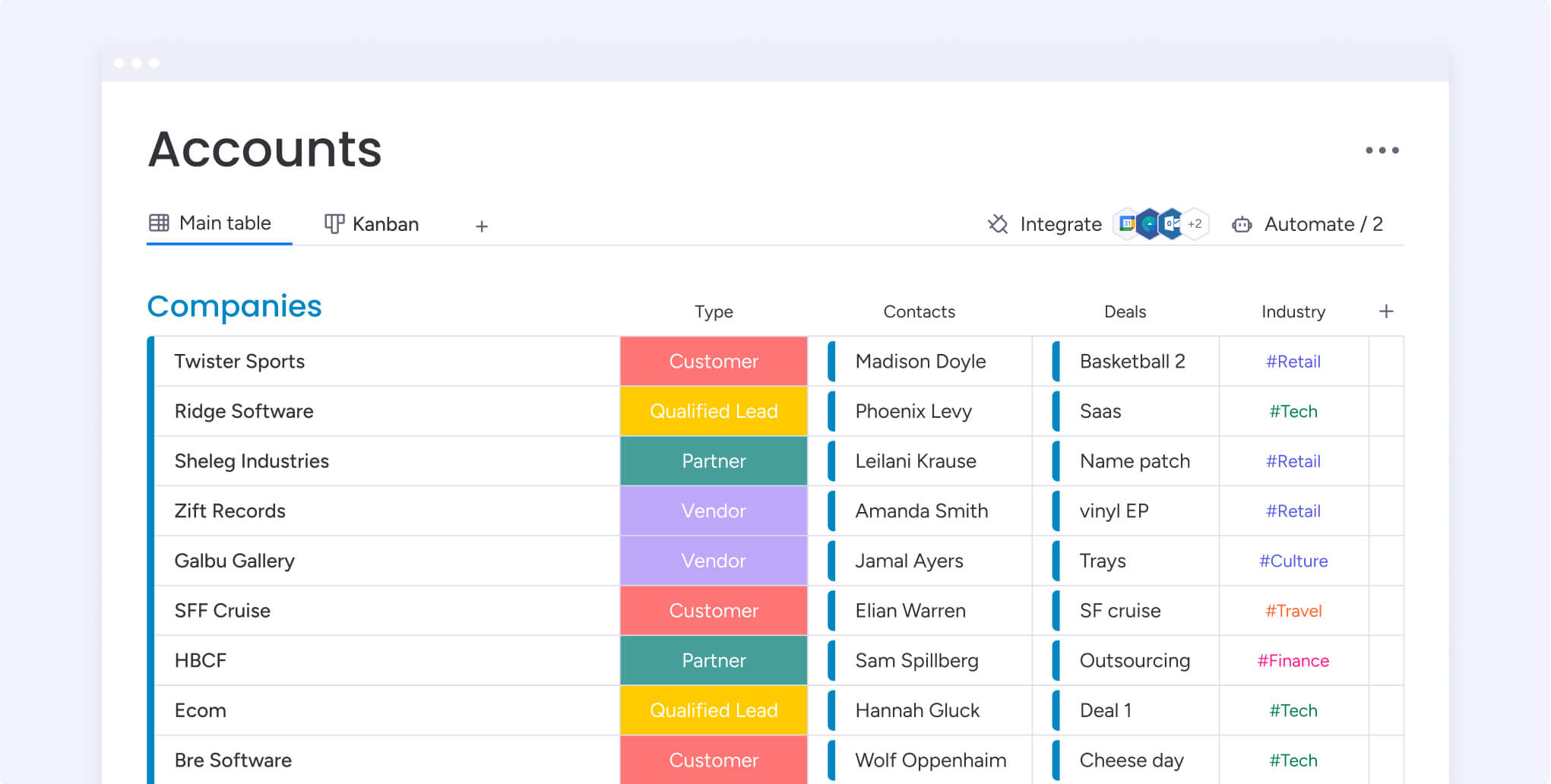

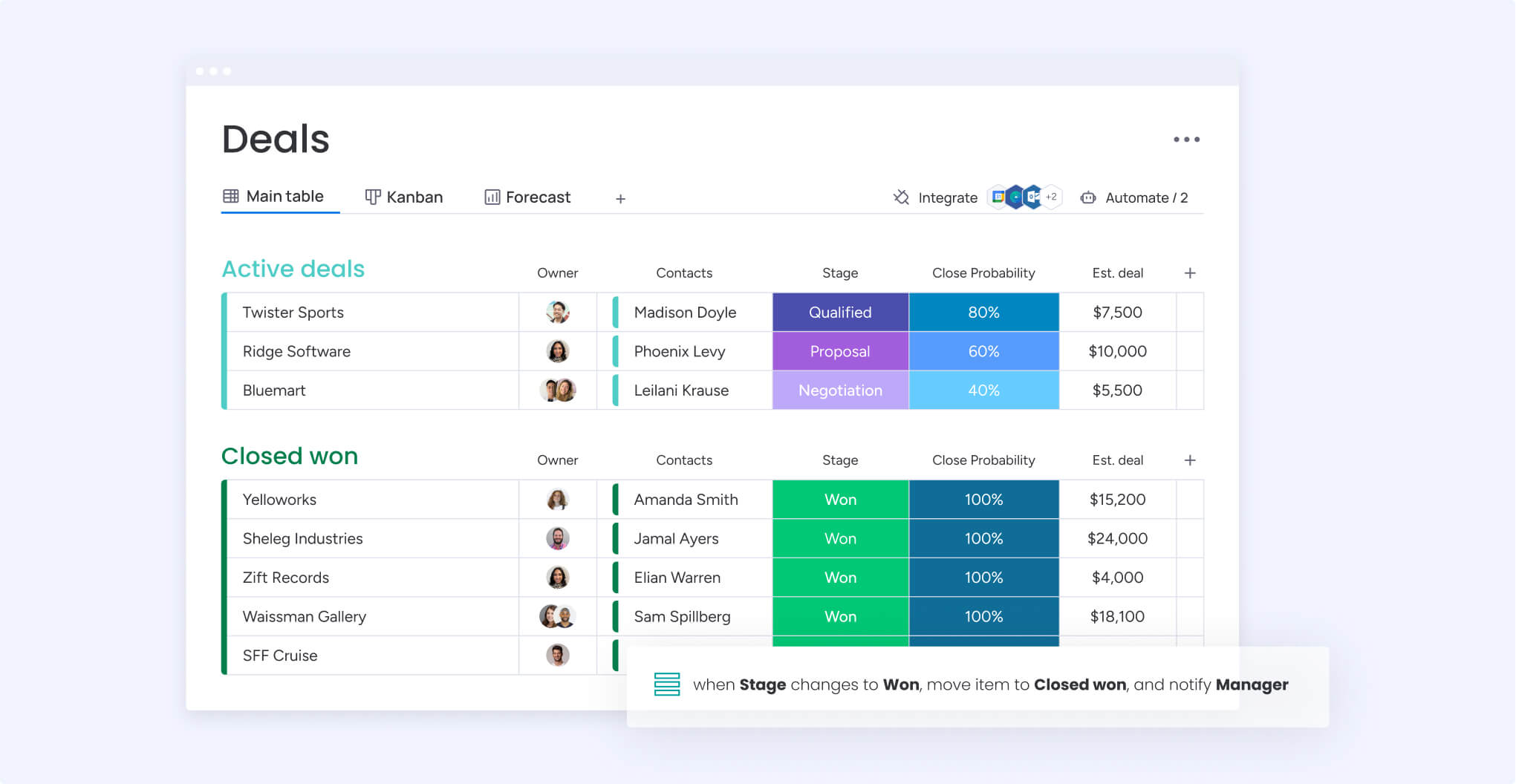

monday CRM is known for its simple and intuitive visual interface, allowing for flexible workflow customization. With monday CRM, financial advisors can effortlessly tailor their CRM to their unique business processes while taking advantage of functionalities for workflow automation, task management, lead and contact management, streamlined communication, and strong collaboration, among others.

monday CRM key features

- Advanced analytics and reporting tools to keep track of tasks, sales, and gain insights into customer behavior

- Customizable dashboards to segment clients based on tailored parameters, like goals, risk level, or financial profiles

- No-code automations to help advisors cut down on manual repetitive tasks while still regularly communicating with customers

monday CRM pricing

- Pricing starting from $12/seat/month

- Four plans to choose from: Basic, Standard, Pro, and Enterprise

- Free trial available

- Learn more about monday CRM plans and pricing

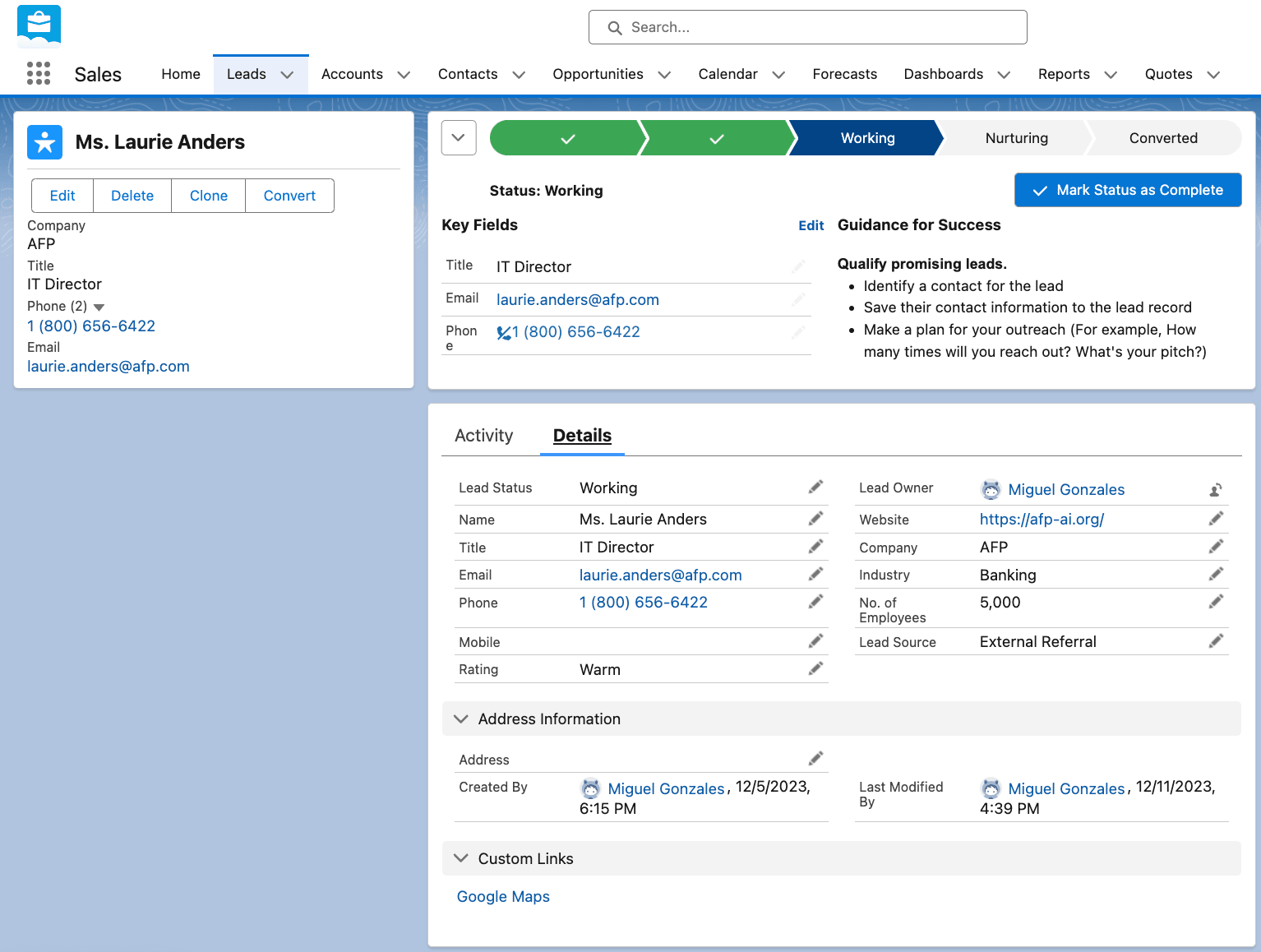

2. Salesforce Financial Services Cloud

Best for: Financial advisors that want a finance-forward CRM powered by AI

Salesforce Financial Services Cloud is a CRM designed for the financial services industry. Featuring a customizable interface, financial teams such as banks, lenders, wealth managers, insurance brokers, and others can use it to organize, store, and gather data. With Salesforce Financial Services Cloud, financial advisors can build stronger relationships with the help of artificial inteligence.

Salesforce Financial Cloud key features

- AI tools help with customer service automation, onboarding, financial discovery, and more

- Gain AI-powered insights on client relationships to identify areas of opportunity

- Created segmented client lists to prioritize contacts and engagement levels and personalize service

Salesforce Financial Services Cloud pricing

- Prices starting from $300/user/month

- Multiple plans offered based on the services you need

- Free trial available

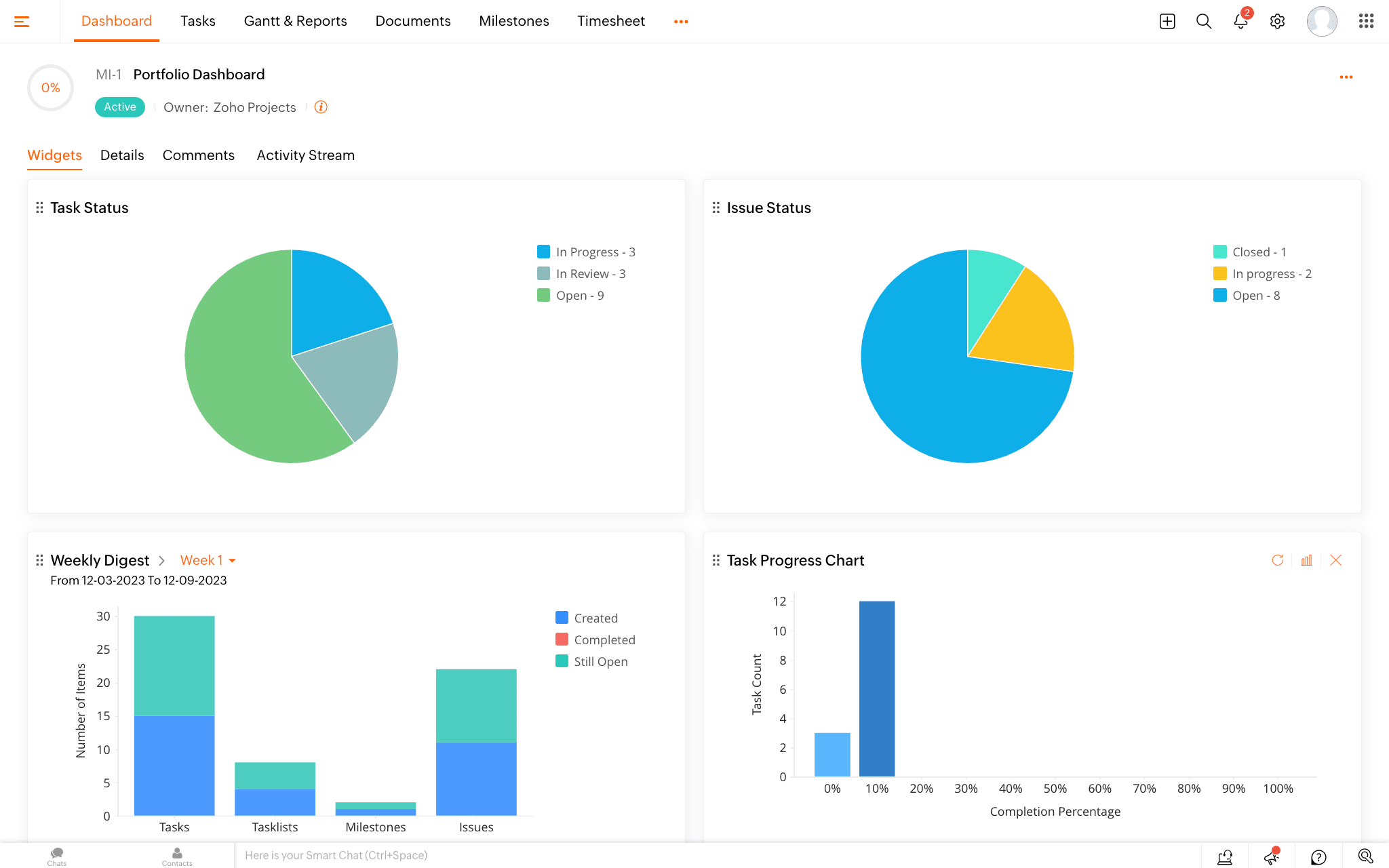

3. Zoho CRM

Best for: Small-to-medium advisor firms who want a simple and affordable CRM that can grow with them

Zoho CRM offers a comprehensive suite of features that help manage client relationships and streamline sales team processes. Powered by AI, Zoho CRM helps financial advisors prioritize leads, automate follow-ups, and personalize communications. Additionally, Zoho CRM’s marketplace of over 800 app integrations makes it a great choice for connecting with other financial tools.

Zoho CRM key features

- Zoho’s AI-powered sales assistant, Zia, helps teams with tasks like email automation and lead scoring

- Set roles, profiles, and permissions, and benefit from Zoho CRM’s data security and compliance features

- Customize everything from layouts to views filters, modules, buttons, and more

Zoho CRM pricing

- Pricing starting from $14/user/month

- Choose from four plans: Standard, Professional, Enterprise, Ultimate

- Free trial available

- Find out more about Zoho CRM plans and pricing here

4. Wealthbox

Best for: Independent advisors or small teams focused on streamlining financial workflows

Wealthbox is a CRM specifically designed for financial advisors and provides a simple platform with a clean interface. Wealthbox promises financial advisors a CRM with all the features they might need to connect with prospects, coworkers, and clients. With solutions tailored also to enterprise firms, banks and credit unions, family offices, and others, it can be a great solution for financial businesses looking for a simple CRM.

Wealthbox key features

- Over 100 integration options with financial tools like Fidelity Investments, MoneyGuide, Black Diamond, and more

- Get a quick overview of your clients including related files, phone calls, emails, and financial data

- Group clients and prospects with tags for advanced filtering and streamlined communication

Wealthbox pricing

- Pricing starting from $59/user/month

- Four plans to choose from: Basic, Pro, Premier, Enterprise

- Free trial available

5. Redtail CRM

Best for: Small teams of financial advisors looking for a low-frills simple CRM

Tailored to the financial advisory sector, Redtail CRM includes features for client data tracking, document management and storage, and compliance management. It integrates with many advisor planning platforms, custodians, compliance tools, robo-advisors, and more. Its ease of use and focus on the financial industry make it a popular choice for financial advisors.

Redtail key features

- Create reports based on client data with standard and customized reports

- Document client history with notes for easier collaboration

- Manage seminars from Redtail CRM and track call and email campaigns for seminar planning

Redtail pricing

- Plans starting from $39/user/month

- Three plans to choose from: Launch, Growth, and Enterprise

- Free trial available

6. Freshsales

Best for: Smaller advisory firms looking for a cost-effective solution to nurture more leads

Freshsales is a part of the Freshworks suite of products and is built to help teams optimize their sales processes. With Freshsales, financial advisors can engage with their client base and leads through tools for marketing, communication, and automation. The interface offers a simple user experience, making it a good choice for financial advisory teams looking to manage contacts and convert more leads.

Freshsales key features

- Create custom automations to connect with customers through personalized messages

- Capture, score, qualify, route leads, and generate reports using Freddy AI

- Manage metrics such as loans, deposits, and values over time with reports and performance tracking

Freshsales pricing

- Plans starting from $9/month/user

- Choose from three plans: Growth, Pro, and Enterprise

- Free trial available

- Find out more about Freshsales pricing here

7. Pipedrive

Best for: Financial advisors who want a CRM that’s focused on sales pipeline management

Pipedrive is a CRM focused on pipeline management, which helps financial advisors manage and track sales, leads, and client relationships. The platform is user-friendly and offers a visual interface where it’s easy to track deals and prioritize tasks. Pipedrive offers plenty of options for customization, from stages, to activity reminders, sales automations, and more.

Key Pipedrive features

- Create custom automations to better nurture leads and strengthen existing relationships

- Improve communication, data collection, and reduce manual processes with Pipedrive AI

- Build client categories to segment your customers and build custom messaging for each

Pipedrive pricing

- Plans starting from $14/month/seat

- Choose from five plans: Essential, Advanced, Professional, Power, and Enterprise

- Free trial available

- Learn more about Pipedrive’s plans and pricing here

Features to look for in a CRM for financial advisors

When looking for new software, it’s important to first understand the features and functionalities you need so you can find the right tool that enhances your existing workflows. Here are some of the most common features you should look for in a CRM for financial advisors.

- Task and workflow automation: Automation capabilities help you follow up with clients, schedule communications, and set reminders for task deadlines

- Data analytics and reporting: Analytics and reporting tools to help advisors track client progress, trends, and inform decisions with reliable data

- Client segmentation functions: Segment clients based on criteria like investment profiles, risk tolerance, financial goals, and more to offer more personalized service

- Integration with financial tools: A CRM for financial services should integrate easily with financial planning software, portfolio management tools, and accounting software

- Compliance and security: When storing sensitive client data, it’s critical that your software is not only secure on its own but can help you improve compliance procedures

- Mobile access: Accessing your client portal and information on the go when running between meetings to stay flexible and responsive

Streamline client and lead management with monday CRM

Not every CRM is going to be a fit for your financial advisory workflows. While it may seem like CRMs built around financial services would be an obvious choice, these platforms can often be limiting and not suitable when you start to scale your team. On the flip side, platforms like monday CRM that are more well-rounded, flexible, and easily scalable can be a great option for financial advisor teams of any level or size.

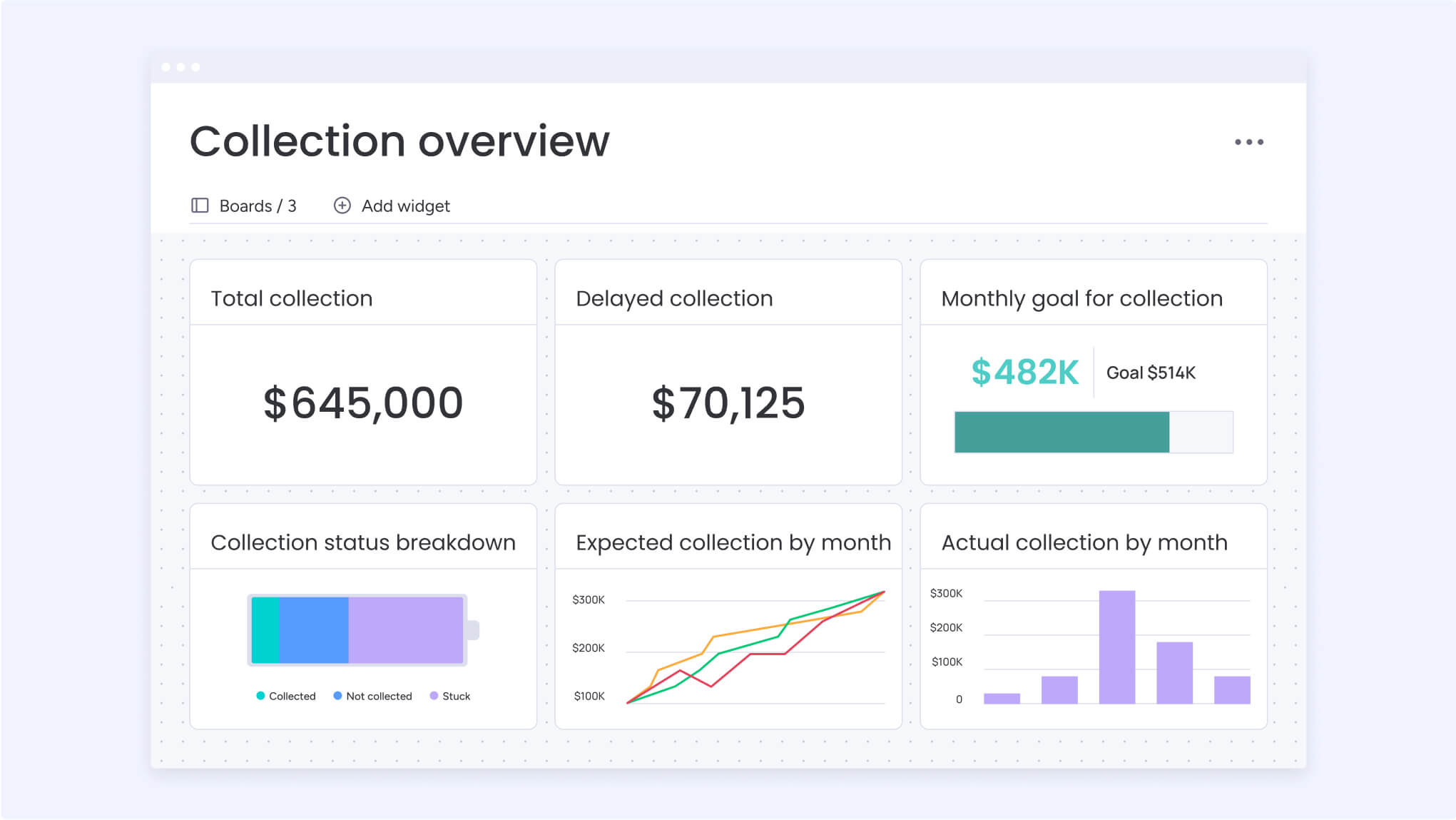

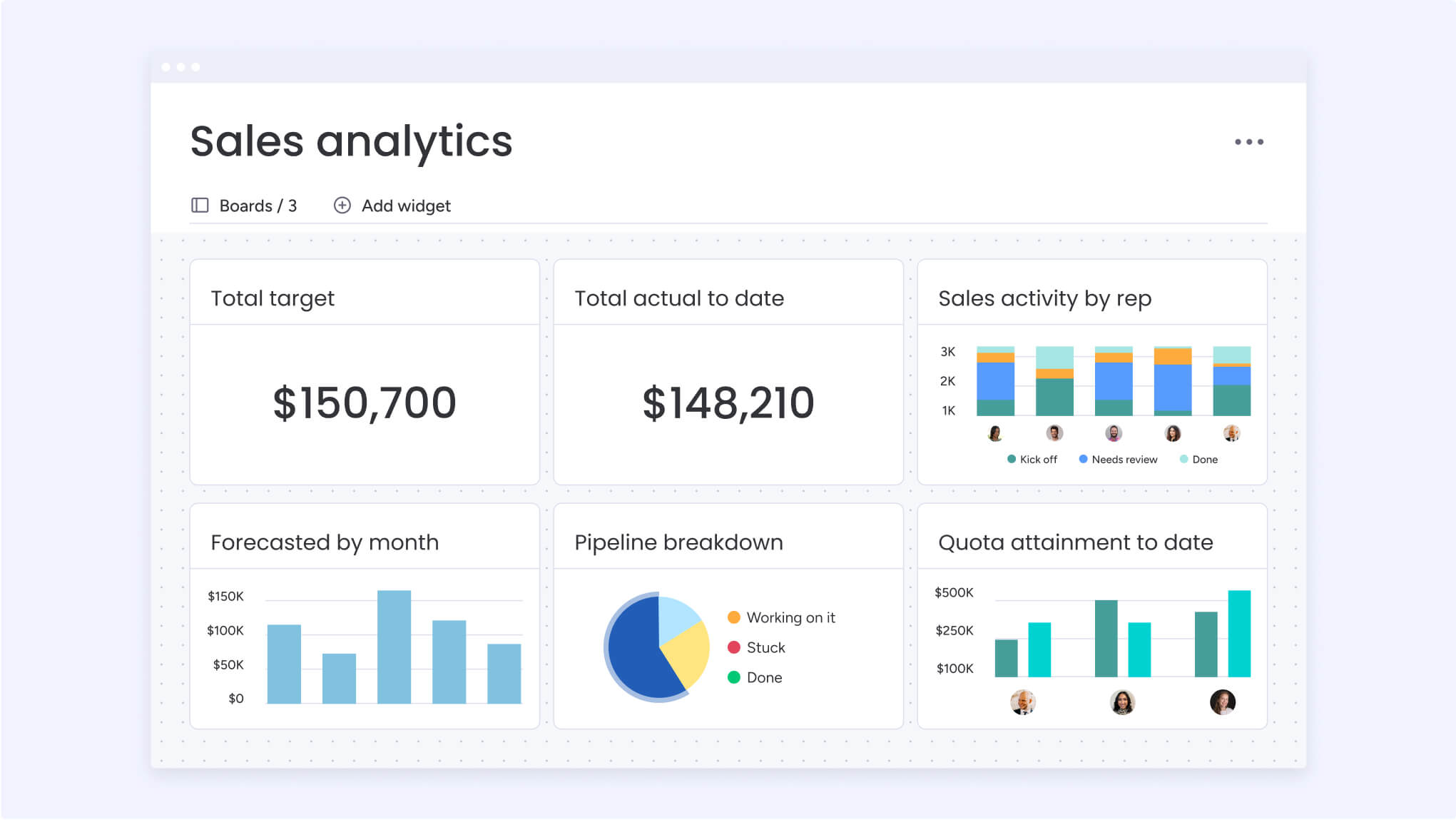

monday CRM helps financial advisors completely customize their platform to their liking with options to personalize work views, dashboards, automations, reports, and a lot more. Despite all the customization options, monday CRM still remains easy and intuitive to use, making onboarding a breeze for your team.

Here’s a quick look at some of monday CRM’s additional features that make it ideal for financial advisory firms:

- Cloud-based CRM that can be accessed from mobile, making it ideal for remote teams

- Lead scoring features to better segment and understand potential customers

- AI features to help you generate personalized emails

- Track team performance in one glance in a dashboard to get a quick overview of sales, quotas, and closed deals

- Advanced security and governance capabilities to stay compliant with client data storage regulations

- See your work in 27 different work views including Kanban, Calendar, Workload, Gantt, and more

- Build custom forms so you can gather necessary information and financial documents from clients and store it directly in your CRM

- Log calls and generate an automatic summary for better collaboration

Improve service levels with a CRM for financial advisors

When financial advisors can keep track of all their clients in one place and easily access the information they need, they’re able to offer a more personalized service to each individual customer, helping firms retain and upsell more clients. With monday CRM, financial advisors have the tools they need to focus on providing the right financial advice at the right time so you can seamlessly grow your business.

FAQs

What is a wealth management CRM?

A wealth management CRM is a specialized software designed to help financial advisors manage client relationships, track interactions, and provide personalized financial services.

What technology do financial advisors use?

Financial advisors use a wide range of technologies such as financial planning software, CRMs, portfolio management tools, compliance management solutions, and others.

What is the role of CRM in financial services?

In financial services, a CRM helps manage client data, streamline communication, improve service, ensure compliance, and gather data-driven insights for strategic decision-making.