Your business can’t survive without accounting, which is why you’re probably on the hunt for an Excel accounting template that can help you stay on top of your organization’s finances.

But before you dive in head-first, there are a few important things you should know about accounting templates and other accounting software.

In this article, we will explain what accounting is, how Excel accounting templates work, and how monday.com’s Accounting Template can take your organization’s accounting to the next level.

What is an Excel accounting template?

Accounting is all about making sure you always have a clear view of your income, petty cash, cost management, cash book, tax obligations, debts, paychecks, and everything else money-related you could possibly think of.

But that can be pretty hard to keep track of — especially if you’re leading a small team and wearing many different hats at any given time. This is where an Excel accounting template really comes to the rescue.

An accounting template is a pre-built accounting statement that you can download and customize to suit your business needs. These templates are typically pre-populated or have a range of labeled columns — and then you simply fill in the blanks with your own financial information.

There are a number of free accounting templates for Excel and Google Sheets you can download and import onto your desktop or web app.

Why use the Excel accounting template?

Excel accounting templates are all about making life easier. If you’re new at this, having a clearly labeled template that can show which values to place and where is a total lifesaver.

For example, let’s say you’re a software engineer managing a new start-up. You might know a whole lot about building apps, but next to nothing about how to fill out an income statement. Don’t worry: most of us aren’t accountants.

Having an Excel accounting template to fall back on gives you some peace of mind in knowing you’re on the right track. A template will guide you in terms of all the fields and columns you have to include and what financial data you’ve got to keep tabs on.

If you’re looking for a more flexible and dynamic accounting template with less manual labor involved, we’ve got you covered. But more on that in a minute. First, let’s talk about the different types of accounting templates.

What are some examples of Excel accounting templates?

Because it’s the bread and butter of most trained accountants, you can find a lot of Excel accounting templates and just about every Excel bookkeeping template you could ever want, depending on your needs.

For example, there’s a General Ledger Template for you to track any business expense, a Statement of Account Template, Credit Card Tracker Template, invoice templates, and more. These templates can help you keep track of your finances and ensure that your business is running smoothly.

Let’s talk about the different types of accounting templates.

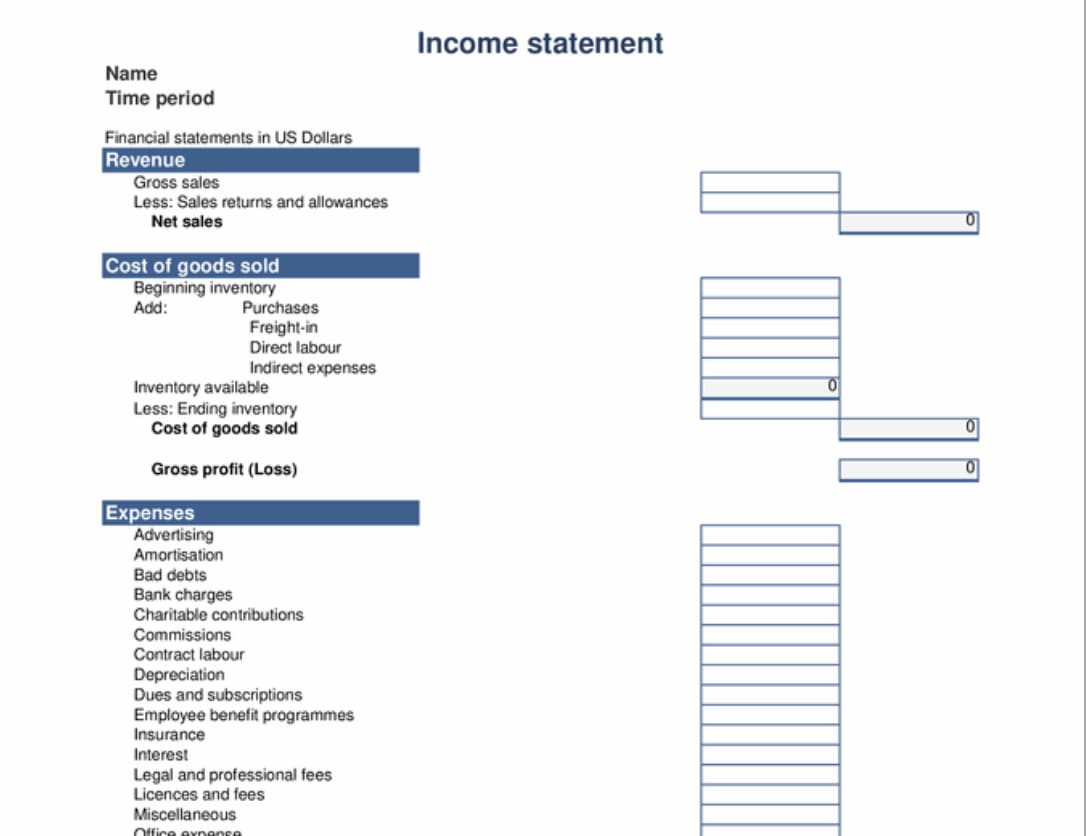

Income statement templates

An income statement template is a pre-designed template to help you record and summarize all of your team’s net income, net sales, and expenses during a given period of time.

An income statement is also often referred to as a “profit and loss statement” or “statement of revenue and expense.” That means you might occasionally see an income statement template labeled as a profit and loss statement template or a statement of revenue and expense template — but it all amounts to the same thing.

There are a number of downloadable income statement templates you can use to record your income information in Excel spreadsheets. They’re normally pretty basic and include a number of pre-labeled rows and columns identifying common expenses and revenue sources that apply to a lot of different business types.

The key benefit here is that these templates will serve as a great prompt in terms of all the expenses or income sources you might not have otherwise considered including in your statement.

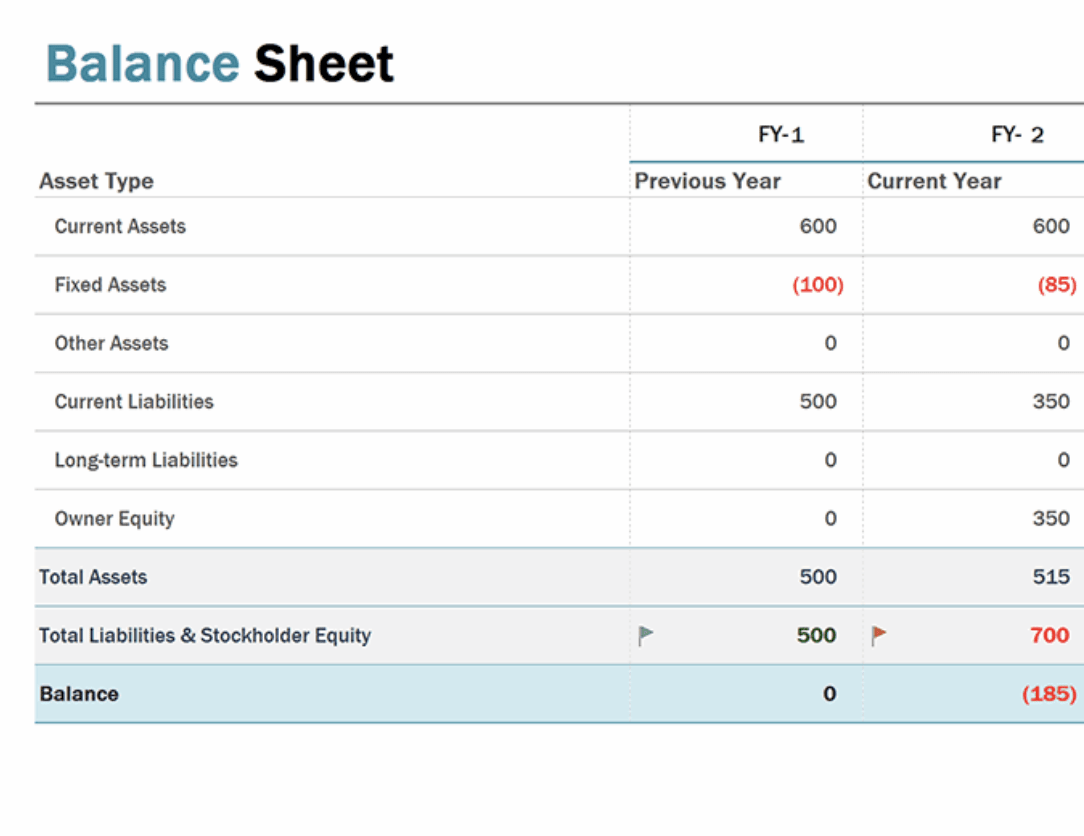

Balance sheet templates

A balance sheet template is a pre-made accounting statement that looks at all of your company’s total assets and liabilities — as well as shareholder equity. Balance sheets are all about demonstrating the “book value” of your company. To figure out your book value, you need to list all your company’s assets, liabilities, and equity for a given reporting date. Balance sheet templates are useful because they include pre-loaded rows that spell out all the basic information you’ll need to include in your accounting statement.

There are a number of pre-built balance sheet templates on Microsoft Office and other apps that include pre-configured formulas to find all your balance totals. This can save you valuable time because all you’ve got to do is drag and drop your financial data — the template does all the hard work.

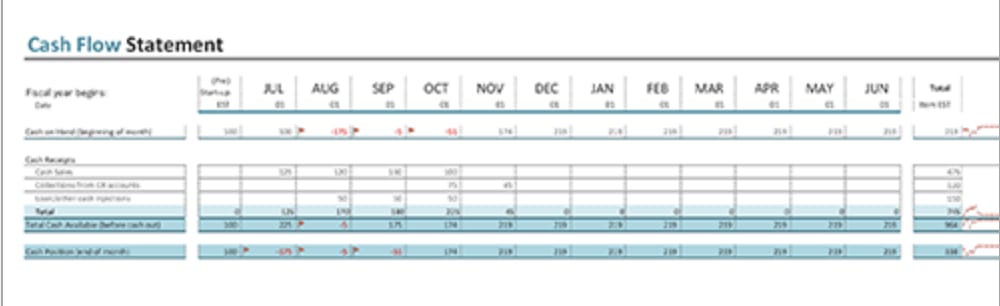

Cash flow statement templates

Next, you’ve got cash flow statement templates. A cash flow statement gives you a breakdown of what your company’s cash balances look like for a given period. There are loads of cash flow templates available on Excel and a number of external sites that you can download for free.

Cash flow statement templates are particularly useful for companies that are scaling up and need to show how sustainable their cash inflows are. For example, a clothing startup might use a cash flow statement template to quickly work out their cash balances over a 12-month period to show a lender that the startup can afford to take on a new business loan.

Managerial accounting templates

Managerial accounting is similar to financial accounting. But instead of looking at various accounting dates, it focuses on monthly or quarterly reports.

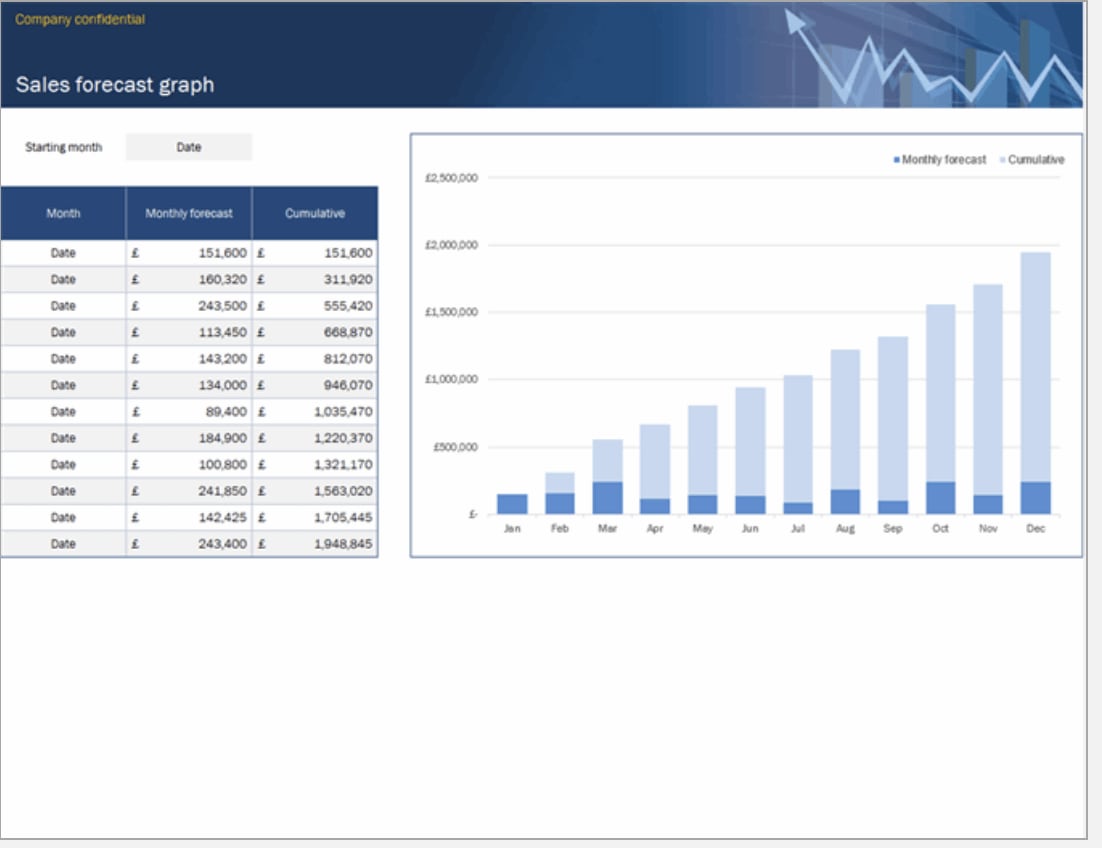

Managerial accounting statements enable you to analyze a company’s income and overheads to make important decisions about how your operations are funded and run. There are a number of managerial accounting templates on Excel — including budget templates and forecast templates.

This makes it easy to share with stakeholders and externals to let them know how your business is doing — without losing hours of precious time building tables yourself.

Cost accounting templates

Cost accounting templates are used to analyze spending and choose how your business prices its products or services. Translation: cost accounting is all about helping you develop price points to promote sales. You’ll encounter quite a few cost accounting templates on Excel and other third-party sites, although these will often be labeled as “cost sheets” or “costing templates.”

A huge benefit of using cost accounting templates is that the cost data you’re inputting is often dependent on other variables. That means your data in one cell may go up or down based on the number you place into a different column — which can get complicated fast. Costing templates come with all those formulas pre-loaded so that you can create an accounting statement without creating a headache.

Excel accounting template by monday.com

If you’re on the hunt for the perfect Excel accounting template but can’t find any Microsoft templates that fit the bill, you should check out monday.com’s free Excel accounting template.

Our dynamic downloadable template comes with a range of pre-built financial reports — including all the basic accounting statements we’ve already talked about. That means rather than worrying about creating loads of new spreadsheets and organizing them all, you can make life simpler with one master template that has everything you need in one place.

Each column is fully customizable, and all you’ve got to do is drag and drop your company’s financials to create fast and reliable financial statements to support your accounting function. All of the formulas you’ll ever need are already integrated into the template, which means you can knock out all your accounting statements in record time without breaking a sweat.

You can download our free Excel accounting template here. But if you want to remove all of the manual processes involved in accounting with Excel, we’ve got an even better solution available in the form of our fully-loaded Work OS Accounting Template.

Why monday.com’s built-in Accounting Template is the only template you’ll ever need

It’s totally possible to run a company’s accounting function offline using Excel. Many companies do it. But if you want to be able to handle all the core accounting functions we’ve covered without working overtime, you may want to rethink Excel and check out monday.com’s Accounting Template.

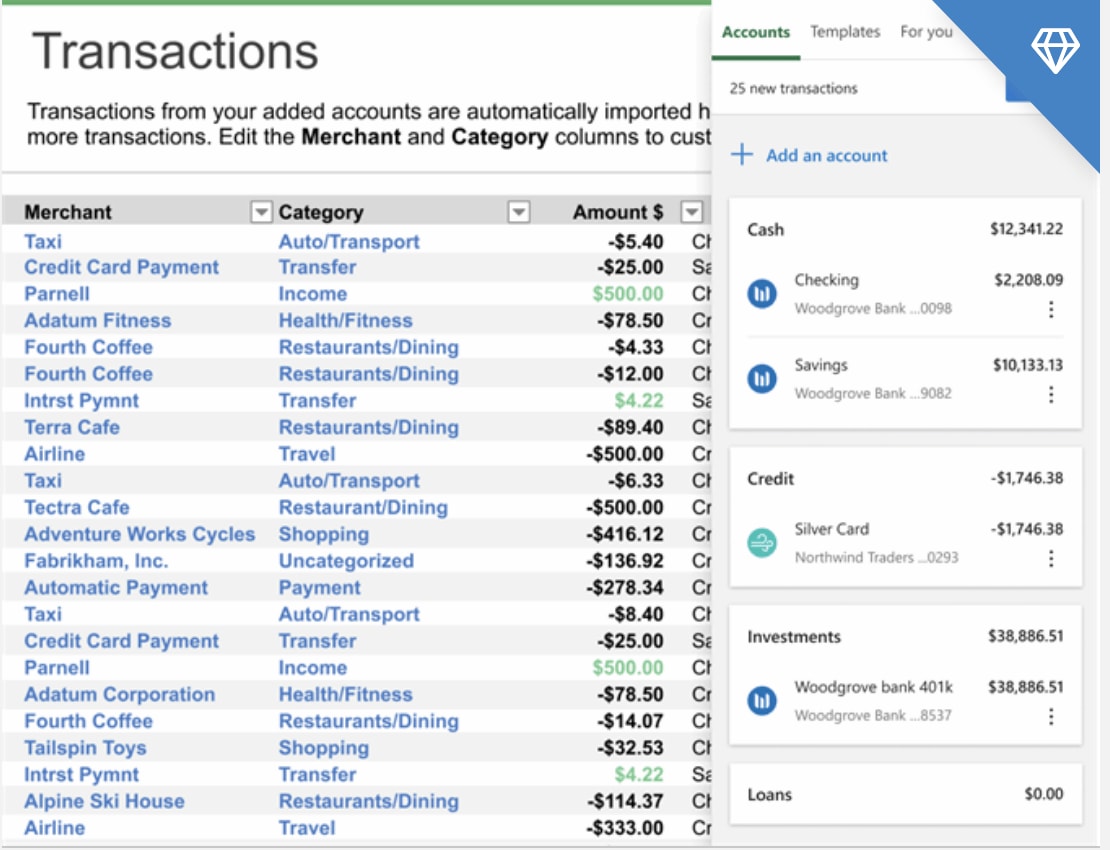

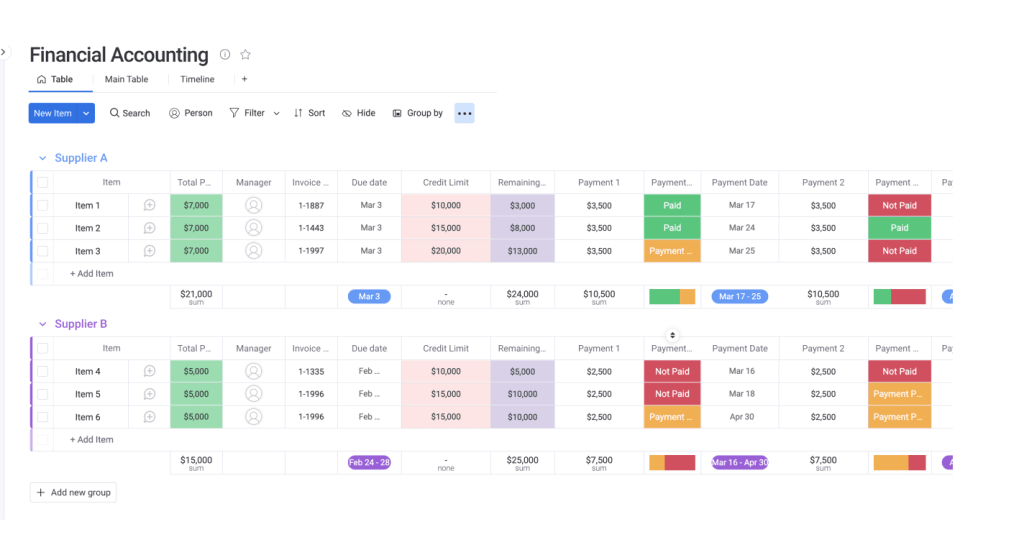

With our easy-to-use Accounting Template, you can consolidate all the accounting information and workflows in your business to manage everything on a single dashboard. This empowers you with a bird’s-eye view of all your finances. You’ll be able to automate financial reports, keep track of spending, set up spending alerts, and you’ll always know where you are in relation to your budget and income streams. This makes performing financial audits a breeze.

And if you really love a particular Excel accounting template — like ours — you can even use it alongside monday.com’s more dynamic template. With the help of our set of handy integrations, you can easily import Excel workbooks onto your monday.com dashboard and use that data to contribute to your wider works on monday.com.

Not only will that save you valuable time, but it also keeps you organized. We’re pretty good at knowing which columns go where — which means that we’ll automatically turn your imported Excel workbooks into a clearly labeled and fully customizable monday.com board in just a few clicks.

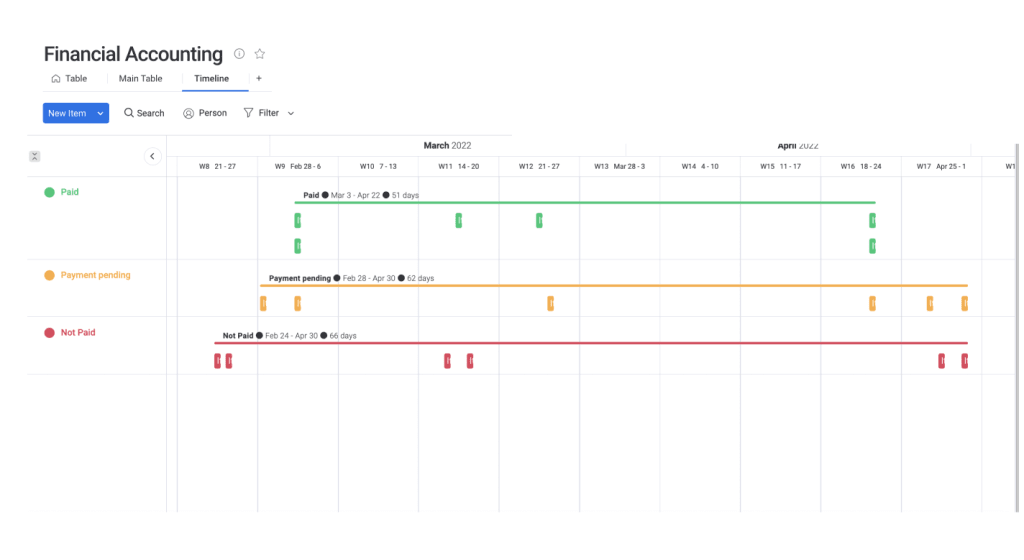

You can then tag and move items, assign tasks to team members based on your imported accounting statements, and change your dashboard view to give you different perspectives on the financial data you’ve imported.

End result: your accounting management will go from slow and reactive to super proactive in a matter of minutes.

Even more accounting templates from monday.com

Financial Statements Template

If you’re focusing less on overall accounting and more on your financial statements, our Financial Statements Template will fit the bill.

You can use this template to manage capital investments, track debts and repayment schedules, and manage corporate audits — all while setting up rules and automations that will keep a running score of your core financial statements like your balance, income, and cash flow.

For example, you could set up an automation that automatically alerts a certain member of your team every time a capital investment posts a loss — or create an automated recurring task for your finance team to perform a monthly expenses audit.

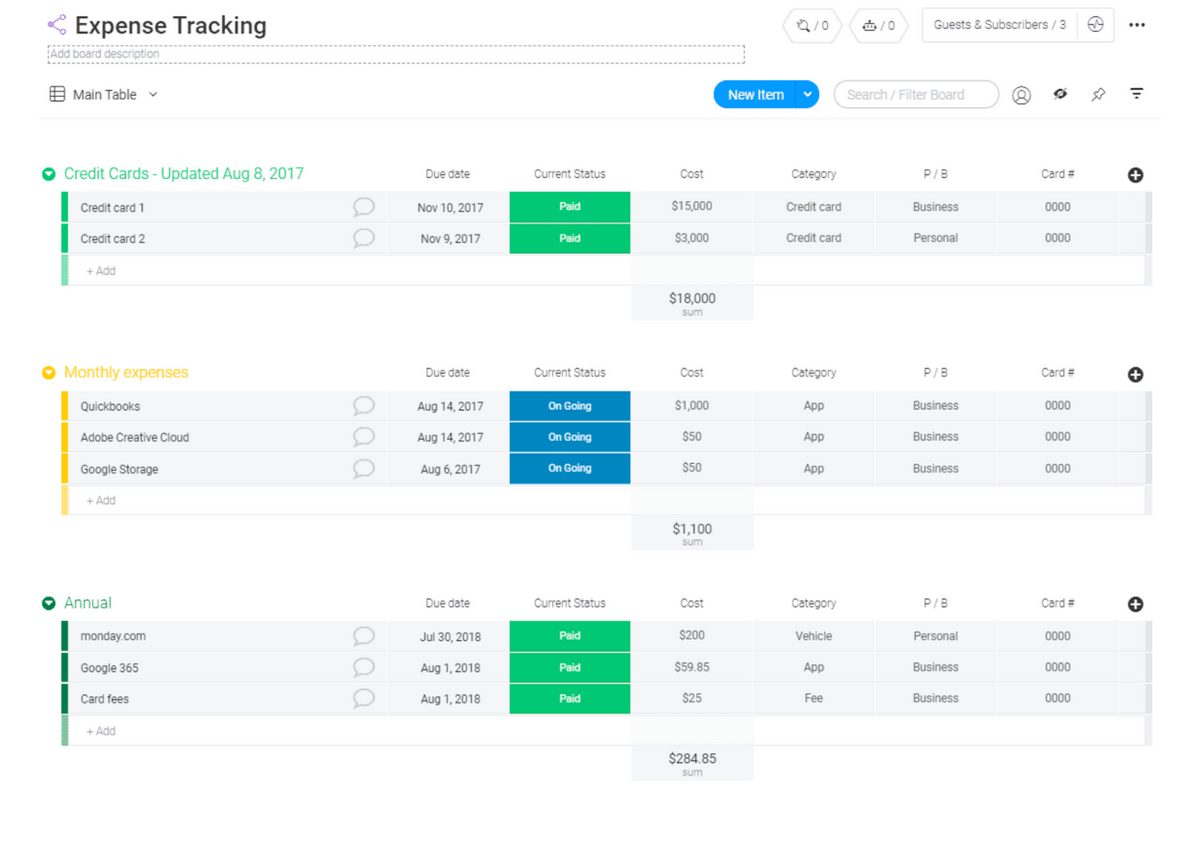

Expense Tracking Template

Our Expense Tracking Template is designed to help you regain control of your finances with a fast and simple proactive approach.

This template offers live updates on all of your project or organization’s financials for any given period.

But it also gives you the chance to skip ahead and forecast where your existing financials will be in the days, weeks, and months ahead.

FAQs about Excel accounting templates

How do I create an accounting template in Excel?

Creating your own accounting template in Excel is pretty straightforward — although it can be a little time-consuming.

First, you’ve got to decide what sort of accounting template you’d like to create. After all, each template includes a range of different fields, so you’ll need to hone in on the reason you’re creating a template.

After opening up Excel, start a blank workbook and label your columns and rows. You may need to add formulas for certain columns depending on the type of statement template you’re creating.

Once you’re happy with the design and layout of your statement, all you’ve got to do is hit “File” and then “Save As Template.”

Does Excel have accounting templates?

The short answer is: yes, Excel has loads of accounting templates. If you open up Excel and then use the relevant keyword in the “Search All Templates” box, you should be able to find a basic template that will fit your needs.

For example, Excel has an inbuilt profit and loss statement template, business expenses budget template, budget planner template, and more.

How do you do accounting in Excel?

If you know what you’re doing, it’s possible to perform all of the core accounting functions for a business on Excel. But there’s a lot to do.

You’ll need to create an excel sheet as an invoice tracker, create a financial transaction tracker, set up multiple managerial accounting spreadsheets to keep tabs on operational expenditure — not to mention prepare income statements and cash flow statements.

These financial records will need to be constantly added into an up-to-date company ledger, which is essentially your master accounting template. Excel does offer a basic, pre-built company ledger template.