With so much paperwork, documentation, regulations, and communication that goes into closing a mortgage, managing it all can be a challenge. If you’re a financial organization offering loans to multiple property buyers, then multiply this challenge by hundreds or even thousands of clients.

With a CRM, mortgage lenders can distinguish high-value prospects from various incoming leads, making growing your business a quicker affair. In this article, we’ll look at mortgage CRMs, their benefits, the main features you need, and some of the solutions available today, including entirely customizable options like monday CRM.

Try monday CRMWhat is a mortgage CRM?

A mortgage CRM is software designed to help mortgage and lending professionals manage borrower relationships from first contact through closing.

Unlike generic CRMs, mortgage CRM systems support industry-specific workflows like lead tracking, loan pipeline management, document handling, and compliance tracking — giving loan officers a single place to manage clients, communications, and deals throughout the lending lifecycle.

The role of a mortgage CRM in 2026

In 2026, a mortgage CRM is no longer just a contact database or deal tracker. Rising compliance requirements, longer loan cycles, and higher lead costs mean mortgage teams need systems that actively reduce risk and friction.

Modern mortgage CRM software combines pipeline visibility, compliance tracking, and AI-driven automation to help brokers prioritize the right borrowers, identify stalled deals earlier, and maintain accurate audit trails without manual work.

As AI adoption grows across financial services, mortgage CRMs are increasingly used as decision-support tools—helping loan officers focus on high-value opportunities while automation handles routine tasks.

Benefits of using a CRM software for mortgage brokers

If your team is still tracking clients and lending data in a spreadsheet, you’re probably missing out on a ton of valuable data. Shifting from spreadsheets to all-in-one mortgage CRM software not only helps mortgage businesses improve client relationships but also allows teams to work more efficiently by prioritizing tasks and leads.

Let’s take a look at some of the core benefits of using CRM software for mortgage professionals:

- Streamline lead management: Organize all your leads in one place so that you never miss a high-priority opportunity.

- Improve client relationships: Build better connections with your clients by gathering data to add a personal touch to customer interactions and automating follow-ups.

- Increase productivity: Automating manual data entry and repetitive work can free up more of your time for high-value activities.

- Strengthen compliance: Built-in tools like document tracking and detailed customer histories can help you stay on top of compliance requirements and industry regulations.

- Gather real-time insights: Access dashboard overviews, comprehensive reports, and data-driven deal forecasts to make informed decisions and close deals quickly.

- Remain flexible and scalable: Adapt a CRM to your business’s needs with customizations so that it can grow as your company expands.

- Visualize your pipeline: Don’t guess where leads are in your pipeline, instead rely on your CRM to visualize progress so you can take action when deals get stuck.

7 best mortgage CRM systems

Mortgage professionals need to use a CRM to manage their daily tasks like lead management, document handling, marketing campaigns, and more. However, selecting the right CRM for your business can be tricky and time-consuming.

In the table below, we’ll compare the best CRMs for mortgage brokers side by side. For a more detailed look at each CRM, keep reading.

| Platform | Use case | Starting price | Free trial | G2 user rating |

|---|---|---|---|---|

| monday CRM | Customizable AI-powered CRM that scales with your business | 14 days | $12/seat/month | 4.6/5 (G2) |

| Salesforce | Comprehensive enterprise-level mortgage CRM solution | 30 days | $25/user/month | 4/5 (G2) |

| HubSpot Smart CRM | Mortgage CRM with integrated marketing and sales tools | Free plan | $45/user/month | N/A* |

| Pipedrive | Simplified lead tracking and sales pipeline management | 14 days | $14/user/month | 4.3/5 (G2) |

| Surefire CRM | Mortgage-specific CRM with a focus on compliance and marketing | Free demo | Contact for pricing | 4/5 (G2) |

| Jungo | Mortgage professionals looking for a Salesforce-powered solution | Free demo | $96/user/month | 4.5/5 (G2) |

| Shape | AI-driven CRM for mortgage teams looking for a simple solution | Free demo | Contact for pricing | 4.9/5 (G2) |

1. monday CRM

Use case: Customizable AI-powered CRM that scales with your business

Mortgage brokers get an all-in-one platform with monday CRM that helps them manage client relationships, automate mortgage workflows, and organize important documentation. With monday CRM’s AI capabilities, mortgage agents can handle complex workflows without constant manual intervention while benefitting from an intuitive platform that can be tailored to specific workflows.

Key features

- No-code AI automations: Implement quick AI automations using AI blocks to uncover customer sentiment, initiate follow-ups, or extract important data from files.

- AI lead management: AI can score and prioritize new incoming leads and then route them to the right team member based on availability, department, or skill level.

- Smart dashboards: Simplify high-level decision-making by viewing real-time customer insights and resource forecasting in clear AI-powered dashboards.

Pricing

- Free 14-day trial

- Price starting from $12/seat/month

Learn more about monday CRM plans and pricing here.

What users are saying

G2 rating: 4.6/5

“I absolutely love the emails and activities feature of monday CRM, which automatically tags emails to clients and leads, making tracking incredibly efficient. This automation, combined with the AI features, helps me extract crucial information like follow-up dates and important details effortlessly. The Workflow Center is another standout feature, offering enhanced automation akin to having if-this-then-that statements that propel my work forward and prevent stagnation, ultimately saving both time and money.” — Desiree M.

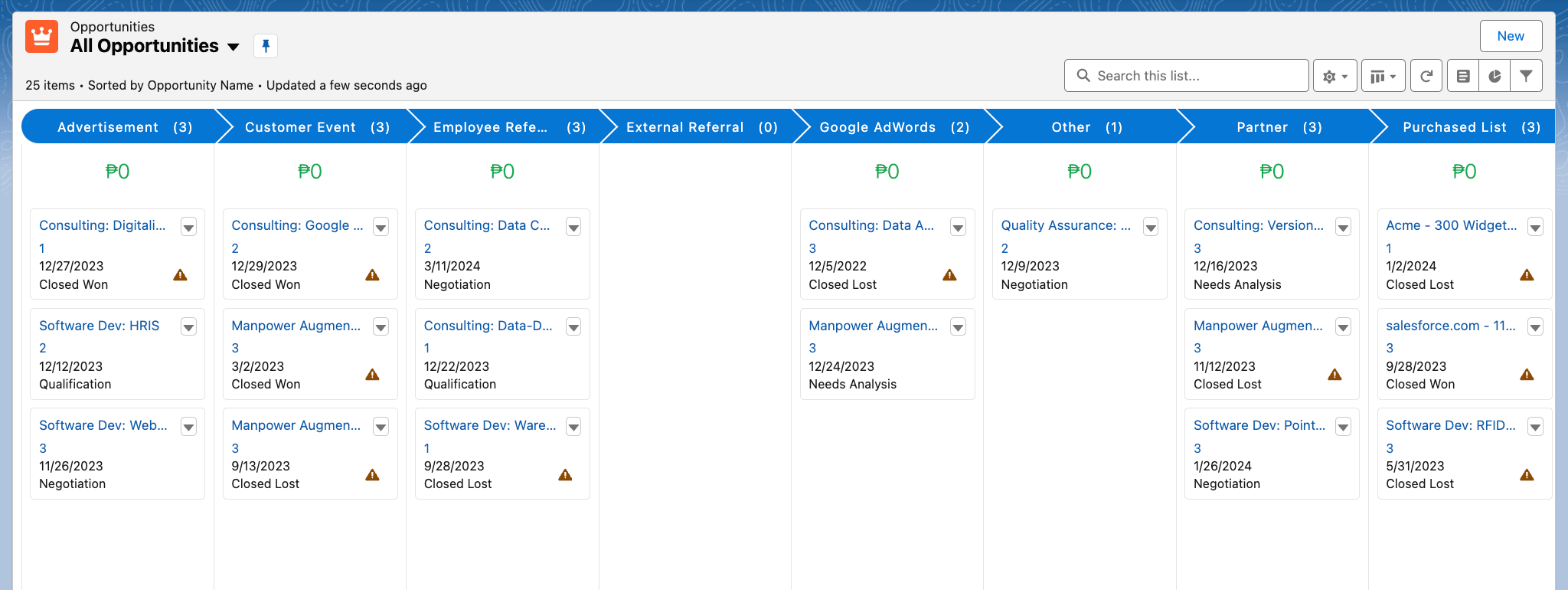

2. Salesforce

Use case: Comprehensive enterprise-level mortgage CRM solution

Salesforce offers a robust set of products that can be combined to create a powerful mortgage CRM, such as Sales Cloud, Financial Services Cloud, Digital Lending, and others. Salesforce is best suited to a larger team of mortgage professionals handling multiple simultaneous complex operations. That said, the ability to combine different Salesforce products to create a CRM system makes it a comprehensive solution that’s flexible for different types of mortgage teams.

Key features

- AI lead nurturing: Salesforce’s built-in Einstein AI tool can help track and nurture leads and suggest cross-selling opportunities.

- Automation tools: Automate routine tasks like sending reminders, processing documents, or managing follow-ups.

- AI agents: Use Agentforce to integrate digital AI agents that can handle initial lead contact, lead nurturing, customer follow-ups, and suggest actions on deals.

Pricing

- Free 30-day trial

- Plans starting from $25/user/month

What users are saying

G2 rating: 4/5

“I love how Salesforce Sales Cloud transformed our client management with its easy client and contract handling, enhancing our service delivery. The transition to Lightning was smooth, and I prefer it much over the classic version. I appreciate having everything in one place, as it makes sales tasks more efficient. I also enjoy using it to create opportunities and follow up on leads, which is crucial for our onboarding process and managing new client contracts.” — Pamela K.

3. HubSpot Smart CRM

Use case: Mortgage CRM with integrated marketing and sales tools

HubSpot Smart CRM is ideal for mortgage professionals who want to combine marketing, sales, and service efforts in a single platform. It provides user-friendly tools to manage client relationships while enabling smoother team collaboration. The platform is well-suited for mortgage teams that want to focus on various marketing campaigns, such as email or drip campaigns.

Key features

- Email tracking: Automatically track client interactions to streamline communication and follow-ups.

- Pipeline management: Visualize and manage your mortgage sales funnel easily and identify roadblocks in deals before they escalate.

- AI data agent: Integrated AI data agent allows team members to ask questions in natural language to get answers from customer history, email, and documents.

Pricing

- Free plan available with basic tools

- Plans starting from $45/seat/month

What users are saying

Trustradius rating: 8.4/10*

“I rely on HubSpot CRM to monitor leads, manage contacts, and streamline follow-ups all in one location. Previously, our team faced challenges with disorganized e-mails and over looked reminders, but HubSpot addressed this by providing a comprehensive timeline of each interaction.” — Ram Kishore

Note: HubSpot Smart CRM does not yet have reviews on Trustradius or G2. This reflects the HubSpot CRM rating from TrustRadius.

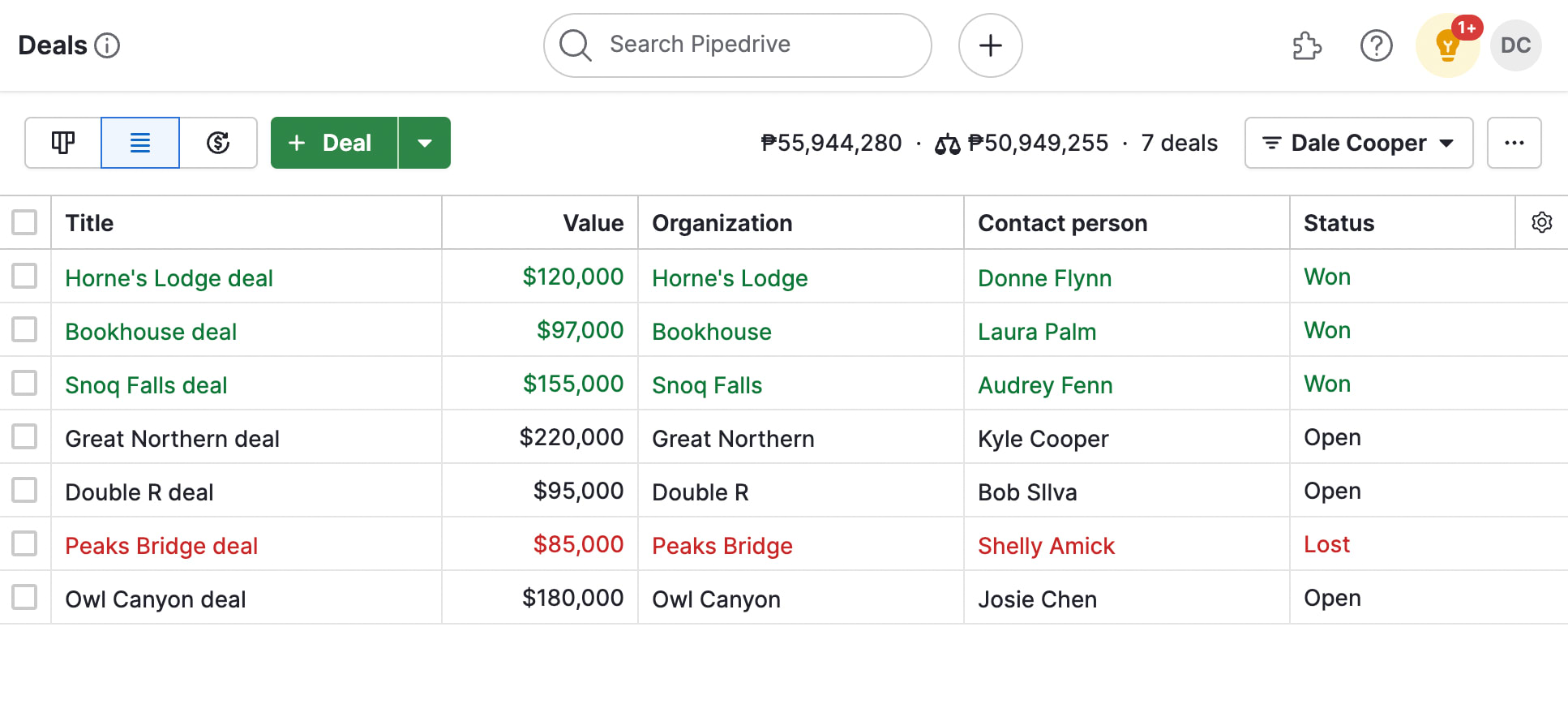

4. Pipedrive

Use case: Simplified lead tracking and sales pipeline management

Pipedrive focuses on ease of use and simplicity, making it a great choice for small mortgage teams or independent agents looking to manage sales pipelines effectively. Its intuitive interface allows users to focus on closing deals rather than managing software, and AI capabilities are seamlessly integrated throughout the platform to enhance productivity without adding complexity.

Key features

- Visual sales pipeline: Track leads at every stage on a user-friendly pipeline to see all your deals at a glance.

- Integrations: Pipedrive has over 500 available app integrations to make it easy for mortgage brokers to continue working with the tools they already use.

- AI sales advisor: Nora, Pipedrive’s AI advisor, helps teams with instant answers, deal recommendations, and even demos of platform features.

Pricing

- 14-day free trial

- Plans starting from $14/seat/month

What users are saying

G2 rating: 4.3/5

“Very focused on the right activities, and not on burdensome forms or tick-boxes. The integrations between computer and phone access are instantaneous and really helpful. I use it every day, wherever I am. Having used a few other CRMs over many years, I firmly believe Pipedrive is the best for my needs, which are sales-focused with a lot of service follow through.” — Andrew E.

5. Surefire CRM

Use case: Mortgage-specific CRM with a focus on compliance and marketing

Surefire CRM is a platform designed for mortgage professionals that helps loan officers and mortgage lenders grow their businesses. Its specialized features cater specifically to the mortgage industry, ensuring compliance and efficiency. Surefire CRM is also a good marketing solution for teams looking to boost marketing automation and outreach.

Key features

- Pre-built marketing campaigns: Access a library of customizable marketing content tailored for mortgage professionals.

- Compliance tools: Ensure adherence to industry regulations with automated compliance checks.

- Sales and loans features: Focus on sales and loans with built-in alerts, reporting, outbound calling, referral partner management, and more

Pricing

- Free demo available

- Plans and pricing available on request

What users are saying

G2 rating: 4/5

“Surefire has a lot of great content that comes ready to begin marketing in all things purchase related and refinance related. The amount of information it is able to store and take advantage of is great. And the marketing material is great. The Loan Milestones are also well done. It comes pretty ready to go, but is also very customizable. Allowing you to create your own fields, workflows, and marketing material rather quickly.” — Nathan G.

6. Jungo

Use case: Mortgage professionals looking for a Salesforce-powered solution

Jungo is a Salesforce-based CRM tailored specifically for mortgage and lending professionals. It combines the flexibility of Salesforce with industry-specific tools, making it ideal for managing leads, automating tasks, and maintaining client relationships.

Key features

- Lead management: Capture, track, and segment leads from sources like Zillow, LendingTree, and others.

- Loan document management: Simplify the loan process with integrated tools for storing, managing, and collaborating on documents.

- Co-marketing: Create custom flyers, emails, and marketing assets to build profitable relationships with referral partners.

Pricing

- Free demo available

- Plans starting at $96/user/month

What users are saying

G2 rating: 4.5/5

“I use Jungo in my everyday work life. It helps me keep up with all my daily tasks, as well as holds all of my past clients, Realtors, prospects, and Mortgage contacts. It helps me stay organized and on top of things.” — Kelli K.

7. Shape

Use case: AI-driven CRM for mortgage teams looking for a simple solution

Shape CRM provides an AI-led solution for teams and lenders managing mortgages. The platform is simple and designed to meet the needs of smaller teams. Shape brings together lead management, marketing, and sales automation in one user-friendly solution to help agents qualify, score, and prioritize mortgage clients and leads.

Key features

- AI lead scoring: Score incoming leads in real-time using Shape’s AI so that your team can focus on the deals most likely to convert.

- AI communications: Send texts, answer inbound calls, or dial outbound to leads using AI to easily connect with potential clients at the right time.

- AI call analytics: Generate quick summaries on customer calls, notes, and next steps to understand where you stand with each lead.

Pricing

- Free demo available

- Plans and pricing available on request

What users are saying

G2 rating: 4.9/5

“What we like most about Shape Mortgage Software is its exceptional customer support, seamless integration, user-friendly interface, robust features, customization and flexibility, and reliable performance. Implementation was a breeze! We use Shape on a daily basis and couldn’t be happier.” — Steven C.

Core features to look for in a mortgage broker CRM

When searching for the best mortgage CRM for your business, it’s important to make a list of the features you’ll need. Start by assessing your organization’s goals for a new CRM platform, and then list the features you’ll need to help you reach them. Some key mortgage CRM features you may want to consider include:

Lead management

The right CRM will have functionalities to make it easier to manage, track, engage, and prioritize leads and automatically distribute them to the right agents based on priority, availability, region, or experience level. Look for lead scoring capabilities that help you identify the most promising prospects based on their behavior and engagement patterns.

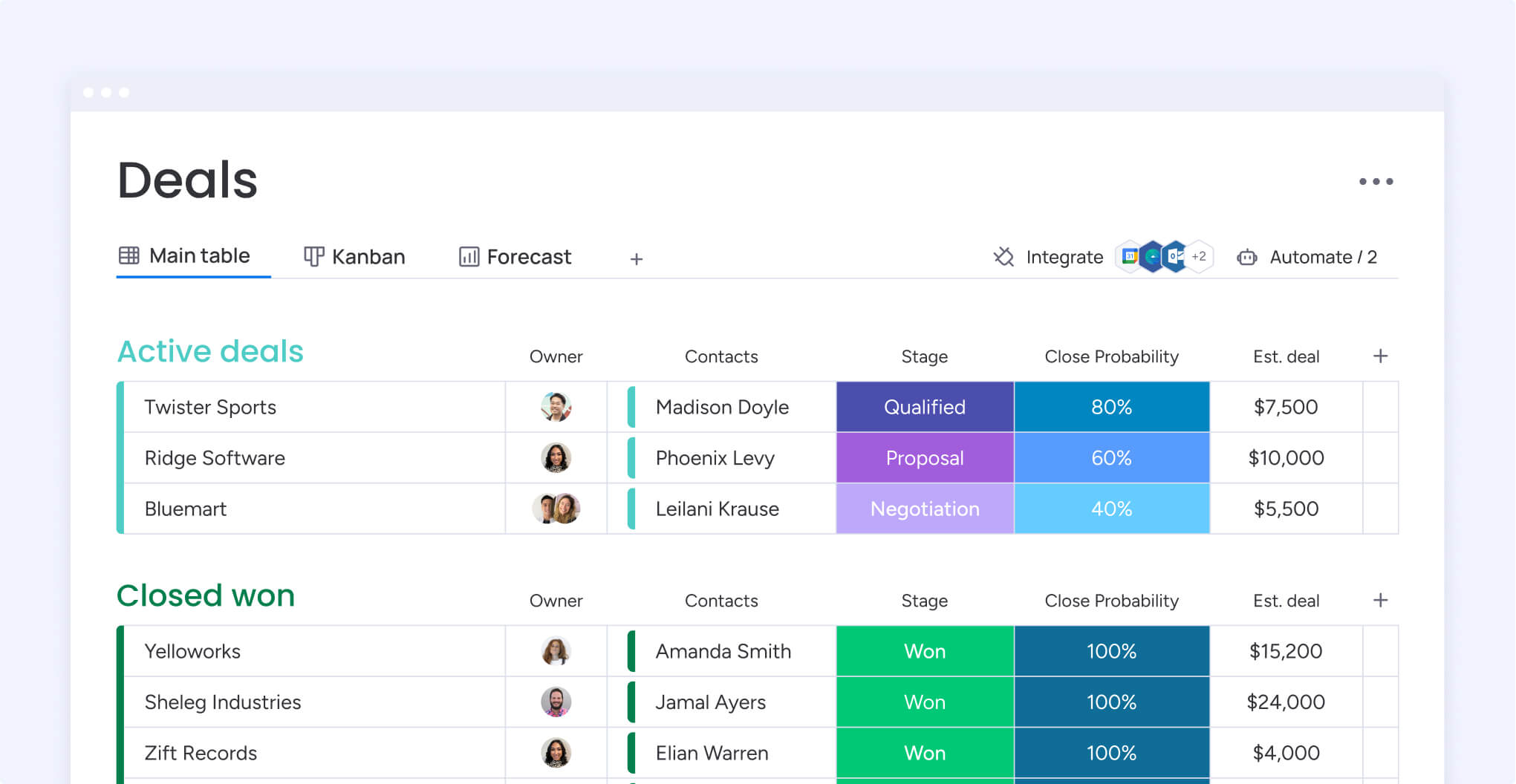

Mortgage pipeline management

You should be able to visualize and manage the loan process from initial inquiry to closing and get pipeline insights into potential deal roadblocks or issues that can prevent closing. Real-time status tracking and customizable drag-and-drop pipeline stages can help your team keep everything organized so that nothing gets forgotten.

AI and workflow automation

Automate repetitive tasks like follow-ups, reminders, and status updates in your CRM so you can keep deals moving without manual intervention. AI-powered functionalities can also analyze borrower data to offer forecasts and predictive analytics like loan approval likelihood while also recommending next-best actions for your team.

Mobile app

For mortgage teams that are always on the go or work remotely in the field, make sure they can update and access the CRM from anywhere through a mobile app. A mobile CRM app should offer critical functionality, like document uploads, real-time status updates, and client inquiry management.

Communication and collaboration tools

Your software should come equipped with tools to merge client communications from multiple channels as well as collaborate on accounts. Features such as email history summarization, collaborative document editing, and shared task management or internal messaging capabilities are all essential for your team to work together efficiently.

Seamless third-party integrations

The solution you opt for should easily integrate workflows and sync data from the work tools you’re already using. Look for a CRM that can integrate with platforms such as loan origination systems (LOS), credit reporting services, or digital document signing platforms.

Compliance tracking

Your CRM should help your team stay compliant with local data regulations by keeping sensitive customer data secure. When comparing software, consider solutions that offer features like centralized document storage with access to version history for a traceable paper trail, as well as role-based access controls, and audit logs that track every interaction with client data.

Residential vs. commercial mortgage broker CRM: Key differences

The type of mortgage lending you focus on — residential or commercial — directly impacts the CRM features and workflows your team needs to manage deals efficiently.

This table breaks down key differences in features:

| Residential mortgage broker CRM | Commercial mortgage broker CRM | |

|---|---|---|

| Client structure | Individual borrowers and households | Businesses, investors, and property ownership groups |

| Deal volume | High-volume pipelines with standardized loan applications | Lower volume, high-value deals with longer timelines |

| Workflow complexity | Predictable, repeatable stages from pre-qualification to closing | Multi-stage, highly customized deal workflows |

| Relationship management | Tracking referrals from real estate agents and partners | Mapping multiple stakeholders and decision-makers per deal |

| Marketing needs | Personalized campaigns for properties, seasonal buyers, and first-time homebuyer programs | Targeted outreach based on property type and investment strategy |

| Automation priorities | Pre-qualification workflows, rate quote delivery, and follow-ups | Task orchestration across long deal cycles and approval stages |

| Document handling | Standard borrower documents (income verification, credit, disclosures) | Complex financial documentation (rent rolls, appraisals, P&L statements) |

Although many mortgage CRM systems can support both lending models, the key is choosing a platform that allows flexible customization without adding unnecessary complexity.

Manage mortgage workflows and scale faster with monday CRM

Backed by feature-rich AI capabilities, monday CRM is a flexible platform that helps mortgage teams manage leads, clients, and lending pipelines in one place. With customizable workflows, automations, and a visual interface, it supports both small teams and larger organizations without forcing rigid, mortgage-specific processes.

AI-powered efficiency

AI automations can extract critical data from PDF documents so that content from files and contracts gets auto-populated on boards, making them easily accessible without manual input.

Use AI to analyze sentiment in customer communications, such as call logs and emails, so that you can get ahead of potential issues and maintain customer satisfaction. Built-in AI assistant, monday sidekick, helps team members plan next steps in complex deals, access historical data just by asking, and create automations with natural language prompts.

Smarter workflows and code-free automation

Automate email communications to clients, partners, or leads and rely on monday CRM’s AI to personalize every interaction. Generate reporting and analysis workflows to constantly have an overview of real-time data so you understand which deals need close attention.

Auto-summarize complex deals, meetings, and customer accounts using AI, so you can easily see the most important details in one glance.

Intuitive interface for a seamless work experience

Choose from over 200 third-party app integrations to make it easy to sign and store documents, communicate with leads over different channels, and sync data to create a single source of truth.

Build compelling marketing campaigns with monday campaigns, where you can design email campaigns in minutes to nurture leads, win back customers, and keep in touch post-sales. Visualize your to-do list, pipeline, deal updates, or other data with over 27 different work views, including Calendar, Map, Timeline, and more.

Mortgage industry use case: From lead intake to post-closing

Here’s an example of how a mortgage team can use monday CRM to manage the loan lifecycle from lead intake through post-closing, without relying on manual follow-ups or disconnected tools:

- Lead intake and routing: New leads from a website or referral partner are automatically captured, scored, and routed to the appropriate loan officer based on availability and deal type.

- Application and document processing: As borrowers upload documents like pay stubs or tax returns, key information is extracted and added to the deal record automatically, reducing manual data entry and errors.

- Active deal management: Throughout the application process, communication history and deal status are tracked in one place. Automated alerts highlight stalled deals or potential issues that require attention.

- Follow-ups and closing coordination: Workflows trigger reminders for outstanding documents, approvals, or signatures, helping teams keep deals moving toward closing without constant manual outreach.

- Pipeline visibility and post-closing follow-up: Loan officers and managers monitor deal progress in a visual pipeline, while automated post-closing workflows support ongoing client communication and relationship management.

Affordable mortgage CRM options for small businesses and independent brokers

Small mortgage businesses or independent brokers have 2 specific needs when it comes to selecting the right CRM: affordability and scalability. Of course, they also want to make sure the software they’re using is easy and quick to implement, but the most important considerations are that a CRM is going to fit into a small budget and scale alongside a growing team.

That’s why small teams and independent mortgage brokers should consider flexible options like monday CRM or Pipedrive. Real estate-specific platforms like Jungo or Surefire CRM may seem like the go-to choice, but when you break it down, solutions like these can feel rigid for small teams who need to move quickly and customize a platform to their specific needs.

A solution like monday CRM is not only a lot more customizable, but it also comes with a much more affordable cost per user, meaning independent brokers and small mortgage teams can get exactly the software they need without blowing their budget. As your team grows, it’s easy and affordable to scale monday CRM to fit a growing organization.

Choose the right mortgage CRM for your team

Not every CRM will be right for every mortgage team. You need to consider your team’s needs alongside requirements that will support your workflows and scale easily as you grow. Robust CRM solutions, like monday CRM, that apply AI to daily workflows, are already at the forefront of change in the mortgage software industry.

In the future, we can expect to see mortgage CRMs rely more heavily on predictive analytics, AI forecasting, and intelligent lead generation to stay competitive. A solution like monday CRM empowers your team to work more productively, but it does a lot more than just that. As your team becomes more comfortable integrating AI into routine workflows, it’ll be easier to adopt new mortgage AI trends as they emerge, keeping your organization one step ahead of the competition.

FAQs

What makes a CRM "mortgage-specific" compared to general sales software?

Mortgage-specific CRMs are built with features tailored to the lending industry, including loan pipeline visualization, compliance tracking for regulations, integrations with loan origination systems, and automated workflows for tasks like rate quotes, pre-approvals, and document collection. That said, many general CRMs can help brokers accomplish the same thing with the added flexibility of customizable workflows that can fit a range of needs and scale as teams grow.

How does mortgage CRM automation help in reducing the loan closing cycle?

Mortgage CRM automation speeds up the loan process by eliminating manual tasks like follow-up emails, status updates, and document requests. It triggers timely reminders for missing paperwork, automatically routes applications to the right team members, and keeps all stakeholders informed. With CRM automations, mortgage brokers can prevent delays so that loans move smoothly from application to closing.

Can a mortgage CRM assist with regulatory compliance and audit trails?

Yes, mortgage CRMs help maintain compliance by centralizing document storage, tracking all client interactions, and creating detailed audit trails with timestamps and version histories. They can automate compliance checks, ensure proper disclosure delivery timing, flag potential regulatory issues, and provide documentation needed for audits or regulatory reviews.

How do AI features like predictive lead scoring improve mortgage sales?

AI-powered features like lead scoring can analyze behavior, engagement patterns, and historical data to identify which leads are most likely to convert. This helps loan officers prioritize outreach, focus on high-value opportunities, and personalize approaches and marketing campaigns based on forecasted needs, ultimately increasing conversion rates and revenue.

How secure is client financial data within a cloud-based mortgage CRM?

Cloud-based mortgage CRMs typically employ bank-level security measures, including data encryption both in transit and at rest, multi-factor authentication, role-based access controls, and regular security audits. Reputable providers comply with industry standards like SOC 2 and maintain certifications to protect sensitive financial information from unauthorized access or breaches.