Your sales team closed a great quarter, and now it’s time to turn those wins into lasting partnerships. When you build loyalty strategically, you’ll see customers responding enthusiastically to outreach, renewing without price negotiations, and staying committed even when competitors come calling.

In this guide, you’ll learn 7 data-driven strategies to measure loyalty accurately, build emotional connections at scale, and turn customer relationships into predictable revenue growth — including which metrics actually matter, how to personalize at scale without hiring, and how to automate the loyalty work that drives revenue.

Try monday CRMKey takeaways

- Focus on emotional loyalty over transactional loyalty by building relationships based on trust and value delivery, not discounts or switching costs.

- Track net revenue retention (NRR) as your north star metric to make forecasting predictable and reduce pressure on new acquisition.

- Anticipate customer needs by reaching out before problems occur with automated triggers based on usage drops, renewal dates, and behavioral signals.

- Eliminate information silos with complete interaction history, automated health scoring, and AI-powered insights that surface risks and opportunities without manual analysis.

- Collect customer input through multiple channels, prioritize by impact and frequency, then personally notify customers when their suggestions drive product improvements.

What is customer loyalty?

Customer loyalty refers to how committed customers are to choosing you over your competitors. You see customer loyalty in action through repeat purchases, renewals, upsells, and referrals. Loyal customers pick your solution because they see real value — not because they’re stuck.

For revenue teams, loyalty drives predictable growth. Loyal customers generate more revenue over their customer lifetime, renew contracts at higher rates, and create qualified pipeline through referrals. They also require less sales effort to retain than new customers require to acquire.

Revenue leaders are under constant pressure to forecast accurately, allocate resources wisely, and prove ROI to leadership. When your customers are loyal they stay longer, buy more, and refer their friends, so forecasting becomes reliable, acquisition costs drop, and resource allocation becomes strategic rather than reactive.

Transactional vs. emotional loyalty: What’s the difference?

There are 2 types of customer loyalty. The difference determines whether your retention efforts create lasting value or simply buy time. Knowing which type you’re building changes where you invest your time, budget, and energy.

| Dimension | Transactional loyalty | Emotional loyalty |

|---|---|---|

| Why customers stay | Discounts, contracts, switching costs | Trust, outcomes, positive experiences |

| How decisions are made | Price- and term-driven | Value- and outcome-driven |

| Response to competitors | Leave when offered better terms | Resist outreach and comparisons |

| Renewal dynamic | High-friction negotiations | Low-friction renewals |

| Growth behavior | Minimal expansion | Expansion, referrals, advocacy |

| Risk profile | Churn spikes at renewal | Stable through pricing and market shifts |

Transactional loyalty depends on convenience, pricing, or contractual friction. Customers stay because switching is difficult or costly — not because they genuinely prefer your solution. As a result, this loyalty is fragile. The moment a competitor offers better terms or reduces switching friction, retention risk spikes.

Emotional loyalty is built on trust and consistent value delivery. Customers stay because they believe in the outcomes you help them achieve and trust the relationship. This loyalty holds up against competitive pressure, price changes, and shifting market conditions.

The distinction matters. Transactional loyalty requires constant discounts and negotiation just to maintain revenue. Emotional loyalty compounds — driving renewals, expansions, and referrals without the same ongoing effort.

How customer loyalty drives predictable revenue growth

Loyal customers solve revenue problems mid-market leaders deal with every day. When loyalty is high, revenue becomes more predictable, acquisition costs fall, and growth compounds. These advantages make loyalty investments measurable — not just qualitative.

| Revenue metric | High customer loyalty | Low customer loyalty |

|---|---|---|

| Net revenue retention | Above 100%; growth from existing customers | Below 100%; shrinking customer base value |

| Customer lifetime value | Expands through renewals and upsells | Capped by short lifespans |

| Customer acquisition cost | Declines through referrals | Rises as paid channels dominate |

| Forecast accuracy | High; renewals and expansion are predictable | Low; churn disrupts projections |

High loyalty stabilizes renewals, unlocks expansion, and fuels referral-driven pipeline, turning forecasting from guesswork into planning. Low loyalty concentrates risk at renewal, inflates acquisition costs, and forces teams into reactive growth mode. This is why loyalty shows up directly in metrics like NRR, CLV, and forecast accuracy.

Measure what matters: Revenue-focused loyalty metrics

Customer loyalty isn’t measured through sentiment alone. Metrics like satisfaction surveys and NPS offer directional insight, but they don’t explain how loyalty affects revenue, forecasting, or growth efficiency.

To justify loyalty investments and track their impact, revenue teams need metrics that connect customer behavior directly to business outcomes. The most effective loyalty measurement combines leading indicators (signals of future risk or expansion) with lagging indicators (confirmed revenue results). Together, these metrics show whether loyalty is compounding growth or quietly eroding it.

Customer lifetime value (CLV)

Customer lifetime value measures the total revenue a customer generates over the course of your relationship. In B2B and subscription models, CLV reflects contract value, renewal frequency, tenure, and expansion — making it a foundational metric for loyalty-driven growth.

CLV informs several critical revenue decisions:

- Account prioritization: Identifies which customers justify higher-touch support and proactive engagement

- Investment justification: Quantifies the long-term return on loyalty initiatives by showing how retention improvements compound over time

- Acquisition targeting: Sets realistic customer acquisition cost thresholds based on lifetime value potential

- Resource allocation: Guides customer success coverage models based on account value rather than account count

As a general benchmark, many SaaS and B2B teams target a CLV-to-CAC ratio of at least 3:1, meaning each customer generates 3x more value than the cost to acquire them. Ratios below this threshold often signal loyalty gaps, excessive acquisition spend, or short customer lifespans.

Net revenue retention (NRR)

Net revenue retention measures how much revenue you retain from existing customers over a given period, including expansions, upgrades, downgrades, and churn. For subscription and B2B companies, NRR is the clearest indicator of whether customer loyalty is producing durable growth.

The calculation:

(Starting MRR + Expansion MRR − Churned MRR − Downgrade MRR) ÷ Starting MRR × 100

| NRR range | What it indicates | Revenue implication |

|---|---|---|

| Below 90% | Significant value erosion | Growth depends heavily on new acquisition |

| 90–100% | Stable but flat | Loyalty maintenance with limited expansion |

| 100–110% | Healthy growth | Strong retention with moderate expansion |

| 110–120% | Strong performance | Effective loyalty and expansion motion |

| Above 120% | World-class | Exceptional product-market fit and customer success |

NRR above 100% means you’re growing revenue from existing customers faster than you’re losing it. When NRR drops below 100%, teams must rely on constant new acquisition just to maintain current revenue — increasing costs and reducing predictability.

Customer health scores

Customer health scores combine multiple behavioral and engagement signals into a single indicator of loyalty and churn risk. Unlike lagging metrics, health scores act as early warning systems, allowing teams to intervene before revenue is at risk.

Effective health scores typically include:

- Product usage signals: Adoption depth, active users, and usage trends

- Relationship signals: Support patterns, responsiveness to outreach, stakeholder engagement

- Business outcome signals: Goal attainment, ROI realization, and expansion history

When tracked consistently, health scores help teams prioritize customer success resources, identify expansion-ready accounts, and forecast renewal risk with greater accuracy.

Advocacy and referral rates

Advocacy and referral metrics capture the highest level of customer loyalty — when customers actively recommend your solution to others. These signals matter because referral-driven growth is both lower-cost and more predictable than paid acquisition.

| Metric | Typical benchmark | Why it matters |

|---|---|---|

| Referral rate | 10–15% of customers | Indicates active advocacy, not passive satisfaction |

| Referral conversion rate | 2–3× higher than outbound | Reflects trust transfer and deal quality |

| Time to close (referred) | 30–50% shorter | Demonstrates sales efficiency gains |

| Retention of referred customers | Higher than average | Referred customers often have stronger fit |

Tracking advocacy inside your CRM allows sales and success teams to identify promoters, prioritize expansion conversations, and systematically turn loyalty into pipeline growth.

Try monday CRM7 data-driven strategies to build customer loyalty

Building customer loyalty requires systematic strategies, not random acts of customer service. According to the SAP’s Global Edition of the Customer Loyalty Index, 64% of shoppers now ignore brand names entirely when making purchases. The message is clear: traditional loyalty tactics no longer work.

The strategies in this article address the core challenges revenue leaders face: lack of visibility into customer sentiment, inefficient manual processes, and difficulty scaling personalization without scaling headcount.

1. Create a single customer view across revenue teams

A single customer view gives every revenue team member access to a unified, real-time record of all customer interactions, data, and history. It eliminates information silos that damage customer relationships and ensures every interaction is informed by complete context.

Creating a single customer view requires centralizing customer data in one system accessible to sales, customer success, and support. Then, you need to integrate communication channels so interactions are automatically logged and create standardized fields and automation to maintain data quality

Here is the essential data you need for complete customer visibility:

- Contact and organizational information: Key stakeholders, decision-makers, organizational structure

- Complete interaction history: Every email, call, meeting, and support interaction

- Purchase and contract details: Products purchased, contract terms, renewal dates

- Health indicators: Current health score, risk factors, opportunity signals

With the right CRM software, you can get a unified customer view by default, with all teams working from the same real-time data. Choose software that logs every interaction in one timeline, eliminating silos that frustrate customers and slow down revenue teams.

2. Design personalized journeys using behavioral data

Personalized journeys are customized sequences of interactions, content, and touchpoints based on each customer’s specific behaviors, needs, and stage in the customer lifecycle. This goes beyond using a customer’s name in emails — it means tailoring the entire experience to their situation.

Behavioral data means actions customers take (or don’t take) that signal their needs, interests, and satisfaction level. Product usage patterns, feature adoption, support ticket themes, and engagement with outreach all provide signals that should shape the customer experience.

| Behavioral trigger | What it signals | Appropriate response |

|---|---|---|

| Low login frequency after onboarding | Adoption struggle or low perceived value | Personalized check-in with resources and training |

| High usage of specific features | Power user, potential advocate | Outreach about advanced features or upgrades |

| Support ticket about recurring issue | Frustration building | Proactive resolution with executive attention |

| Approaching renewal with declining usage | Churn risk | Executive sponsor engagement and value review |

| Multiple users added organically | Natural expansion | Account review to support and accelerate growth |

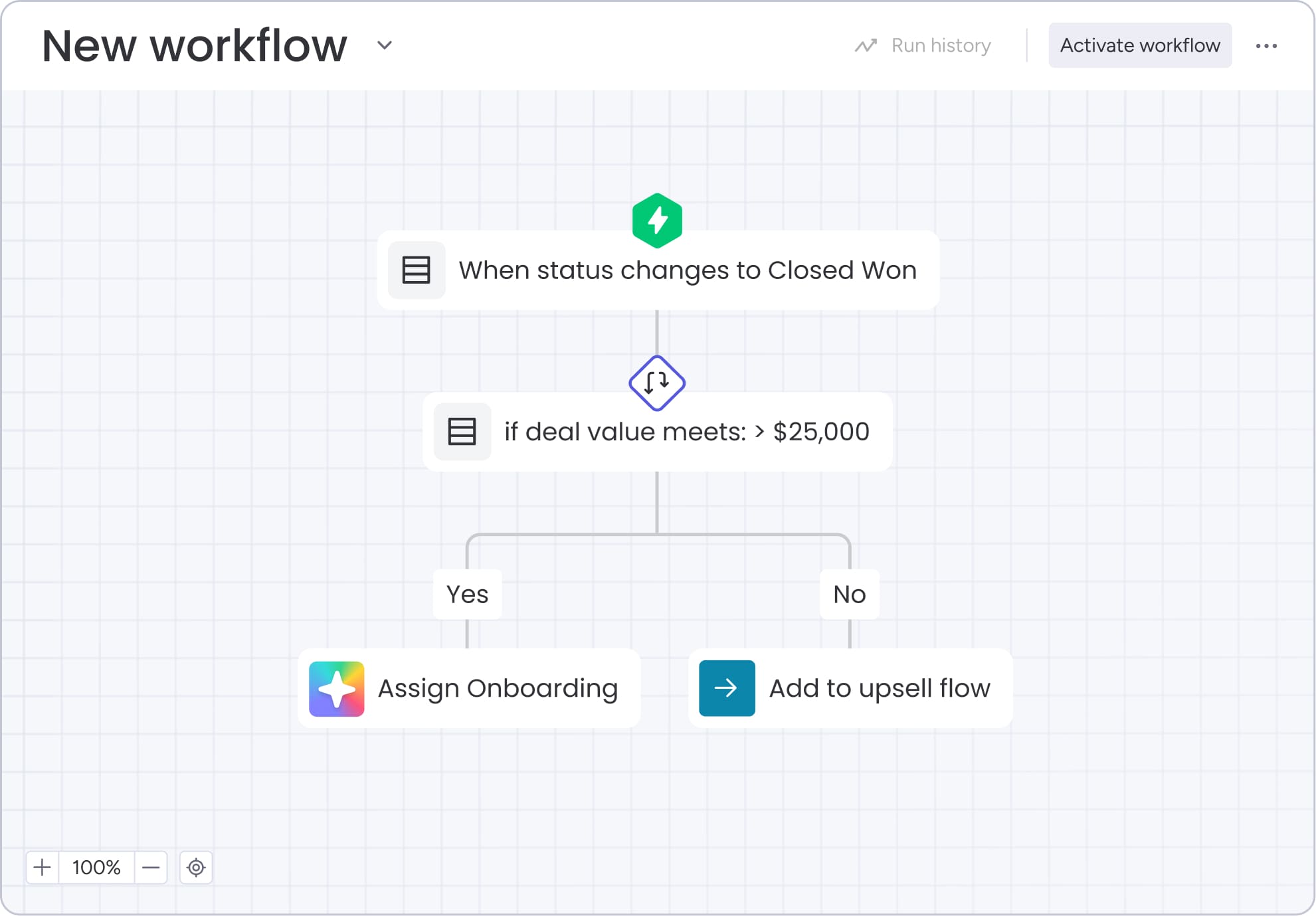

Designing personalized journeys involves mapping customer lifecycle stages, identifying key behavioral signals, creating journey variations, and building automated workflows that trigger based on behavioral signals.

3. Build proactive communication workflows

Proactive communication workflows are automated, systematic outreach that anticipates customer needs before they ask. This contrasts with reactive communication, where teams only respond when customers reach out with problems. Proactive communication prevents issues from escalating and shows customers you’re monitoring their success.

Building proactive communication workflows starts with:

- Identifying key moments where proactive outreach adds value, such as onboarding milestones, usage drops, approaching renewals, and feature releases

- Creating communication templates for each scenario that provide specific value, not generic check-ins

- Setting up automated triggers based on customer data, behavior, or time-based milestones

Some examples of proactive communication include:

- 30 days before renewal: Automated value review showing ROI achieved, followed by customer success outreach to discuss continuation

- Usage drops 50% week-over-week: Automated alert to customer success with suggested talking points and intervention options

- Customer reaches 80% of usage limits: Proactive outreach about upgrade options before they hit constraints and experience friction

- New feature launches relevant to customer’s application: Personalized notification with implementation guidance and training offer

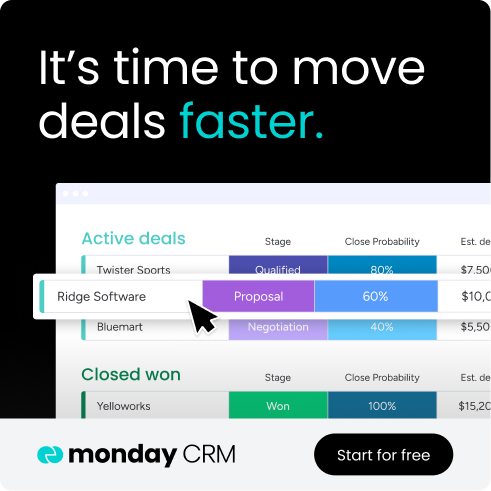

With software like monday CRM, teams can build proactive workflows triggered by any data change or time-based milestone, ensuring no critical moment passes without appropriate outreach.

4. Implement value-based loyalty programs for B2B

Value-based loyalty programs are structured initiatives that reward customers for behaviors that indicate loyalty and drive mutual value. According to SAP’s Global Edition of the Customer Loyalty Index, 41% of consumers participate in a loyalty program.

That said, B2B loyalty programs differ fundamentally from consumer programs, focusing on business outcomes and partnership behaviors, not points and discounts.

| Program element | B2C approach | B2B approach |

|---|---|---|

| Primary metric | Transaction frequency and volume | Business outcomes and partnership behaviors |

| Reward type | Discounts, points, perks | Strategic benefits, exclusive access |

| Target audience | Individual consumers | Organizational decision-makers |

| Value exchange | Transactional savings | Strategic business advantage |

Value-based programs align your success with customer success, creating a partnership rather than a vendor-customer relationship through strong customer orientation. They reward behaviors that benefit both parties, strengthening the relationship while generating business value.

Building a loyalty program requires several strategic steps:

- Identify valuable behaviors that indicate loyalty and drive mutual value, such as referrals, case studies, product feedback, community participation, and advisory board membership.

- Create tiered program levels based on engagement and value contribution, not just spend.

- Design rewards that provide strategic business value, such as executive access through quarterly strategy sessions, product influence via early beta access and roadmap input, or co-marketing opportunities.

5. Turn customer feedback into immediate action

Creating systematic processes to collect, analyze, and act on customer feedback quickly builds loyalty more effectively than the changes themselves. Many companies collect feedback but fail to act on it, which actually damages customer loyalty by signaling that customer input doesn’t matter.

The feedback loop has 4 stages: Collect feedback, analyze and prioritize, implement changes, and communicate back to customers what changed and why. Most companies execute the first 3 stages adequately but miss the final step, which is what actually builds loyalty.

Use this prioritization matrix to decide which feedback to act on first based on impact and frequency:

| Impact | High frequency | Low frequency |

|---|---|---|

| High | Prioritize immediately; affects many customers | Address for key accounts |

| Low | Batch and address systematically | Document but deprioritize |

Turning feedback into action requires collecting input through multiple channels (surveys, advisory boards, support tickets, usage data), centralizing it in one system, and establishing a regular review process to prioritize based on impact and frequency. Prioritize feedback that affects many customers significantly, address key account requests that impact important relationships, and batch minor but widespread issues systematically.

Close the loop by directly notifying customers when their suggestions are implemented, sharing release notes with attribution, and publicly recognizing valuable contributions. With monday CRM, you can centralize feedback from all sources, allowing teams to track feedback through implementation, ensuring every suggestion is managed and accounted for.

6. Master the post-purchase experience

The post-purchase experience encompasses everything that happens after a customer signs a contract, including onboarding, adoption, ongoing support, and expansion. This is where loyalty is actually built or destroyed, yet many revenue teams focus disproportionately on pre-sale activities.

- Post-sale outreach (within 24 hours): Customer success reaches out with next steps and confirms ownership.

- Onboarding kickoff (first week): Structured session to align on goals, expectations, and success metrics.

- First value milestone (within 30 days): Achieve a meaningful outcome that demonstrates early value.

- Adoption checkpoint (60–90 days): Review feature adoption and identify expansion opportunities.

- Quarterly business reviews (every 90 days): Data-driven conversations showing ROI and planning the next phase.

- Renewal preparation (90 days before renewal): Begin renewal discussions with documented outcomes and value delivered.

The post-purchase experience determines whether customers achieve their desired outcomes. Customers who realize value quickly become loyal, improving customer retention. Customers who struggle during onboarding churn, often before they ever had a chance to succeed.

Mastering post-purchase experience requires mapping the ideal journey with specific milestones, creating structured handoffs from sales to customer success with complete context transfer, and building time-bound onboarding programs with clear success metrics. Avoid treating onboarding as a single event, using identical approaches for all customer segments, or waiting until renewal time to discuss value and outcomes.

7. Foster customer advocacy and community

Customer advocacy and community create structured opportunities for customers to connect with each other, share experiences, and become active promoters of your solution. This strategy transforms customers from passive users into active participants in your ecosystem.

To build an advocacy program, start by identifying natural advocates based on satisfaction scores, referral history, and engagement levels. Then, create structured advocacy opportunities with value exchange and community spaces where customers can connect (e.g., online forums, user groups, and annual events).

Be sure your advocacy program has the following:

- Reference program: Structured process for customers to speak with prospects, with preparation support and appropriate recognition

- Case study participation: Collaborative content creation highlighting customer success with professional production and promotion

- Review site engagement: Guided process for customers to share experiences on G2, Capterra, or industry-specific platforms

- Advisory board: Strategic input on product direction and company strategy with executive access

Using monday CRM, you can track advocacy activities and community participation as part of the customer record, ensuring this valuable information is visible to all revenue team members.

Try monday CRMUse AI and automation to scale customer loyalty

Building customer loyalty at scale requires 2 things that mid-market teams often lack: deep customer insight and the ability to act on it consistently. AI and automation bridge this gap by making proactive, personalized loyalty strategies possible without enterprise-level headcount or infrastructure.

Rather than reacting to churn after it happens, AI enables teams to anticipate risk, personalize engagement, and focus effort where it has the greatest impact.

Predictive analytics for churn prevention

Traditional churn management is reactive. Teams respond after usage drops, complaints escalate, or renewal conversations turn tense — often when the customer has already decided to leave.

AI-powered predictive analytics flips this model. By analyzing historical patterns across usage, engagement, support, and account changes, AI can identify churn risk before frustration becomes visible, giving teams time to intervene while the relationship is still recoverable.

AI-powered personalization and insights

AI also solves the tension between personalization and scale. Instead of relying on manual effort or institutional knowledge, AI can continuously analyze customer behavior to surface:

- Early risk and expansion signals

- Context-aware insights for customer conversations

- Recommended next actions based on real-time data

This allows revenue and customer success teams to deliver relevant, timely experiences consistently — even as customer volume grows.

AI doesn’t replace relationship-building. It removes the manual work that prevents teams from doing it well.

Platforms that combine AI, automation, and unified customer data make these capabilities practical for everyday revenue teams — not just enterprises.

How monday CRM helps revenue teams build customer loyalty

Execute customer loyalty strategies at scale with monday CRM. Instead of stitching together disconnected tools, monday CRM gives teams a unified customer data, automation, and AI-powered insights in one platform — making proactive, personalized loyalty practical without enterprise complexity.

Unified customer data for complete visibility

Customer loyalty breaks down when teams lack context, but monday CRM creates a single source of truth for every customer, ensuring sales, customer success, and support operate from the same up-to-date information.

Unified customer data gives teams complete interaction history (emails, calls, meetings, support activity), deal and contract context (purchase history, renewal dates, pricing, terms), product usage signals (engagement and adoption data), and health scoring that combines behavioral and relationship signals to surface risk and loyalty trends.

This shared visibility prevents customers from repeating themselves, preserves relationship context through team changes, and enables more consistent, informed interactions across the lifecycle.

Automation that scales personalized engagement

Delivering personalized experiences consistently is one of the biggest loyalty challenges for mid-market teams, and monday CRM’s automation capabilities allow teams to respond to customer behavior in real time — without increasing headcount.

| Trigger | Automated action | Loyalty impact |

|---|---|---|

| Usage drops sharply | Alert to CSM with talking points | Proactive churn prevention |

| Approaching renewal | Automated ROI summary | Outcome-based renewal |

| Support ticket resolved | Satisfaction follow-up workflow | Trust and loop closure |

| Customer reaches milestone | Personalized recognition | Reinforces engagement |

| Relevant feature launch | Targeted notification | Proactive value delivery |

These workflows turn customer data into timely, relevant touchpoints, helping teams stay ahead of issues and reinforce value at moments that matter most.

AI insights that prevent churn and unlock growth

With monday CRM’s AI capabilities, you can surface patterns and opportunities that would otherwise require manual analysis. Instead of reacting after problems escalate, teams can identify risk and growth potential early and act with confidence.

AI-powered capabilities include:

- Churn risk prediction: Detects early warning signs across usage, engagement, and relationship signals

- Account summaries: Synthesizes recent activity to reduce prep time and improve customer conversations

- Next best action recommendations: Highlights when to intervene, expand, or reinforce value

- Opportunity detection: Flags accounts showing expansion-ready behavior based on real usage patterns

- AI-assisted communication: Helps teams draft personalized outreach quickly and consistently

By removing manual analysis and guesswork, AI allows customer success and revenue teams to focus their time where it has the greatest loyalty and revenue impact.

Reporting that connects loyalty to revenue outcomes

Loyalty investments only scale when leaders can see their impact. To enable data-driven decisions about where to focus resources, monday CRM connects customer loyalty metrics directly to revenue performance.

Teams can track customer health dashboards, retention and expansion metrics, CLV trends, advocacy and referral program performance, team activity reporting, and more. This visibility allows revenue leaders to demonstrate the ROI of loyalty initiatives, forecast more accurately, and continuously refine strategies based on real results.

“With monday CRM, we’re finally able to adapt the platform to our needs — not the other way around. It gives us the flexibility to work smarter, cut costs, save time, and scale with confidence.”

Samuel Lobao | Contract Administrator & Special Projects, Strategix

“Now we have a lot less data, but it’s quality data. That change allows us to use AI confidently, without second-guessing the outputs.”

Elizabeth Gerbel | CEO

“Without monday CRM, we’d be chasing updates and fixing errors. Now we’re focused on growing the program — not just keeping up with it."

Quentin Williams | Head of Dropship, Freedom Furniture

“There’s probably about a 70% increase in efficiency in regards to the admin tasks that were removed and automated, which is a huge win for us.“

Kyle Dorman | Department Manager - Operations, Ray White

"monday CRM helps us make sure the right people have immediate visibility into the information they need so we're not wasting time."

Luca Pope | Global Client Solutions Manager at Black Mountain

“In a couple of weeks, all of the team members were using monday CRM fully. The automations and the many integrations, make monday CRM the best CRM in the market right now.”

Nuno Godinho | CIO at VelvTurn customer loyalty into your competitive advantage

Customer loyalty isn’t just about keeping customers happy — it’s about building a sustainable growth engine that compounds over time. The strategies and metrics outlined in this article work together to create a systematic approach so revenue teams can master customer loyalty, get predictable growth, reduce acquisition costs, and gain the peace of mind that comes from knowing their customers will stick around and grow with them.

Ready to turn customer loyalty into your competitive advantage? Try monday CRM to see how unified customer data, AI-powered insights, and automated workflows can make proactive, personalized loyalty strategies practical — without technical complexity or additional headcount.

Try monday CRMFAQs

What is the most important metric for measuring customer loyalty?

Net revenue retention (NRR) is the most important metric for measuring customer loyalty in B2B and subscription businesses because it captures the complete picture by measuring revenue retained from existing customers, including expansions and upsells, minus churn and downgrades.

How long does it take to see results from customer loyalty initiatives?

Customer loyalty initiatives typically show measurable results within 3-6 months for early indicators like customer health scores and engagement rates, with full impact on retention rates and expansion revenue visible over 12-18 months as customers move through renewal cycles.

What is the difference between customer loyalty and customer retention?

Customer retention measures whether customers continue doing business with you (a binary outcome), while customer loyalty measures the strength of the relationship and their commitment to your business (a spectrum that predicts future behavior including expansion and referrals).

How do B2B loyalty programs differ from consumer loyalty programs?

B2B loyalty programs focus on business outcomes and partnership behaviors rather than transaction frequency, rewarding referrals, case study participation, and community engagement with strategic benefits like executive access and co-marketing opportunities rather than points and discounts.

Can small revenue teams effectively build customer loyalty without dedicated customer success staff?

Small revenue teams can build customer loyalty effectively by leveraging automation, AI, and systematic processes, using automated onboarding sequences, behavioral triggers for proactive outreach, and AI-powered health scoring to deliver personalized experiences at scale without proportional headcount increases.

What role does product usage data play in building customer loyalty?

Product usage data is the most reliable indicator of customer loyalty because it reveals whether customers are realizing value through high adoption and expanding usage, struggling through declining engagement, or at risk through dramatic usage drops, making it essential for health scores, proactive outreach triggers, and expansion opportunity identification.