Tracking business expenses in a spreadsheet can do wonders for your financial visibility — especially if you don’t have an in-house accounting team or a ready-made system. A well-structured spreadsheet helps you stay organized, spot trends, and make smarter spending decisions.

In this article, we’ll walk through real examples of spreadsheets for business expenses, highlight why every business needs a template, and show how monday work management can take your expense tracking to the next level with automation and insights.

What is an Excel spreadsheet for business expenses?

An Excel spreadsheet for business expenses is a standardized tool that records and tracks your company’s spending. It answers key financial questions:

- Who spent the money?

- What was it spent on?

- When was the expense made?

- Where does the expense come from in the budget?

- Why was the money spent?

- How much was spent?

Some of these spreadsheets track specific company expenses, while others provide a simple, high-level summary of your expense history. For example, a travel expense spreadsheet tracks travel-related expenses like lodging, mileage, and meals. A monthly expense spreadsheet provides an overview of your total monthly spending, including business income, operating expenses, and marketing costs.

Expense tracking spreadsheets typically share these standard features:

- Rows for individual expense items

- Columns specifying date, vendor, category, expense description, amount, payment method, and notes

- Built-in formulas for automatic calculations

4 reasons to use a dedicated template to track business expenses

Still wondering if using a spreadsheet for expense tracking is worth it? Here are a few ways you’ll benefit:

1. Make smarter financial decisions

When you have detailed expense data right in front of you, it’s much easier to make informed financial decisions. Having expense information summarized in a clear, easy-to-follow spreadsheet is critical.

For example, let’s say you own a bakery and are trying to decide whether shopping locally for your ingredients saves you money. You might analyze your existing expenses and compare them against product estimates from food service wholesalers. With accurate expense data in front of you, it’s much easier to make informed business decisions.

2. Keep everything in one place

We’ve all been there: George from sales scribbles expenses on diner napkins, while Betty in HR records hers in random Notes on her iPhone. Eventually, this becomes a chaotic mess. Using a standardized Excel spreadsheet means no more chasing down stray notes or scattered records. Everything’s neatly in one place, easy to access and review.

3. Save yourself time (and headaches)

Crunching numbers by hand is tedious — and unnecessary. With built-in formulas, Excel spreadsheets automatically calculate totals and averages, saving you valuable time.

Even better, pairing your Excel spreadsheets with a powerful tool like monday work management lets you automate your expense reporting entirely.

Automating these tedious tasks can help streamline your financial management and give you valuable insights into the financial position of a specific department, project, activity, or company as a whole.

4. Quickly catch unusual spending

Ever noticed a sudden spike in expenses and wondered what happened? With consistent tracking, unusual or fraudulent expenses become obvious immediately. For example, if your monthly office supply budget jumps unexpectedly, your spreadsheet will help you spot and address the issue quickly.

Now that we’ve covered why spreadsheets are great for tracking expenses, let’s look at some practical examples you can start using today.

5 examples of business expense templates

Not every business manages expenses the same way and that’s okay. Whether you’re part of a growing marketing team, a busy operations department, or an established agency, choosing the right expense-tracking spreadsheet is essential to maintaining your company’s financial health. Here are 5 popular templates to simplify your expense management process:

1. Basic business expenses spreadsheet template

This template is ideal if your team needs straightforward expense tracking without extra clutter. This easy-to-use template includes essential columns like date, amount, payment method, category, and a brief expense description. It’s perfect for teams or departments looking to quickly implement a standardized expense tracking system without complicated setups or extensive training.

For instance, if you’re managing business operations for a local office or a small team just starting to track expenses, this streamlined option keeps things organized and simple.

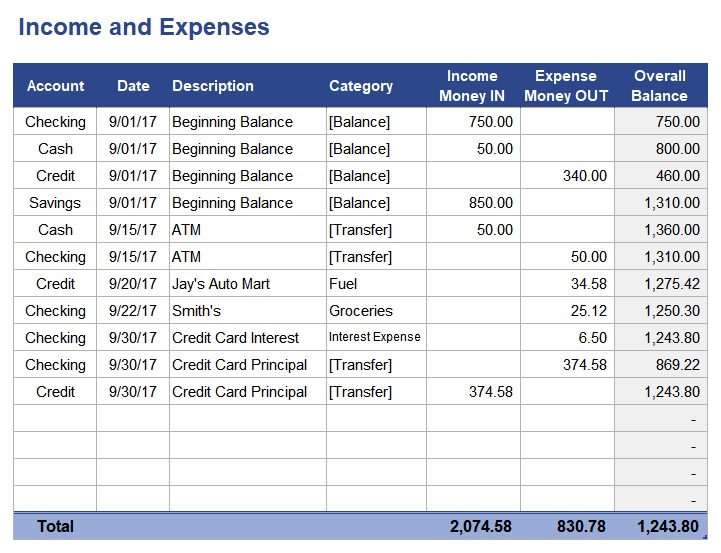

2. Income and expenses spreadsheet template

Need a clearer picture of your overall financial balance? An income and expenses spreadsheet provides a quick snapshot of how your spending stacks up against business revenue. It’s particularly valuable for teams managing project budgets or department-level expenses, making it easier to spot trends, stay on track, and achieve departmental goals.

Imagine your content marketing team trying to justify additional freelance writer expenses — this spreadsheet would clearly illustrate how those costs compare against the returns from increased blog traffic.

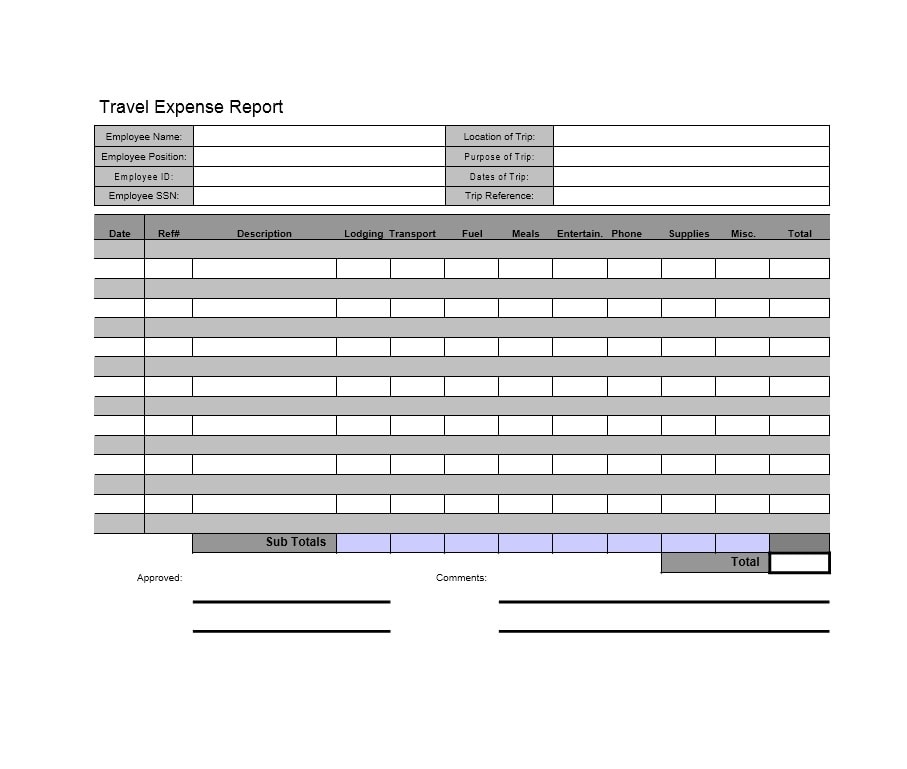

3. Travel expenses spreadsheet template

If your team travels frequently for client projects or industry conferences, this spreadsheet is a lifesaver. It’s specifically designed to capture airfare, hotels, meals, rental cars, and other travel-related expenses — all neatly organized with built-in formulas for quick calculations.

Teams managing client projects, external stakeholders, or frequent collaboration across regions will find this especially helpful for detailed tracking and smooth reimbursement processes.

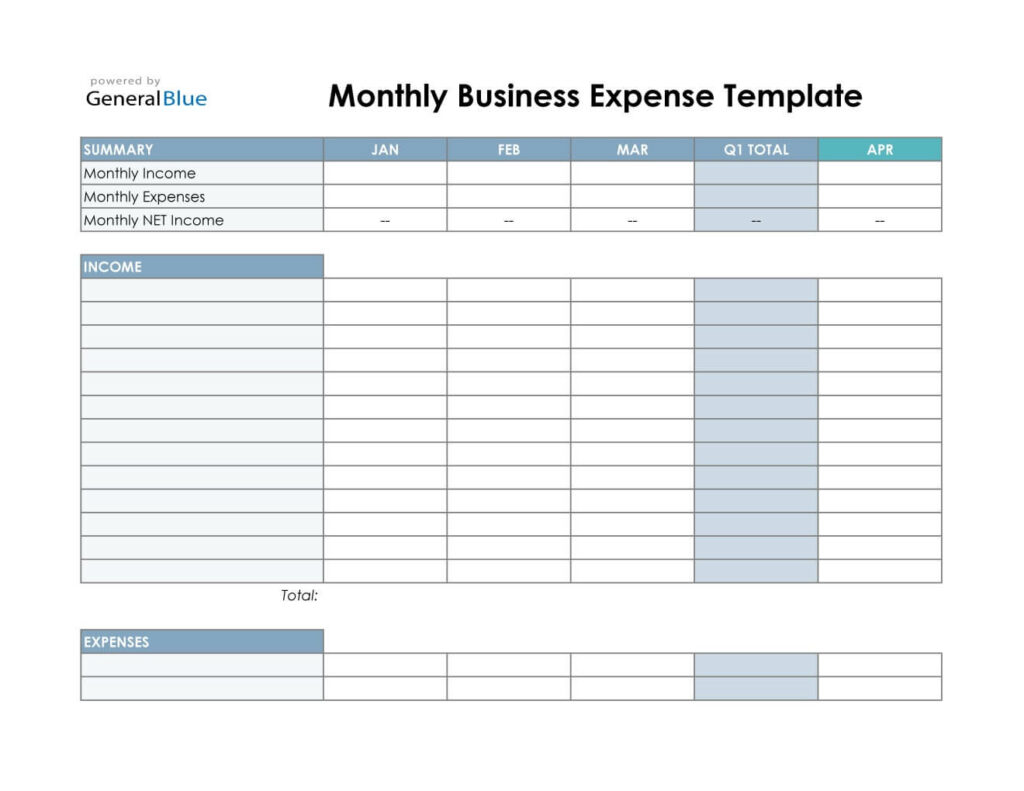

4. Monthly business expense spreadsheet template

A monthly expense spreadsheet lets your team quickly summarize month-to-month spending. It highlights patterns, helps teams adjust monthly budgets proactively, and provides valuable insights into spending habits over time.

A simple monthly expenses spreadsheet contains:

- Columns for each month of the year

- Rows for total business income and expenses

- Rows for expense line items and expense categories

These spreadsheets will often include income and expense summaries for the quarter, making them rather useful for quarterly reporting.

This spreadsheet is especially useful for mid-sized businesses or teams juggling multiple campaigns or operational budgets, helping them to quickly understand their monthly spending patterns and make data-driven adjustments on the fly.

For example, an operations manager could use this spreadsheet to quickly spot overspending on monthly subscriptions or office supplies, allowing for quick action to stay within budget.

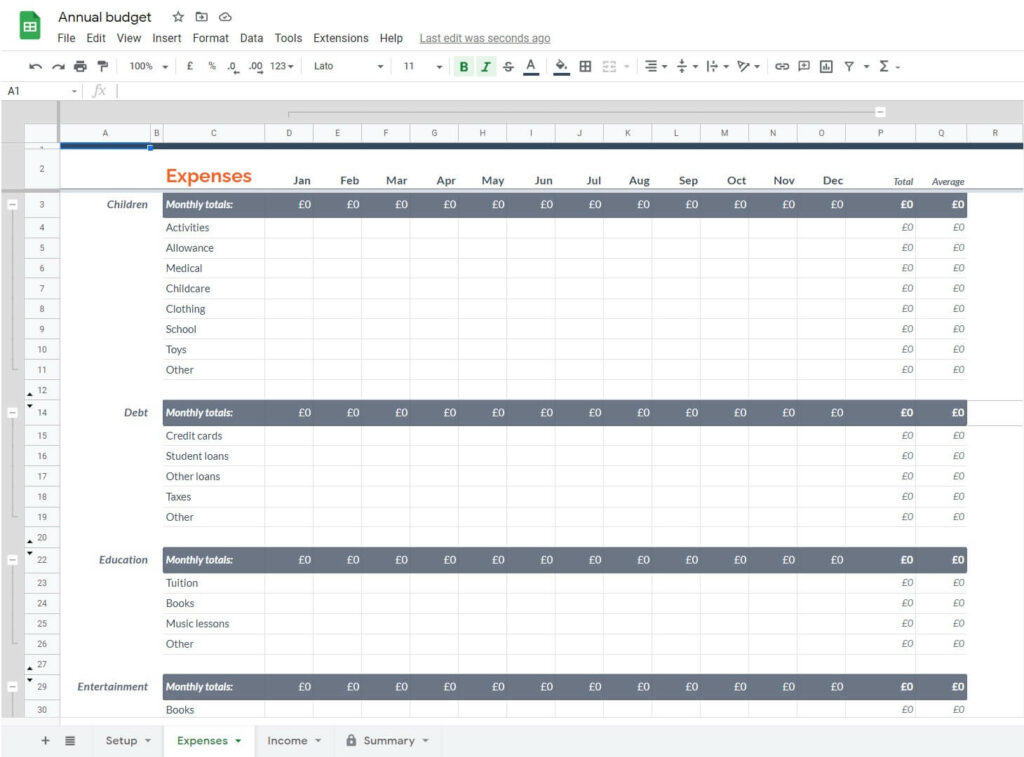

5. Annual business expense spreadsheet template

For teams and businesses conducting extensive yearly financial reviews, an annual business expense spreadsheet provides a comprehensive summary of your financial situation over the entire year. Visualize your total income — including taxable income — against expenses, enabling your team to pinpoint exactly when and where significant spending occurs. This detailed tracking guarantees smarter strategic decisions and simplifies the process of reporting financial transactions at tax time.

This type of template is especially beneficial for larger organizations managing numerous departments, substantial miscellaneous expenses, or annual projects like major marketing campaigns or infrastructure updates. It’s also helpful for categorizing spending clearly into relevant income categories, improving the accuracy of your year-end reports.

Imagine your department planning next year’s budget. Having a clear annual expense breakdown makes it easier to forecast accurately and allocate resources confidently.

10 tips for getting the most out of your business expense template

Here are some tips and best practices that will help you improve clarity and accuracy in your expense reporting and record financial transactions more accurately.

1. Choose the right template from the start.

Not every template suits every scenario. Whether you’re tracking monthly departmental budgets, annual spending, or even personal expenses, selecting the right spreadsheet ensures your expense tracking meets your specific business needs.

2. Customize categories to fit your workflow.

Rather than generic categories, tailor your spreadsheet’s expense types to match real scenarios. Your marketing department might use “Social Media Advertising” or “Event Sponsorship,” while finance teams might track expenses separately under clear income categories like “Interest Income” or “Service Fees.”

3. Keep an eye on income vs. expenses.

Regularly reviewing your income — including taxable income — against your expenses helps maintain financial stability and quickly spot potential budget overruns. Set monthly reminders in monday work management to compare your reports against your business budget template, keeping your financial situation transparent and manageable.

4. Avoid vague categories like “miscellaneous.”

The “miscellaneous expenses” category quickly turns into a catch-all that lacks clarity. Encourage your team to assign every expense clearly — for example, categorize a team lunch under “Employee Meals” or “Team-Building Events.” Precise categorization leads to more actionable insights.

5. Automate your receipt management.

Manually tracking receipts for every financial transaction is tedious. Instead, use integrated tools like the PDF scanner app in monday work management to digitize receipts automatically, streamlining organization and simplifying tax reporting.

6. Leverage built-in formulas and automations.

Skip manual calculations by taking advantage of built-in spreadsheet formulas. When paired with monday work management, Excel spreadsheets automate totals and averages, significantly reducing the time spent crunching numbers.

7. Set up automated workflows.

Automate your expense-reporting workflows within monday work management to simplify approval processes. Route completed expense sheets directly to your finance department, sending automatic alerts and reminders until tasks are complete — no more delayed approvals or overlooked key expense items.

8. Regularly update your templates.

A spreadsheet loses its effectiveness if it’s outdated. Regularly update your templates with recent financial transactions, including payroll, vendor payments, and other recurring costs. Schedule weekly or monthly reviews within monday work management to keep your financial data reliable and accurate.

9. Visualize your data to drive smarter decisions.

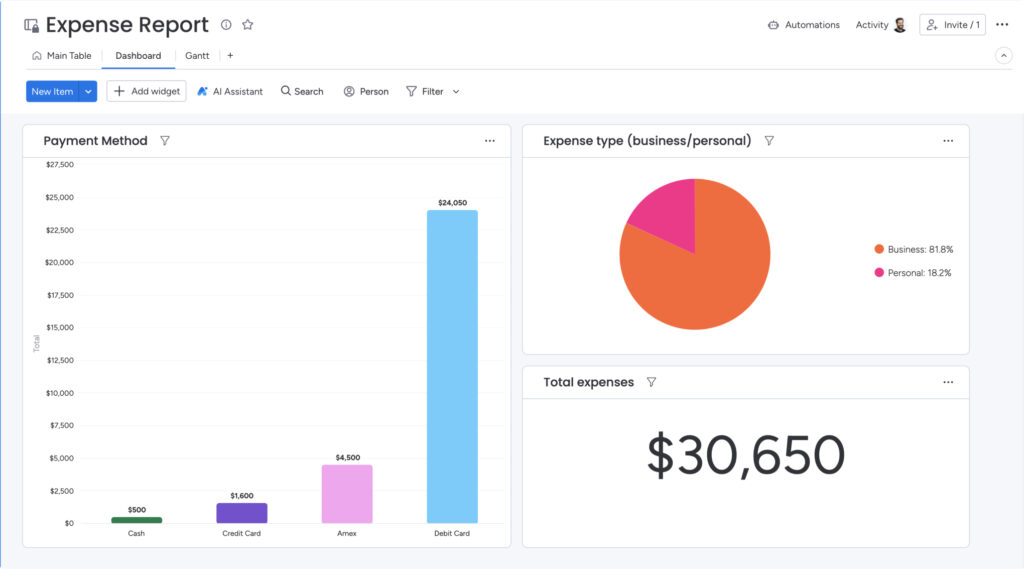

Use visual dashboards, graphs, and charts within monday work management to clearly illustrate your spending patterns. Visualizing key expense trends enables executives and departmental leaders to quickly assess spending, identify opportunities for savings, and adjust the business budget template accordingly.

10. Integrate your spreadsheet with accounting software.

Boost your team’s productivity and accuracy by integrating your expense tracking templates directly with accounting software like QuickBooks. Seamless integration through monday work management simplifies the reconciliation of your financial transactions, reduces errors, and makes year-end reporting effortless.

Track expenses more easily with monday work management

When managing your business expenses effectively, monday work management has you covered. Start by downloading our free, customizable expense tracking template for an easy way to organize your spending, maintain your financial health, and streamline expense management.

This flexible template adapts perfectly to any business scenario — whether you’re coordinating budgets across multiple departments in a large enterprise or just starting to organize expenses for your growing business. And when you’re ready to unlock even more powerful tools and advanced features, easily connect your Excel spreadsheet with monday work management and manage your expenses directly from our intuitive platform.

Here’s how monday work management makes expense tracking even easier:

- Collaborate from anywhere: monday work management is cloud-based, enabling teams across departments — or even countries — to work together seamlessly. You could be managing expenses from your office in London while collaborating effortlessly with your team in New York.

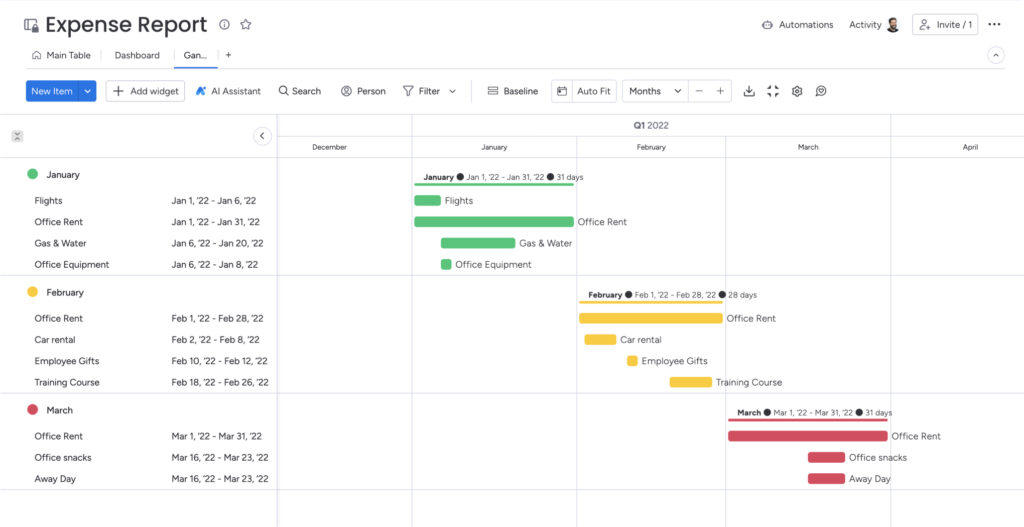

- Advanced data visualization: Transform your expense data into visual insights with custom dashboards, graphs, charts, and Gantt charts. Quickly identify spending patterns, budget trends, and opportunities for savings.

- Time-saving automations: Set up automations that send expense reports directly to the right people, and trigger reminders until tasks are completed. No more chasing team members or endless email follow-ups — monday work management keeps your expense tracking process smooth and hassle-free.

- Enhanced security: Feel confident knowing your sensitive financial information is protected with enterprise-grade security, multi-level permissions, and compliance that meets the highest industry standards.

Bonus: more expense management templates from monday work management

Want to further simplify your expense management and boost your team’s financial health? Check out these other easy-to-use templates from monday work management, which are designed to help teams across your organization gain deeper insights and better control of their budgets and spending.

Budget tracking template

Our budget tracking template will help you gain more control over your finances. It’s perfect for departments and teams that want greater visibility into their spending. Compare your actual expenses with budgeted amounts in real-time, quickly spot discrepancies, and make informed, strategic financial decisions. This template is great for project leads, operations teams, and finance managers looking for clarity and control.

If you prefer using Google Sheets, we have a dedicated budget template there, which is ideal for quick personal budgeting or smaller team projects.

Expense tracker template

Ready for a more proactive approach to expense tracking? Our dynamic expense tracker template consolidates all your important financial data in one central location. Keep track of every dollar your team spends, effortlessly categorize transactions, and stay organized with built-in automations like automated alerts for expense approvals and payment reminders. This template is perfect for teams managing multiple projects or coordinating cross-departmental workflows.

Whether you’re managing client projects or internal budgets, you’ll appreciate how simple, flexible, and streamlined this template makes your expense tracking.

Simplify expense tracking with monday work management

Managing business expenses doesn’t have to be overwhelming. With the right Excel spreadsheet and a platform like monday work management, you can streamline tracking, improve accuracy, and gain deeper financial insights across your organization.

Whether you’re just starting out or scaling fast, using a dedicated template helps you stay organized, make smarter decisions, and keep your budgets on track. Download our free templates to get started — and when you’re ready, explore how monday work management can take your expense tracking to the next level.

FAQs

How do I create a spreadsheet for my business expenses?

You’ve got a few options for creating a spreadsheet for your business expenses. You could build your own spreadsheet from scratch using Excel or Google Sheets, but why reinvent the wheel? Save yourself the headache by downloading a ready-to-use, customizable template from monday work management. You’ll skip the tedious formatting and formulas and jump right into simplified, organized expense tracking.

How do I create an expense sheet in Excel?

To create an expense sheet directly in Excel, simply open the app, click New, and type a keyword like "business expenses" or "travel expenses" into the search bar. Excel will show you several template options.

Keep in mind that Excel's built-in templates don’t always offer the advanced features, automation capabilities, and flexible visualizations that you get when combining Excel with a powerful platform like monday work management.

How do I track business expenses in Excel?

Tracking expenses in Excel starts with creating a clear and organized spreadsheet. Typically, you'll need columns for essential details like the date, description, category, amount, and payment method. Feel free to customize the spreadsheet further — maybe add specific columns like “client” or “project ID” to match your team's workflow.

For even greater efficiency, you can integrate your spreadsheet with monday work management to automate processes and gain richer insights.

- Tags:

- Project cost management