Financial projects come with their own breed of risks — the kind that blow up budgets and deadlines

Financial projects don’t just carry risk — they collect it. One regulatory update, one misaligned forecast, one resource bottleneck, and suddenly your entire delivery plan is on fire. For project managers in finance, the real challenge isn’t spotting risks… it’s spotting them before they snowball.

That’s where modern risk management software changes everything. Today’s top platforms sift through your project data, flag threats you didn’t see coming, and automate the work that used to steal hours from your week. Instead of reacting to problems once they hit your budget or compliance deadlines, you’re finally out ahead — steering risk instead of being buried by it.

This article breaks down what actually matters when evaluating risk management tools for finance, how the best platforms support PMOs, and what features deliver the biggest lift in visibility, compliance, and portfolio control. You’ll walk away with a clear view of the tech landscape and practical steps to build a smarter, more proactive risk framework.

Key takeaways

Before diving into specific features and platforms, it helps to understand the shifts shaping financial risk management right now. These five takeaways highlight the capabilities that truly move the needle for finance PMOs:

- Shift from reactive to proactive: use AI to identify patterns and predict issues before they escalate.

- Unify risk and project data: eliminate silos by connecting risk tracking directly to project execution.

- Automate manual processes: replace spreadsheets and email trails with automated alerts, approvals, and reporting.

- Track ROI through time and cost savings: organizations save 60+ hours per employee yearly while avoiding costly escalations.

- Integrate risk across your entire tech stack: sync data seamlessly with financial systems, project tools, and communication channels.

Understanding risk management software for financial projects

Risk management software for financial projects is a digital platform that helps organizations identify, assess, track, and mitigate risks across their financial initiatives and portfolios. These platforms transcend basic spreadsheets to provide real-time visibility, automated workflows, and intelligent insights that help project managers in finance maintain control over complex, multi-project environments.

For finance PMO departments, this means transforming scattered risk data across emails, documents, and disconnected systems into a unified view. You gain the ability to monitor compliance requirements, track regulatory risks, and maintain audit trails — all while keeping projects on schedule and within budget.

Intelligent risk management platforms tackle financial project challenges head-on with capabilities you won’t find in basic spreadsheets:

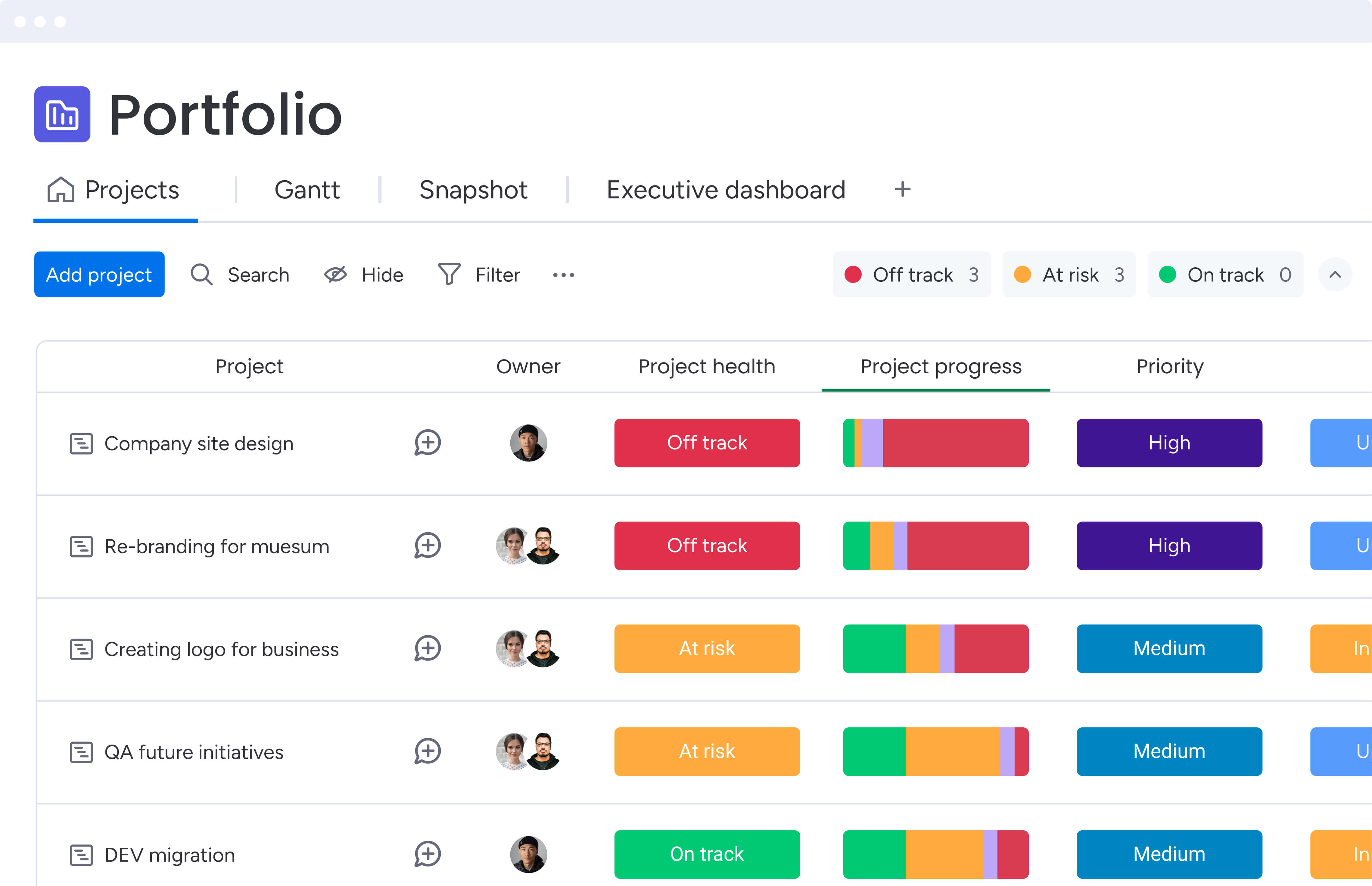

- Portfolio-level visibility: see risks across all projects simultaneously, not just individual initiatives.

- Automated compliance tracking: monitor regulatory requirements like SOX, Basel III, or GDPR without manual updates.

- Real-time risk scoring: assess probability and impact automatically based on project data.

- Cross-functional coordination: connect risk signals from different departments and teams.

The shift from manual risk tracking to intelligent platforms represents a huge change in how finance PMOs operate: instead of reacting to problems after they escalate, you can now identify patterns, predict issues, and take preventive action before risks impact delivery.

Building a complete risk management lifecycle for financial projects

Financial initiatives move quickly, and risks can shift just as fast. To stay ahead, finance project managers need a structured lifecycle that covers early identification, strategic response, continuous monitoring, and formal closure.

The four steps below create a complete, repeatable framework that supports proactive risk oversight across every project.

Step 1: identify and assess risks in financial environments

Start by examining project scope, dependencies, and historical patterns to uncover potential threats — budget overruns, compliance gaps, resource conflicts, and technical failures.

Next, evaluate each risk using probability and impact scoring, building a clear prioritization matrix and a structured risk register that guides where attention should go first.

Step 2: develop comprehensive mitigation strategies

Once you’ve identified and assessed risks, developing a risk management plan becomes essential for maintaining project control. Each high-priority risk requires a specific strategy that aligns with your organization’s risk tolerance and project objectives.

Once risks are prioritized, you must define a clear response for each one. These mitigation strategies form the core of your risk management plan, ensuring your team knows exactly how to act when a threat materializes.

- Risk avoidance: changing project approach to eliminate the threat.

- Risk reduction: implementing controls to minimize probability or impact.

- Risk transfer: using insurance or contracts to shift responsibility.

- Risk acceptance: acknowledging certain risks as acceptable given the potential rewards.

Step 3: monitor and control risks throughout the project lifecycle

Step 4: close risks and capture lessons learned

The final stage involves continuous tracking, regular reviews, and adjustments as new information emerges. In fast-moving financial environments, maintaining a risk register is crucial because risks can evolve quickly — what starts as a minor resource conflict can cascade into missed regulatory deadlines if not caught early.

Effective monitoring requires:

- Regular risk reviews: weekly or bi-weekly assessments of risk status.

- Trigger-based alerts: automated notifications when thresholds are exceeded.

- Cross-project visibility: understanding how risks in one area affect others.

- Stakeholder communication: keeping teams informed of changing risk landscapes.

Essential features for centralizing financial risk management

Financial projects move fast and carry high stakes, so your risk management software needs to offer more than basic tracking. The strongest platforms bring visibility, automation, and intelligence together, turning scattered information into a connected system you can actually rely on.

These are the capabilities that matter most for Finance PMOs:

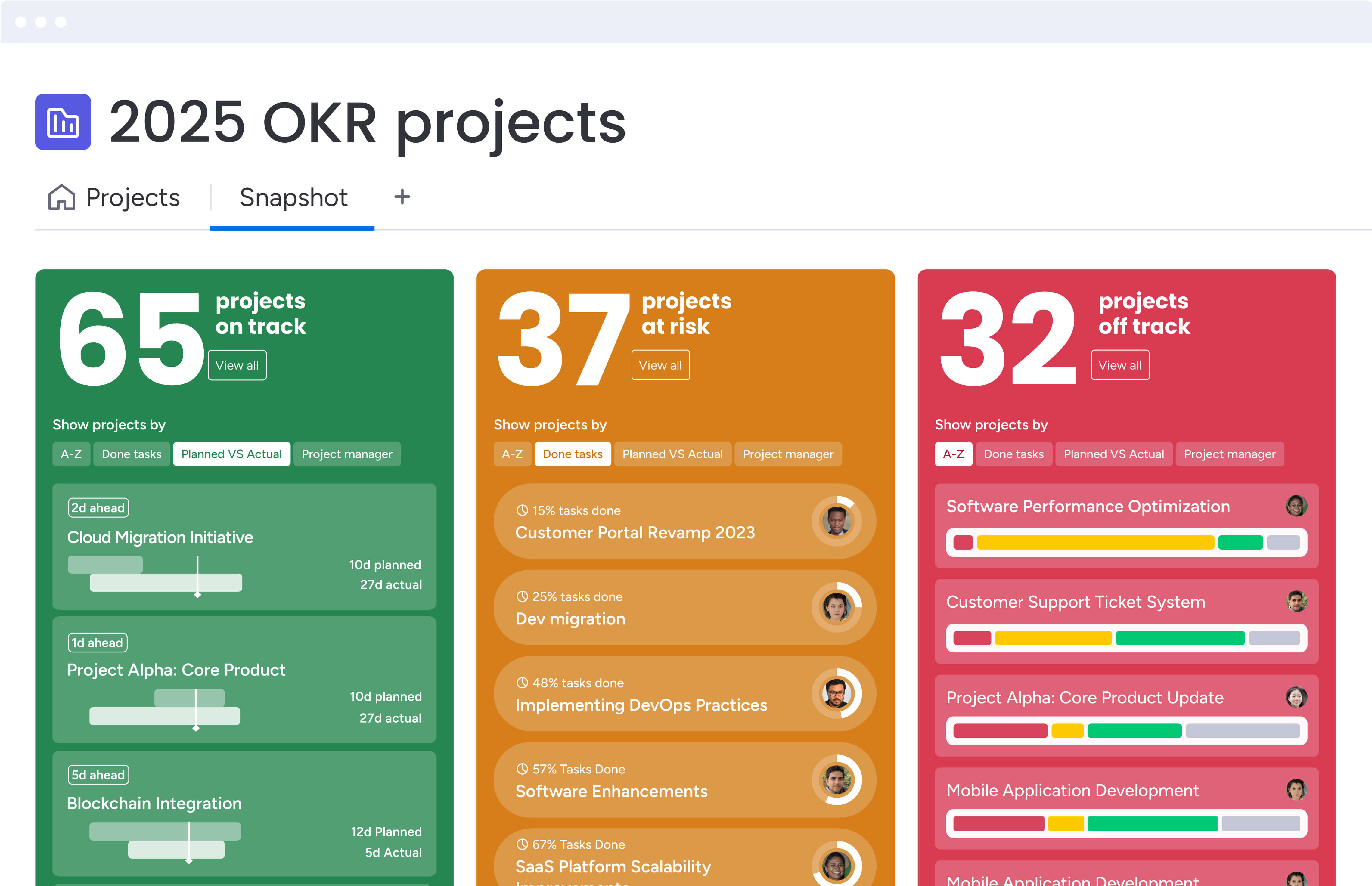

- AI-powered risk detection: continuously analyzes project timelines, budget trends, resource allocation, and historical patterns to surface risks early. Instead of manually scanning reports, teams get proactive alerts that highlight issues before they become costly setbacks.

- Real-time dashboards and reporting: give PMOs instant insight into risk severity, mitigation status, compliance deadlines, and portfolio-wide exposure. Custom dashboard views ensure every stakeholder — executives, project teams, compliance leads — sees the metrics that matter most to them without building reports from scratch.

- Automated workflows: replace manual follow-ups with intelligent triggers. Set rules for escalation, compliance checks, overdue mitigation tasks, budget threshold alerts, and review cycles. Automation helps prevent human error and ensures high-priority risks get attention the moment conditions change.

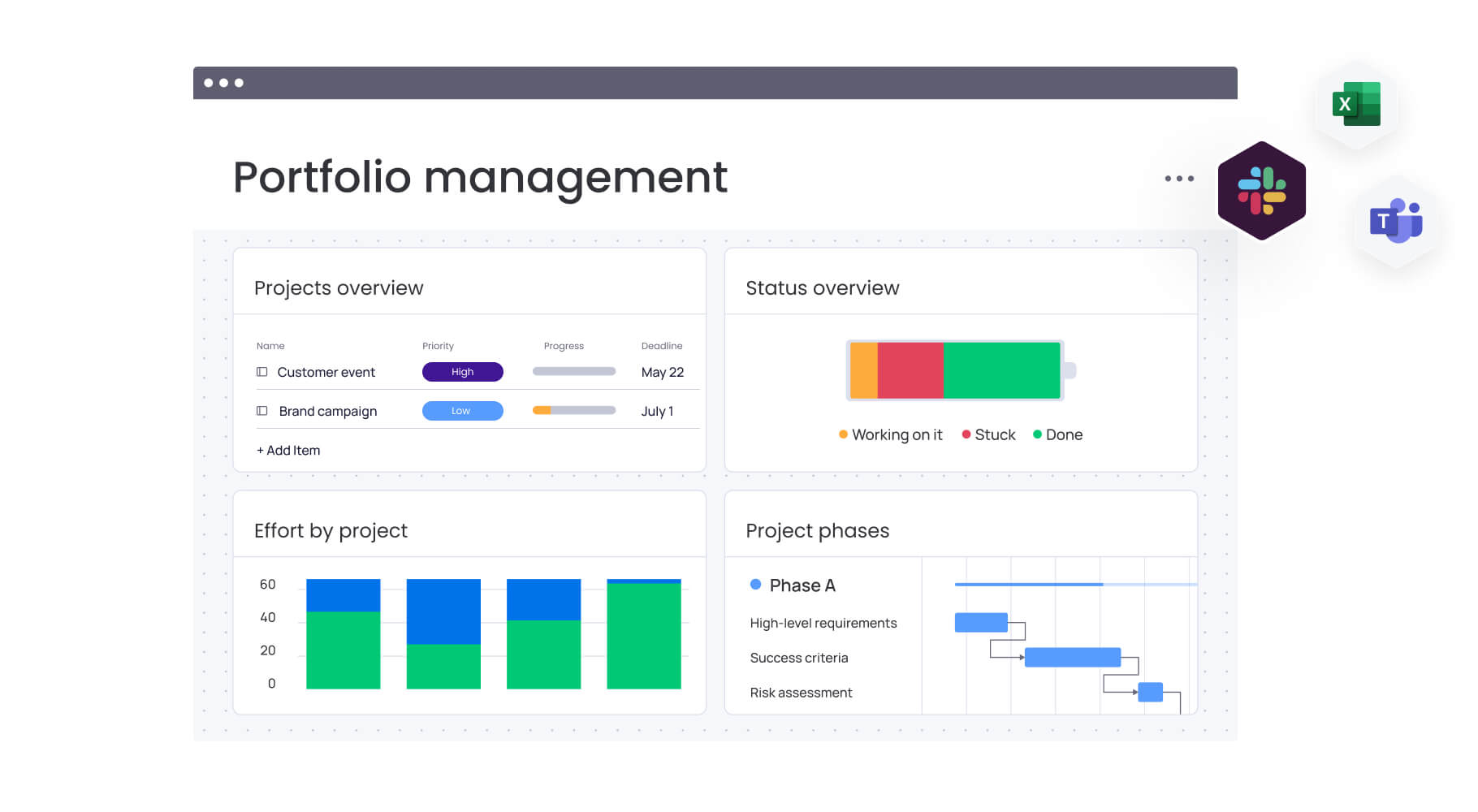

- Integration capabilities: connect risk data with your financial systems, project management tools, communication platforms, and spreadsheet models. Smooth data flow ensures consistency across platforms, eliminates duplicate entry, and keeps risks tied to real project activity rather than static documents.

- Customizable risk frameworks: allow teams to define scoring models, risk categories, and severity levels that match internal governance standards. Whether assessing operational, regulatory, market, or technology risks, you can tailor matrices to reflect your organization’s requirements while keeping everything structured and actionable.

Comparing leading risk management platforms

The risk management software landscape offers diverse options, each with distinct strengths for financial project management. Understanding these differences helps you select the platform that best fits your organization’s needs and maturity level.

The comparison below highlights key factors that impact implementation success and long-term value.

| Feature | monday work management | Wrike | Asana |

|---|---|---|---|

| Dedicated risk tracking | Full risk cards with scoring | Limited | Custom fields only |

| AI risk detection | Portfolio-wide analysis | Limited | Not available |

| Critical path in Gantt | Complete with overlays | Available | Limited functionality |

| Automated escalations | Customizable workflows | Available | Basic automation |

| Portfolio dashboards | Real-time with drill-down | Available | Limited views |

| Creative tool integrations | 200+ including Adobe | 400+ integrations | 200+ integrations |

| Media industry adoption | SPH Media, VML, M Booth | Various | Limited examples |

| Starting price (annual) | $10/user/month | $10/user/month | $10.99/user/month |

After looking at the table comparison side-by-side, it’s clear that monday work management stands out for finance PMOs because it embeds risk management directly into project workflows. Unlike standalone risk tools that create another silo, the platform connects risk tracking to actual work execution.

Teams using monday work management report faster implementation and higher adoption rates compared to traditional GRC platforms, reflecting clear work management vs project management distinctions.

The platform’s AI capabilities analyze project data across your entire portfolio, automatically flagging risks based on patterns in updates, timelines, and resource allocation. This means project managers can identify issues without manually reviewing hundreds of project boards or waiting for weekly status reports.

How AI transforms risk detection and mitigation

AI has become the difference between catching risks early and cleaning up after them. Instead of scanning spreadsheets or combing through updates, AI reviews your project data around the clock — flagging emerging threats, predicting delays, and helping teams prioritize what truly matters.

It’s no longer just a helpful add-on; it’s the engine powering modern financial risk management.

Pattern recognition capabilities

Examine historical project data to identify recurring risk indicators. When similar patterns emerge in current projects, AI flags them immediately. For example, if past projects with certain resource allocation patterns experienced delays, the system alerts you when current projects show similar characteristics.

Predictive analytics

Go beyond pattern matching to forecast potential issues. By analyzing factors like task completion rates, dependency chains, and team capacity, AI can predict which projects are likely to face challenges. This gives project managers time to intervene before problems materialize.

Automated risk scoring

This capability removes subjectivity from assessments. AI evaluates multiple factors simultaneously — timeline slippage, budget variance, resource conflicts, compliance gaps — to generate consistent risk scores. This standardization helps teams prioritize mitigation efforts and allocate resources more effectively.

Natural language processing

Project communications and updates can now be analyzed to detect risk signals. When team members mention challenges, delays, or concerns in status updates, AI recognizes these indicators and adjusts risk assessments accordingly. This ensures nothing gets lost in the volume of daily communications.

monday work management leverages these AI capabilities through features like Portfolio Risk Insights, which continuously monitors projects and surfaces risks with recommended actions. The platform’s AI doesn’t just identify problems — it suggests specific mitigation steps based on what’s worked in similar situations.

Revolutionize your financial risk management approach today

Finance PMOs who’ve ditched their patchwork of risk tools for a single, smart platform are working in a completely different league. You’re not wasting hours on manual updates anymore, and you can actually see what’s happening across every project in your portfolio as it unfolds.

The result is faster risk identification, more effective mitigation, and improved project outcomes.

Intelligent solutions like monday work management unify risk management with project execution in a single platform. With AI-powered risk identification, customizable dashboards, and seamless integrations, you can spot issues early, respond quickly, and maintain compliance without switching between multiple tools.

The platform’s intuitive interface also means teams adopt it quickly, delivering value within weeks rather than months.

Organizations using integrated risk management platforms report significant improvements in project success rates, compliance performance, and team productivity. By connecting risk data to actual work execution, teams gain the visibility and control needed to deliver financial projects with confidence.

The content in this article is provided for informational purposes only and, to the best of monday.com’s knowledge, the information provided in this article is accurate and up-to-date at the time of publication. That said, monday.com encourages readers to verify all information directly.

Frequently asked questions

What is the best risk management software for financial projects?

The best risk management software for financial projects depends on your organization's size, complexity, and integration needs. monday work management excels for finance PMOs seeking to unify project and risk management in one platform, offering AI-powered insights, customizable workflows, and rapid implementation in under four months.

How does AI improve risk detection in financial project management?

AI improves risk detection by continuously analyzing project data to identify patterns and anomalies that humans might miss. It examines timelines, budgets, resource allocations, and even communication patterns to flag potential issues before they escalate, enabling proactive mitigation rather than reactive responses.

What's the typical implementation timeline for risk management software?

Implementation timelines vary significantly by platform complexity and organizational readiness. monday work management typically deploys in less than four months, while specialized GRC platforms like Archer can take 12+ months to fully implement with all customizations and integrations.

Can risk management software integrate with existing financial systems?

Yes, risk management platforms offer extensive integration capabilities through APIs, pre-built connectors, and automation platforms. monday work management integrates with 200+ applications including Excel, Microsoft Teams, and financial planning systems, ensuring risk data flows seamlessly between tools.

How do you measure the success of risk management software implementation?

Success metrics include time saved on manual risk tasks (typically 60+ hours per employee yearly), improved project delivery rates, reduced compliance violations, and faster risk identification. Track both quantitative metrics like ROI and qualitative improvements in team confidence and stakeholder satisfaction.

What's the difference between risk management software and GRC platforms?

Risk management software focuses specifically on identifying and mitigating project risks, while GRC platforms encompass broader governance, risk, and compliance functions. finance PMOs often find dedicated risk management tools like monday work management more practical for project-level risk tracking, while GRC platforms suit enterprise-wide compliance programs.

Get started

Get started