Loans help us buy things that are too expensive to pay for with cash in hand, such as homes, cars, and business assets. Paying loans back involves using an amortization schedule, breaking the loan into equal monthly payments of principal and interest.

To help make this easier, we’ve created a fully customizable template that you can export into a completed Excel spreadsheet with just a few clicks.

What is an Excel loan amortization schedule template?

An Excel amortization schedule template — what a mouthful — is a pre-structured document with fillable fields that helps you fill out a loan amortization schedule. A template simplifies what can often be a complex process with many difficult formulas.

Amortization involves breaking a fixed-rate loan into equal monthly payments to pay off by a certain date. It’s used commonly for mortgages, auto loans, student loans, and personal loans. Amortization builds principal and interest into each payment, ensuring you pay both, and structures predictable payments for the borrower.

When amortizing a loan, your first loan payment consists mostly of interest. As you reduce the principal balance, less interest is charged per payment. Thus, each successive payment consists of more principal than the last.

A finished Excel amortization schedule lays out payments for each month in a spreadsheet format and includes how much of each payment consists of principal vs. interest. This is where a template comes in.

Why use an Excel amortization schedule template?

Loan amortization schedules help you turn a long-term loan into a predictable monthly payment. As a result, you can budget for that monthly payment more easily and reduce the risk of default.

But this isn’t something you can calculate in your head. Luckily, amortizing a loan is much easier with an amortization schedule Excel template. Here are some reasons to use this type of template:

Save time on creating new schedules

You can simply save your Excel template as a new file each time to quickly create new amortization schedules. This will save you a lot of time designing, building, and adding formulas to your amortization schedules.

Avoid miscalculations with accurate pre-created formulas

Excel amortization templates include pre-written formulas within cells to automatically calculate whatever data you need.

In a good amortization Excel template, you only need to enter a few numbers, and formulas will take over and fill out the entire table for you. No need to change each individual box if you make an error — simply fix the input number, and the formulas will adjust.

Cloud-based if using Microsoft Office 365

Microsoft Office 365 allows you to take your Excel spreadsheet to the cloud. That way, you can access your amortization table from anywhere you have a device and an Internet connection.

What are some examples of Excel amortization schedule templates?

Now that we’ve covered the benefits, let’s dive into the nitty-gritty and explore some actual templates.

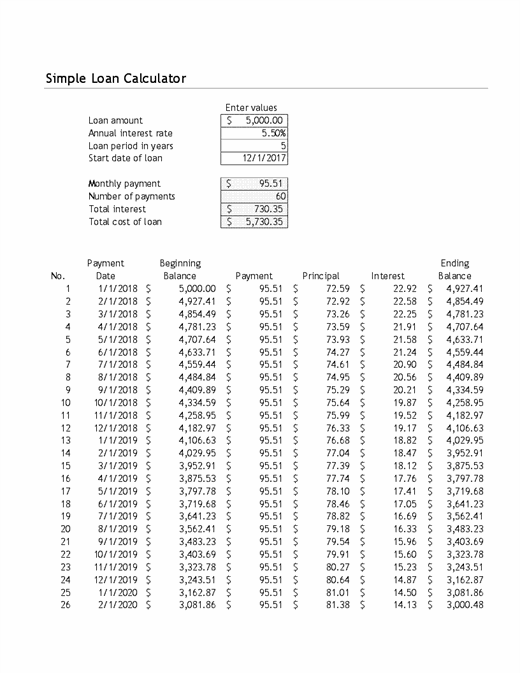

Microsoft’s Excel loan amortization schedule

This is Microsoft’s official basic amortization schedule template for Excel. As you can see, it has a few boxes to enter the loan information, such as loan amount and interest rate.

Then it contains an amortization table with information about each monthly payment. It also helps you see how many of your dollars are going to principal vs. interest. This template does the job, but adding some color and other design elements could make it easier to read and understand.

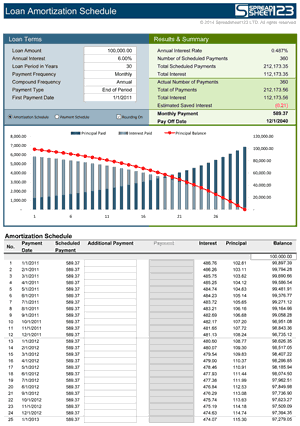

Amortization schedule Excel template with chart

Here, we have an Excel amortization template with several design elements that provide more information visually.

In particular, the chart shows you how each successive payment covers more principal as the total loan balance decreases. Plus, there’s a line for “estimated saved interest,” which can tell you how much total interest you’d save by paying more than the minimum payment. This template also uses colors to create visual appeal and draw your eye to specific information.

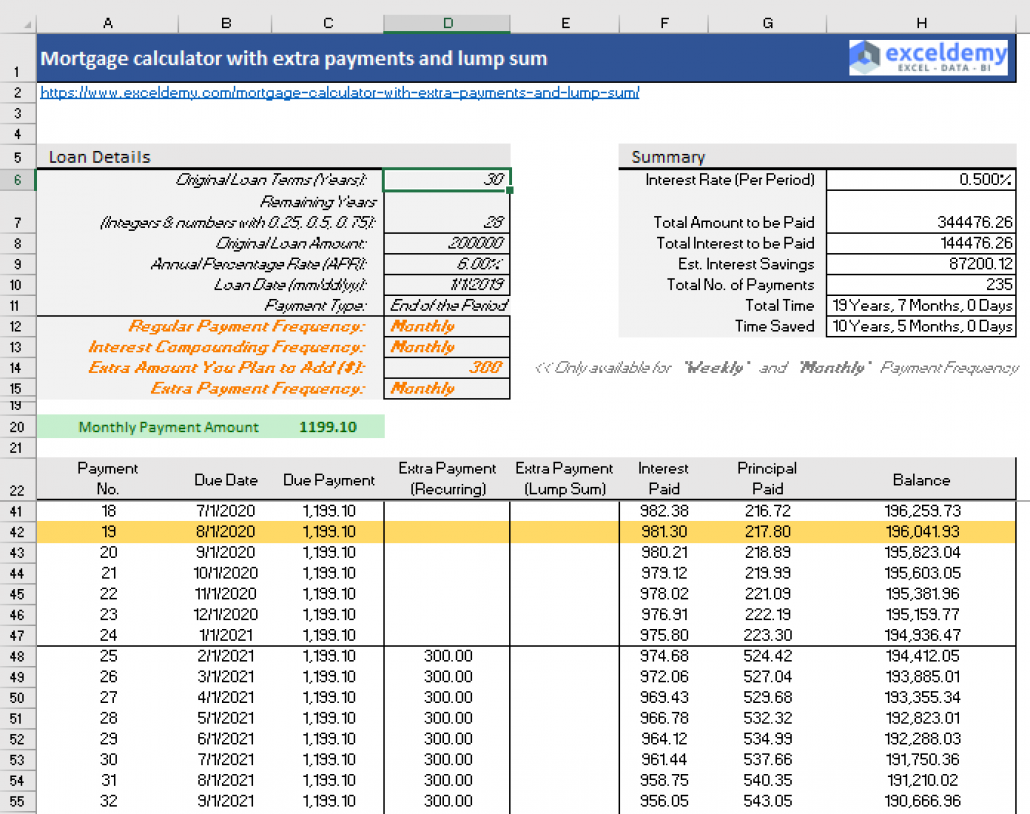

Mortgage amortization schedule template with extra payments

This Excel template contains a typical loan amortization schedule, with the boxes at the top for loan info and the table to lay out each monthly payment.

However, it also builds in a few boxes where you can add information about extra payments — both the amount and frequency. You can choose between weekly and monthly frequency.

As a result, you can project how much faster you’d pay off a loan given a certain payment amount and how much you could save on interest.

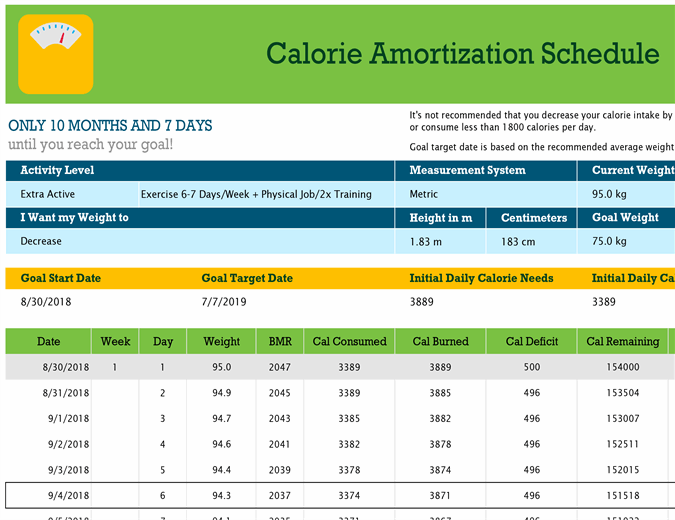

Calorie amortization schedule

Amortization is mainly used for loans, but you can apply this concept to fitness and nutrition with this calorie amortization schedule.

Instead of loan information, you enter info about yourself — height, current weight, weight goals, age, gender, and activity levels. You can switch between metric and imperial measurements.

As for the table itself, it replaces the total loan balance with a total calorie balance. It also changes the principal and interest payments to “calories consumed” and “calories burned,” and the payoff date with a goal target date.

It ends up working kind of like a loan amortization table. The goal is to keep your calorie deficit the same, but the calories consumed can vary. For example, your caloric deficit might come mostly from lower calorie consumption first, but more of it could come from burning calories later as you pick up a new exercise routine.

monday.com’s amortization schedule template

Excel can be a decent place to start when making an amortization schedule, but if you want more customization and flexibility, monday.com’s template is the place to go. With drag-and-drop customization, you can quickly build and rearrange your template to match your needs.

You can also collaborate with your team in real-time and give team members varying levels of permissions so that the right people have the right amount of access. It’s perfect for a distributed team that mostly works remotely.

As a Work OS, monday.com lets you integrate your amortization table alongside your entire digital workspace. That way, you can handle all your financial matters — not just amortization — without switching between platforms.Oh, and you can import any existing amortization schedules from Excel straight into monday.com Work OS and then export them again if needed. You can even export the template itself to a fully-functioning Excel spreadsheet.

Amortization schedule template tips & tricks

Now that you’re all set with a template, let’s cover a few tips for how to make the most of it.

1. Input formulas

Formulas in Excel — and on monday.com Work OS — can save you a lot of time doing the math on your amortization schedule. You can create a formula by using the “=” sign and then typing out the formula you want. For instance, if you type “=B1+B2” into B3, Excel will automatically calculate the sum of B1 and B2 and put the result in B3.

Most amortization schedule Excel templates will come with formulas for the core amortization schedule, but you can modify them if needed or add formulas elsewhere to calculate other relevant information.

2. Use color to highlight data

Excel lets you add colors and format the text to make certain information stand out. This can make it easier to locate that information and distinguish it from other data on the template.

For instance, you can make your payments in the amortization schedule colored red. This indicates that you’re subtracting this amount from your loan balance. It also helps you locate that column more quickly among all the words and numbers within your template.

3. Find templates that suit your use cases

Many people have multiple loans of different types, whether for business or personal matters. It’s good to create several amortization schedules to track all your loans, but you may need different templates.

For instance, a mortgage amortization schedule with a balloon payment will look different from a personal loan with a shorter term length and no balloon payment. Your templates should look different to accommodate each type of loan.

Fortunately, you can duplicate Excel templates to create multiple amortization schedules with just a few mouse clicks. Save them with different names — such as “mortgage amortization table” — and you’re good to go.

FAQs about amortization schedule Excel templates

How do I create an amortization schedule in Excel?

Amortization schedules require several complex formulas to work properly, and you could technically manually add these into a blank Excel spreadsheet to calculate it. However, the easy way to create an amortization schedule in Excel is to grab an amortization schedule template and just fill in your information — loan amount, interest rate, and timeline.

This will save you a lot of time and energy over attempting to build an amortization table yourself.

Does Excel have a loan amortization schedule?

Yes, Excel has a simple loan amortization schedule template available. It’s fairly basic, so if you only need something with no frills, it can work for you. However, if you want a more customizable template with additional features, give the monday.com Work OS amortization schedule template a try.