As humans, we’re used to assessing risks; it’s part of our survival mechanisms. But limiting risk — also called risk mitigation — impacts whether a business survives.

Imagine a scenario where business leaders don’t stop to reflect on past mistakes or constantly dive into new opportunities without considering how they could impact their business — this wouldn’t be sustainable.

To effectively reduce risk within an organization, we need to understand the different types of risk and how to prevent them. In this article, we’ll cover the various types of risks, share four risk mitigation strategies, and show you how to build a plan on monday.com Work OS to help you future-proof your business.

What is risk mitigation?

Risk mitigation is the practice of reducing the impact of potential risks by developing a plan to manage, eliminate, or limit setbacks as much as possible. It’s the last (and most important) step in any risk management plan.

After management creates and carries out the plan, they’ll monitor progress and assess whether or not they need to modify any actions.

In a nutshell, risk mitigation describes the tactics and techniques that bring risk levels down to a tolerable level for the business.

Though it might feel tempting to take a page from another business’s risk management book, your plan will depend on your unique business strategy.

Taking the time to create a unique risk mitigation plan could be the difference between maintaining a strong relationship with clients and losing out on business. Let’s look closer at what you would want to achieve when you mitigate risks.

Why do we mitigate risk?

Unfortunately, ignoring risk factors won’t make risks disappear, and forging ahead without a plan may damage your bottom line. This is why risk mitigation is important.

With a concrete plan with clear action items, you can prevent risks from turning into problems that spin out of control or even prevent risks altogether.

This not only carries tangible benefits — such as keeping your business profitable — but it also has intangible benefits, such as helping you maintain a good reputation for stability within the industry and keeping internal and external stakeholders happy.

The latter is significant. In a recent survey, two-thirds of respondents said the volume and complexity of risks were near their highest level in 14 years for all types of organizations, while less than one-third described their risk management processes as mature or robust.

Those operational risks can cost time, money, and other valuable resources. If stakeholders feel the risks are too high or mishandled, that could lead to a reshuffle in management. So risk mitigation is essential, but before you can develop a plan, you need to know what risks you can face.

What are the types of risk you may encounter?

The risks you face may differ from those of another business or industry, catering to different clients or customers. That said, a few common risks include:

- Compliance risk — when a company violates external or internal rules, regulations, or standards, its reputation or finances are at risk. Companies may face losing customers or paying a fine due to breaking compliance regulations.

- Legal risk — a type of compliance risk that happens when a company breaks the government’s rules for companies. Companies facing legal risks could also get caught up in expensive lawsuits.

- Strategic risk — the result of a company’s faulty business strategy or lack thereof.

- Reputational risk — a risk that can negatively impact the company’s standing or public opinion. Reputational risks can result in profit losses and decreased confidence among company shareholders.

- Operational risk — a business’ day-to-day activities can potentially drain its profits. Both internal systems and external factors can cause operational risks.

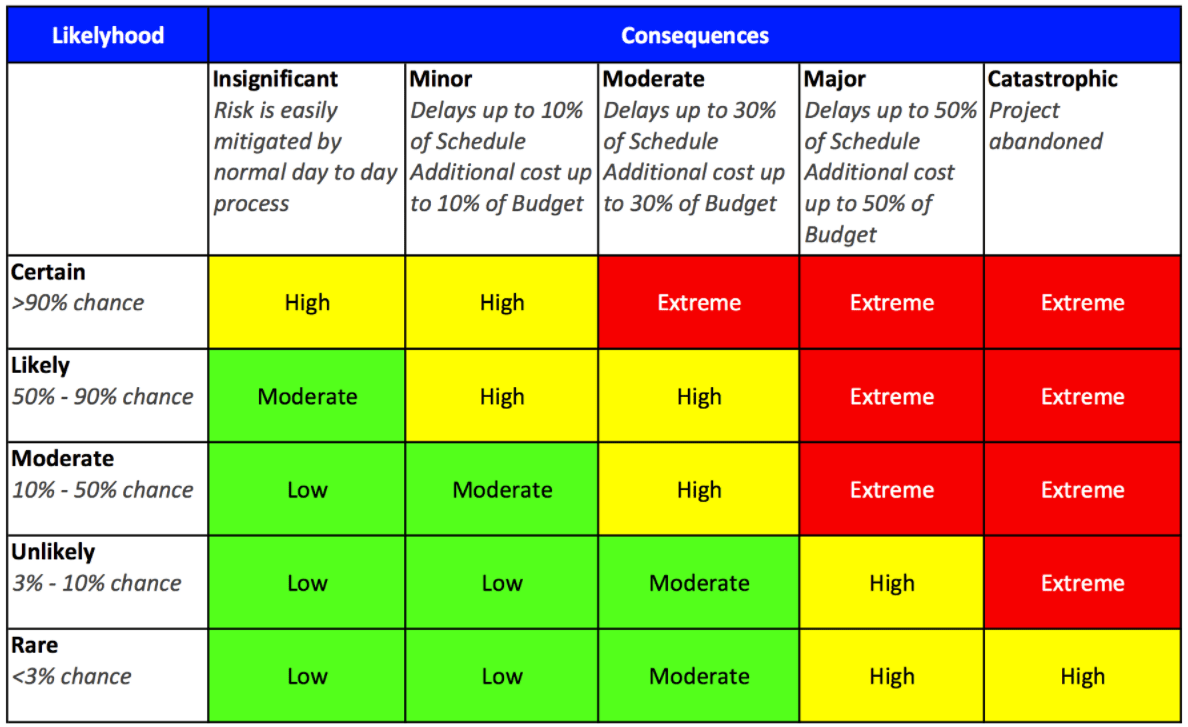

Many businesses organize matrices by potential consequences and likelihood, like the one above. Identifying which risks you’ll face is the first step toward preventing them. Generally, there are a few types of risk mitigation strategies you can use to protect your business.

What are the four risk mitigation strategies?

There are four common risk mitigation strategies: avoidance, reduction, transference, and acceptance.

Risk avoidance

With a risk avoidance strategy, you take measures to avoid the risk from occurring. This may require compromising other resources or strategies to ensure you’re doing everything possible to avoid the risk.

For example, you may face a risk where you won’t be able to complete a task for an important project due to a lack of specialists. To avoid this risk, you could hire multiple specialists in case one got sick or wasn’t available.

Of course, hiring more resources would take a bigger slice out of the budget, so assessing how much you can compromise is an important step in this strategy.

Risk reduction

With this mitigation approach, once you’ve completed your risk analysis, you would take steps to reduce the likelihood of a risk happening or the impact should it occur.

Let’s say your budget is tight, and there’s a risk you can’t complete a particular project due to a lack of funds.

You can reduce the likelihood of that risk occurring by proactively managing the costs within the budget. In this scenario, you could choose a cheaper option for raw materials or reduce the project scope to complete it within budget, like the image below:

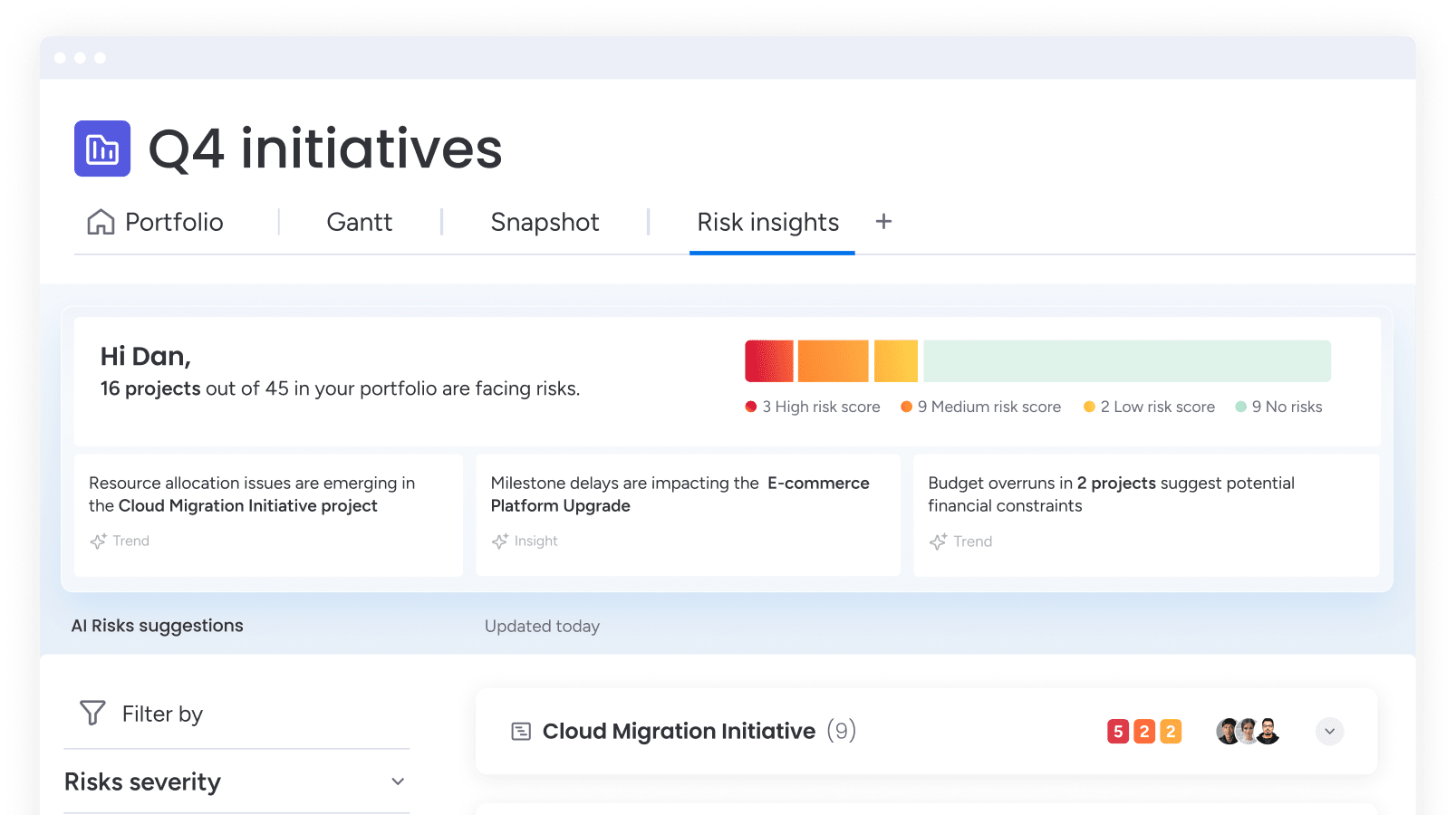

Pro tip: use our new feature to identify and manage your risk with AI and create an automated dashboard where you can see all of your organizations risks by priority, stage, and project progress.

Risk transfer

Transferring risks involves passing the risk consequence to a third party. For many businesses, that might involve paying an insurance company to cover certain risks.

Risk transference might also be written into contracts with suppliers, outsourcing partners, or contractors. If a project gets delayed awaiting a part or service from an external contractor, for instance, the contractor might face penalties for any loss of revenue the business incurs.

Also, if a company has employees or contractors from around the world, a global compliance adviser can help support and address the challenges inherent to extending operations across different countries.

Risk acceptance

Lastly, we have the risk acceptance strategy, which means accepting the risk as it stands. Sometimes, the possibility of reward outweighs the risk, and it’s more beneficial in the long run to take the chance.

It could also be that the probability of the risk occurring is minimal or the negative impact is minor. For items in this “Low” risk category, a business might have an ongoing strategy to accept the risk.

With risk acceptance, it’s vital to monitor the risk carefully for any changes to impact or likelihood of occurrence. You may also want to keep weighing the risk against your risk appetite and assess whether carrying the burden of risk continues to be the best move.

We’ve identified different types of risks and discussed several mitigation strategies. Now, it’s time to put the above into action and see how you can mitigate risks.

Get startedPractical steps you can take to mitigate risk

Risk mitigation steps need to be practical. It won’t help your business if you can’t figure out how to actually mitigate the risks you’re facing.

The following five steps will help you figure out a way forward through your risk mitigation process. Let’s break it down.

1. Identify all possible risks

Before developing any plan, you may want to identify any risk that could impact your project or wider business operations. In this stage, it’s important to collaborate with a broad selection of stakeholders with different business perspectives to give yourself the best chance of identifying all possible risks.

For projects, project documentation can act as a valuable source of information. Review similar projects for hints about potential risks you might encounter.

2. Conduct a risk assessment

Now you’ve got a list of all your possible risks, it’s time to assess them by analyzing the likelihood that they will occur and the degree of negative impact your business would face.

Your actions for each risk will depend on which category they fall into after your risk assessment. For example, as we mentioned earlier, you might decide to accept all “Low” category risks, reduce or transfer “Medium” risks, and avoid all “High” category risks.

3. Treat the risks

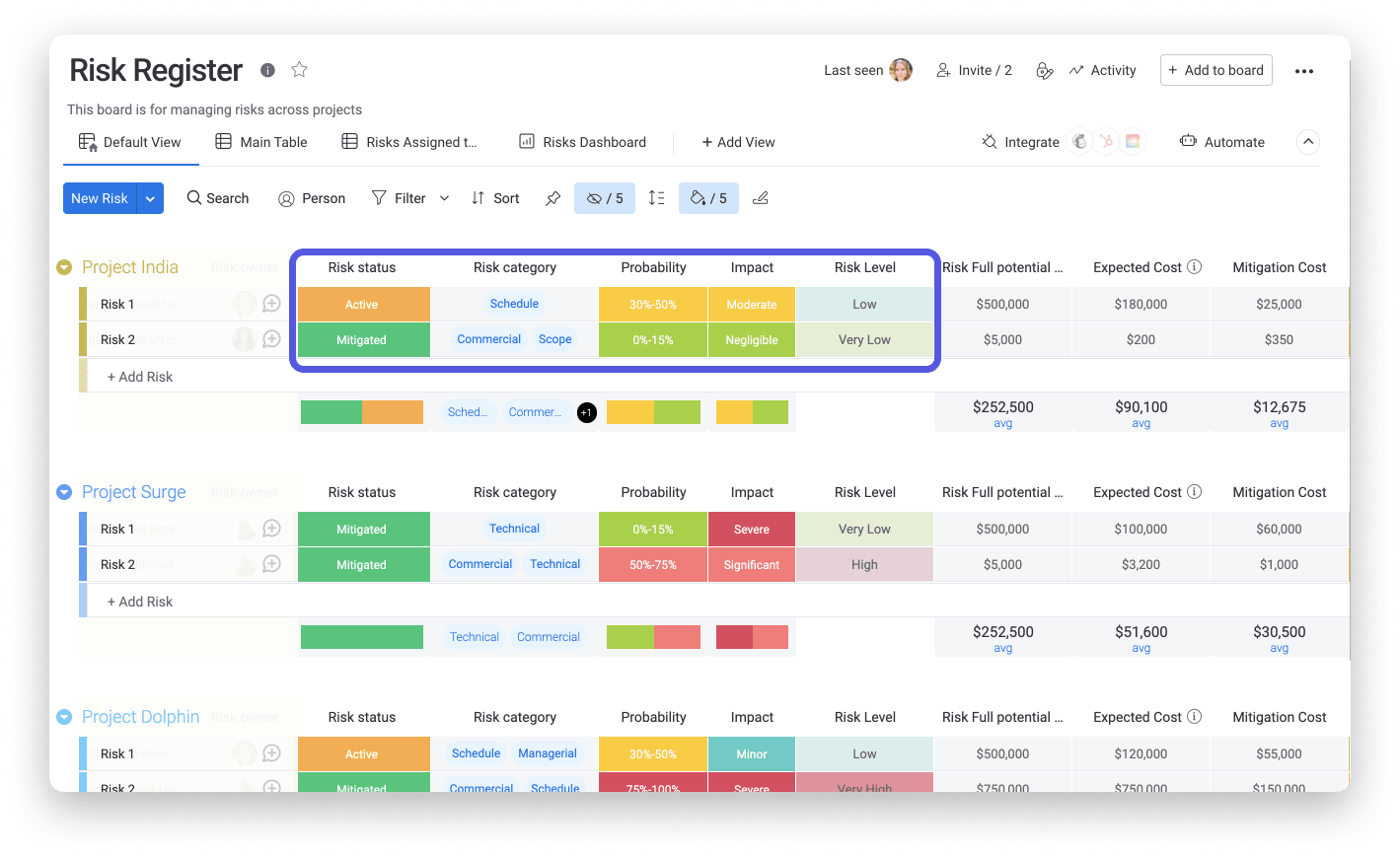

At this point, you’re deciding on your mitigating action and putting strategies in place. Make sure to record each risk, its category, and your chosen prevention measures in a risk register.

This is a resource for all stakeholders to refer to and understand the plan and which actions to take if needed. A risk register or a risk matrix board will prevent confusion down the line, helping your team stay organized and aligned if risks occur.

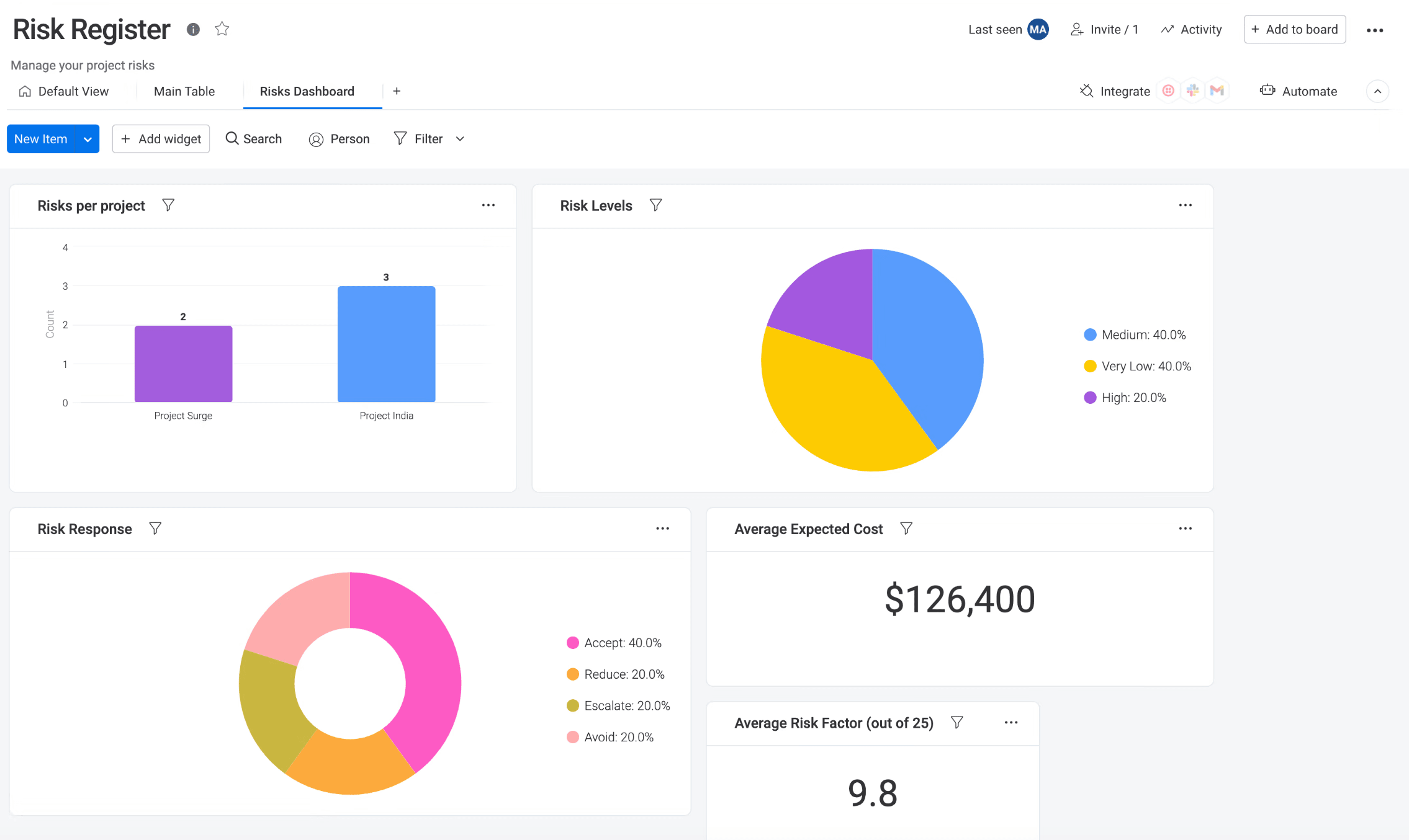

On monday.com, you can get as detailed as necessary, and add risk owners, dates, and statuses for a fully actionable plan:

4. Monitor risks regularly

Businesses aren’t static and projects frequently change. It’s essential to regularly monitor each risk to check its category and mitigation strategy.

There are many different ways you could conduct risk monitoring. You can set up times in your weekly meetings or daily stand ups to quickly review risks. You can also use several statistical tools — such as S-curves — to track project progress and flag any changes in the risk profile for key variables, such as project cost and duration.

5. Report on any potential risks

Sharing information on risks, best practices, and mitigation approaches can make your business’ risk mitigation strategy even more effective. Keeping risks at the forefront of stakeholders’ minds is vital for informed decision-making, and regular reporting may surface other risks that haven’t been identified yet.

The most effective risk mitigation strategies make risk reporting part of regular business operations by weaving it into the daily or weekly workflows. One way to easily implement reporting is with the built-in reporting capabilities and pre-built risk management templates on monday.com Work OS.

How monday.com can help you mitigate your risk

monday.com Work OS brings visibility and automation to your enterprise risk management strategy, allowing you to identify business risks across all departments and present them in a single risk register and mitigation plan.

Customization

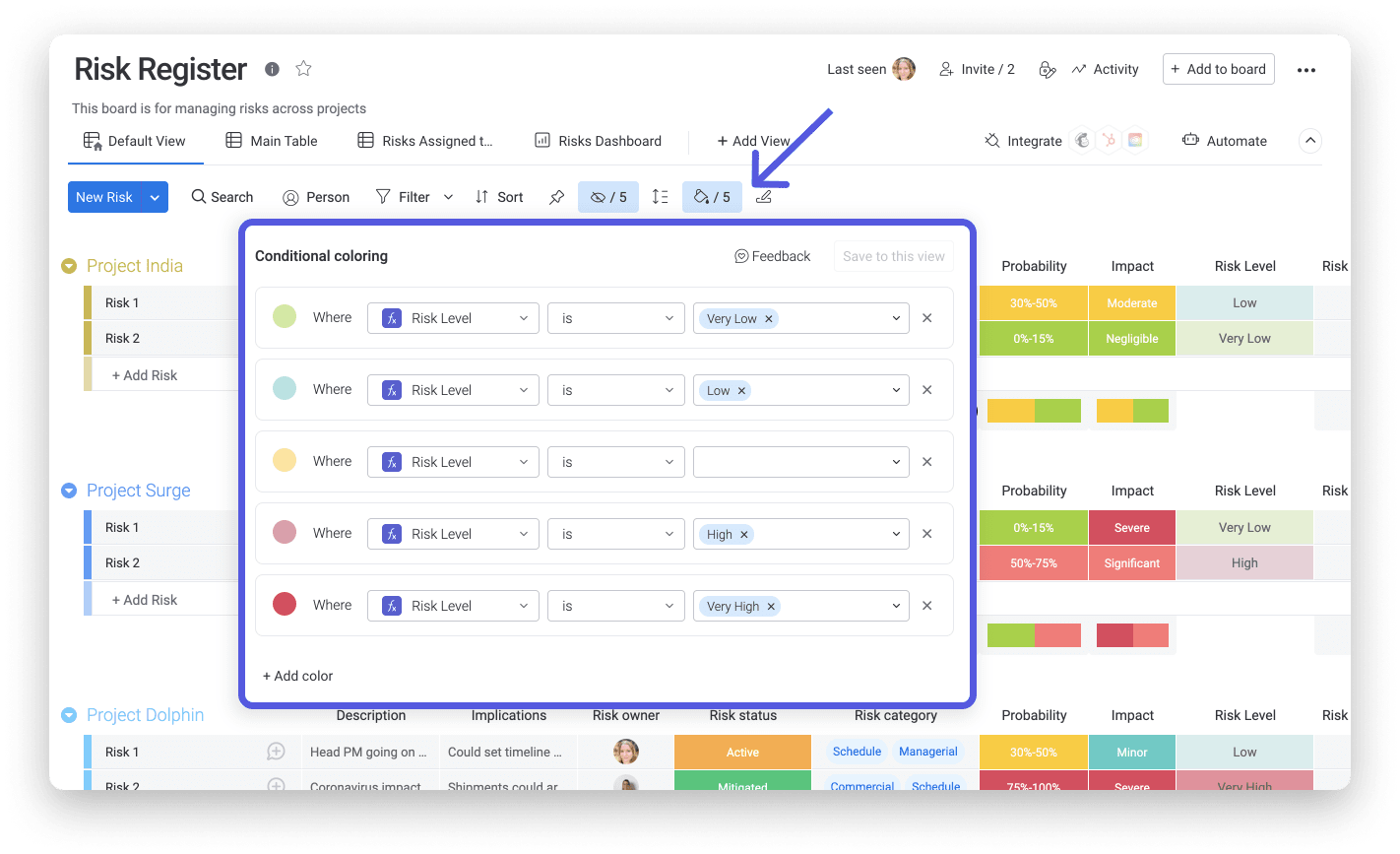

The platform is highly customizable, so you can view, track, and report on your data at a business, functional, team, or project level, depending on your needs. With a few clicks, you can change your risk mitigation plan as things progress and alert your team or stakeholders to those changes.

Choose from pre-selected statuses to keep everyone informed, or change the text and the label color to make them your own:

Automations

The powerful automations immediately notify risk owners and stakeholders of any changes and enable them to take action. Use the monday.com Workflows Center to create custom processes that update stakeholders when important dates arrive, notify the right people when a status changes, create dependencies as needed, and much more.

Collaboration

On monday.com Work OS, it’s easy to collaborate on risk identification and categorization. Anyone can view, share, and annotate documents and tag colleagues to ask questions, gain clarity, or inform, which means everyone stays aligned and in agreement on the way ahead.

Visualization

Teams can view the strategy in several different ways according to what works for them. From the table view to dashboards, charts, Kanban, and others, it’s easy to get the full picture of events and action items.

Centralization

Lastly, keep all important files and documents in one central place. You can even create documents on monday.com with Workdocs, a tool that allows your team to seamlessly collaborate on new ideas, outlines, or proposals without disrupting each other.

You can also embed monday.com boards, dashboards, videos, and more directly into your Workdoc. Each component will automatically sync and update as you work, so nothing falls through the cracks.

Help future-proof your business with monday.com risk mitigation

It’s impossible to remove all business risks — however, early risk identification provides the best chance of mitigating them to levels your business can handle.

With monday.com as a risk management software, businesses can easily identify, classify, and manage risks. Take the first step towards risk mitigation by downloading our free risk register template.

FAQs

What’s the difference between risk mitigation and risk management?

Risk mitigation is a part of the risk management process. While risk management encompasses the broader process of identifying, analyzing, and addressing risks, risk mitigation focuses explicitly on taking actions to reduce the probability of risks occurring and minimize their impact.

What is a risk mitigation plan?

A risk mitigation plan is essential for identifying, assessing, and reducing risks to a project or organization. It typically involves identifying likely risks, prioritizing risk preparation and responses, and monitoring and updating the plan accordingly.

What is a key risk indicator (KRI)?

A key risk indicator (KRI) is a metric that measures the likelihood of an adverse event occurring and its possible effects on the organization. KRIs also consider the organization's ability to absorb the impact based on its current resources.

What are the 4 Ts of risk management?

There are different ways of mitigating actual and potential risks. One common way to summarize the critical steps required to mitigate risk is using the 4 T's- tolerate, terminate, treat, and transfer.

What are two basic strategies for mitigating risk?

The two basic strategies for mitigating risks are first to identify all the various activities or steps needed to reduce the probability or potential impact of an adverse risk. Second, to create an action plan to deal with risk should it occur.

What is the goal of risk mitigation?

The goal of risk mitigation is to reduce the likelihood of business or project risk down to an acceptable level, as well as to put strategies in place to monitor and respond to potential threats in the event they happen. Risks could involve a financial risk caused by a natural disaster, or a cybersecurity risk. Mitigation strategies could include an insurance policy, a better project planning process, employee training, or a better contingency plan.

Don’t miss more quality content!