Effectively managing your budget can lead to a reduction in wasted time and resources so that you don’t lose out in the long run. However, knowing where to start when it comes to balancing and planning a budget can be tricky. With a budget template, you can easily track, monitor, and control money going in and out of your accounts.

There are plenty of Google Sheets budget templates, or you can customize your own from scratch. You can also use a work management platform like monday.com with built-in budget boards and templates to help you get started quickly.

Regardless of which option you choose, understanding the ins and outs of using a budget template will help you make the most of it. In this article, we’ll take you through the details of using different budget templates so that you can find a solution that works for you.

Check out our other templates

Budget Proposal Template

A budget proposal template is a reusable document with categories for every potential cost for any project or activity a company or organization might undertake.

Budget Template Google Sheets

With a budget template, you can easily track, monitor, and control money going in and out of your accounts.

What is a budget template for Google Sheets?

A budget template provides you with a clear picture of your financial situation. It outlines all your budget details, including expenses, savings, or projected earnings. A budget template shows how much money is coming into an account, whether business or personal as well as how money is being spent.

Budget templates can be broad or more narrow by either grouping spending into budgets like “utilities” or noting each one such as “gas,” “electricity,” “internet,” and so on. This allows you to get as detailed as you want with a template.

While you can create your own budget planner, using a premade Google Sheets budget template can help save you time and ensure you’re including all of the necessary information.

Get templateTypically, a budget template includes areas to record the following data:

- Variable or fixed costs, such as rent, subscriptions, business credit cards, etc

- Cash flow

- Income or revenue

- Expenditures

- Profit

- One-off costs

- Losses

Some templates also include things like charts, projected weekly, monthly, or yearly budgets, savings, calendars, and more. After using a budget planner over time, you’ll be able to manage your finances by tracking trends, forecasting future spending, and finding more areas for saving.

Why use a Google Sheets budget template?

Google Sheets budget templates are beneficial for a very good reason: they help you make the budgeting process quicker and simpler. However, that’s not the only benefit you’ll get with a budget template. Here’s a look at why you should use a Google Sheets budget template to track your finances:

- Visualize your entire budget in one place: Instead of moving between platforms, you can track all your spending, costs, and allotted budget in the same location.

- Track spending efficiently: Keep track of your cost management by accessing this information from anywhere at any time.

- Highlight important data: This is especially important if people other than you, like a consultant or accountant, will also be accessing the budget.

- Share budget updates: A digital budget planner is a great way to share that information with external stakeholders.

- Improved accuracy: Avoid costly mistakes in your budget by relying on built-in formulas in a Google Sheet.

- More customization options: You can alter a Google Sheet budget template to your liking to make it fit your specific budgeting needs.

While Google Sheets templates are reliable and customizable, they’re not necessarily as collaborative as workflow management platforms.

Solutions like monday.com allow you to easily share your budget with external users and control their levels of access, enabling them to add feedback without altering anything on your planner.

A bit later on, we’ll take a closer look at the benefits of using a platform like monday.com over Google Sheets

How to create a budget template for Google Sheets?

Budgets come in different shapes and sizes depending on the use case. If you don’t find one that fits your needs, you can always create your own free budget template from scratch. It may be a little time-consuming, but you’ll end up with a sheet that’s entirely tailored to your specific budgeting needs. To create your own budget template, follow these basic steps:

- Open a new sheet in Google Sheets

- Decide on the budget categories and parameters you want to include, like income, expenses, spending, savings, etc.

- Settle on a budget period, like weekly, monthly, quarterly, or daily, and build out columns accordingly.

- Add in formulas where appropriate to cut down on time spent calculating budget parameters.

- Input financial information and data like costs and numbers to start building your planner, and then continuously update it as necessary.

Of course, building your own template takes a lot more time and effort than simply starting with a template. Before you take on building your own, consider which type of premade template might be helpful for you. Let’s go over some of the more common Google Sheets budget template types to give you an idea.

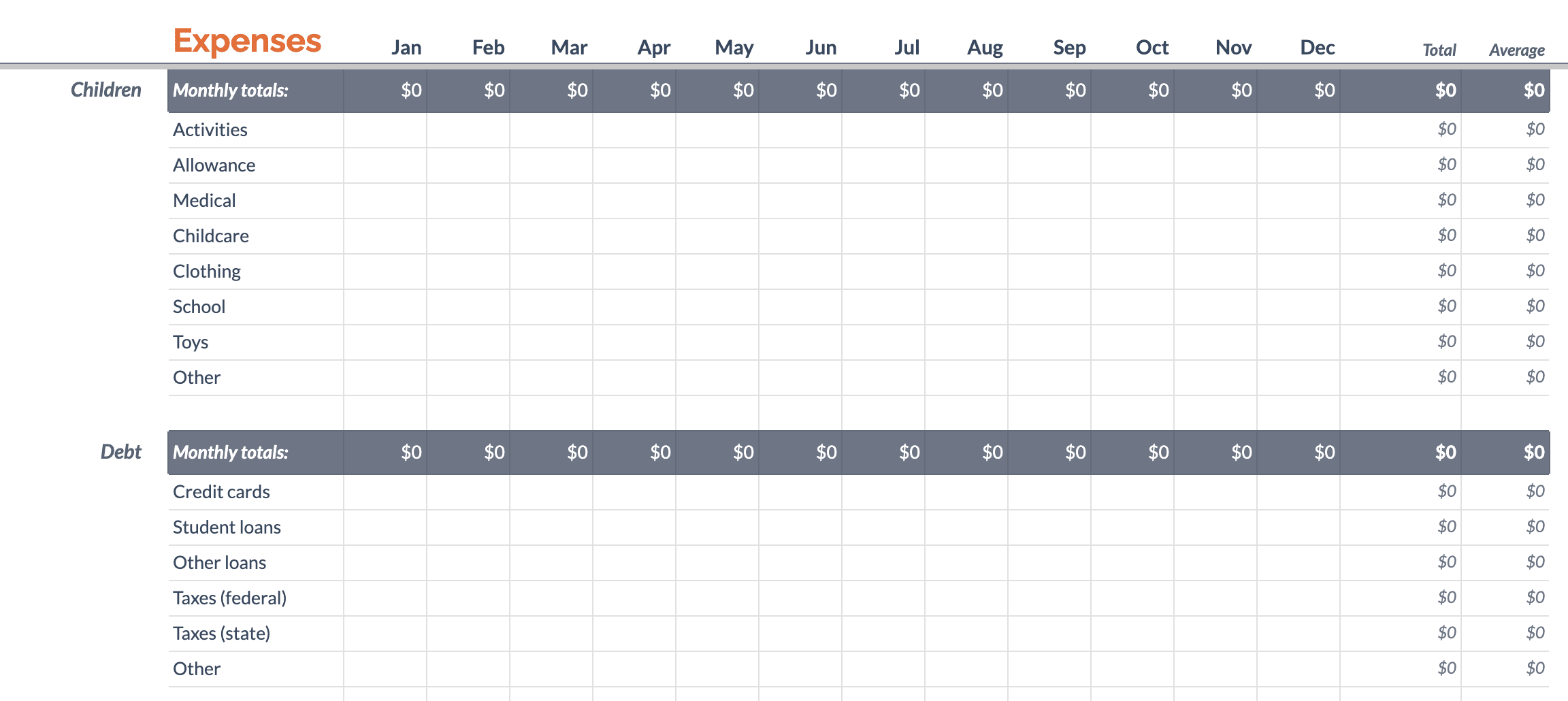

Default Google Sheets budget templates

(Image Source: Google Sheets)

Google Sheets has a few free budget template options for budgeting, such as an annual budget template, a monthly budget template, and an expense report. To access this template, open a new Google Sheet, go to File → New → From template gallery, and select the right one. However, most of these templates are designed for personal use. For businesses, you’ll need something with a little more detail.

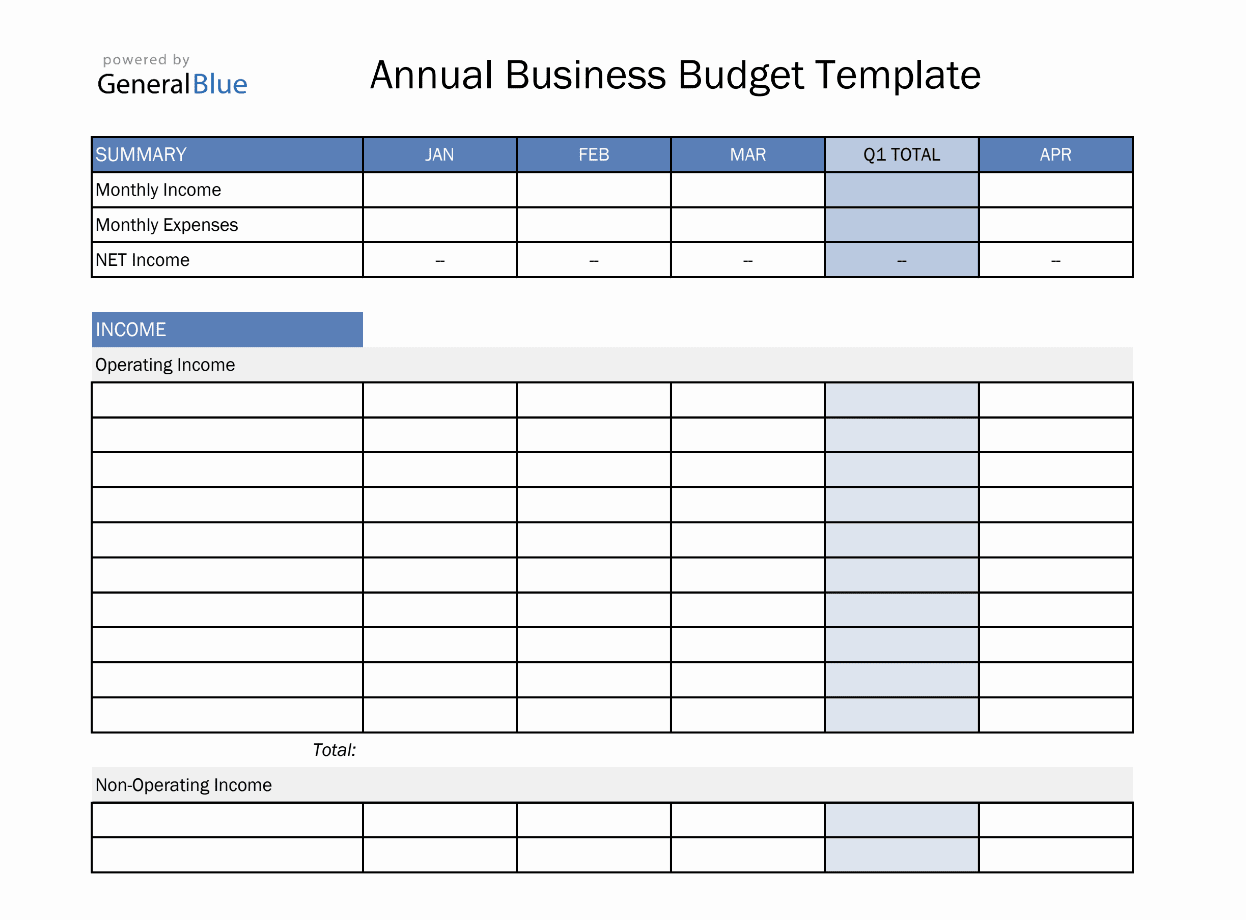

Annual budget template

With an annual business budget template, you’ll get a top-level overview of all your spending throughout the year. You’ll see your annual budget figures in one location, including expenses, income, revenue, and profit. You can also find templates with breakdowns of expenses based on categories like marketing, office rent, payroll, and more.

Because of the amount of information it contains, it’s great for getting an overview of the bigger picture. If you want something easier to digest, consider a monthly budget template.

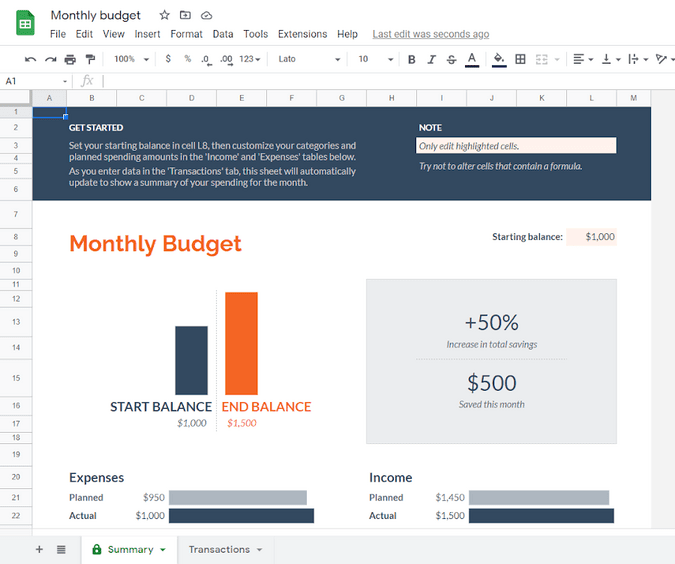

Monthly budget template

For personal finance, the monthly budget Google Sheet template isn’t a bad option. It outlines all your monthly expenses, your monthly income, your savings, and your start/end balance.

(Image Source: Google Sheets)

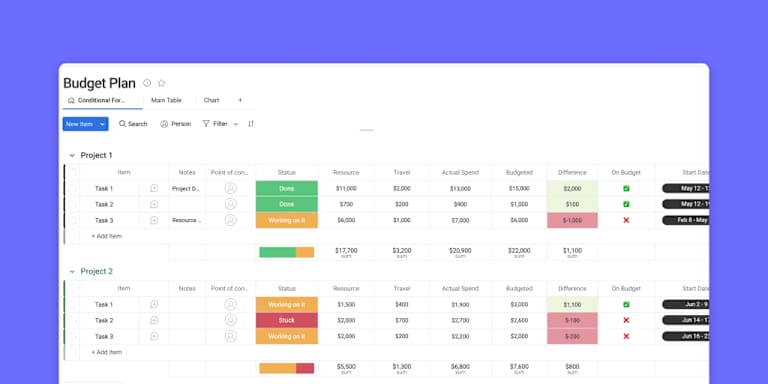

That said, if you want something you can use for business purposes, you might need a template with a bit more detail. A good monthly budget template allows you to track your monthly spending across the business. You can see all your outgoing costs and incoming revenue, categorize and color-code to track expenses and make sure that you’re not overspending.

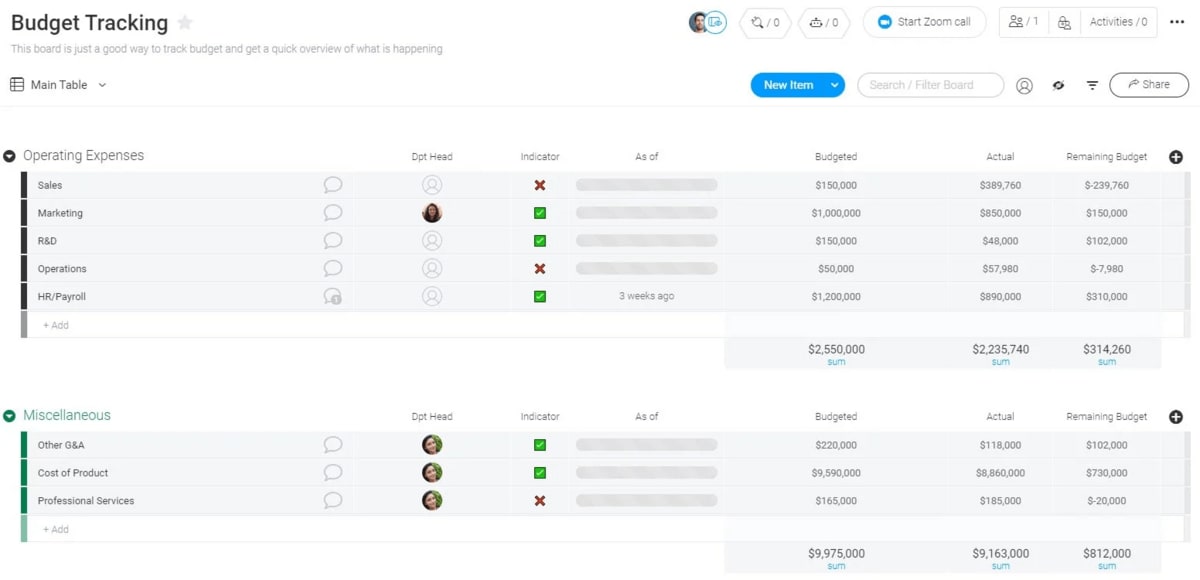

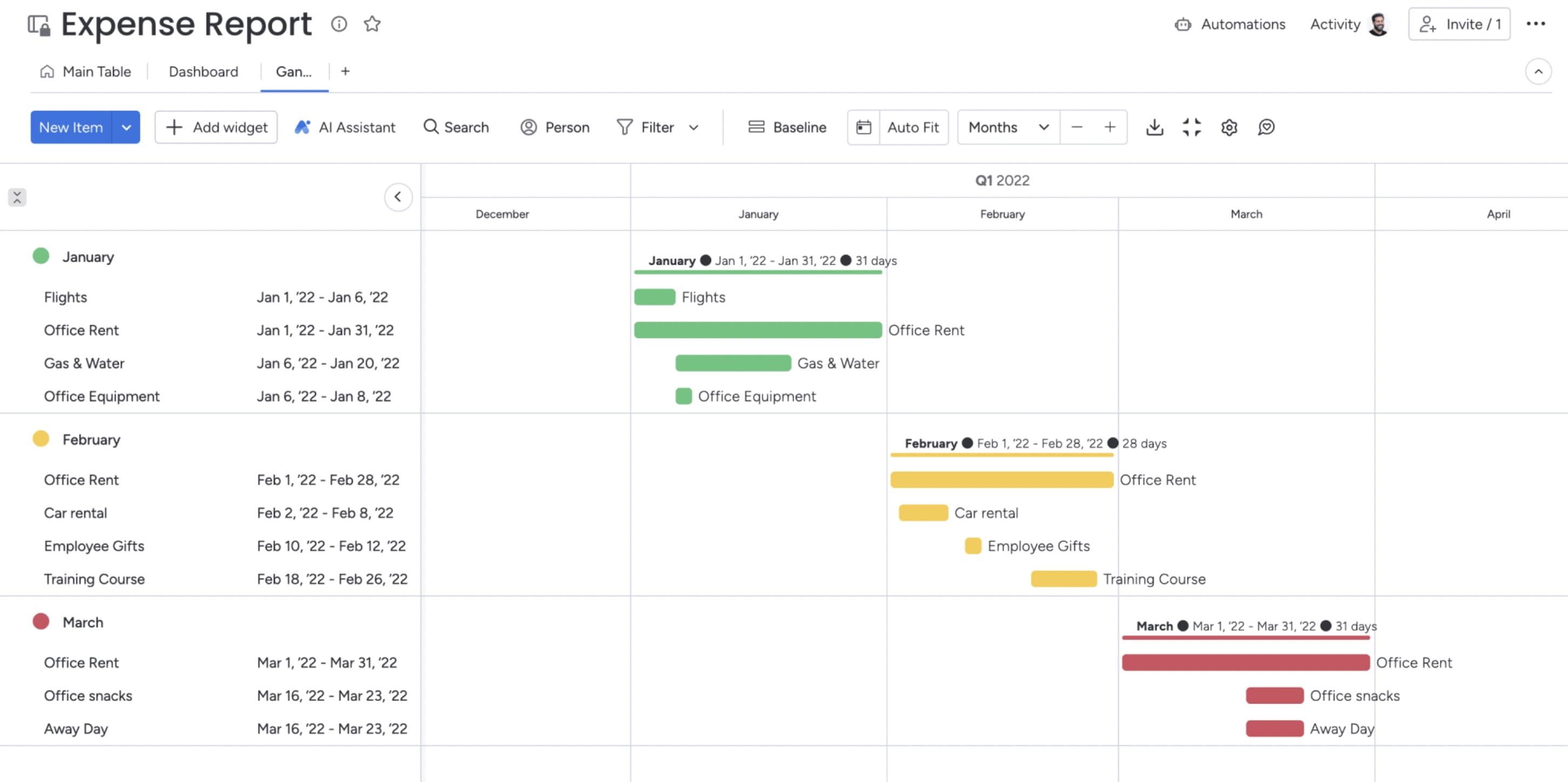

Budget tracking template

A budget tracking template helps you with financial planning. It shows you how much you’re spending in relation to your budget, making it easier to keep your spending in check.

Depending on the template you use, you can break your budgets down into different departments. For example, you can track all operational expenses against your operations budget. This gives you a deeper insight into where your spending is going and how you can best allocate your resources.

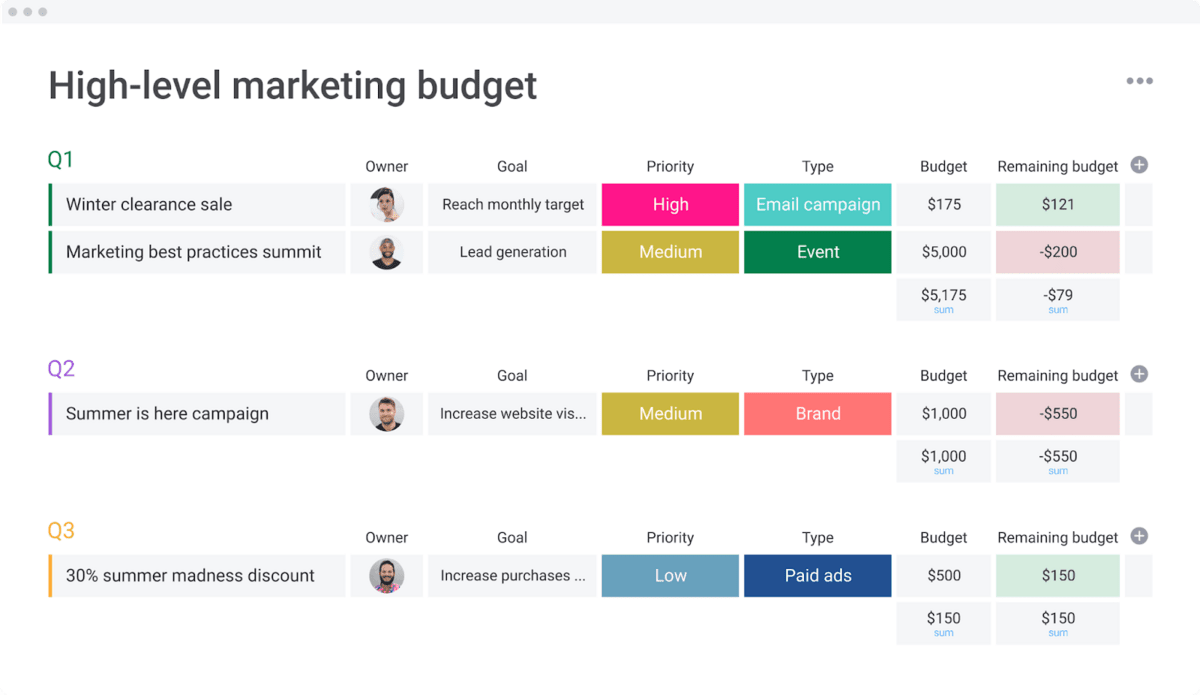

Marketing budget template

Track your marketing costs and budget allocation with a marketing budget template. With this template, you can align your marketing efforts with quarterly and yearly spending goals.

If you use monday.com’s marketing budget template, you can integrate with ad platforms like Facebook Ads to track your spending in real time and instantly see if you’re over or under budget. This helps you make quick and informed decisions about your marketing efforts to maximize resources and reduce overspending.

Get templateIncome and expense template

Keep up to date on payments coming in and going out of your business with an income and business expense template. With this template, you can better manage your cash flow and be proactive with your finances.

Income and expense templates are good for accounting purposes to help you track money moving in and out of accounts, but they don’t give you a big picture like an annual or monthly budget template.

monday.com’s budget template for Google Sheets

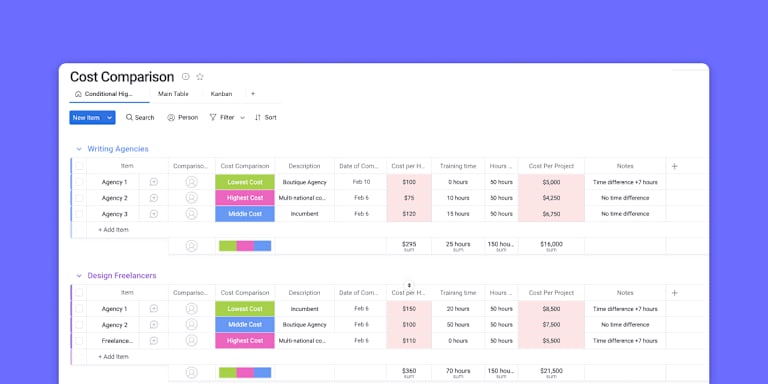

monday.com gives you all the simplicity of Google Sheets with the added benefits of additional capabilities for collaboration and communication. monday.com makes managing budgets even easier since it integrates with Google Sheets, allowing you to use an existing budget template you’re familiar with but with added functionality.

With monday.com, you don’t need any accounting experience to manage your budget. Our intuitive and user-friendly interface makes it easy for teams to start straight away. All you have to do is select our ready-made template, input your financial information, and start managing your budget. Let’s take a closer look at some of the benefits of using monday.com to plan, track, and manage your budget.

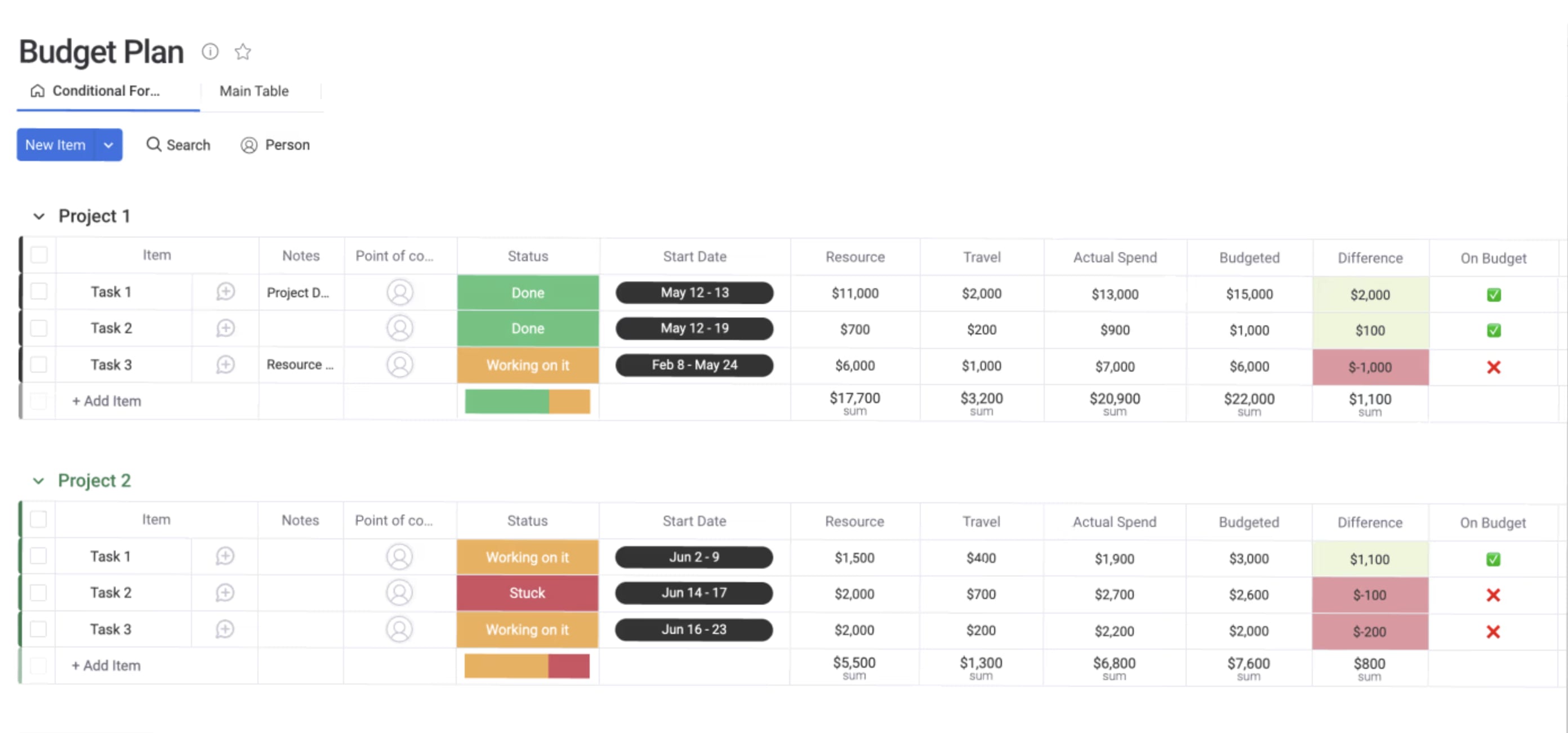

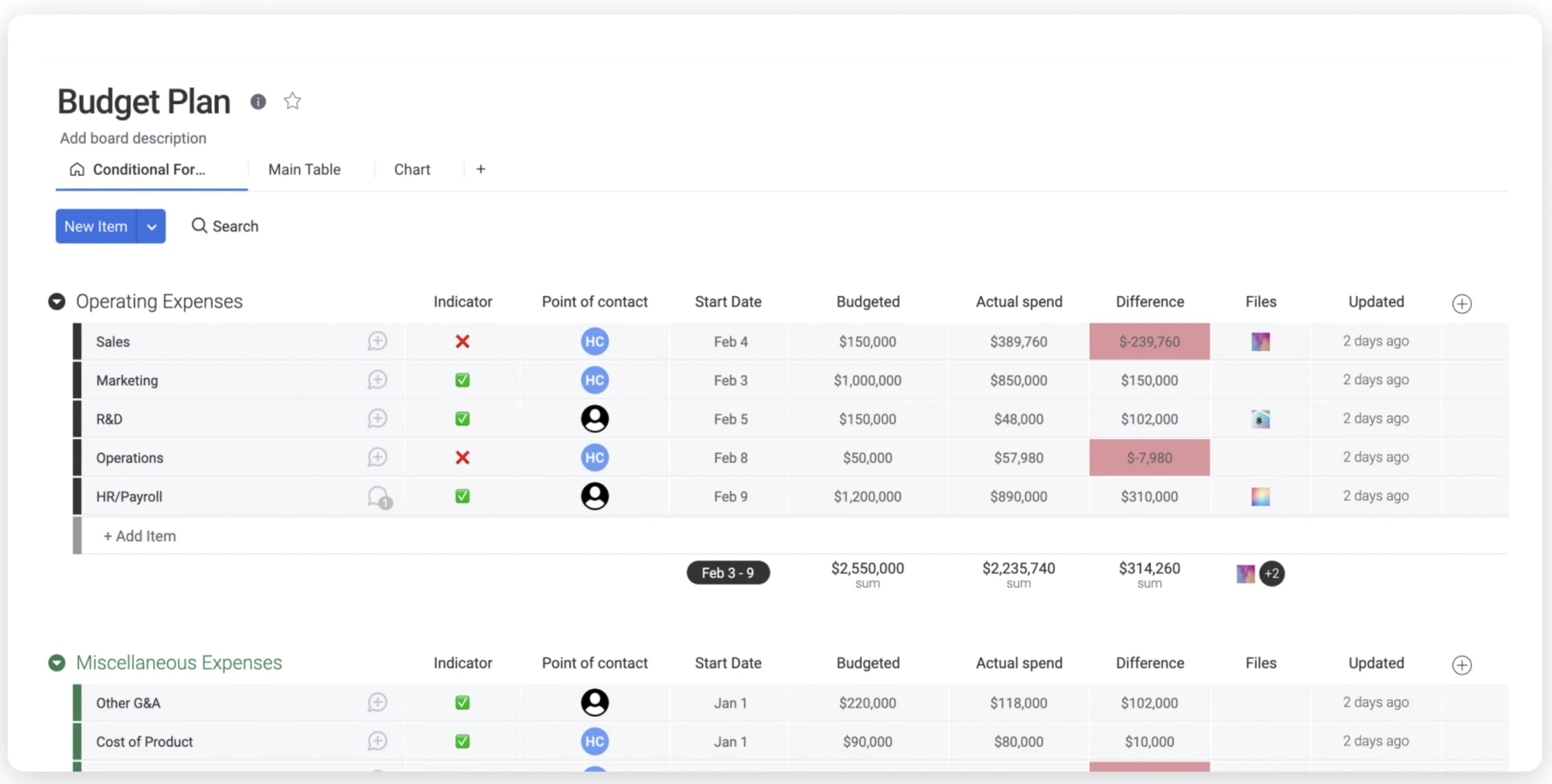

Customizable template

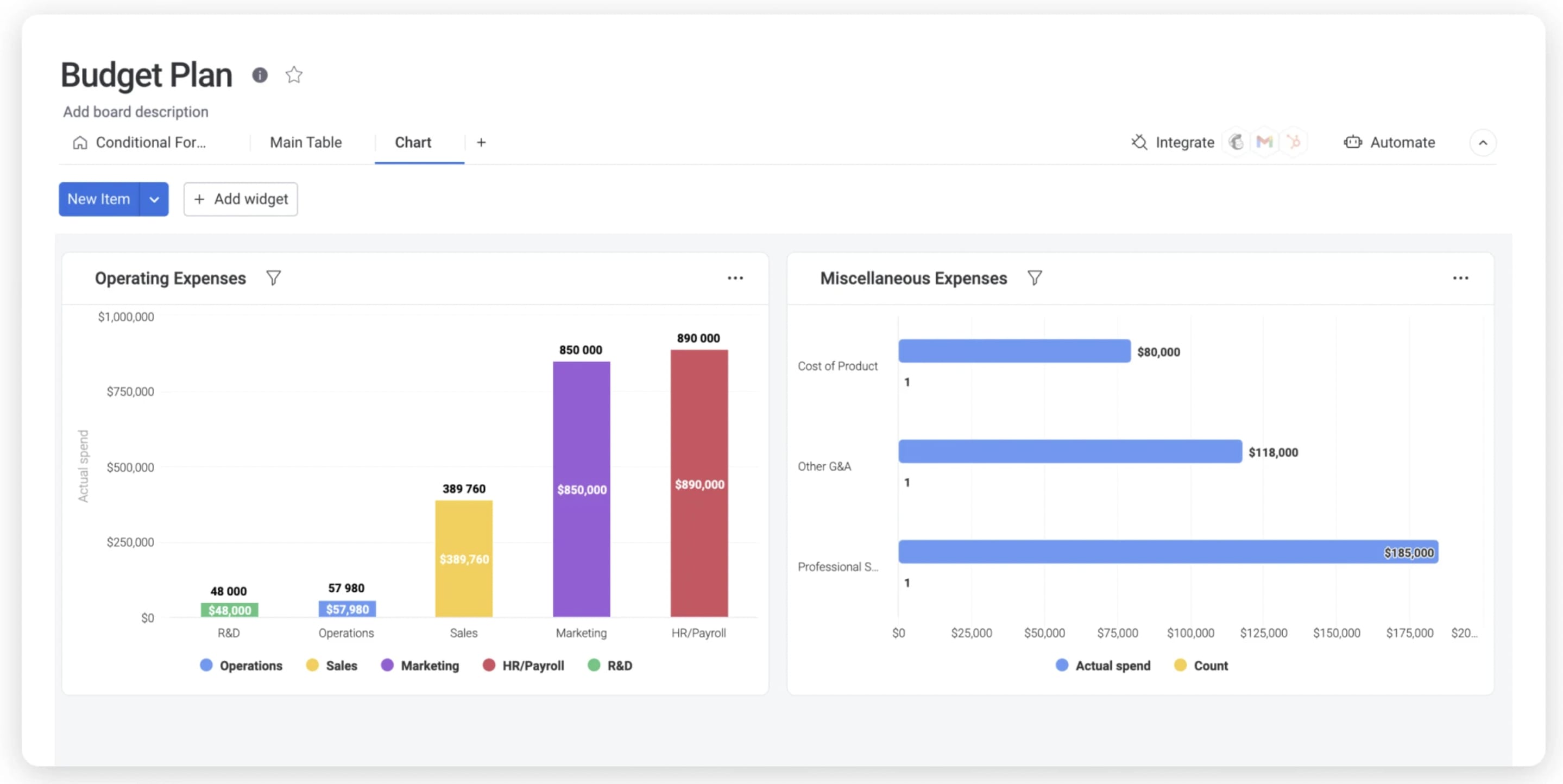

Our intuitive and customizable budget template lets you track expenses, highlight important data, and analyze your spending habits your own way. You can easily customize the template to suit your needs by adding columns and labels, creating custom automations, assigning payments to a specific budget category, and even integrating with external platforms to track costs in real time.

Manage all aspects of your budget and workflow

As a work management platform, monday.com helps teams manage their entire workflow, not just budgets. Optimize your company’s spending, processes, and habits, and start collaborating with your team as efficiently as possible in order to maximize your productivity and keep costs low. Furthermore, see all your critical budget data at a glance in your custom dashboard.

Automate your budget without using formulas

While the formulas in Google Sheets make it easy to automatically calculate costs, that’s the only way to add any sort of automations to your templates. With monday.com, you get a variety of automations that don’t require any knowledge of formulas like in Google Sheets. You can set automated reminders of when a payment is due, when you’re overspending, or trigger an action in your budget sheet like assigning a task to someone on your team.

Get templateTips & tricks for successfully executing the budgeting process

Effectively managing a budget is easier said than done. While what works for one person or company may not be as effective for another, there are still tips and best practices you can apply to use any budget template to its full potential and ensure you’re making the most of the budgeting process.

Prioritize your spending

Being able to prioritize where to allocate your budget and resources ensures that your project runs as smoothly and efficiently as possible. To effectively prioritize your spending, follow these simple steps:

- Make a list of outgoing cash flow.

- Highlight the essential payments and figure out the total amount.

- Once you’ve got a handle on the essential payments and how much they’ll cost, you can prioritize these costs.

These costs are non-negotiable, so take them into account before spending in other areas. In monday.com, you’ll be able to flag these payments in the template so that they’re easy to spot.

Automate parts of the process

Automation can help you streamline the entire budget management process. For example, you can:

- Set due-date reminders to prompt you before payments are due

- Create dependencies to automatically assign tasks and deadlines

- Streamline recurring administrative actions like assigning tasks or setting follow-up reminders

Ultimately, all of these automations save you valuable time. You’ll spend less time checking due dates and making payments and more time managing your budget proactively.

Use a work management platform for real-time access to your expenses

Using a work management platform helps you not only manage your budget but also see it in relation to other aspects of your business for a big-picture overview. On monday.com you can track hours in real-time to see if more time and budget is being spent on certain tasks or track habits across work tasks to help cut down on costs. By viewing your budget holistically in relation to your global operations, you can see different ways your budget is impacting your workflow and vice versa.

Get templateFAQs about budget templates for Google Sheets

What is a budget plan?

A budget plan, sometimes called a spending plan, outlines how your budget will be spent. It helps you figure out if you have the budget to do what needs to be done, and how your budget should be spent to reach your financial goals.

Is there a budget template in Google Sheets?

Yes, there is an annual budget template designed for personal use. There’s also a single-month budget template and an expense report template included by default.

How do I make a budget spreadsheet?

How to make a budget spreadsheet varies from business to business, so there’s no set formula. However, most budget spreadsheets include parameters like revenue, expenses, profit, loss, and outgoing costs. If you want to use Google Sheets, you can choose one of the ready-made templates. If you’d prefer to use an interactive budget template, take a look at monday.com.

What is the 50 20 30 budget rule?

The 50-30-20 budget rule says that you should spend up to 50% of your after-tax monthly income on things you actually need, save 20%, and spend the remaining 30% on things you want but don’t necessarily need. If you owe money you should spend a portion of that 30% on debt repayment.

Is there a free budget template?

Yes, absolutely. Google Sheets has several pre-made templates for you to try out. There are also budgeting apps that integrate with major banks (even if you’re not using dollars and live outside the US) and can automatically split your spending into categories and display everything visually. monday.com offers several budget templates to help on your budgeting journey.

How to budget for beginners?

It’s easier than you might think First, figure out your after-tax income. Second, choose a system or a budget app you want to use. Third, create spending categories and break down your sheet by week. Then, write down all of your spending into the sheet or app, and finally - analyze month to month and create a plan for the next 3-6 months.