Strategic goals often get lost in the daily shuffle of competing priorities, urgent requests, and scattered updates across multiple systems. Finance project managers (PMs) know this reality well: you’re juggling regulatory compliance initiatives, system implementations, and cross-functional transformations while stakeholders demand real-time visibility into progress and ROI.

The challenge isn’t setting ambitious objectives. It’s maintaining alignment between high-level strategy and daily execution when teams work across departments, tools, and timelines. Without centralized goal tracking, you’re stuck manually compiling updates from disconnected sources, creating reports that are outdated before they’re shared, and watching strategic initiatives drift off course.

This article explores the best goal tracking software for finance organizations, covering essential features that connect strategy to execution, platform comparisons tailored to enterprise needs, and implementation strategies that deliver measurable results. We’ll also cover how centralized platforms eliminate manual reporting overhead while providing the visibility and accountability needed to keep complex portfolios on track.

Key takeaways

- Replace manual reporting with automated goal visibility: connect strategic objectives to daily work so progress updates happen automatically, freeing your team from hours of status compilation each week.

- Start with a process audit before selecting software: map your current goal tracking ecosystem to understand the true scope of transformation needed and build a compelling business case for centralization.

- Choose platforms that support your existing goal frameworks: look for software that accommodates OKRs, KPIs, and custom methodologies without forcing standardization across departments.

- Leverage AI-powered insights: use artificial intelligence to proactively identify at-risk goals, automate task assignments, and generate executive summaries without manual effort.

- Implement systematically with pilot programs: launch with one high-visibility initiative to prove value, refine processes, and build internal champions before scaling organization-wide.

Understanding goal tracking software for enterprise organizations

.jpg)

In simple terms, goal tracking software bridges the gap between your big-picture strategy and day-to-day work. It’s where teams align their efforts, track real progress (not just status updates), and pivot when needed — turning what would be disconnected initiatives into one cohesive game plan.

For finance PMs drowning in competing priorities, it means finally having a single source of truth. This gives you a single source of truth that consolidates OKRs, status updates, and KPIs into one unified workspace.

Great goal tracking does more than just count numbers too. It shows everyone exactly how their work matters to the bigger picture, spots potential problems before they blow up deadlines, and kills those soul-crushing hours of manual reporting.

The result? Teams naturally align because they can actually see why their daily work matters.

Why finance project managers need specialized goal tracking

Finance PMs deal with challenges that standard project platforms just can’t handle. One day you’re knee-deep in compliance requirements, the next you’re rolling out new systems across departments, all while your stakeholders want perfect audit trails and concrete ROI numbers yesterday.

The complexity multiplies when you consider the stakeholders involved. Executive leadership wants real-time visibility into strategic goal achievement. Department heads need to understand resource allocation across initiatives. Team members require clarity on priorities and deadlines.

Without a central goal tracking system, you’ll waste hours cobbling together updates from a dozen different places, only to share reports that are already obsolete. This mess creates three real headaches:

- Alignment gaps: teams work hard but not necessarily on the right priorities.

- Visibility delays: by the time you spot a risk, it’s already impacting timelines.

- Manual overhead: hours spent on status updates instead of strategic work.

Finance organizations that implement comprehensive goal tracking see immediate improvements in these areas. For example, when one PMO adopted a centralized work management platform, they achieved a 26% increase in efficiency and saved three hours per person weekly on coordination tasks.

Essential features for enterprise goal tracking

Don’t get distracted by flashy demo features that don’t deliver in real life. When you’re managing complex financial portfolios, you need substance over style.

Here’s what separates the enterprise-grade platforms from the basic tools that’ll fall short:

Goal-setting frameworks and cascading objectives

First, you need a platform that works with your planning style, not against it. Your team might swear by OKRs while another department lives and dies by KPIs — your goal tracking system shouldn’t force everyone into the same box.

Key capabilities to evaluate:

- Hierarchical goal structures: connect company objectives to department goals to individual tasks.

- Mixed methodologies: support both OKRs for transformation initiatives and KPIs for operational metrics.

- Goal dependencies: visualize how achieving one objective impacts others.

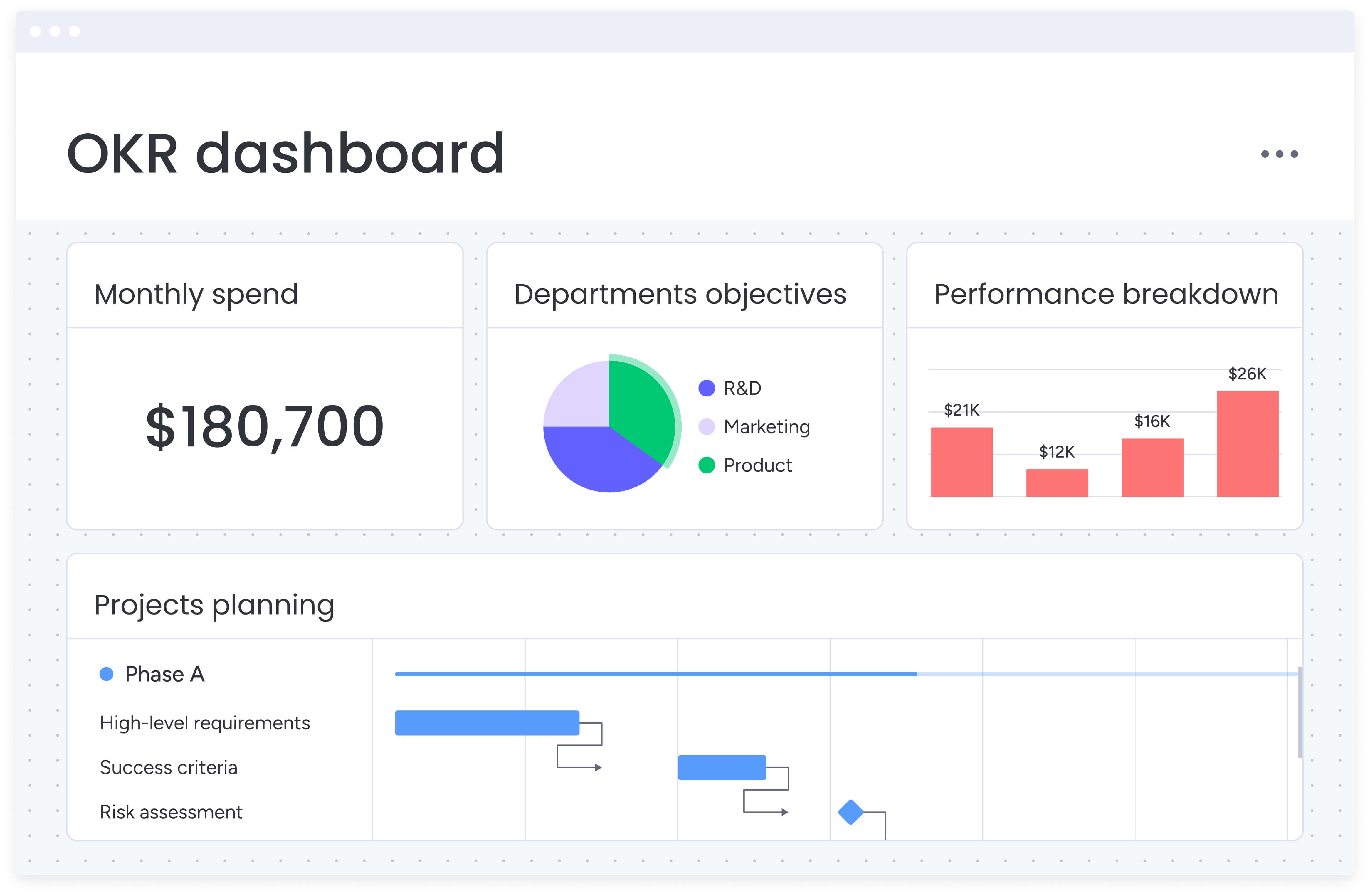

Real-time dashboards and automated reporting

Manual reporting is a productivity killer that leaves you making decisions based on last week’s news. The right dashboards update themselves as work happens, giving you back hours of your life and keeping everyone on the same page. The right dashboards update themselves as work happens, giving you back hours of your life and keeping everyone on the same page.

What to look for in dashboard capabilities:

- Portfolio-level views: monitor goal progress across hundreds of projects simultaneously.

- Drill-down functionality: move from executive summary to task-level details in clicks.

- Automated distribution: schedule reports to stakeholders without manual compilation.

Dashboards in monday work management connect directly to project data, providing instant visibility into goal achievement rates, resource allocation, and risk indicators — all without manual updates.

Cross-functional alignment and dependency tracking

No finance project lives on an island. When you’re rolling out that new ERP system, you’re touching operations, IT, and accounting all at once. Need to implement new compliance measures? You’ll need legal, risk, and audit teams on board. Your goal tracking needs to capture all these moving parts.

Critical alignment features include:

- Cross-project dependencies: see how delays in one initiative impact related goals.

- Resource capacity views: understand team bandwidth across departments.

- Stakeholder mapping: track who’s responsible for each goal component.

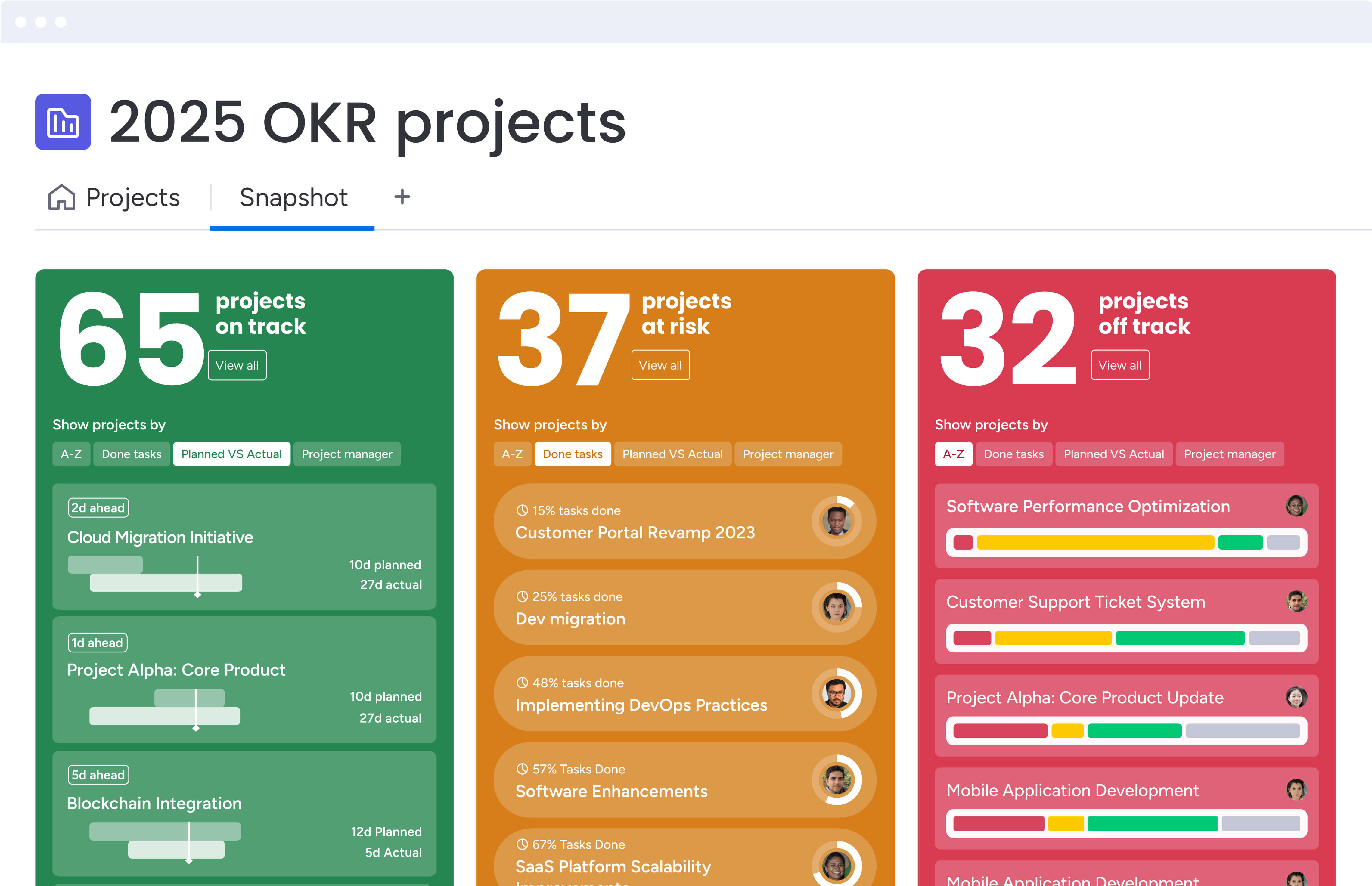

AI-powered insights and risk identification

Regular dashboards only tell you where things stand right now. The key differentiator is using AI-powered platforms that predict where projects are headed and flag potential issues before they escalate. It’s the difference between constantly putting out fires and preventing them in the first place.

Advanced AI capabilities that matter:

- Risk pattern detection: identify goals at risk based on update language and progress trends.

- Automated categorization: sort and prioritize incoming requests by urgency and goal alignment.

- Intelligent task assignment: match work to team members based on skills and capacity.

Comparing leading goal tracking platforms

Before you make the switch or try any platform, it’s really important to understand each one’s strengths, especially if you need intelligent goal management software.

Different solutions excel in different areas, making it crucial to match capabilities with your specific finance PMO requirements. Here’s how major platforms compare for finance PMO needs:

| Platform | Goal frameworks | Dashboard customization | AI capabilities | Enterprise security | Starting price |

|---|---|---|---|---|---|

| monday work management | OKRs, KPIs, custom | Fully customizable with 30+ widgets | AI Blocks, Digital Workers, risk insights | SOC 2, ISO 27001, SSO, BYOK | $9/user/month |

| Asana | Goals in higher tiers | Limited customization | Basic automation | Enterprise plan only | $13.49/user/month |

| Smartsheet | Formula-based tracking | Requires add-ons | Limited | Business plan+ | $12/user/month |

| ClickUp | Goals feature available | Moderate flexibility | Basic automation | Available | $7/user/month |

| Wrike | OKR support | Good visualization | Limited AI | Enterprise features | $9.80/user/month |

Platform-specific considerations

Each platform approaches goal tracking differently. Understanding where each one excels, and where it creates friction, helps finance teams choose a solution that supports scale, governance, and long-term adoption.

- Asana: strong for team-level collaboration, but advanced goal tracking and reporting require higher-cost tiers, which can limit scalability for enterprise finance teams.

- Smartsheet: powerful reporting and spreadsheet-style control, but heavy reliance on formulas and manual configuration increases setup effort and ongoing maintenance.

- ClickUp: competitively priced with broad functionality, though feature density and configuration complexity can overwhelm teams and slow adoption.

- monday work management: purpose-built for enterprise scale, combining flexible goal frameworks, real-time dashboards, AI-powered risk insights, and strong security controls to support finance governance without adding manual overhead.

For finance organizations, platforms that balance enterprise-grade security, automation, and clear goal-to-work alignment consistently deliver stronger adoption and faster time to value.

Step-by-step implementation guide for finance organizations

Successful implementation requires more than selecting the right platform. It demands thoughtful planning, stakeholder alignment, and systematic rollout.

The following six-step approach ensures your goal tracking initiative delivers measurable value from day one.

Step 1: audit current goal management processes

Before introducing new software, document your existing goal tracking ecosystem. Map every spreadsheet, slide deck, and system currently used to track objectives. Map every spreadsheet, slide deck, and system currently used to track objectives. Identify who owns each process, how often they update it, and where data gaps exist.

This audit reveals the true scope of transformation needed and helps build the business case for centralization. When Indosuez Wealth Management conducted this analysis, they discovered their fragmented approach was costing $139,000 annually in lost productivity.

Step 2: define success metrics and governance

Establish clear metrics that demonstrate goal tracking effectiveness. These might include first-time approval rates for goal-aligned projects, time saved on reporting, or improvement in strategic initiative completion rates.

Governance considerations for finance teams:

- Approval workflows: who can create, modify, or close goals?

- Access controls: which stakeholders see sensitive financial objectives?

- Audit requirements: what documentation satisfies compliance needs?

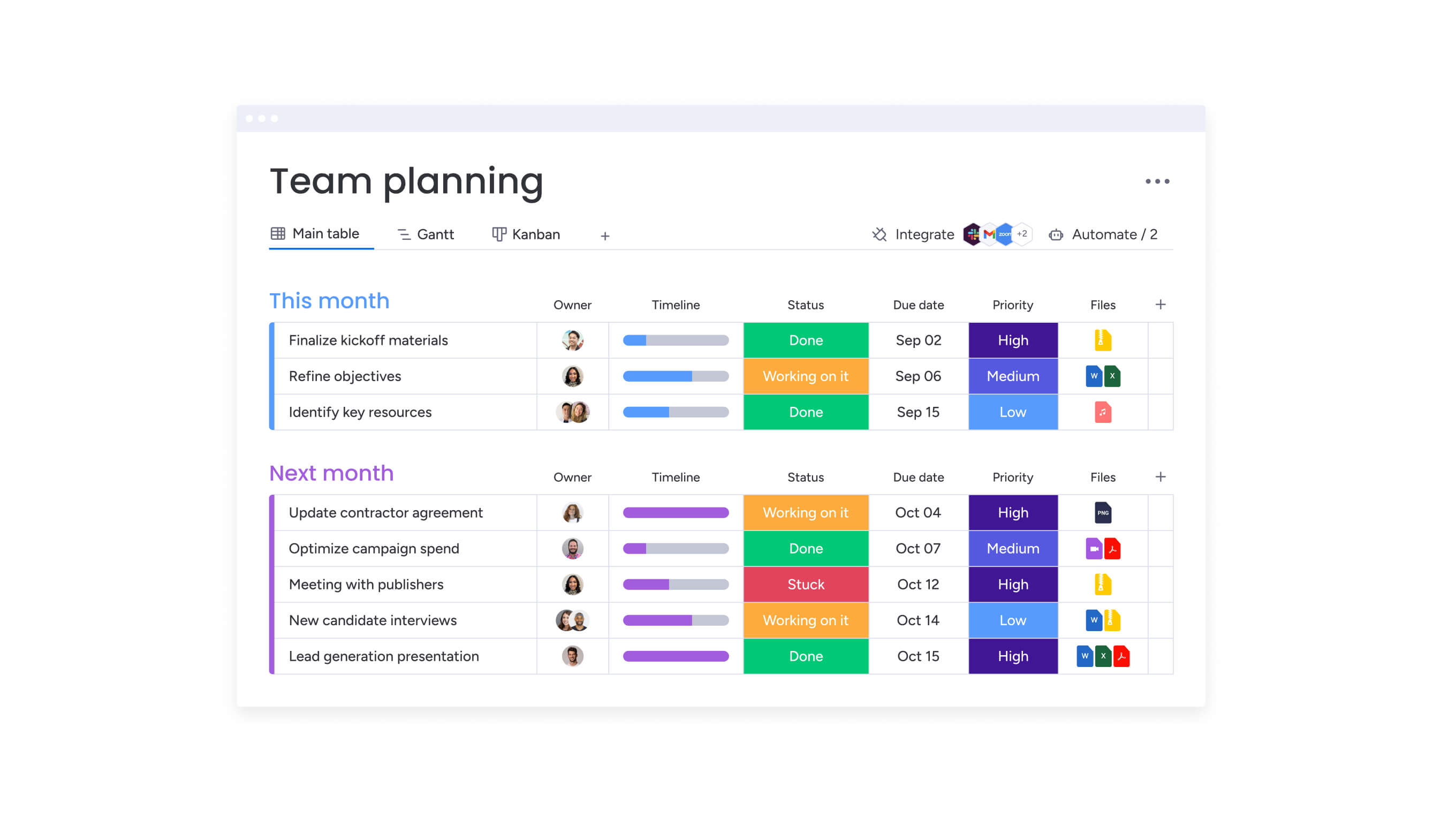

Step 3: build your goal hierarchy

Create the structure that connects strategic objectives to operational work by using a goal setting template for consistent alignment. Start with company-level goals, then cascade to departments, teams, and individuals. Each level should clearly show how it contributes to the level above.

The right platform’s managed templates ensure this hierarchy remains consistent across departments while allowing teams to customize their specific workflows.

Step 4: configure automation and integrations

Reduce manual work by automating routine goal tracking tasks. Set up automatic status updates when milestones are reached, notifications when goals fall behind, and integration with existing financial systems.

Automation opportunities that deliver immediate value:

- Progress roll-ups: automatically calculate goal completion based on underlying tasks.

- Risk alerts: flag goals that haven’t been updated or are trending behind.

- Stakeholder notifications: keep executives informed without manual reports.

Step 5: launch with a pilot group

Start with one high-visibility initiative rather than organization-wide rollout. Choose a project with clear goals, engaged stakeholders, and measurable outcomes. Use this pilot to refine processes, demonstrate value, and build internal champions.

Step 6: scale and optimize

After proving value with your pilot, expand systematically. Use lessons learned to improve templates, refine automations, and enhance training materials. Monitor adoption metrics and gather feedback to continuously improve the goal tracking process.

Maximizing ROI from goal tracking software

You’ll achieve the highest return on investment when goal tracking becomes part of your team’s daily rhythm, not just another system they have to update. Finance teams see the most dramatic results when they zero in on three areas that actually move the needle:

Time savings through automation

Automating routine goal tracking tasks delivers immediate productivity gains. Oscar’s PMO saves 1,850 hours monthly by eliminating manual status collection and report generation. These time savings compound as more teams adopt the platform.

High-impact automation use cases:

- Automated progress updates: pull completion data directly from project tasks.

- Scheduled stakeholder reports: distribute customized views without manual effort.

- Intelligent work routing: assign goal-related tasks based on capacity and skills.

Improved decision quality

Real-time goal visibility enables faster, more informed decisions. Instead of waiting for monthly reviews to identify issues, leaders can spot trends immediately and adjust resources accordingly.

AI-powered portfolio insights analyze patterns across hundreds of projects, surfacing risks and opportunities that human review might miss. This proactive intelligence helps finance teams prevent delays rather than react to them.

Enhanced strategic alignment

When every team member understands how their work connects to strategic objectives, execution improves dramatically. Goal tracking software makes these connections visible and measurable, driving accountability at every level.

Organizations using monday work management report significant improvements in strategic alignment. Teams spend less time on low-priority work and more on initiatives that directly support financial objectives.

Transform goal tracking with monday work management

If you’re a finance PM buried under spreadsheets and status meetings, monday work management can pull you out of the weeds. It combines everything you need — goals, projects, team updates — in one place that actually makes sense for how finance teams work.

Key capabilities that set monday work management apart:

- Enterprise-grade security: sOC 2, ISO 27001, and GDPR compliance with full audit trails.

- AI-powered insights: proactively identify risks and suggest optimizations across your portfolio.

- Flexible frameworks: support OKRs, KPIs, and custom goal structures without forcing standardization.

- Seamless integration: connect with existing financial systems through 200+ native integrations.

- Scalable architecture: manage hundreds of projects and thousands of goals without performance degradation.

The platform’s Digital Workers act as always-on assistants, monitoring goal progress, flagging risks, and suggesting next steps based on real-time data. Instead of spending hours compiling reports, project managers can focus on strategic decisions that drive goal achievement.

With managed templates for standardization and customizable workflows for flexibility, monday work management delivers the governance enterprises need without sacrificing the agility teams want. Real-time dashboards provide instant visibility from C-suite to individual contributors, ensuring everyone stays aligned on what matters most.

Bringing it all together for finance project managers

Goal tracking software transforms how finance organizations connect strategy to execution, replacing fragmented spreadsheets and manual reporting with unified, automated visibility. The right platform eliminates alignment gaps, reduces manual overhead, and enables proactive risk management across complex portfolios.

Success depends on selecting enterprise-ready capabilities — flexible goal frameworks, real-time dashboards, cross-functional alignment tools, and AI-powered insights. Implementation requires systematic planning, starting with process audits and pilot programs before scaling organization-wide.

Finance teams using comprehensive goal tracking platforms like monday work management achieve measurable improvements: reduced reporting time, faster decision-making, and enhanced strategic alignment. The investment pays dividends through automation, improved visibility, and teams that execute with confidence on what matters most.

Ready to transform your goal tracking approach? Start by auditing your current processes, defining success metrics, and exploring how a unified platform can eliminate the manual work that’s consuming your team’s strategic focus.

The content in this article is provided for informational purposes only and, to the best of monday.com’s knowledge, the information provided in this article is accurate and up-to-date at the time of publication. That said, monday.com encourages readers to verify all information directly.

Frequently asked questions

What is the best program to track goals?

The most effective goal tracking software connects strategic objectives to daily work while providing real-time visibility and automated reporting. Platforms like monday work management excel by combining flexible goal frameworks with AI-powered insights and enterprise security, enabling organizations to track OKRs and KPIs across departments without manual overhead.

How can goal tracking software ensure daily work aligns with strategic objectives?

Goal tracking software ensures alignment by creating clear hierarchies that link company objectives to department goals to individual tasks. The platform shows each team member how their work contributes to larger goals while automatically rolling up progress to provide leadership with real-time visibility into strategic achievement.

Which platforms offer real-time dashboards for automated goal progress reporting?

Platforms with strong real-time dashboard capabilities include monday work management, which offers 30+ customizable widgets, Asana's Goals feature in higher tiers, and Smartsheet with add-on reporting modules. monday work management stands out with fully automated dashboards that update as work progresses without manual input.

What features should cross-departmental teams prioritize in goal tracking software?

Cross-departmental teams should prioritize platforms with cross-project dependency tracking, unified resource management, role-based permissions, and integration capabilities. The software should support different goal methodologies across departments while maintaining centralized visibility and standardized reporting for leadership.

How do AI and automation enhance goal tracking in work management platforms?

AI and automation transform goal tracking by automatically categorizing and prioritizing work, identifying at-risk objectives through pattern analysis, and generating executive summaries without manual compilation. Features like monday work management's AI Blocks can extract insights from project updates and flag goals that need attention before they impact deadlines.

What is the typical implementation timeline for enterprise goal tracking software?

Enterprise goal tracking software typically achieves initial value within four months, with full implementation spanning six to twelve months depending on organizational complexity. Organizations using platforms like monday work management often see immediate time savings from automated reporting while building toward comprehensive goal alignment over subsequent quarters.

Get started

Get started