The most successful companies have a secret weapon for predictable growth: a loyal customer base. While many organizations focus solely on acquisition, keeping existing customers forms the foundation of a strong, resilient business. The difference between companies that scale sustainably and those that struggle often comes down to one number: retention rate.

Retention rate shows the percentage of customers or employees who stick around over a specific period. It’s an early warning system for revenue leaks and a scorecard for relationship strength. When tracked properly, retention reveals problems before they become departures, guides resource allocation toward maximum impact, and builds the predictable growth that comes from keeping the people who matter most.

To help you master this critical metric, this guide provides a comprehensive framework for everything you need to know about retention, ranging from basic calculations to advanced AI-driven prediction strategies. Ultimately, these insights will empower you to move from reactive troubleshooting to a proactive strategy that transforms retention into a primary engine for long-term profitability.

Key takeaways

- Track retention rate to predict revenue growth: calculate the percentage of customers who stay over time — it directly impacts your bottom line through lower acquisition costs and higher lifetime value.

- Focus on the first 90 days for maximum impact: strong onboarding experiences during this critical period predict long-term retention better than any other factor.

- Use AI to spot departure risks before they happen: predictive analytics provided by platforms like monday CRM identify at-risk customers weeks early, triggering automated retention workflows that save relationships proactively.

- Combine multiple retention strategies for compound results: leadership development, personalized experiences, and feedback loops work together; individual tactics improve retention 3-5%, but comprehensive approaches deliver 15-20% gains.

- Set realistic benchmarks based on your industry: SaaS companies should target 90%+ annual retention while consumer subscriptions aim for 75-80%: compare against relevant competitors, not arbitrary numbers.

What is retention rate?

Retention rate measures the percentage of customers or employees who stick with your organization over a specific period. It’s your loyalty scorecard, showing who stays versus who leaves. When a company starts the year with 100 customers and keeps 85 of them through December, that’s an 85% retention rate.

The same math applies to employees: if your sales team has 20 people in January and 18 of those same people are still there in March, you’ve got a 90% quarterly retention rate.

This metric hits your bottom line hard because high retention significantly reduces acquisition costs while simultaneously boosting customer lifetime value. By maintaining a stable base, you can escape the expensive, exhausting cycle of constantly replacing lost customers, allowing you to build predictable revenue and sustainable momentum.

Customer retention rate definition

Customer retention rate tracks the percentage of customers who keep buying from you or renewing their subscriptions over a set time frame. Importantly, this calculation focuses only on your existing customer base; new customers don’t count.

If your SaaS company has 500 subscribers on January 1st and 450 of those original subscribers are still paying you on December 31st, you’ve achieved a 90% annual retention rate.

Strong customer retention signals that your product solves real problems and your service meets expectations. Weak retention? That’s your wake-up call about product-market fit, service quality, or value perception pushing customers toward competitors.

Employee retention rate definition

Employee retention rate shows what percentage of your workforce stays put during a specific period. A sales organization with 200 employees on July 1st that still has 180 of those same people on June 30th the following year has a 90% annual retention rate.

Organizations track this metric to gauge workforce stability and calculate turnover costs.

- High employee retention: preserves institutional knowledge and maintains team momentum.

- Low retention: creates constant training demands and signals problems with compensation, culture, or management.

Why does employee retention drive customer retention?

Your employee and customer retention rates are joined at the hip. Experienced employees who stick around develop deeper product knowledge and build stronger customer relationships. When employees constantly leave, customers face service disruptions and knowledge gaps that erode trust.

The connection manifests in several practical ways:

- Service consistency: long-term employees understand customer preferences and histories, enabling personalized service that builds loyalty.

- Relationship continuity: customers value working with familiar faces who know their business inside and out.

- Institutional knowledge: experienced employees resolve issues faster because they’ve seen it all before.

How does retention rate impact revenue growth?

Retention rate determines your revenue potential through three financial levers that work together to accelerate growth. Understanding these connections helps you prioritize retention investments and measure their impact on your bottom line.

Retention rate determines your revenue potential through three financial levers: reduced acquisition costs, expanded customer lifetime value, and increased referral generation. According to research from Harvard Business Review, new customer acquisition costs five to 25 times more than keeping existing ones.

Companies with strong retention rates can invest those savings into product development and customer service instead of constantly replacing churned customers.

Key financial impacts of improved retention:

- Lower acquisition costs: retained customers spend more over time, purchasing more frequently and buying premium products.

- Expanded lifetime value: a three-year customer typically generates two to three times the revenue of a first-year customer.

- Multiplied growth effects: when you improve retention from 80% to 85%, you’re capturing multiplied lifetime value across multiple years.

The referral effect amplifies everything. Satisfied long-term customers become your unpaid sales force, generating new business through recommendations. Because these referred prospects arrive with built-in trust, they typically show higher retention rates and lifetime values than those acquired through traditional paid channels. A 10% retention improvement can boost referral volume by 20-30%, creating a self-reinforcing growth cycle.

4 steps of calculating retention rate

Understanding retention calculation helps you track performance accurately and make data-driven decisions. While the formulas are mathematically straightforward, the process requires clean data and consistent measurement periods to provide meaningful insights.

Calculating retention rate requires three numbers: customers or employees at period start, the count at period end, and new additions during that period. Clean data tracking and consistent measurement periods that match your business cycles make all the difference. Monthly calculations work for businesses with short customer lifecycles, while annual measurements suit longer-term relationships.

Step 1: choose your measurement approach

The calculation breaks down into four steps: define your measurement period, gather accurate counts at start and end, identify new additions, and apply the formula. Data quality determines accuracy: you need solid records of status changes and a defined process for handling edge cases, like customers who leave and return.

Essential preparation steps:

- Define measurement period: match your business cycles for meaningful insights.

- Gather accurate counts: ensure clean data at start and end points.

- Identify new additions: separate new customers from retained ones.

- Apply the formula: use consistent methodology across all calculations.

Step 2: apply the customer retention rate formula

The customer retention rate formula is: ((E-N)/S) × 100

Breaking down each component:

- S (Start): customers on day one of your measurement period.

- E (End): total customers on the last day, including retained and new.

- N (New): customers acquired during the period, subtracted to isolate retention.

Step 3: calculate employee retention rate

The employee retention rate formula simplifies things: (Employees who stayed / Employees at start) × 100

This approach focuses on overall workforce stability. A company with 150 employees on January 1st that keeps 135 of those same people through December 31st calculates: (135/150) × 100 = 90% annual retention.

Step 4: work through practical examples

Consider a practical example: a subscription software company begins January with 1,000 active subscribers (S = 1,000). Throughout the year, the company acquires 300 new subscribers (N = 300). By December 31st, the total reaches 1,150 active subscribers (E = 1,150).

Applying the formula: ((1,150 – 300) / 1,000) × 100 = 85%

This 85% retention rate indicates that 850 of the original 1,000 customers remained while 150 departed (15% churn). The 300 new customers contributed to a net growth of 150 subscribers.

For employee retention, examine a retail organization measuring quarterly performance. Beginning April 1st with 250 employees, 35 depart during the quarter. By June 30th, 215 of the original 250 employees remain.

Calculation: (215 / 250) × 100 = 86%

Common calculation mistakes to avoid:

- Double-counting: customers who left and returned aren’t continuously retained.

- Inconsistent periods: mixing monthly and quarterly data invalidates comparisons.

- Trial confusion: including trial users who haven’t converted skews results.

- Mixed departures: lumping voluntary and involuntary terminations together.

Retention rate vs churn rate

These two metrics represent opposite sides of the same performance coin, but choosing which to emphasize affects how your organization thinks about customer relationships. Understanding when to use each metric helps you communicate more effectively with different stakeholders.

The math is straightforward: retention and churn rates are perfectly inverse, always adding up to 100%. If you are keeping 85% of your customers, you are, by definition, losing 15%. Similarly, a sales team with 92% of its members staying put has 8% heading for the exit. It is a simple equation where what you keep plus what you lose equals your total population.

However, the strategic application of these metrics varies based on your objectives:

- Churn rate focus: subscription businesses highlighting revenue loss urgency.

- Retention rate focus: enterprise software companies celebrating positive momentum.

- Context-dependent: HR departments discuss retention for stability but analyze churn for problem diagnosis.

Your metric choice affects organizational psychology. Churn rate creates urgency by emphasizing losses, whereas retention rate builds momentum by celebrating success. Smart organizations track both but choose their primary communication metric based on whether they need to sound alarms or celebrate wins.

“With monday CRM, we’re finally able to adapt the platform to our needs — not the other way around. It gives us the flexibility to work smarter, cut costs, save time, and scale with confidence.”

Samuel Lobao | Contract Administrator & Special Projects, Strategix

“Now we have a lot less data, but it’s quality data. That change allows us to use AI confidently, without second-guessing the outputs.”

Elizabeth Gerbel | CEO

“Without monday CRM, we’d be chasing updates and fixing errors. Now we’re focused on growing the program — not just keeping up with it."

Quentin Williams | Head of Dropship, Freedom Furniture

“There’s probably about a 70% increase in efficiency in regards to the admin tasks that were removed and automated, which is a huge win for us.“

Kyle Dorman | Department Manager - Operations, Ray White

"monday CRM helps us make sure the right people have immediate visibility into the information they need so we're not wasting time."

Luca Pope | Global Client Solutions Manager at Black Mountain

“In a couple of weeks, all of the team members were using monday CRM fully. The automations and the many integrations, make monday CRM the best CRM in the market right now.”

Nuno Godinho | CIO at VelvWhat makes a good retention rate?

Retention performance varies dramatically across industries and business models, making context the most crucial factor in setting realistic expectations. Rather than chasing arbitrary benchmarks, organizations must focus on the unique drivers of their specific market.

In fact, a 70% annual retention rate might be considered stellar for a high-volume consumer app, yet it would be viewed as catastrophic for enterprise software.

Ultimately, context beats absolutes. To measure success accurately, you must compare your performance against relevant peer benchmarks and your own historical trends rather than universal targets.

Several key factors naturally shape these retention expectations:

- Switching costs: high switching costs enable higher retention.

- Contract terms: long-term contracts naturally show higher retention during contract periods.

- Market competition: few alternatives mean higher retention than crowded markets.

Industry retention rate benchmarks

Retention benchmarks reflect different customer relationships, switching costs, and competitive pressures across industries. These ranges represent typical performance, though individual results vary based on product quality, service excellence, and customer focus.

| Industry | Annual customer retention | Annual employee retention | Key retention drivers |

|---|---|---|---|

| SaaS/Enterprise software | 90-95% | 85-90% | High switching costs, integration complexity |

| Consumer subscriptions | 70-80% | 75-85% | Low switching costs, price sensitivity |

| Telecommunications | 75-85% | 80-85% | Contract terms, service quality |

| Professional services | 85-90% | 80-85% | Relationship strength, specialized expertise |

| Retail/E-commerce | 60-75% | 65-75% | Price competition, convenience factors |

| Healthcare | 80-90% | 75-80% | Insurance networks, specialized care |

| Financial services | 85-90% | 80-85% | Switching friction, regulatory factors |

Setting achievable retention targets

Effective retention targets balance ambition with reality. Start by establishing your baseline: measure performance across multiple periods to find your true average and account for seasonal swings. This baseline becomes your foundation for improvement goals that challenge without demoralizing teams.

Target-setting best practices:

- Start with baseline measurement: track performance across multiple periods for accurate averages.

- Plan incremental improvements: a company at 75% retention should target 78-80%, not 90%.

- Account for business cycles: retail sees different retention during holidays versus slow periods.

- Reflect seasonal realities: B2B companies face fluctuations tied to budget cycles.

Moving from 75% to 80% means cutting churn from 25% to 20%; that’s serious operational improvement that requires systematic effort and resource investment.

7 key factors that influence retention rate

Retention success depends on multiple interconnected elements working together to create positive experiences. Understanding these factors helps you identify improvement opportunities and allocate resources where they’ll have the greatest impact on keeping customers and employees engaged.

What drives people to stay? It’s never just one thing. Instead, factors like leadership, compensation, flexibility, growth paths, and culture all work together to influence retention. For example, great leaders make competitive pay packages feel even more valuable, while a toxic culture can make even the highest salaries feel worthless.

1. Leadership and management quality

Leadership quality shapes retention through transparent decisions, effective communication, and people development. Strong leaders create environments where employees and customers feel valued. Poor leaders generate confusion and frustration that drives people away regardless of other strengths.

Your middle managers make or break retention; they’re where the rubber meets the road. When they communicate clearly, play fair with everyone, and actually invest in their people’s growth, both employees and customers stick around longer.

2. Compensation and total rewards

Competitive compensation affects employee retention directly and customer retention through service quality. Well-compensated employees stay longer, develop expertise, and deliver superior service. Total rewards extend beyond salary to include benefits, recognition, equity, bonuses, and flexibility.

Fair pay matters just as much as big pay. People who get how compensation decisions work and trust the process are way more likely to stay than those who smell favoritism.

3. Flexibility and work-life balance

Workplace flexibility influences retention through schedule control, location options, and workload management. Different flexibility types serve different needs:

- Schedule flexibility: helps manage personal commitments.

- Location flexibility: eliminates commute stress.

- Workload management: prevents burnout and enables development.

Balanced employees bring energy to customer interactions, building satisfaction that improves retention outcomes.

4. Growth and development opportunities

Career paths and skill development signal investment in people’s futures. Employees seeing progression possibilities and receiving development support outlast those feeling stuck. Development encompasses training programs, mentoring, stretch assignments, and education support.

Employee growth connects to customer retention through expertise and service capability. Continuously developing employees solve problems more effectively and build stronger relationships.

5. Organizational culture and values

Culture isn’t just a buzzword but the invisible force that keeps people around when they share the same values and communication style. When your culture rings true, it naturally pulls in people who belong and pushes away those who don’t. That self-selection saves you headaches down the road.

6. Customer experience quality

Customer experience directly drives retention through satisfaction, ease of use, and problem resolution. Customers receiving consistent excellence stay loyal despite competitive offers.

Experience improvements create compounding benefits. Each enhancement lifts retention slightly, increasing lifetime value and providing resources for additional improvements. Touchpoint consistency across the customer journey determines overall experience quality.

7. Operational efficiency and technology

Efficient operations affect both employee and customer retention by reducing friction and improving service. Employees serve customers effectively without fighting systems. Inefficient operations frustrate everyone, driving both groups away.

Technology platforms like monday CRM enable retention tracking and management through centralized data, automated processes, and retention risk visibility. The impact extends beyond tracking to proactive intervention through early warning systems.

8 proven strategies to improve retention rate

Improving retention requires systematic approaches across multiple areas. These strategies work best as part of comprehensive programs addressing root causes. Organizations typically see three to five percentage point improvements from individual strategies, with cumulative effects reaching 15-20 points when combining multiple approaches.

Strategy 1: design comprehensive onboarding experiences

The first 90 days predict long-term retention more accurately than any other period. Comprehensive onboarding programs establish expectations, build relationships, and ensure early success.

Key onboarding milestones that predict retention:

- First week: setup completion and initial value realization.

- First month: capability development and relationship building.

- First quarter: pattern establishment and habit formation.

- First year: full integration and advanced capabilities.

Strategy 2: establish continuous feedback loops

Regular feedback collection and response prevents issues from becoming departures. Therefore, organizations that gather feedback, analyze patterns, and take visible action retain more customers and employees than those collecting feedback sporadically.

Remember that different mechanisms serve different purposes; for instance, surveys provide quantitative data at scale but lack depth. One-on-one conversations deliver rich insights but don’t scale. The key? Actually responding to feedback: collecting without action creates cynicism that harms retention.

Strategy 3: build transparent career advancement paths

For employee retention, people need to see a future to stay in the present. By creating clear, merit-based progression paths, you eliminate the ambiguity that often leads top talent to look elsewhere.

Furthermore, this expertise stays within your company, directly benefiting your customers through higher service quality.

Strategy 4: personalize every customer interaction

Personalization makes interactions relevant and valuable. Customers receiving personalized service feel understood, building emotional connections that strengthen loyalty. Data enables personalization at scale, transforming small-business capabilities into enterprise possibilities.

Personalization approaches vary across different contexts:

- Communication preferences: messages reach customers appropriately.

- Product recommendations: increased relevance and value.

- Service customization: tailored rather than standardized experiences.

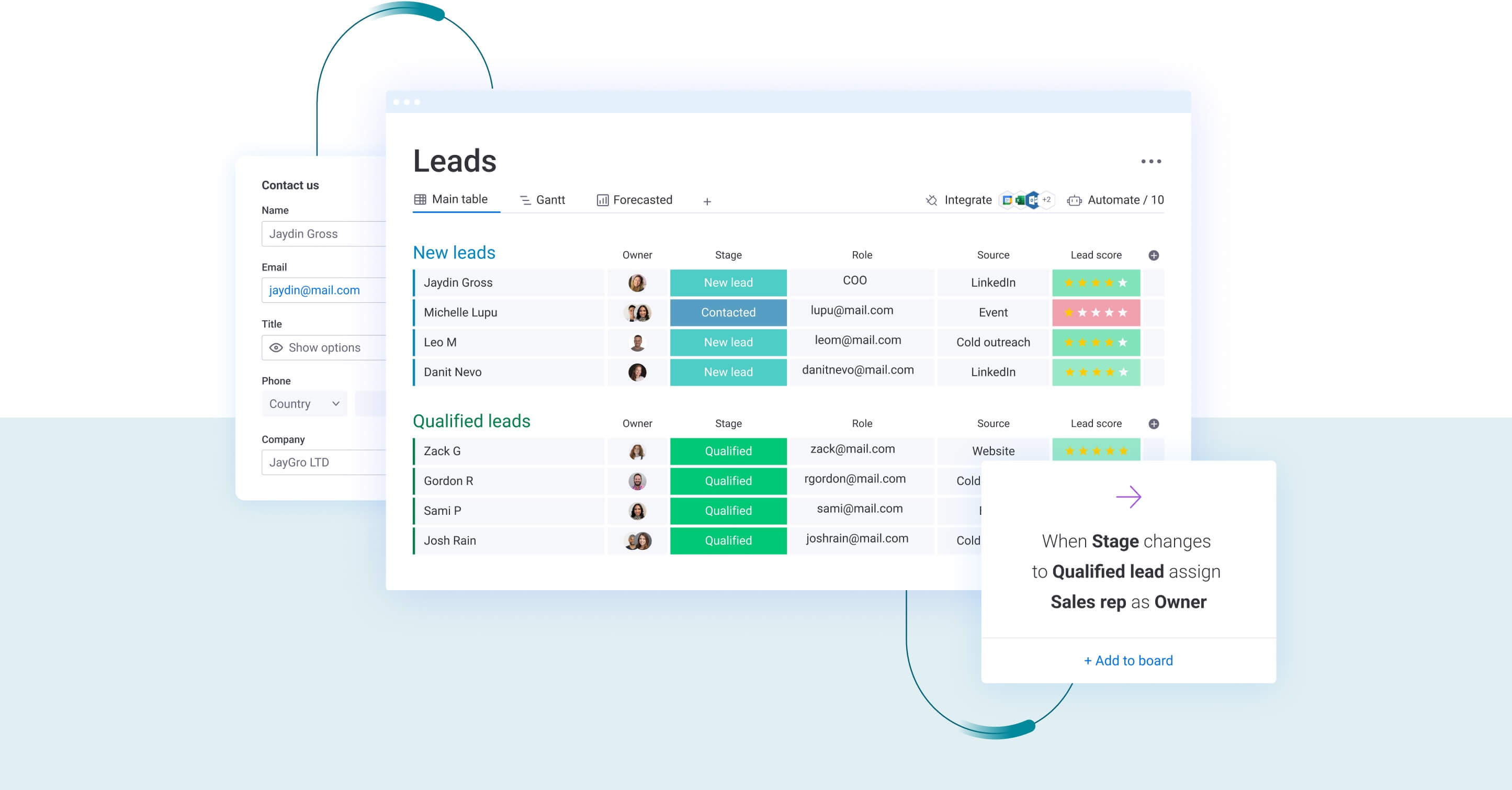

Strategy 5: leverage predictive analytics for early intervention

Predictive analytics identify at-risk customers or employees before departure, enabling relationship-saving interventions. Key departure risk indicators include engagement decline, support ticket increases, payment delays, usage changes, and communication reduction.

Intervention strategies vary by risk level and relationship value. High-value customers showing early signals might receive executive outreach. AI enhances prediction accuracy by processing more data points and identifying subtle patterns humans miss.

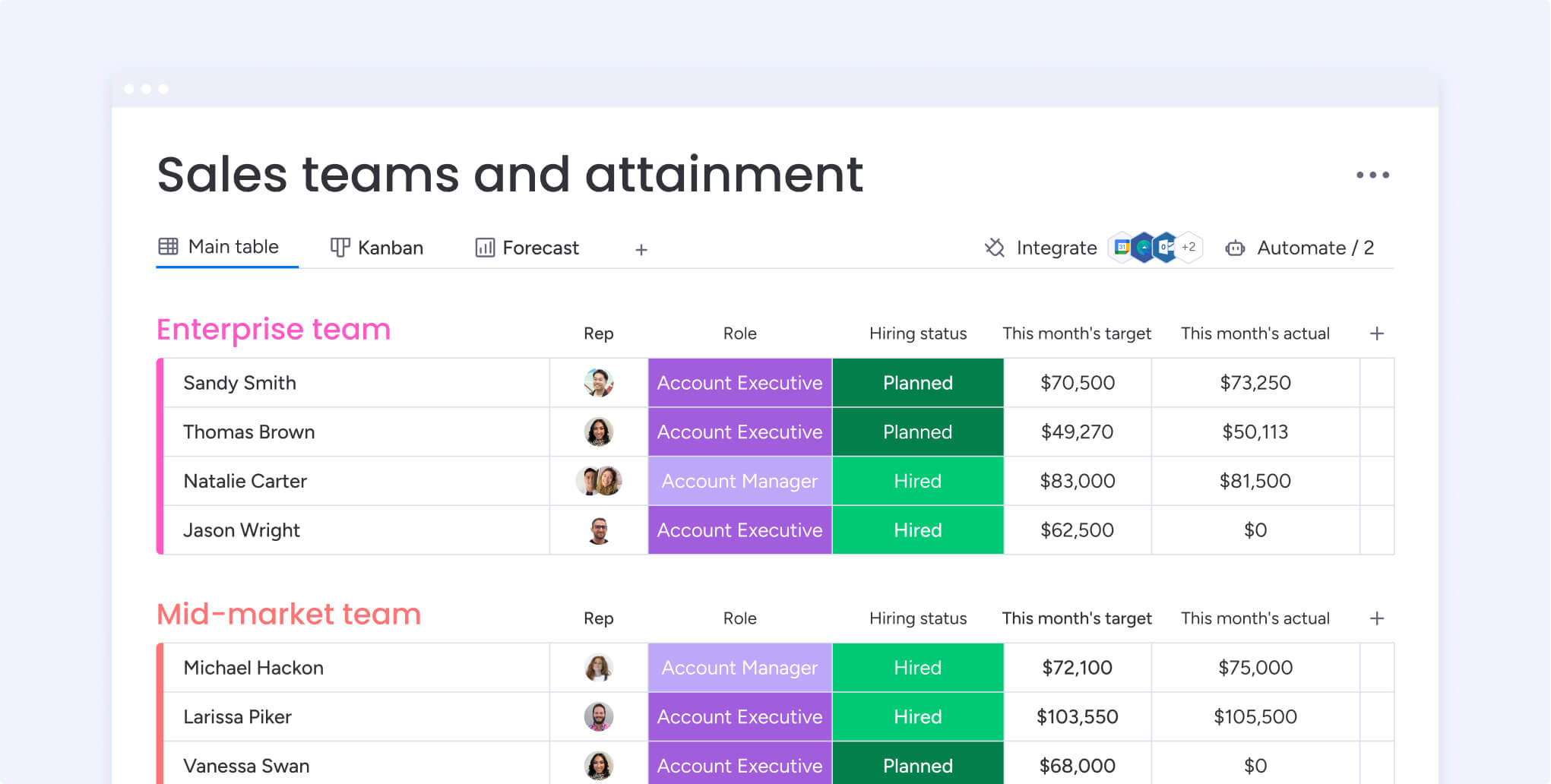

Strategy 6: automate retention-focused workflows

Automation ensures consistent follow-up and timely interventions at scale. Renewal reminders begin weeks before expiration with multiple touchpoints. Check-in sequences provide scheduled outreach at lifecycle moments. Escalation processes route at-risk customers based on risk and value.

Modern solutions like monday CRM enable these automations through conditional triggers that initiate retention activities when customer behavior changes. The platform’s automation capabilities handle complex sequences impossible to manage manually while personalizing communications based on customer data.

Strategy 7: invest in manager development programs

Manager quality impacts retention through leadership skills and decision-making. Specific competencies driving retention include coaching, feedback delivery, conflict resolution, performance management, and team building.

In fact, good management creates multiplier effects. A manager retaining 95% of their team annually preserves knowledge, maintains consistency, and builds cohesion that further strengthens retention.

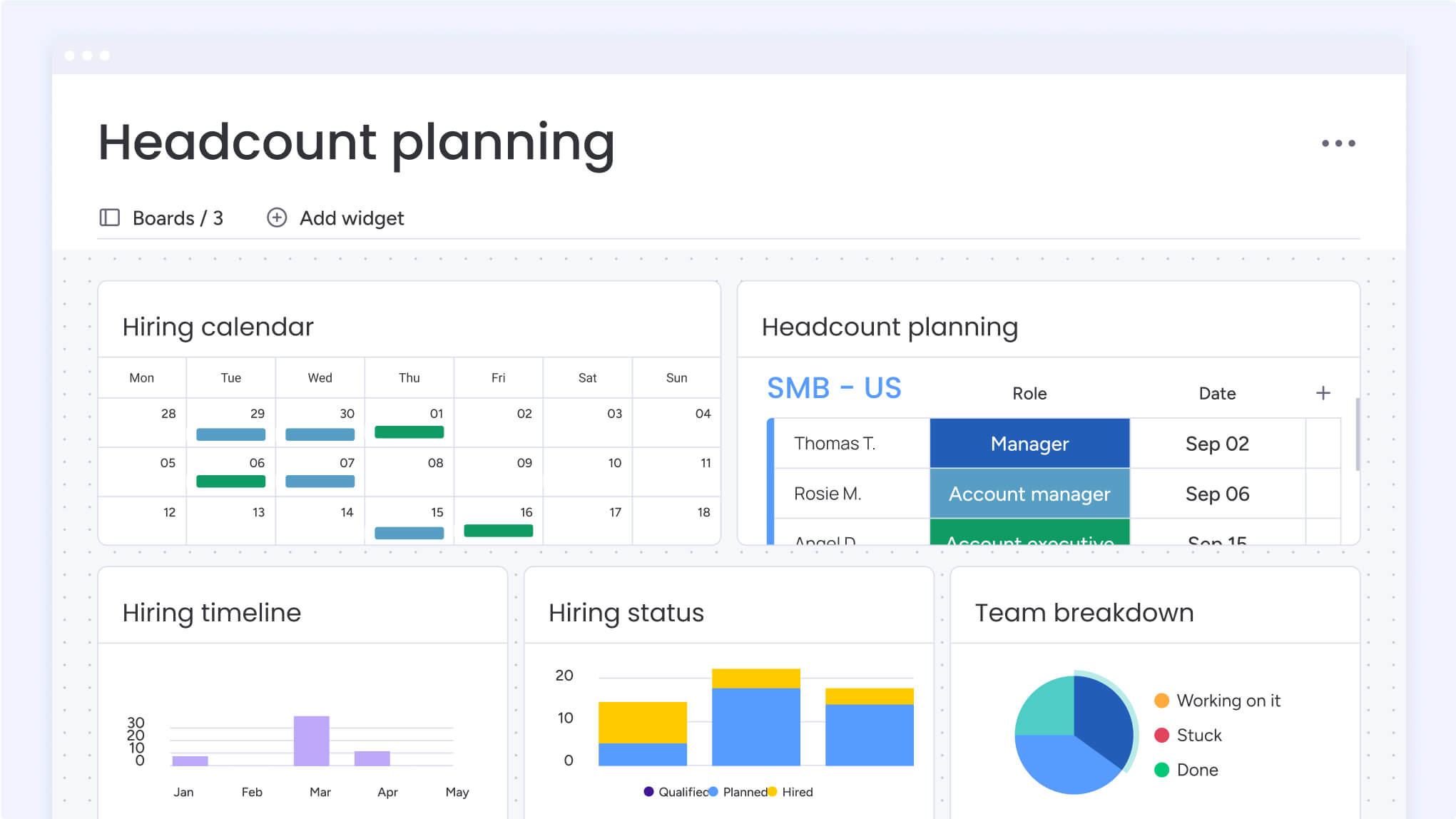

Strategy 8: create real-time retention dashboards

Real-time visibility enables faster response to risks and improved decisions. Role-based customization ensures stakeholders see relevant user retention metrics. Executives need high-level trends. Managers need team-specific metrics. Frontline staff need customer-level indicators.

Key dashboard metrics to track:

- Overall retention: by period and segment.

- Early warnings: engagement scores and usage patterns.

- Intervention effectiveness: success rates and outcomes.

- Trend analysis: historical patterns and projections.

How does AI transform retention rate prediction?

Artificial intelligence revolutionizes retention management by identifying patterns and predicting risks that human analysis can’t detect at scale. AI systems process vast amounts of behavioral data to spot subtle changes that signal departure risk, often weeks before customers or employees make conscious decisions to leave.

AI spots the warning signs humans miss when dealing with thousands of customers. It catches those tiny behavior shifts that signal someone’s got a foot-out-the-door ,often weeks before they’ve even decided to leave. By flagging who’s most likely to bolt, AI helps you focus your rescue efforts where they’ll actually pay off.

Core AI capabilities transforming retention are listed below:

- Behavioral pattern recognition: spots subtle changes indicating departure risk.

- Predictive risk scoring: assigns likelihood scores for prioritized intervention.

- Automated trigger systems: initiates outreach when behavior crosses risk thresholds.

- Personalized intervention: customizes approaches based on profiles and preferences.

When someone starts showing the warning signs, AI jumps into action without waiting for human approval. It tailors the response based on what it knows about them, then tracks what works and what doesn’t to get smarter over time.

AI capabilities supporting retention include:

- Sentiment analysis: evaluates communications for satisfaction issues.

- Predictive scoring: forecasts renewal likelihood.

- Automated composition: personalizes retention outreach at scale.

- Timeline summarization: provides quick context on customer histories.

AI features provided by platforms like monday CRM enhance retention management through timeline summarization that condenses interaction histories into actionable insights. Sentiment detection flags unhappy customers before they churn. The platform’s AI-powered email composition helps craft personalized retention communications based on customer profiles and situations.

Maximize retention rate with monday CRM

Effective retention management requires platforms that combine tracking, prediction, intervention, and optimization in unified systems. Organizations need solutions that provide real-time visibility while automating complex workflows that would be impossible to manage manually at scale.

Organizations improving retention need platforms combining tracking, prediction, intervention, and optimization. Advanced solutions like monday CRM address these challenges through intuitive design and powerful functionality, enabling systematic retention management without extensive technical requirements.

The platform’s customizable dashboards provide real-time retention metrics giving teams instant performance visibility. Sales forecasting features predict retention-related revenue impacts by modelling different scenarios. Leaderboard and funnel widgets transform metrics into actionable insights, showing retention by segment, period, or team member.

- AI-powered retention insights: monday CRM uses AI to predict churn and guide intervention. Timeline summaries condense customer histories into clear risk signals, email assistance suggests personalized messaging, and sentiment analysis flags dissatisfaction before it escalates.

- Automated retention workflows: conditional automations trigger check-ins when usage drops and escalate high-value at-risk accounts when needed. Personalized mass emails support targeted retention campaigns, while automated reminders and follow-ups reduce manual work.

- Comprehensive customer visibility: centralized account management provides a complete view of every interaction across channels. Teams can spot renewal risks, identify expansion opportunities, and coordinate outreach without duplication.

This adaptability enables organizations to implement retention processes matching their specific needs rather than forcing rigid approaches.

Establish retention into your primary growth engine

Ultimately, your retention rate is the most honest reflection of your organization’s health. It functions as a high-stakes scorecard where every percentage point gained translates directly into higher profit margins and a more resilient brand. By mastering this metric, you move beyond the “acquisition treadmill” and instead build a foundation where existing relationships fuel future expansion.

The path to high retention is paved by the seven core pillars we’ve discussed, ranging from the integrity of your leadership to the seamlessness of your technology. When these cultural and operational elements align, they create an environment where staying is the natural choice for both talent and clientele.

Furthermore, the transition from surviving churn to mastering loyalty is significantly accelerated by modern technology. By utilizing an AI-powered platform like monday CRM, you replace manual guesswork with predictive precision. As a result, you gain the ability to spot friction points before they escalate into departures, ensuring your intervention is always timely and relevant.

Frequently asked questions

How often should you calculate retention rate?

The frequency for calculating retention rate depends on your business type and customer lifecycle length. Most organizations calculate it monthly, quarterly, or annually. Businesses with shorter lifecycles benefit from monthly calculations identifying trends quickly, while longer relationships typically use quarterly or annual measurements allowing meaningful patterns to emerge.

Can retention rate exceed 100%?

Traditional retention rate cannot exceed 100% since it measures the percentage staying during a period. Net retention rate can exceed 100% when existing customers expand spending beyond starting value, indicating revenue growth from the retained cohort despite some departures.

What's the difference between gross and net retention rate?

Gross retention measures customers remaining without considering expansion revenue. Net retention includes expansion through upsells, cross-sells, or usage increases. SaaS businesses focus on net retention because it captures both loyalty and account growth, providing complete relationship value pictures.

How does retention rate impact business valuation?

Higher retention increases valuation by demonstrating predictable revenue, lower acquisition costs, and sustainable growth. Investors view strong retention as evidence of product-market fit and competitive advantage, applying higher multiples to businesses exceeding industry norms.

What retention rate do investors expect?

Investor expectations vary by industry. SaaS companies typically need 90%+ annual retention while consumer subscriptions might target 75-80%. Consistent improvement and industry-appropriate rates matter more than absolutes. Investors value upward trends and performance exceeding relevant benchmarks.

How can CRM systems improve retention rate tracking?

CRM systems improve tracking through automated data collection eliminating manual errors, real-time analytics identifying emerging trends, and integrated communication management connecting metrics to relationship activities. Platforms like monday CRM provide AI-powered insights predicting risks and automated workflows ensuring consistent intervention, transforming retention from reactive to proactive management.