The biggest risks businesses face aren’t always dramatic events. More often, they’re the small issues hidden in spreadsheets or siloed chats that grow over time. Without visibility, teams are left reacting instead of planning, which slows progress and hurts confidence. Risk management software gives organizations a central place to identify, track, and resolve risks before they escalate.

This guide explains what risk management software does, why it matters, and which 25 platforms are leading the way in 2025. You’ll also learn the key features to look for when evaluating solutions for your team.

Get StartedWhat risk management software does

Risk management software provides a framework to identify, assess, and address potential disruptions. It helps teams evaluate risks by likelihood and impact, assign ownership, and monitor them in real time. By capturing risks in one system, organizations can move from reactive responses to proactive planning.

Instead of managing scattered spreadsheets or disconnected updates, risk management platforms create a single view of potential threats and the actions needed to mitigate them. This clarity turns risk management into a repeatable process that supports smarter, faster decisions across projects and business functions.

Why teams need risk management solutions

When risks are tracked in isolation, whether in email threads, spreadsheets, or team chats, critical information is easy to miss. That makes a thorough risk assessment nearly impossible and leaves teams in a defensive posture. Centralizing risk management solves this by making risks visible, measurable, and actionable.

With better visibility, teams can prepare for issues before they escalate, improve compliance readiness, and allocate resources more effectively. A well-designed system doesn’t eliminate challenges altogether, but it gives organizations the structure to address them with confidence and consistency.

Key features of enterprise risk management software

Enterprise risk management software connects data points across the organization to build a complete picture of risk. The most effective platforms include:

- Centralized risk registers that make ownership, status, and next steps clear.

- Real-time dashboards that track metrics and highlight issues early.

- Automation for alerts, escalations, and recurring reviews.

- Compliance tools that simplify audits and vendor oversight.

- Integrations with core business systems for finance, operations, and security.

- AI support that summarizes risks, predicts impact, or suggests next actions.

These capabilities replace manual reporting with dynamic insights and streamline collaboration across teams. The result is faster decisions, stronger compliance, and a culture of prevention rather than reaction.

25 best risk management software tools

The most effective teams don’t leave risk management to chance. They use structured processes and software that provide visibility, accountability, and foresight. The right platform brings risks into the workflow, making them trackable items instead of hidden issues. This clarity gives teams the information they need to act early and keep projects moving.

Our review highlights 25 leading risk management solutions for 2025. Some are all-in-one work management platforms, while others specialize in areas like compliance, audits, or IT risk. The common thread is helping teams see the full picture, act with confidence, and reduce the impact of uncertainty.

1. monday work management

monday work management is a flexible platform that teams can shape into a central workspace for risk. It brings risk data into one place so you can spot, track, and resolve issues before they disrupt projects.

Its visual interface makes risk status easy to understand at a glance, while collaborative features keep everyone aligned on mitigation steps. The platform is designed for teams that need adaptability without added complexity, with risk management built directly into existing workflows.

Best for: Teams that want flexible work management and risk tracking in one platform.

Key features:

- Customizable digital risk register with formula columns for user-configured calculations (like impact x probability) and real-time status tracking

- No-code automation that triggers alerts when risk thresholds are crossed or responsibilities change

- Real-time dashboards that pull data from multiple boards, with 200+ app integrations to create a central view of risk across key business tools

Pricing: All paid plans are billed annually and require a minimum of 3 seats.

- Free: $0 forever (up to 2 seats, 3 boards, basic features)

- Basic: $9/seat/month (unlimited viewers, 5GB storage, prioritized support, dashboards combine 1 board)

- Standard: $12/seat/month (Timeline & Gantt views, guest access, 250 automations & integrations actions/month, dashboards combine 5 boards)

- Pro: $19/seat/month (private boards, time tracking, formula columns, 25,000 automations & integrations actions/month, dashboards combine 20 boards)

- Enterprise: Custom pricing (advanced security, enterprise support, 250,000 automations & integrations actions/month, dashboards combine 50 boards)

Why it stands out:

- The visual interface makes risk status immediately clear to all stakeholders, eliminating confusion about threat levels.

- Deep integration capabilities connect risk data from your favorite tools, helping you create a single source of truth for decision-making.

- Its flexibility allows teams to build risk workflows that match their specific processes without heavy technical requirements, with more advanced capabilities available on higher-tier plans.

monday work management connects with more than 200 business tools, creating one view of risk across your ecosystem. Pull in security data, financial metrics, and compliance updates without leaving your dashboard. These integrations reduce blind spots and give your team the complete context needed for confident decisions.

The platform’s no-code automations shift risk management from manual tracking to proactive monitoring. Create workflows that escalate risks when thresholds are met, assign tasks automatically, and trigger approvals when status changes. These automations keep work moving and free your team to focus on strategy instead of administration.

monday AI helps teams act faster by turning risk data into clear, actionable insights. It can analyze historical patterns to score new risks, draft descriptions with minimal input, and recommend tailored mitigation steps. When reviewing registers, monday AI highlights the most critical threats and suggests next actions, so priorities stay clear and manageable.

Get Started2. LogicManager

LogicManager provides a unified enterprise risk management platform that connects every department and decision, transforming scattered data into a coherent strategy. Specializing in breaking down organizational silos with AI-powered taxonomy technology, the platform is ideal for heavily regulated industries that require comprehensive risk visibility. Their dedicated advisory support model ensures organizations don’t just implement software—they build mature risk management programs.

Use case: Organizations in regulated industries that need to connect risk management across departments while receiving ongoing advisory support to mature their enterprise risk management programs.

Key features:

- Taxonomy-driven platform that reveals interconnected risks across departments and business units

- AI-powered Risk-Based Analyzer that extracts risk information from documents and connects it to organizational frameworks

- Automated workflows with built-in business intelligence for configurable reporting to stakeholders and board members

Pricing:

- Custom pricing: Starting at $10,000 annually with value-based, job-to-be-done pricing model

- Unlimited users: No per-seat limitations for internal and external stakeholders

- All-inclusive package: Fixed pricing covers licensing, advisory services, implementation, training, and lifetime support

- Bundle discounts: Available when engaging multiple risk management solutions

Considerations:

- Higher starting price point may be prohibitive for smaller organizations with limited risk management budgets

- Some users report navigation challenges and limited customization flexibility for highly complex or unique business requirements

3. Riskonnect

By integrating both insurable and non-insurable risks into a single command center, Riskonnect gives enterprise leaders complete visibility across their entire risk landscape. This makes it the go-to choice for large organizations managing complex supply chains and regulatory environments. With over 2,500 customers across six continents, Riskonnect has established itself as the largest Risk Management Information Systems (RMIS) provider in the market.

Use case: Large enterprises seeking comprehensive risk management enterprise software that consolidates all risk types into a single, integrated platform for complete organizational visibility.

Key features:

- Comprehensive RMIS capabilities for managing claims, insurance policies, and risk-related data across the enterprise

- Advanced GRC modules covering compliance management, policy administration, internal audits, and third-party risk assessments

- AI-powered “Intelligent Risk” platform that automates routine tasks and uncovers hidden risk correlations for proactive decision-making

Pricing: Contact Riskonnect directly for custom pricing based on organizational size and requirements

Considerations:

- High implementation costs may put it out of reach for smaller organizations with limited risk management budgets

- The comprehensive feature set can create complexity that overwhelms teams without mature risk management programs

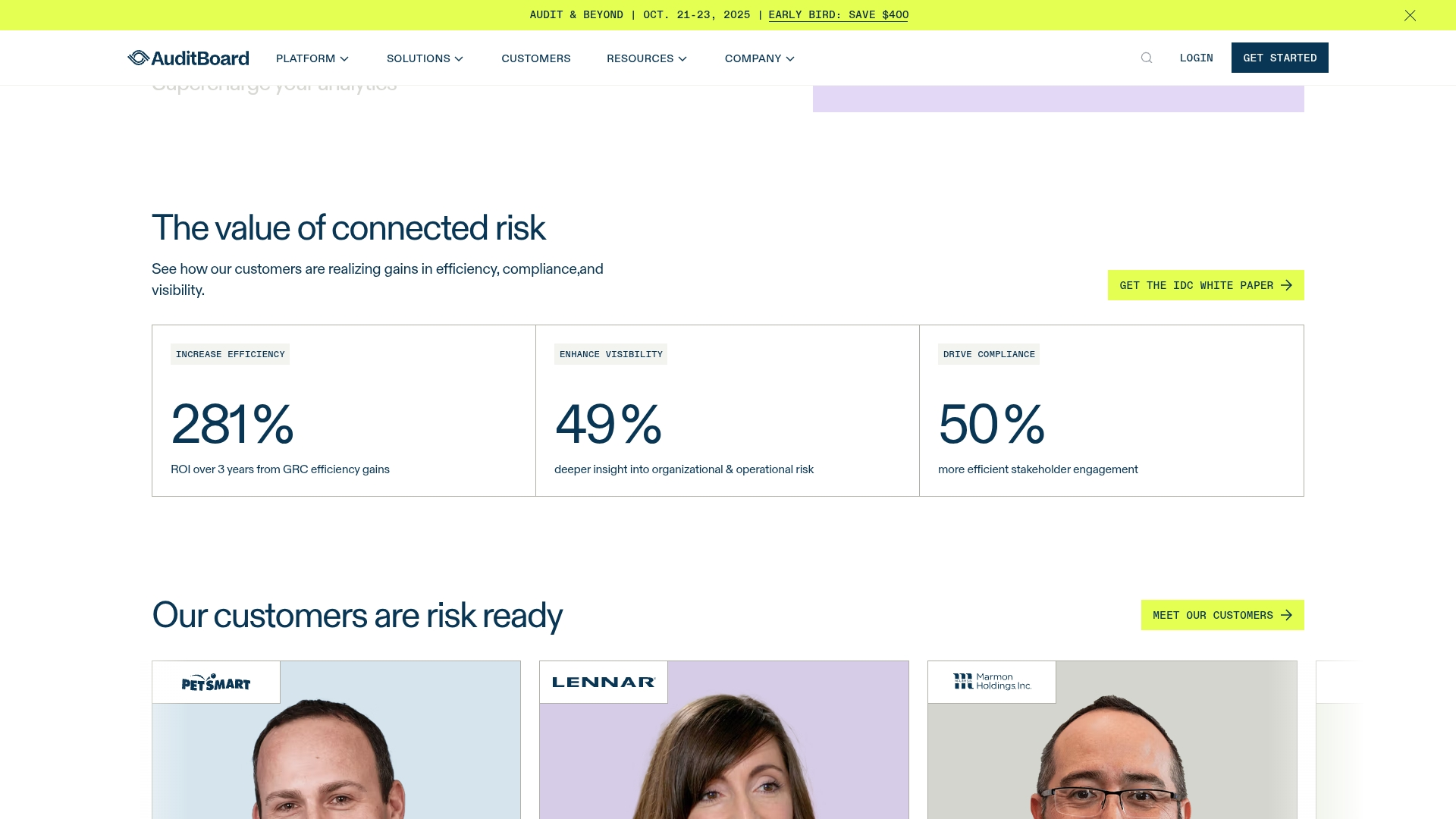

4. AuditBoard

AuditBoard delivers a connected risk platform that unifies audit, risk, and compliance management in one powerful solution. The platform specializes in SOX compliance and internal controls, making it ideal for Fortune 500 companies seeking integrated risk oversight across their entire organization.

Use case: Large enterprises with complex audit and compliance needs who want to break down silos between risk, audit, and compliance functions.

Key features:

- Centralized risk register that unifies all risks, controls, policies, and frameworks in one location

- AI-powered automation for risk assessments, vendor evaluations, and content generation

- Real-time dashboards and reporting with risk heatmaps and trend visualization

Pricing:

- Annual subscription: $20,091 to $88,282 per year

- Median buyer cost: $42,775 per year

- Average discount: 16% savings available

- Multi-year commitments may qualify for additional discounts

Considerations:

- Learning curve can be steep for users outside core audit and risk teams

- Pricing may feel overwhelming for smaller businesses with simpler compliance needs

5. Archer

With over two decades of GRC expertise, Archer provides comprehensive integrated risk management solutions that redefine how enterprises address governance, risk, and compliance challenges. The platform serves large organizations seeking a unified approach to managing operational resilience across multiple risk domains. Its extensive template library and deep configuration capabilities make complex enterprise risk scenarios manageable and trackable.

Use case: Large enterprises with mature risk management programs requiring a comprehensive, configurable platform to manage multiple dimensions of risk from a single location.

Key features:

- Enterprise and operational risk management with centralized risk aggregation and program oversight

- IT and security risk management covering cyberattacks, data breaches, and technical vulnerabilities

- Third-party governance and vendor risk management with extended ecosystem oversight

Pricing: Pricing information is not publicly available and requires contacting Archer directly for custom enterprise quotes.

Considerations:

- User interface feels outdated compared to modern risk management platforms, creating potential adoption challenges

- Implementation complexity often requires paid consultants and extended timelines, increasing total cost of ownership

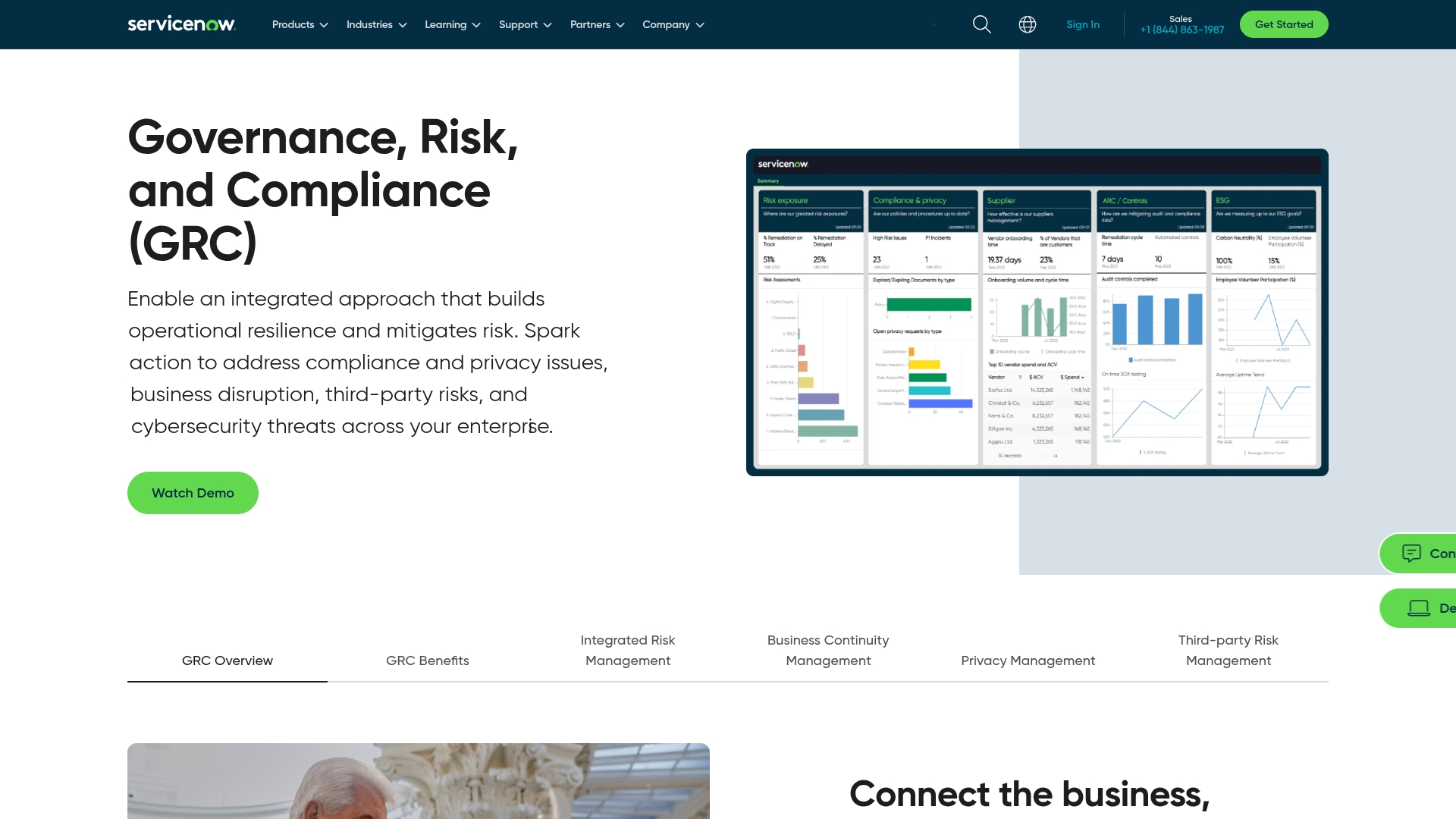

6. ServiceNow GRC

By embedding risk management directly into automated workflows, ServiceNow GRC creates a unified enterprise platform connected to your IT operations. This specialization makes it ideal for organizations that need to manage both operational and technology-related risks from a single, cohesive system.

Use case: Organizations seeking to integrate risk management with IT service management for comprehensive visibility into technology and operational risks.

Key features:

- Continuous risk monitoring with key risk indicators that detect failing controls between assessments

- AI-powered smart issue management that assigns, groups, and suggests remediation actions automatically

- Real-time executive dashboards with role-based information for communicating risk posture across the organization

Pricing:

- Custom pricing based on organizational needs and requirements

- Contact ServiceNow for personalized quotes tailored to your business size and complexity

Considerations:

- The platform’s extensive capabilities can lead to complexity in deployment and management, requiring significant implementation effort

- Users report the GRC module can be less intuitive compared to purpose-built risk management software solutions, especially for teams not familiar with the ServiceNow ecosystem

7. Onspring

Onspring offers a no-code risk management platform that empowers business users to build custom risk workflows without IT dependency. This approach transforms scattered risk data into a unified command center, making it perfect for large organizations seeking flexible governance, risk, and compliance solutions. With framework-agnostic support and automated risk processes, Onspring turns complex risk management into streamlined execution.

Use case: Large enterprises needing a customizable, no-code risk management platform that consolidates cyber, financial, operational, and reputational risks into a single source of truth.

Key features:

- Centralized risk register that aggregates all risk data types with automated workflows and real-time reporting

- Framework-agnostic support for NIST, ISO, COSO, HIPAA, and FAIR methodologies with customizable risk matrices

- Third-party integrations with RapidRatings, SecurityScorecard, and BitSight for comprehensive risk monitoring

Pricing:

- Custom pricing: Based on licensing model (by users, by product, or hybrid) and platform level (Bronze, Silver, Gold, Platinum)

- Implementation included: Up to 8 weeks of setup with 3-year contract

- Contact required: Request quote for specific organizational needs

Considerations:

- Requires clear planning upfront to avoid cumbersome design due to extensive customization options

- Limited pre-populated content for frameworks like SOX and PCI, requiring custom setup or partner services

8. LogicGate Risk Cloud

LogicGate Risk Cloud provides a unified command center where teams can see, assess, and act on threats before they derail business goals. The platform specializes in no-code customization and financial risk quantification, making it ideal for organizations that need flexible governance without IT dependency. With its visual workflow builder and Risk Cloud Quantify® feature, teams can finally communicate risk in the language of executives: dollars and cents.

Use case: Organizations seeking a highly customizable, no-code risk management platform that can quantify cyber risks in financial terms and adapt to unique business processes.

Key features:

- Visual workflow builder with drag-and-drop customization for creating tailored risk management processes

- Risk Cloud Quantify® translates cyber risks into financial impact using Monte Carlo simulations and Open FAIR™ methodology

- Connected graph database provides holistic view linking assets, controls, risks, and policies across the organization

Pricing:

- Custom component-based pricing model tailored to each organization

- Pricing determined by specific Applications needed and number of Power User licenses

- Standard and External User licenses included at no additional cost

- Implementation, professional services, and integrations available for additional fees

- Exact pricing must be requested directly from LogicGate

Considerations:

- No free trial or free version available, which may limit initial evaluation opportunities

- Some users report limitations in built-in visual reporting capabilities, requiring data export to dedicated BI tools for advanced analysis

9. StandardFusion

StandardFusion offers comprehensive governance, risk, and compliance (GRC) solutions that unify scattered risk management processes into strategic operations. The platform is distinguished by its user-friendly interface and robust compliance management features, making it an ideal choice for mid-market organizations seeking enterprise-level capabilities without the associated complexity.

Use case: Technology-focused small to medium-sized businesses and enterprise information security teams who need to navigate complex regulatory landscapes while maintaining operational efficiency.

Key features:

- Integrated threat library for comprehensive risk identification and asset mapping

- AI-powered Checkpoint AI assistant for streamlined GRC tasks and data insights

- Unified compliance framework supporting ISO 27001, SOC 2, GDPR, and HIPAA standards

Pricing:

- Contact StandardFusion directly for custom pricing information.

Considerations:

- Learning curve exists for users unfamiliar with GRC practices, requiring initial time investment for proper onboarding

- Notification management system can be overwhelming with limited customization options between full alerts or none

10. MetricStream

MetricStream provides enterprise-grade risk management software that converts scattered risk data into unified, actionable intelligence. The platform’s specialization in AI-powered risk analytics and comprehensive governance, risk, and compliance (GRC) capabilities makes it ideal for large organizations managing complex risk landscapes across multiple business lines.

Use case: Large enterprises seeking a comprehensive enterprise risk management platform with advanced AI capabilities and native risk quantification features.

Key features:

- AI-powered risk intelligence with predictive analytics and automated risk assessment recommendations

- Native risk quantification and Monte Carlo simulation for enterprise and cyber risk scenarios

- Integrated data model connecting business objectives, processes, risks, and controls across the organization

Pricing:

- Custom pricing based on organizational needs and requirements

- Contact MetricStream directly for detailed pricing information

- Enterprise-level costs can exceed $1 million annually for large implementations

Considerations:

- Complex platform with a steep learning curve that may overwhelm users new to enterprise risk management software

- High total cost of ownership, especially when factoring in customizations, support, and ongoing maintenance requirements

11. SAI360 GRC

SAI360 GRC offers comprehensive governance, risk, and compliance solutions that consolidate scattered risk data into unified, actionable insights. The platform’s unique strength lies in integrating risk management with ethics and compliance learning, making it ideal for highly regulated industries like financial services, healthcare, and manufacturing. With AI-powered emerging risk intelligence and a 360-degree view of enterprise risk, SAI360 helps Fortune 500 companies move from reactive to proactive risk management.

Use case: Organizations seeking an integrated enterprise risk management platform that combines software solutions with ethics and compliance learning to build a risk-aware culture.

Key features:

- Real-time risk dashboards with automated alerts based on key risk indicators and control failures

- AI-powered Emerging Risk Radar that provides horizon scanning for external threats and emerging risks

- Comprehensive risk modules covering enterprise, operational, IT, third-party, and business continuity management

Pricing:

- Pricing information is not publicly available — contact SAI360 directly for custom quotes

Considerations:

- Users report a steep learning curve, particularly for those without extensive GRC platform experience

- Some customers find the user interface outdated and report that generating complex reports can be challenging

12. Corporater

By creating a “digital twin” of your organization, Corporater connects risk management directly to business performance in a unified command center. This specialized approach makes it ideal for large enterprises seeking comprehensive governance, risk, and compliance (GRC) integration that models their entire operational structure.

Use case: Large enterprises and Fortune 500 companies needing integrated governance, risk, and compliance management with advanced customization capabilities.

Key features:

- Digital twin technology that creates a comprehensive organizational model for holistic risk oversight

- Automated risk aggregation that rolls up insights through your command structure for faster decision-making

- Multi-framework support including COSO, ISO 31000, and BASEL for streamlined compliance across regulations

Pricing: Pricing information is available upon request through their website.

Considerations:

- Complex setup process may require significant time investment and technical expertise

- Extensive feature set might overwhelm smaller organizations with limited resources

13. Hyperproof

Hyperproof turns scattered compliance tasks into a unified risk management powerhouse by automating evidence collection and continuous monitoring. The platform specializes in integrating risk management with compliance operations, making it ideal for mid-market to enterprise companies juggling multiple regulatory frameworks. Its “hypersyncs” feature automatically pulls evidence from over 70 cloud integrations, eliminating the manual spreadsheet chaos that bogs down most compliance teams.

Use case: Organizations in highly regulated industries like fintech, healthcare, and technology that need to manage multiple compliance frameworks while maintaining real-time visibility into their risk posture.

Key features:

- Centralized risk register that maps controls to risks for continuous, real-time monitoring and streamlined mitigation reporting

- Automated evidence collection through 70+ integrations that reuse evidence across controls for audit readiness

- Vendor risk management module with automated security questionnaires and centralized third-party risk tracking

Pricing: Pricing information is not publicly available and requires a custom quote, though third-party sources suggest annual costs range from approximately $12,000 to over $99,700 depending on company size and feature requirements.

Considerations:

- The platform can feel overwhelming initially due to the amount of information presented, with certain features requiring a learning curve for new users

- Some users note that while strong in compliance automation, the platform functions more as a task manager for compliance rather than a comprehensive operational risk management solution

14. SureCloud

SureCloud provides integrated risk management software that combines powerful technology with built-in advisory content and risk intelligence dashboards. The platform specializes in highly configurable, no-code solutions, making it ideal for organizations seeking both sophisticated risk management capabilities and expert guidance within a single system.

Use case: Organizations requiring flexible enterprise risk management software that adapts to existing business processes without rigid constraints.

Key features:

- Dynamic Risk Intelligence that analyzes and predicts risks proactively across enterprise and IT environments

- Centralized risk register with automated workflows, notifications, and comprehensive dashboards for real-time visibility

- No-code Aurora platform supporting multiple frameworks including ISO 27005, ISO 31000, and NIST standards

Pricing:

- Pricing information not publicly available – contact SureCloud directly for custom quotes

Considerations:

- Reporting and dashboard features can be limited and clunky, lacking modern business intelligence capabilities like drill-down functionality

- Third-party integrations may take longer than expected to implement, particularly with tools like ServiceNow and Jira

15. New Relic

New Relic redefines technology risk management by delivering comprehensive observability and security monitoring in one unified platform. The solution specializes in real-time vulnerability detection and performance monitoring, making it an essential tool for DevOps teams and organizations that prioritize IT risk management.

Use case: Organizations seeking to integrate security monitoring directly into their development lifecycle while maintaining comprehensive application performance visibility.

Key features:

- Interactive Application Security Testing (IAST) with zero-configuration vulnerability detection

- Real-time monitoring across the entire technology stack from applications to infrastructure

- AI-powered anomaly detection with automated vulnerability validation and proof-of-exploit capabilities

Pricing:

- Free tier: 100 GB data ingest per month, unlimited basic users, one free full platform user

- Standard: $10 for first user, $99 per additional user (max 5 users)

- Pro: $349 per user annually or $418.80 per user monthly

- Enterprise: Contact sales for custom pricing

- Data ingestion: $0.35/GB (Original Data) or $0.55/GB (Data Plus) beyond free tier

- Vulnerability Management: $0.10/GB ingested (included with Data Plus option)

Considerations:

- Complex pricing model based on data ingestion can lead to unpredictable costs as data volumes grow

- Steep learning curve with a cluttered user interface that may overwhelm new users

16. Wrike

Through AI-powered features, Wrike offers project risk management that changes how teams predict and prevent costly delays. The platform specializes in machine learning-driven risk alerts and customizable workflows, making it ideal for organizations juggling multiple complex projects simultaneously.

Use case: Organizations managing multiple projects that need predictive risk insights and highly customizable workflows to prevent delays before they impact budgets or timelines.

Key features:

- AI-powered Work Intelligence® that predicts project delays and sends automated risk alerts

- Pre-built risk management templates including RAID logs and IT risk assessments

- Customizable dashboards and Gantt charts for visualizing risk impact across project portfolios

Pricing:

- Free: $0/month (limited features for small teams getting started)

- Team: $10/month per user (billed annually, 2-15 users)

- Business: $25/month per user (billed annually, 5-200 users, includes AI risk prediction)

- Enterprise: Custom pricing (5+ users, includes advanced security features)

- Pinnacle: Custom pricing (5+ users, includes advanced reporting and budgeting tools)

Considerations:

- Steep learning curve due to extensive feature set that can overwhelm new users

- Higher-tier plans required for advanced AI risk management features, making it expensive for larger teams

17. ProcessMAP

ProcessMAP consolidates scattered EHS data into a unified risk management powerhouse that keeps safety teams ahead of incidents before they happen. The platform specializes in mobile-first data collection and comprehensive safety compliance, making it ideal for organizations with significant field operations and regulatory requirements.

Use case: Organizations with complex EHS compliance needs who require integrated incident management, risk assessment, and mobile data collection capabilities.

Key features:

- Incident management with root cause analysis and corrective action tracking

- Mobile-enabled risk assessments and safety inspections for field operations

- Asset risk management with predictive analytics for equipment and facility safety

Pricing:

- Pricing available upon request

- Starting at approximately $100,000 per year for enterprise deployments

Considerations:

- Steep learning curve for new users, particularly when transitioning from other EHS systems

- Mobile app functionality has received mixed reviews, with some users reporting issues with forced updates and password requirements

18. TrackMyRisks

TrackMyRisks centralizes scattered compliance documents into a single risk management platform designed for smaller organizations. The platform specializes in document-centric governance, risk, and compliance (GRC) management, making it accessible for teams without dedicated risk management backgrounds.

Use case: Small to medium enterprises seeking an affordable, user-friendly risk management platform that replaces manual spreadsheet processes with automated compliance tracking.

Key features:

- Centralized document management with automated version control and expiry reminders

- Immutable activity logs and role-based permissions for complete audit trails

- Custom document tagging and templated content tailored to specific industry needs

Pricing:

- Pricing information is available through their dedicated pricing page but specific tiers are not detailed in available research

Considerations:

- Limited advanced features compared to enterprise-level risk management software solutions

- Currently only supports English language, which may restrict global organizations

19. IBM OpenPages

IBM OpenPages elevates enterprise risk management with AI-powered insights that turn reactive compliance into predictive risk intelligence. The platform specializes in comprehensive governance, risk, and compliance (GRC) solutions for large enterprises, making it particularly valuable for financial services organizations managing complex regulatory environments.

Use case: Large enterprises seeking an integrated risk management platform that combines AI-driven analytics with comprehensive compliance capabilities across multiple business domains.

Key features:

- Operational risk management with automated risk and control self-assessments, loss event tracking, and scenario analysis

- AI-powered insights through IBM Watson integration for predictive risk analysis and automated compliance workflows

- Unified GRC platform supporting financial controls, third-party risk management, and regulatory compliance across enterprise operations

Pricing:

- Pricing information available through IBM’s custom quote process

Considerations:

- High implementation costs and complexity may be prohibitive for smaller organizations

- Steep learning curve due to the platform’s extensive functionality and enterprise-focused design

20. Diligent

Diligent provides comprehensive governance, risk, and compliance (GRC) software that connects boardroom oversight with operational risk management. The platform specializes in integrating enterprise risk management with board-level governance, making it ideal for large organizations in highly regulated industries that need to align risk strategy from the C-suite down to daily operations.

Use case: Organizations seeking to transform enterprise risk management into a strategic advantage by connecting operational risks directly to board-level decision making.

Key features:

- AI-powered risk identification using benchmarking data from over 120,000 SEC 10-K filings

- Integrated third-party risk management with supplier risk scores powered by Moody’s credit data

- Real-time risk reporting and executive dashboards that provide board-ready insights

Pricing:

- Custom pricing based on organizational needs and feature requirements

- Annual costs typically range from $2,500 to $420,000 depending on company size and modules

- Average implementation cost around $43,000 annually

- Contact Diligent directly for detailed pricing quotes

Considerations:

- High implementation costs may be prohibitive for smaller organizations that don’t utilize the full feature set

- Steep learning curve due to extensive functionality requires significant training investment for teams

21. Fusion Framework

Built on Salesforce’s Lightning Platform, Fusion Framework creates a unified operational resilience powerhouse that keeps organizations ahead of disruptions. This enterprise risk management software specializes in breaking down silos between business continuity, crisis management, and risk oversight—making it the go-to choice for large organizations that cannot afford to be caught off guard.

Use case: Large enterprises seeking comprehensive operational resilience through integrated business continuity, risk management, and crisis response capabilities.

Key features:

- Centralized risk relationship mapping across people, processes, systems, and third parties

- Real-time scenario modeling and testing to enhance preparedness for various disruptions

- Automated risk monitoring with customizable dashboards and impact tolerance alerts

Pricing:

- Contact Fusion Framework for custom enterprise pricing

Considerations:

- Steep learning curve for new users due to extensive customization options

- Higher cost structure may limit accessibility for organizations requiring many user licenses

22. Resolver Inc.

Resolver Inc. helps turn complex risk data into clear, actionable business intelligence, so your team can move from just reacting to risks to planning ahead with confidence. This platform is a powerhouse for unified risk intelligence, making it a fantastic choice for organizations looking to bring all their governance, risk, and compliance (GRC) operations under one roof. With its AI-powered automation and super-flexible workflows, it’s already helping over 1,000 global companies in fields like financial services, healthcare, and manufacturing.

Use case: Teams that need a comprehensive, customizable platform to transform scattered risk data into strategic insights across enterprise risk, compliance, and security.

Key features:

- AI-powered incident management with automated triage and remediation workflows

- A unified risk intelligence platform that connects the dots between compliance, audit, and security data

- Customizable risk assessment frameworks, complete with handy heat maps and scoring

Pricing:

- Enterprise solution: Kicks off at $10,000 annually

- Custom pricing is available to fit your organization’s size and needs

- Implementation and support services are available separately

Considerations:

- The initial setup can be a bit complex, so be prepared for a project that might take some time and resources.

- Its reporting features are powerful and highly customizable, which is great, but you’ll likely want to set aside some time for training to get the most out of them.

23. Microsoft Project for risk control

Microsoft Project provides a centralized control system for project risks that integrates seamlessly with the existing Microsoft ecosystem. The platform specializes in linking risk management directly to project schedules and timelines, making it ideal for organizations already invested in Microsoft tools who need comprehensive risk visibility within their project plans.

Use case: Organizations seeking risk management system software that integrates deeply with Microsoft Office tools and provides robust project scheduling capabilities.

Key features:

- Custom risk registers with tailored fields for probability, impact, and mitigation tracking

- PERT analysis for schedule uncertainty assessment using optimistic, pessimistic, and likely scenarios

- Direct risk-to-task linking that visualizes potential impacts on project timelines

Pricing:

- Pricing information was not available in the provided research

Considerations:

- Requires significant manual setup and customization to create comprehensive risk management processes

- Advanced quantitative risk analysis features like Monte Carlo simulations require third-party add-ins, increasing overall costs

24. greytHR

With greytHR, you can turn HR compliance from a constant headache into a streamlined, automated process. This platform packs powerful risk management features right into its core, specializing in Indian statutory compliance and employment law. It’s a perfect teammate for SMEs navigating complex labor regulations without a dedicated compliance crew.

Use case: SMEs in India and the Middle East seeking automated HR compliance management with robust statutory reporting capabilities.

Key features:

- Automated statutory compliance for PF, ESI, Professional Tax, and TDS calculations

- Role-based access control with two-factor authentication for sensitive employee data

- Comprehensive audit trails and compliance reporting to track all system changes

Pricing:

- Pricing information is available through their website but specific tiers are not detailed in the research.

Considerations:

- Steep learning curve for new users, particularly when accessing advanced features

- Limited customization options for reports and leave management policies compared to enterprise risk management software solutions

25. Vantage Risk Analytics

Vantage Risk Analytics converts complex risk assessment into data-driven insights that help organizations stay ahead of potential threats. This specialty re/insurer combines advanced predictive analytics with experienced underwriting expertise, making it perfect for companies facing challenging risks that traditional insurers might avoid. Built from the ground up as a tech-enabled platform, Vantage brings fresh capacity to constrained markets with innovative solutions.

Use case: Organizations seeking bespoke risk management solutions for complex, challenging risks that require innovative underwriting approaches and data-driven insights.

Key features:

- Smart underwriting that leverages multiple data sources to make scientific, evidence-based risk decisions

- Management liability coverage including Directors and Officers, Fiduciary, and Employment Practices insurance

- Catastrophe modeling and risk analytics for natural disasters, cyber threats, and terrorism risks

Pricing: Contact Vantage Risk directly for custom pricing based on your specific risk profile and coverage needs.

Considerations:

- Limited operating history since launching in 2020 may concern organizations preferring established providers

- Initial underwriting performance showed challenges with combined ratios above 100% in early years

How to choose the right risk management platform

Choosing a risk management platform comes down to how well it helps your team work together. The right solution connects risk-related data in one place and makes it easy to act on. That connection shifts teams from fragmented efforts to a consistent, proactive approach.

Look for platforms that integrate with the tools you already use and maintain enterprise-grade security without adding extra friction. The goal is a connected environment where risk data sits alongside projects and day-to-day work.

Adoption is the most important measure of success. A platform should be simple and adaptable enough that your team relies on it naturally. When it fits into existing workflows, risk management becomes a shared process instead of an added burden.

How to strengthen risk mitigation

Effective risk management starts with transparency. Teams work best when potential issues are flagged early and treated as useful signals rather than interruptions.

A platform like monday work management captures these conversations in project boards, keeping accountability clear and next steps defined. This creates shared ownership and prevents risks from slipping through the cracks.

Dynamic dashboards and AI-driven insights make patterns easier to spot and give teams the chance to address problems before they escalate. This shift builds resilience and keeps organizations focused on progress instead of reaction.

Building resilience with proactive risk management

Moving from reactive firefighting to proactive planning is essential for long-term success. The strongest organizations identify risks early and create strategies to handle them with confidence.

monday work management supports this approach with a single view of risks across the organization. Teams can collaborate in real time, monitor changes, and act before challenges grow into larger issues.

Ready to create a risk management process built for the pace of your business? Explore how monday work management helps you design workflows that strengthen agility and resilience.

Get StartedFAQs

What is the fastest way to evaluate a risk management platform?

The fastest way to evaluate a risk management platform is to run a live project in the platform. This shows right away if it can handle your team’s real needs instead of relying on a demo.

Can risk management software integrate with existing project tools?

Yes. Leading platforms integrate with the tools you already use, keeping risk data visible alongside project work.

How do AI features help with risk mitigation?

AI surfaces patterns in data and flags potential issues early. This gives your team more time to plan and act before risks escalate.

Which software works best for smaller teams?

Smaller teams benefit from flexible platforms that are easy to adopt and expand as needs grow. monday work management is one option that supports both starting small and scaling over time.

How do I measure ROI from risk management software?

ROI is measured in fewer costly incidents and time saved from automation. The biggest impact comes from the major disruptions you prevent.

Is there a free trial to test integrations?

Yes. Most platforms offer a free trial so you can connect core tools and confirm everything works as expected.