Projects rarely fail because of a single, obvious mistake. More often, disruption comes from overlooked risks, vendor delays, talent gaps, and regulatory shifts, that compound quietly until timelines slip and budgets strain. The difference between controlled delivery and reactive firefighting often comes down to how systematically risk is identified before it materializes.

A risk breakdown structure provides that structure. It organizes potential threats into clear categories and subcategories, giving teams a shared way to surface, track, and manage risks early. Instead of abstract concerns about what might go wrong, teams gain visibility into specific, actionable risks with defined ownership and response paths.

Below, we explore how this approach helps teams spot and manage threats early, how it differs from related planning tools, and practical steps for building a risk framework that stays relevant throughout a project’s life.

Key takeaways

- A risk breakdown structure brings clarity to uncertainty: organizing risks hierarchically turns vague concerns into clearly defined, trackable threats with ownership and response plans.

- RBS works best when embedded into daily workflows: integrating risk categories into planning, execution, and monitoring helps surface issues early instead of after timelines or budgets are impacted.

- Four core risk categories provide a strong foundation: technical, organizational, commercial, and external risks cover most project threats without creating unnecessary complexity.

- Ownership is critical to effective risk management: assigning accountable owners and escalation paths ensures identified risks are actively monitored and addressed rather than documented and forgotten.

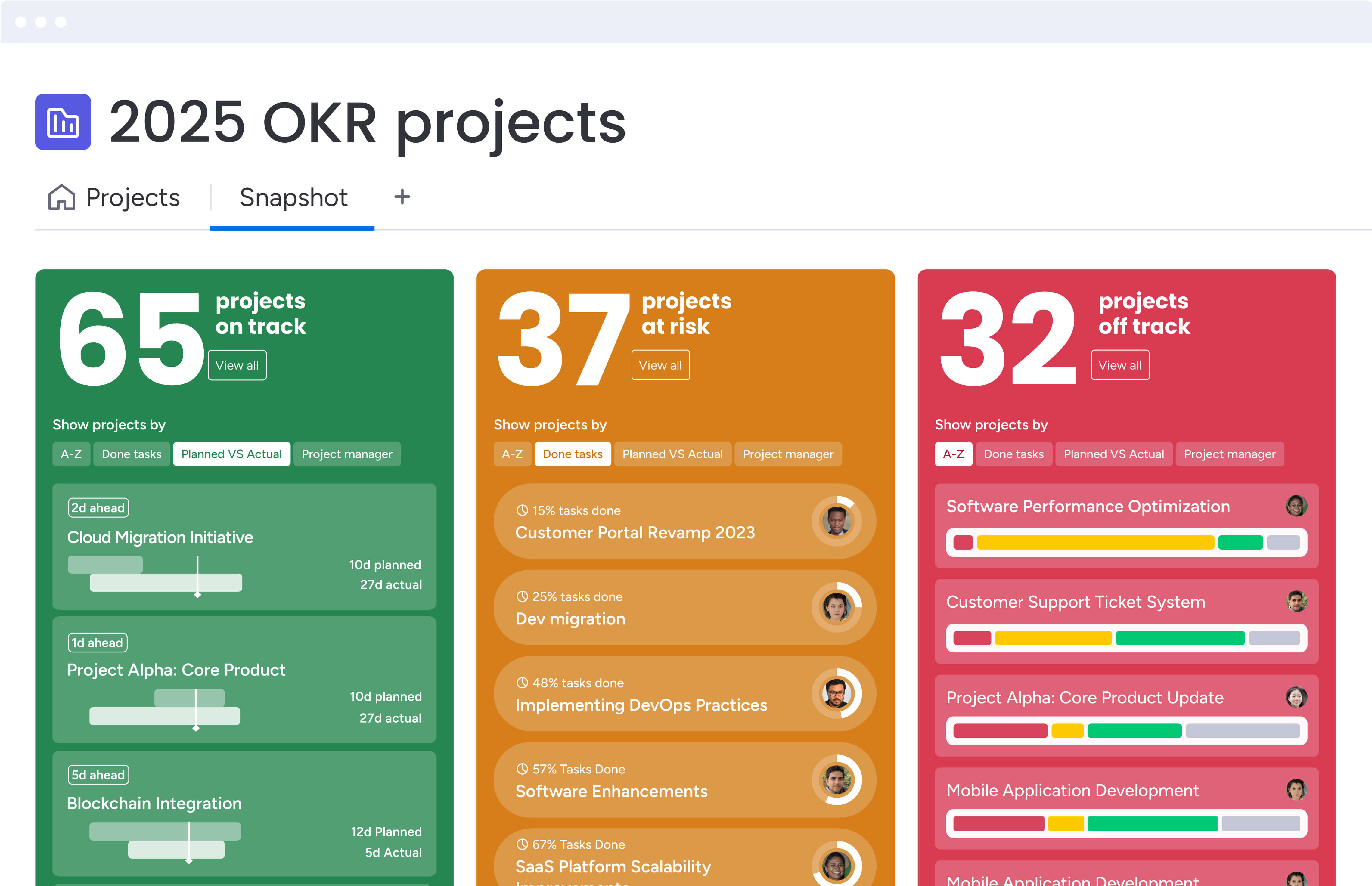

- Modern work management platforms elevate RBS at scale: tools such as monday work management enable automated categorization, real-time monitoring, and portfolio-level visibility, turning static risk frameworks into dynamic intelligence.

What is a risk breakdown structure?

A risk breakdown structure (RBS) is a structured way to organize project risks into logical categories and subcategories. It acts as a visual framework that shows where potential threats may originate across a project or program.

Rather than treating risk as a single list, an RBS maps risks hierarchically, starting with broad categories and narrowing into specific, actionable threats. This structure encourages teams to review the entire project landscape, from technical dependencies to financial exposure.

Each level of the RBS follows a parent-child relationship, with increasing detail at every step. For example, a software development initiative may structure risks as follows.

- Level 1: technical risks.

- Level 2: software development risks.

- Level 3: integration risks.

- Level 4: API compatibility issues.

Breaking risks into layers turns abstract concerns into clearly defined issues. Each risk can be assigned ownership, analyzed for impact, and tracked within a structured risk management approach.

Why every project needs a risk breakdown structure?

Managing risk without a framework often leaves gaps and weakens decision-making. Major risks may be obvious, but secondary and interconnected issues usually stay hidden until they disrupt timelines or budgets.

A risk breakdown structure adds consistency and discipline to how organizations identify and respond to uncertainty. It builds a shared framework that supports proactive planning instead of reacting only when problems appear.

Complete visibility across projects

When risks remain isolated within departmental silos, leadership lacks the clarity needed to make informed decisions. A risk breakdown structure (RBS) establishes a shared language for risk across the organization, replacing fragmented spreadsheets and inconsistent reports with a single, unified view.

This structured visibility has proven effective at scale. The UK Government Major Projects Portfolio illustrates this approach clearly, with 30 projects rated Green (14%), 135 Amber (63%), and 31 Red (15%), giving leaders transparent and comparable risk assessments across the entire portfolio.

By seeing patterns early, like recurring vendor reliability issues, organizations can address systemic risks instead of fixing problems one project at a time.

Smarter resource allocation

A clear understanding of the risk landscape directly informs how people and budgets are allocated. When technical integration emerges as a primary risk area, experienced engineers and additional capacity can be assigned before issues escalate.

Centralized planning allows organizations to match effort with risk severity, keeping high-risk areas on track while low-risk work progresses efficiently. This approach minimizes surprises and safeguards delivery timelines.

Stakeholder communication that drives action

High-level statements about project challenges rarely lead to decisions. Structured risk reporting provides specific, measurable insights that guide action and accountability.

For example, showing a 15% increase in technical risks during an integration phase signals exactly where leadership focus is required. This transforms uncertainty into data-driven conversations that strengthen governance and oversight.

Try monday work management

Risk breakdown structure vs. work breakdown structure

While both frameworks are hierarchical, they serve different purposes. A work breakdown structure (WBS) defines what must be delivered and how tasks are organized. An RBS focuses on what could prevent that work from succeeding.

Mapping RBS categories to WBS elements ensures risk awareness is embedded in planning, rather than treated as a separate exercise.

| Aspect | Risk breakdown structure | Work breakdown structure |

|---|---|---|

| Primary focus | Identifying potential threats | Breaking down project deliverables |

| Structure | Categories of risk sources | Hierarchy of work packages |

| Timeline | Updated continuously | Created during planning phase |

| Ownership | Risk owners and stakeholders | Project managers and task assignees |

| Output | Risk register and mitigation plans | Project schedule and budget |

4 essential risk categories for your RBS

A strong RBS typically starts with four main categories, capturing the majority of project threats. These core areas help teams uncover both obvious and hidden risks.

Technical and technology risks

Technical risks affect a project’s ability to perform as intended. These risks range from system limitations to security exposure and integration challenges.

Common technical risks to consider:

- System compatibility: legacy systems that won’t integrate with new solutions.

- Performance issues: applications that can’t handle expected user loads.

- Security vulnerabilities: gaps that expose sensitive data or operations.

- Technology maturity: unproven tools or platforms that might not deliver.

Management and organizational risks

Risks can also stem from internal processes, governance, and decision-making. Key considerations include:

- Resource availability: key team members leaving mid-project.

- Scope creep: requirements expanding beyond original boundaries.

- Communication breakdowns: misaligned expectations between departments.

- Decision delays: slow approvals that cascade into timeline impacts.

Commercial and financial risks

Financial concerns influence delivery feasibility and long-term project value. Common areas include:

- Budget overruns: costs exceeding approved funding.

- Vendor instability: suppliers failing to deliver or going out of business.

- Contract disputes: disagreements over deliverables or payment terms.

- Market shifts: changes that reduce project value or relevance.

External and environmental risks

External risks originate outside organizational control but still require active monitoring. Recent executive surveys highlight their impact, with geopolitical instability cited by approximately 59% of respondents as a leading threat to global growth.

Major external factors:

- Regulatory changes: new compliance requirements mid-project.

- Economic conditions: recessions or inflation affecting resources.

- Natural disasters: events disrupting operations or supply chains.

- Competitive moves: rival products changing market dynamics.

Build your risk breakdown structure in 5 steps

Creating an effective RBS requires structure, collaboration, and ongoing review. The steps below outline how to build a framework that integrates smoothly into existing workflows.

Step 1: define your project scope and boundaries

Begin by clarifying what the risk analysis will include. Clearly defined boundaries prevent the process from becoming unfocused or overly broad.

Key activities for scope definition:

- Map organizational boundaries: identify which teams and functions your RBS will cover.

- Set external monitoring limits: determine which external factors will be tracked.

- Document exclusions: note what’s deliberately outside your risk framework.

Clear boundaries keep the RBS focused, relevant, and manageable throughout the project life cycle.

Step 2: identify potential risk categories

Bring stakeholders together for structured input and analysis. Reviewing historical outcomes and gathering cross-functional perspectives improves coverage and accuracy.

Effective risk identification involves:

- Historical analysis: review past project failures and near-misses.

- Stakeholder interviews: capture perspectives from different departments and roles.

- Industry research: study common risks in your sector.

- Expert consultation: engage specialists who understand specific risk domains.

Starting with the four core categories creates consistency, while additional categories can be added to reflect industry-specific needs.

Step 3: create your hierarchical structure

Organize identified risks into logical groups and subgroups that are easy to navigate and review. Keep the hierarchy to three or four levels to maintain clarity. Deeper structures quickly become difficult to manage and reduce adoption across teams.

Each level should add meaningful detail while staying practical for everyday use. A well-structured hierarchy supports analysis without overwhelming stakeholders.

Structure guidelines:

- Maintain logical groupings: ensure subcategories naturally belong under their parent categories.

- Balance detail and usability: provide enough specificity without creating complexity.

- Use consistent naming: apply clear, descriptive labels at each level.

- Enable visual mapping: structure should work well in charts and diagrams.

Visual mapping helps teams quickly identify gaps and overlooked risk areas.

Step 4: assign risk ownership

Each risk should have a responsible owner. Evaluate the likelihood and potential impact to prioritize mitigation strategies effectively.

Ownership requirements:

- Designate category owners: assign specific individuals to monitor each risk area.

- Define escalation paths: create clear procedures for when risks exceed thresholds.

- Document decision authority: specify who can approve risk responses and mitigation strategies.

- Establish communication protocols: set up regular reporting and review cycles.

Without ownership, even well-documented risks remain unmanaged. Structured risk approaches deliver measurable impact, with federal agencies realizing nearly $759 billion in financial benefits over the past two decades by addressing high-risk areas systematically.

Step 5: connect RBS to risk management workflows

An RBS only delivers value when it is embedded into daily operations. Risk categories should connect directly to assessment processes, monitoring routines, and response planning.

This integration ensures risks remain visible as projects evolve, rather than being reviewed only during formal checkpoints.

Integration activities:

- Embed in project planning: include RBS review in standard project initiation.

- Connect to monitoring systems: link risk categories to project tracking tools.

- Automate alerts: set up notifications when risk indicators change.

- Integrate reporting: include RBS data in regular project and portfolio reports.

Organizations using monday work management can embed their RBS directly into project workflows, triggering automated alerts when risk indicators change.

Try monday work management

Risk breakdown structure templates and examples

Templates simplify RBS creation and keep consistency across projects. They give teams a reliable starting point that can be adjusted for industry needs or specific project contexts. With a structured template, the focus shifts from figuring out the framework to analyzing real risks.

Standard RBS template structure

This universal template works for most projects and is easy to customize:

Project risks

- Technical: requirements, technology, performance.

- External: vendors, regulations, market conditions.

- Organizational: resources, funding, priorities.

- Management: estimation, planning, communication.

This structure hits the major risk areas but stays flexible for different project types and organizations.

Industry-specific adaptations

Different sectors face unique challenges that need custom structures:

Construction projects emphasize:

- Environmental risks: weather delays, site conditions, geological factors.

- Safety categories: hazardous materials, worker safety, regulatory compliance.

- Supply chain risks: material availability, transportation, vendor reliability.

Software development prioritizes:

- Technical architecture risks: scalability, integration, performance.

- User adoption challenges: interface design, training, change management.

- Data security: privacy compliance, access controls, vulnerability management.

Healthcare initiatives focus on:

- Patient safety: treatment protocols, medication management, emergency procedures.

- Data privacy: HIPAA compliance, access controls, audit trails.

- Regulatory compliance: FDA requirements, quality standards, documentation.

Customize templates by digging deeper into high-risk areas and keeping low-risk categories simple. Build a structure that matches your real risks, not a list of generic what-ifs.

Transform static RBS into dynamic risk intelligence

Traditional RBS documents often become outdated as projects evolve. Stored in shared drives or spreadsheets, they fail to reflect real-time conditions or support timely decision-making.

Static files struggle to scale across multiple initiatives, and manual updates lag behind actual developments. This delay reduces leadership’s ability to respond before risks affect timelines or budgets.

Dynamic risk management platforms bridge this gap by linking RBS categories directly to live project data. When updates indicate delays, budget pressure, or technical issues, affected risk categories are flagged immediately, keeping teams aware and responsive.

Scaling risk management across the enterprise with monday work management

Modern work management solutions combine scale, flexibility, and automation. They support enterprise risk oversight while preserving team-level autonomy, helping organizations respond to risks faster and more effectively.

Portfolio risk insights powered by AI

Manual risk reviews at scale often miss emerging threats. AI capabilities analyze project data across the portfolio, classifying risks within the RBS framework automatically.

Patterns that are hard to detect manually, like recurring issues, subtle shifts in project sentiment, or early warning signals, become clear. Leadership gains immediate visibility into portfolio-wide exposure without extra reporting work.

Automated categorization and smart alerts

Automation improves risk categorization by recognizing indicators in project communications and mapping them to the correct RBS categories. Threshold-based alerts notify risk owners as soon as exposure rises. This enables faster response times and reduces reliance on manual monitoring.

Executive dashboards for strategic decisions

Centralized dashboards bring risk data from multiple projects into one clear view. Heat maps show category concentration, trend views track exposure over time, and drill-down options provide deeper insights.

AI-generated executive summaries transform complex risk signals into concise, actionable narratives. Leaders can make faster, more informed decisions with confidence, supported by real-time portfolio insights.

| Capability | Traditional RBS | monday work management approach |

|---|---|---|

| Risk detection | Manual identification | AI-powered scanning |

| Categorization | Manual sorting | Automatic classification |

| Portfolio view | Disconnected files | Unified dashboards |

| Updates | Periodic reviews | Continuous monitoring |

| Alerts | Basic notifications | Context-aware smart alerts |

| Reporting | Manual compilation | AI-generated summaries |

Turn risk awareness into competitive advantage today

Enterprise projects face constant, interconnected risks that rarely stay confined to a single initiative. Without structure, risks surface too late, ownership is unclear, and leadership lacks timely insight.

Embedding risk awareness into daily workflows allows teams to connect live project data to the RBS. Emerging threats are identified, categorized, and addressed early, turning risk management from a reactive process into a strategic advantage.

Key capabilities that support this approach include:

- A risk breakdown structure creates clarity: organizing risks into hierarchical categories turns uncertainty into clearly defined, trackable threats with ownership and response paths.

- Proactive risk management depends on structure: using an RBS helps teams identify and address risks early, rather than reacting after timelines, budgets, or quality are affected.

- Four core categories cover most project risks: technical, organizational, commercial, and external risks provide a strong foundation without adding unnecessary complexity.

- Ownership drives accountability: assigning clear owners and escalation paths ensures risks are actively monitored and addressed, not simply documented.

- Scalability requires modern platforms: enterprise teams benefit from work management platforms that support real-time monitoring, automated categorization, and portfolio-level visibility across projects.

By combining structure, visibility, and automation, teams can manage uncertainty without slowing work. This ensures stronger alignment between daily execution and strategic goals, better resource use, and a proactive approach to risk that strengthens long-term resilience.

Try monday work managementFrequently asked questions

What is the difference between RBS and a risk register?

The difference between an RBS and a risk register is that a risk breakdown structure organizes risks into hierarchical categories to provide systematic visibility, while a risk register is a detailed log that tracks individual risks with their assessments and mitigation actions. The RBS provides the organizational framework that structures how risks are categorized in the register.

When should you create an RBS in the project lifecycle?

You should create your risk breakdown structure during the project planning phase, after defining project scope but before detailed scheduling. This timing allows the RBS to inform resource allocation and contingency planning decisions from the start.

Who is responsible for creating the risk breakdown structure?

The project manager typically leads RBS creation with input from key stakeholders, subject matter experts, and team leads who understand different risk domains. Risk management specialists contribute to ensure comprehensive coverage and proper categorization.

How often should you update your risk breakdown structure?

Update your RBS whenever new risk categories emerge, project scope changes significantly, or lessons learned reveal gaps in the original structure. Most organizations review their RBS quarterly or at major project milestones.

Can you use RBS for agile project management?

Yes, RBS works effectively in agile environments by organizing risks into categories that align with sprint planning and retrospectives. Agile teams often use simplified RBS structures focusing on technical, business, and team-related risk categories.

What platforms help manage risk breakdown structures at scale?

Work management platforms like monday work management provide AI-powered risk categorization, automated monitoring across project portfolios, and integrated dashboards for enterprise-scale RBS management. These platforms eliminate manual tracking and enable real-time risk visibility across hundreds of projects.