A single overlooked risk can quietly unravel months of planning. Budgets slip, timelines stretch, and leadership is left explaining surprises that should have been visible much earlier. In fast-moving markets shaped by tighter regulation and constant disruption, uncertainty rarely announces itself in advance. It builds gradually in overlooked spreadsheets, fragmented updates, and assumptions that no longer hold.

Risk analysis matters because it turns scattered warning signs into a clear, structured view of exposure. Instead of reacting after damage is done, organizations can identify threats early, measure their impact, and respond with intention. Below, we break down how risk analysis works in practice, the methods that actually hold up at scale, and how modern approaches support continuous visibility in 2026.

Key takeaways

- Structured processes drive better outcomes: strong results come from consistent identification, assessment, and prioritization rather than one-off reviews. A repeatable framework keeps risk discussions focused and actionable.

- Different risk categories require tailored methods: strategic, operational, financial, compliance, and technology risks each call for distinct evaluation techniques. Treating them the same can blur dependencies and distort impact.

- Qualitative and quantitative analysis work best together: expert judgment helps you surface emerging risks early, while data modeling sharpens precision for high-impact scenarios. Used together, they create a more reliable picture.

- Continuous monitoring protects accuracy: because risk conditions shift quickly, static assessments lose relevance fast. Real-time tracking and trigger-based updates keep your risk profile current in 2026.

- Enterprise platforms strengthen visibility at scale: solutions such as monday work management support standardized risk analysis, automated monitoring, and portfolio-level insight without relying on disconnected spreadsheets.

What is risk analysis?

Risk analysis is the process you use to spot, evaluate, and rank potential threats before they disrupt your objectives, operations, or assets. You look at what could go wrong, how likely it is, and how serious the consequences might be. From there, you make informed decisions about how to manage that uncertainty.

Three core phases work together to create a complete view of your exposure. When these phases are handled consistently, scattered data turns into practical direction for leadership and operational teams alike.

- Risk identification: discover potential threats before they materialize using techniques like risk identification.

- Risk assessment: evaluate the likelihood and impact for each identified risk.

- Risk prioritization: rank risks based on their potential consequences to guide resource allocation.

Together, these steps shift risk management from isolated discussions to an ongoing, scalable discipline. Increasingly, organizations rely on AI-powered platforms to maintain real-time visibility as operations expand.

Core components of effective risk analysis

Risk analysis works best when treated as a connected system rather than a checklist. Each component builds on the next, turning raw observations into meaningful direction. When these elements are aligned, risk insights consistently support strategic decisions.

Four elements differentiate insights that inform decisions from data that remains unused. By mastering these components, teams can replicate quality results across projects and departments.

- Context establishment: define boundaries, scope, and objectives before diving into risk details. For example, a financial services firm may clarify regulatory obligations before assessing operational exposure.

- Threat identification: systematically surface both internal and external risks, including hidden process weaknesses or technology gaps.

- Impact evaluation: measure potential consequences across financial, operational, and reputational dimensions to avoid narrow assessments.

- Continuous monitoring: update risk profiles regularly so new threats and shifting conditions are reflected in real time rather than once a year.

Why risk analysis matters for organizations?

Risk analysis gives you the visibility needed to operate confidently in complex environments. Its value becomes clear in three areas that directly influence long-term performance.

Strategic protection

When risks remain hidden, they quietly undermine major initiatives. Early detection helps you avoid costly missteps before significant resources are committed. As a result, leadership can invest with greater confidence instead of relying on assumptions.

Operational resilience

Clear awareness of vulnerabilities strengthens day-to-day stability. By identifying dependencies and failure points, you design systems that withstand disruption and recover faster when incidents occur. That resilience often determines who adapts quickest during market shifts.

Competitive advantage

Organizations that understand their risk exposure can pursue opportunities others hesitate to explore. With strong oversight in place, expansion and innovation become calculated moves rather than gambles. Platforms like monday work management support this by providing portfolio-wide visibility while maintaining structured governance.

Try monday work managementHow to conduct risk analysis in 6 steps?

A structured framework turns theory into action. These six steps guide you from defining scope to maintaining ongoing oversight, ensuring nothing critical is overlooked.

Step 1: establish context and scope

Start by defining clear boundaries, specifying which assets, processes, or objectives require protection.

The scope should identify:

- Time horizon for the analysis.

- Relevant stakeholder groups.

- Success criteria and objectives.

Documenting assumptions and constraints early prevents scope creep and ensures the analysis remains focused on high-priority areas.

Step 2: identify potential risks

Use diverse techniques to capture a complete risk profile. Teams often employ brainstorming, historical data review, expert interviews, and industry benchmarking.

Effective identification includes:

- Internal risks: operational failures or personnel issues.

- External risks: market changes, regulatory shifts, and cyber threats.

Step 3: analyze risk impact and likelihood

Assess each risk by examining probability and potential severity. Risk matrices help establish consistent evaluation criteria across different risk types, ensuring that financial risks and reputational risks are assessed using comparable standards.

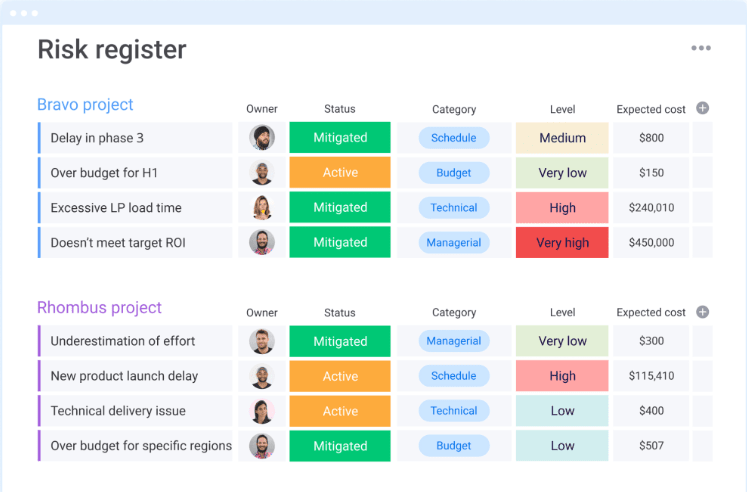

Step 4: evaluate and prioritize risks

Rank risks by combining their impact and likelihood scores. This step distinguishes between:

- Inherent risk: the risk level before controls.

- Residual risk: the risk level after controls are applied.

Risk registers capture this information, creating a prioritized list that guides decision-making.

Step 5: develop response strategies

Pick one of four responses based on your risk tolerance and resources:

- Avoid: altering plans to eliminate the risk entirely.

- Mitigate: implementing controls to reduce likelihood or impact.

- Transfer: shifting the risk to a third party through insurance.

- Accept: acknowledging the risk and monitoring it without further action.

Step 6: monitor and update continuously

Risk analysis never stops. Monitoring systems track trigger events that require reassessment, keeping your risk profiles current. Modern platforms can automate monitoring by scanning project boards nonstop and alerting you the moment a risk status changes.

5 essential types of risk analysis

Different teams require tailored approaches. Understanding the purpose of each type ensures comprehensive organizational risk intelligence.

Strategic risk analysis

Focuses on threats to long-term goals, market positioning, and competitive advantage. Examples include market disruption, strategic misalignment, and reputational risk. A retail chain, for instance, might analyze the strategic risk of consumer preference shifts toward e-commerce.

Operational risk analysis

Examines daily business operations, including process failures, supply chain interruptions, and human error. Operational risks directly affect continuity and revenue.

Financial risk analysis

Covers credit, market, liquidity, and operational financial risks. This type supports compliance requirements and guides decisions on capital allocation and investments.

Compliance and regulatory risk analysis

Focuses on risks arising from laws, regulations, and industry standards. Tracking regulatory changes and assessing business impact is crucial for highly regulated sectors such as healthcare and finance.

Technology and cyber risk analysis

Addresses cybersecurity threats, system failures, data breaches, and technology obsolescence. With increased digital transformation, this area is vital to organizational resilience.

Quantitative vs qualitative risk analysis methods

Choosing the right approach depends on data availability, required precision, and timelines. Using each method appropriately ensures actionable insights.

| Aspect | Quantitative methods | Qualitative methods |

|---|---|---|

| Data requirements | Extensive historical data | Expert knowledge and judgment |

| Time to complete | Longer (weeks to months) | Faster (days to weeks) |

| Precision | High numerical precision | Relative ranking and categories |

| Best applications | Financial modeling, engineering | Strategic planning, emerging risks |

| Resource requirements | Specialized analysts, software | Cross-functional teams |

When to use quantitative methods?

You should apply quantitative models when precision directly influences financial or operational outcomes. For example, Monte Carlo simulations and value-at-risk models help estimate potential losses in capital-intensive environments. These techniques are particularly effective in financial services, infrastructure projects, and safety-critical engineering.

Because these methods rely heavily on reliable datasets, they are best used when historical records are complete and consistent. Without strong data foundations, numerical outputs can create a false sense of certainty.

When to use qualitative methods?

Qualitative analysis is more practical when risks are new, ambiguous, or difficult to quantify. Strategic initiatives, regulatory shifts, and emerging technologies often fall into this category.

Risk matrices and structured expert scoring systems allow you to rank exposure quickly without waiting for full datasets. As a result, you maintain momentum while still creating defensible prioritization.

Combining both approaches

Strong risk programs rarely rely on a single method. You might begin with a qualitative assessment to surface a broad range of threats. Then, for the most significant risks, you apply quantitative modeling to sharpen precision.

monday work management supports both paths by helping teams categorize risks consistently and apply data-driven calculations within structured workflows. This flexibility allows you to adapt methods based on context rather than forcing one model across every initiative.

Risk analysis vs risk assessment

Although often used interchangeably, these concepts differ and guide program structure.

- Risk analysis: the broader process of identifying, evaluating, and understanding risks.

- Risk assessment: a specific step that evaluates the probability and impact of identified risks.

Think of risk analysis as a full health examination and risk assessment as a blood pressure check, one informs the other.

Risk assessment provides insights for strategic decisions, while risk analysis uses these results to allocate resources and manage risk systematically. Effective programs integrate both with technological support to enhance human judgment.

Try monday work management

AI and automation in risk analysis

AI strengthens risk analysis by processing volumes of data that exceed manual capacity. Instead of replacing expert judgment, it supports it by surfacing patterns and anomalies quickly. The most effective programs balance automation with strategic oversight.

AI-powered risk detection

Machine learning identifies patterns across large datasets that human reviewers might overlook. Applications include fraud detection, supply chain disruption forecasting, and cybersecurity threat monitoring.

AI can also scan news feeds, regulatory updates, and internal communications to surface early warning signals. This expands visibility beyond traditional reporting channels.

Automated risk monitoring

Manual reviews conducted once or twice a year leave significant blind spots. Automated monitoring shifts you to continuous observation, flagging trigger events as they occur.

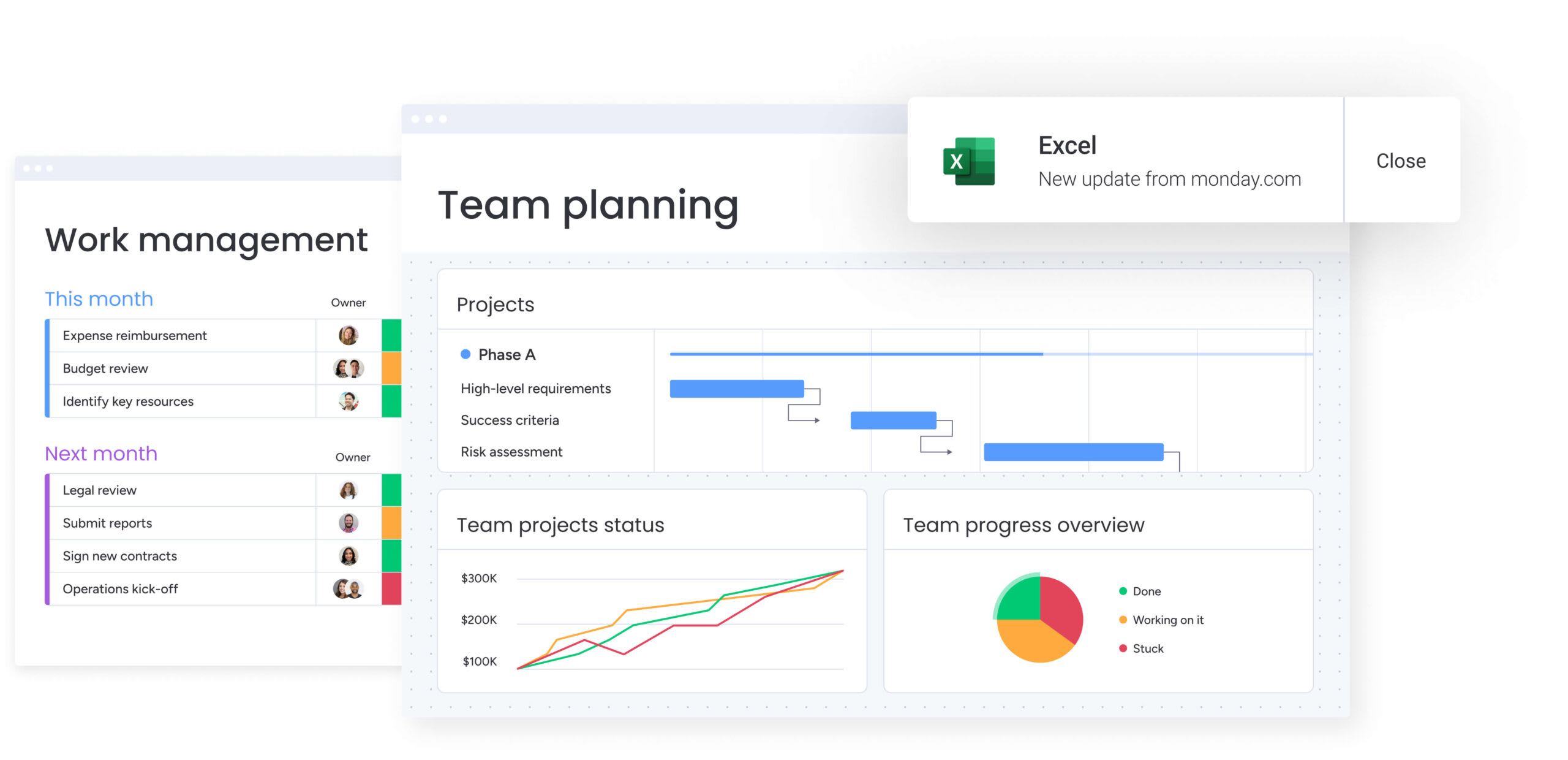

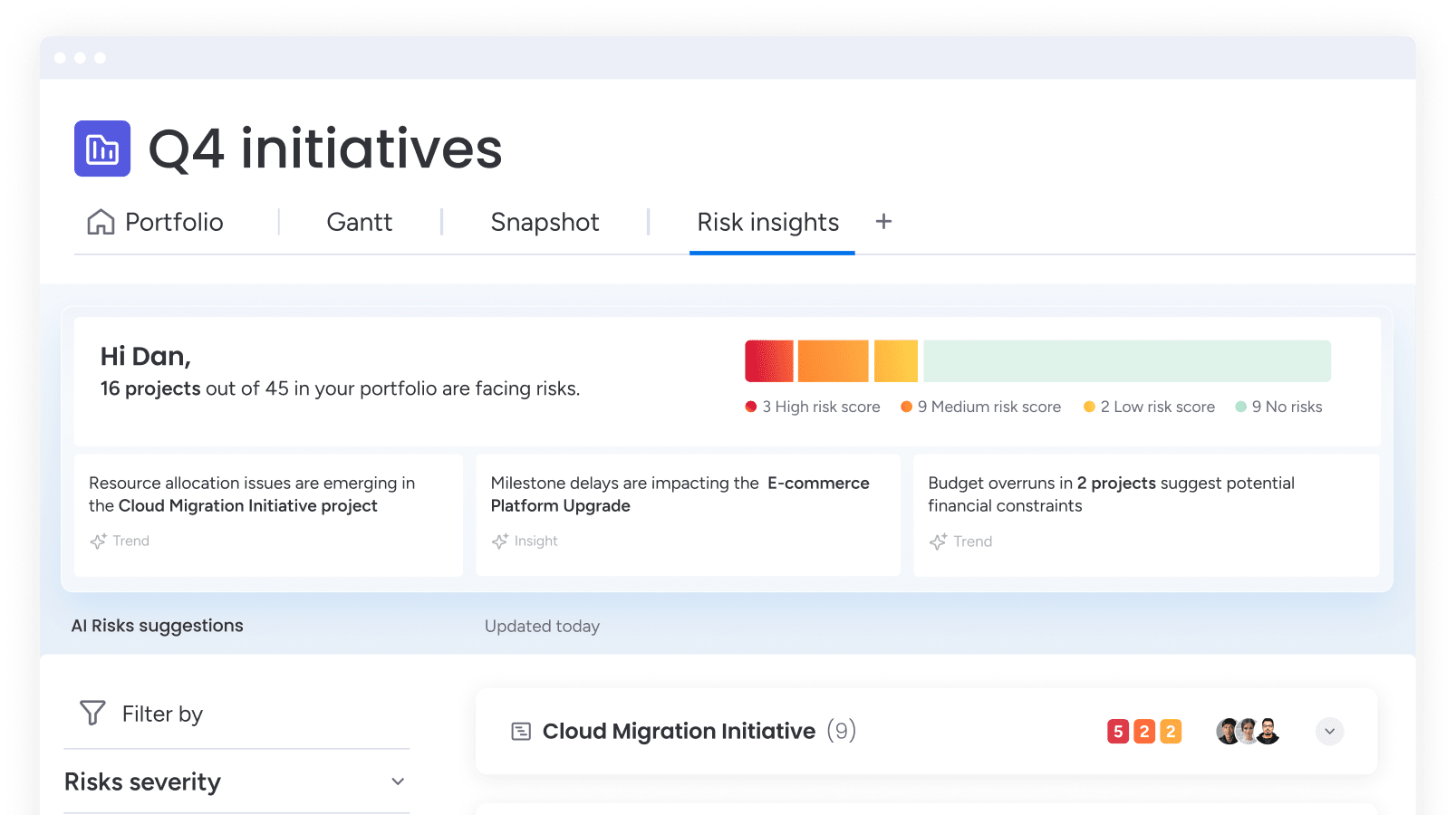

monday work management enables portfolio-level risk visibility by scanning project boards daily, prioritizing risks by urgency, and providing context, ownership, and mitigation guidance within the same environment.

Predictive analytics for risk prevention

Predictive models use historical patterns and current signals to forecast potential disruptions. That insight allows you to intervene before risks escalate.

Common applications include maintenance forecasting, market volatility tracking, and compliance monitoring. With predictive analytics in place, risk management becomes proactive rather than reactive.

Overcoming common risk analysis challenges

Implementing a structured program requires more than selecting a framework. Data limitations, organizational silos, and inconsistent processes often slow progress. Addressing these barriers strengthens reliability across the enterprise.

Improving data quality

Challenges include incomplete records, outdated information, inconsistent formats, and siloed datasets. Strategies include:

- Data standardization: creating consistent formats across systems.

- Validation processes: implementing checks for accuracy and completeness.

- Governance frameworks: establishing ownership and maintenance responsibilities.

Automated data collection and AI-powered cleansing fix these problems across your entire operation.

Breaking down organizational silos

When teams operate independently, risk visibility becomes fragmented. Shared reporting standards and cross-functional committees encourage alignment.

Executive sponsorship is equally important, as it reinforces accountability and ensures adoption across departments.

Scaling consistently

As organizations grow, maintaining consistency becomes more complex. Standardized templates combined with localized flexibility provide balance.

monday work management enables this by supporting shared frameworks while allowing teams to adapt fields and workflows to their context.

Maintaining real-time accuracy

Risk environments change quickly, which makes static assessments unreliable. Establishing review cycles, trigger events, and automated alerts keeps risk profiles current.

AI-driven monitoring within monday work management ensures that updates occur continuously rather than only during scheduled reviews.

Risk analysis templates and frameworks

Structured templates turn risk analysis into a repeatable process. Without defined formats, insights remain inconsistent and difficult to scale. The right framework supports both discipline and flexibility.

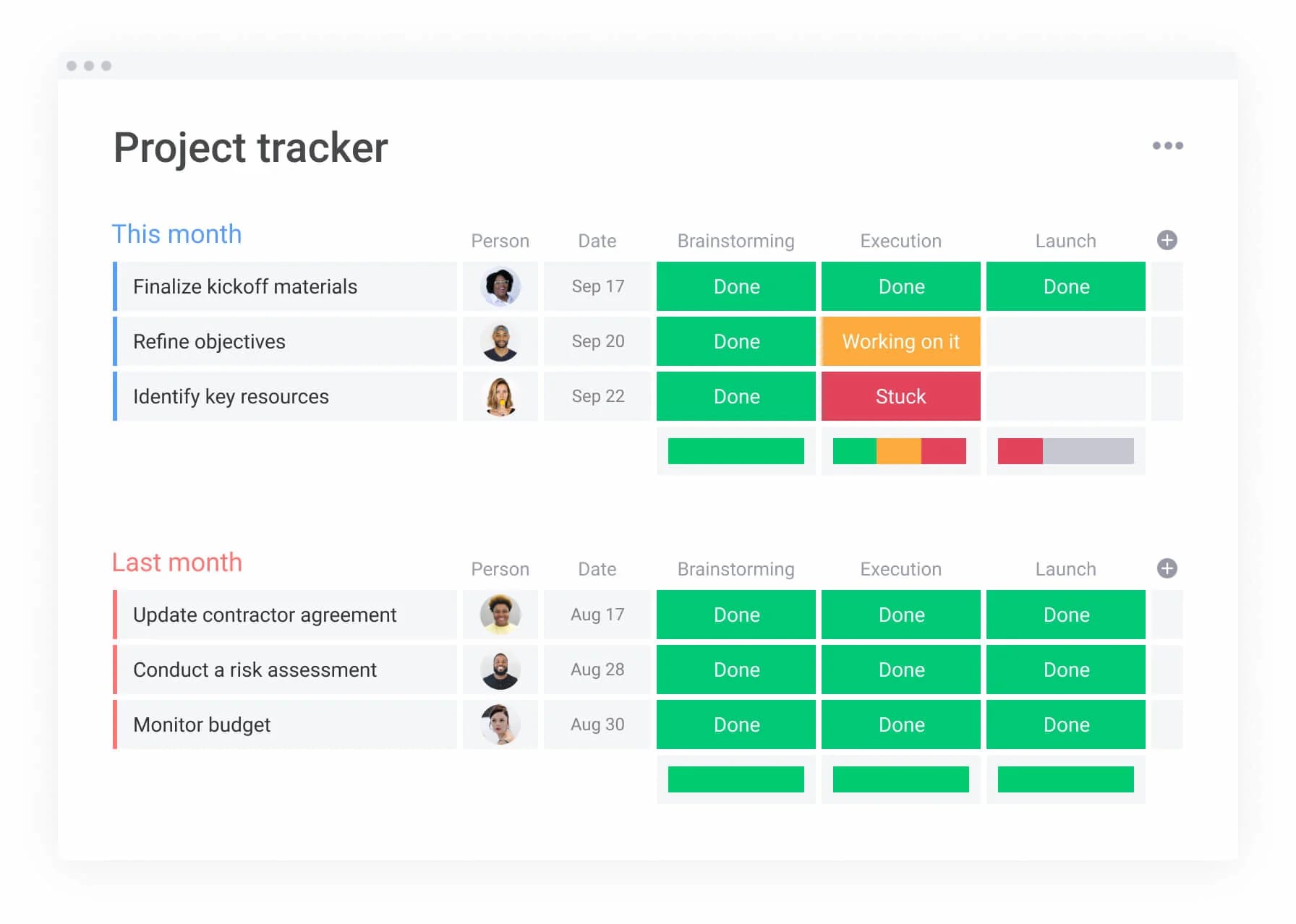

Risk register templates

Risk registers serve as central repositories for risk information. Essential fields include:

- Risk description and category.

- Likelihood and impact ratings.

- Risk owner and current controls.

- Action plans and timelines.

Maintaining and updating these registers ensures that risk data remains actionable.

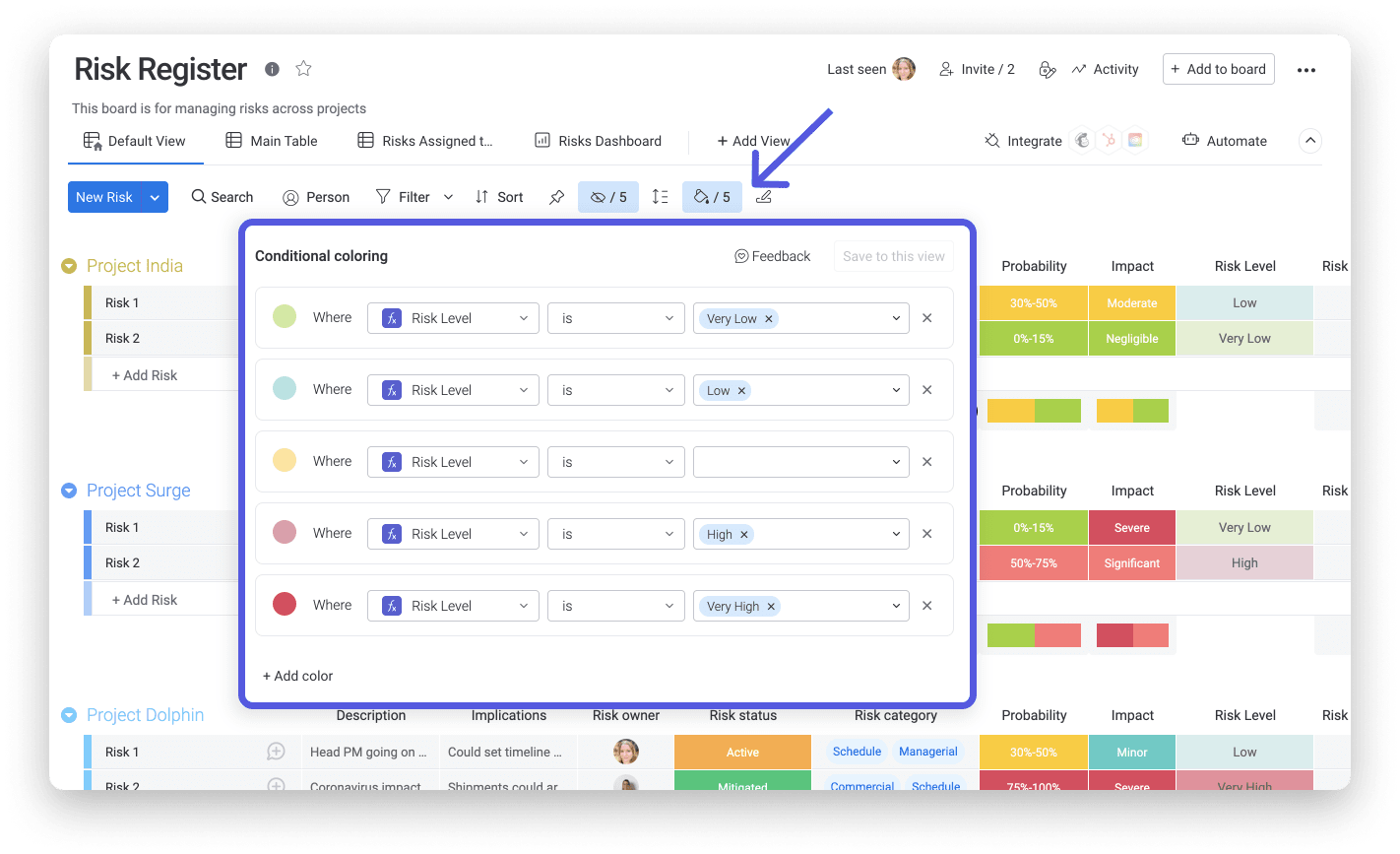

Risk matrix development

Risk matrices are customized for different organizational contexts. The process involves:

- Defining likelihood scales.

- Establishing impact categories.

- Setting risk tolerance thresholds.

Organizations typically use 3×3, 4×4, or 5×5 matrices depending on the required granularity.

Enterprise risk dashboards

Dashboards bring together indicators, trend analysis, and executive summaries in a single view. Different audiences require different levels of detail, from leadership overviews to operational breakdowns.

AI-powered dashboards within monday work management update automatically, ensuring decision-makers always see current data.

Manage risk with monday work management

Managing risk at scale requires more than spreadsheets and periodic meetings. monday work management connects daily execution with portfolio-level oversight, helping you move from reactive responses to structured risk intelligence.

Below is a comparison of traditional methods and a modern platform approach:

| Risk analysis approach | Traditional methods | monday work management |

|---|---|---|

| Risk detection | Manual review cycles | AI-powered continuous scanning |

| Data integration | Siloed spreadsheets | Unified platform with real-time updates |

| Scalability | Limited by manual processes | Hundreds to thousands of projects |

| Reporting | Static periodic reports | Dynamic AI-generated insights |

| Collaboration | Email and meetings | Integrated workflows with automated notifications |

| Customization | Rigid templates | Flexible frameworks with standardization |

AI-powered portfolio risk insights

Portfolio Risk Insights scans project boards to identify potential issues across large portfolios simultaneously. Risks are prioritized by urgency and presented with ownership and mitigation options.

Automated risk workflows

AI Blocks integrate into risk analysis workflows to automate manual work, freeing analysts for strategic activities:

- Categorize blocks: sort risks by type, urgency, or severity automatically.

- Extract info blocks: pull risk indicators from documents and communications.

- Summarize blocks: generate concise executive summaries instantly.

- Detect sentiment blocks: flag language that may signal emerging concerns.

Enterprise-scale risk visibility

Leadership gains visibility across entire portfolios through AI-generated reports and real-time dashboards. These dashboards can display risk status across up to 200 projects and expand to 1,000.

Cross-project dependency views highlight how delays or issues in one initiative may affect others. This connected visibility supports faster, more confident decisions.

Building a risk-intelligent organization

Today’s risk landscape is shaped by fragmented data, siloed workflows, and rapidly evolving threats. To respond effectively, you need visibility that connects daily execution with strategic objectives.

monday work management addresses this by centralizing risk tracking, automating monitoring, and scaling standardized frameworks across initiatives. Key benefits include:

Key benefits include:

- AI-powered risk detection: continuous scanning reduces reliance on manual reviews.

- Centralized risk tracking: unified dashboards provide enterprise-wide clarity.

- Automated workflows: structured categorization and reporting streamline oversight.

- Scalable frameworks: consistent templates maintain governance across hundreds of projects.

- Predictive insights: analytics anticipate disruptions before they escalate.

By embedding risk analysis into everyday workflows, you transform uncertainty into structured advantage. Instead of reacting to surprises, you operate with visibility, alignment, and measurable control.

Try monday work managementFrequently asked questions

What are the 4 stages of risk analysis?

Risk analysis typically follows four stages: risk identification (discovering potential threats), risk assessment (evaluating likelihood and impact), risk evaluation (comparing against tolerance levels), and risk treatment (developing response strategies).

Is a SWOT analysis a risk analysis?

A SWOT analysis is not a complete risk analysis, though it's a useful component for identifying potential threats and weaknesses. Risk analysis requires more detailed evaluation of likelihood, impact, and specific mitigation strategies than a standard SWOT framework provides.

What are the three methods of risk analysis?

The three primary methods are qualitative analysis (using descriptive scales and expert judgment), quantitative analysis (using numerical data and statistical models), and semi-quantitative analysis (combining elements of both approaches).

How often should you update risk analysis?

Risk analysis requires continuous updates through automated monitoring systems, with formal reviews conducted quarterly or when significant changes occur. High-risk areas often require monthly or weekly reassessment depending on risk tolerance.

Can AI predict all types of risks?

AI cannot predict all types of risks, particularly those involving unprecedented events or complex human behaviors. AI excels at identifying patterns and trends that may indicate emerging risks and works best when combined with human expertise.

What's the difference between risk analysis and risk management?

Risk analysis is the systematic process of identifying and evaluating potential threats, while risk management is the broader discipline that includes risk analysis plus the implementation of strategies to address those risks.