Managing multiple projects at once can get messy very quickly. Between evenly distributing resources, handling shifting priorities, and ensuring overall alignment with strategic goals, It’s common for portfolio project managers to feel overwhelmed. That’s why portfolio management, which the Project Management Institute defines as “a way to bridge the gap between strategy and implementation,” is so essential. A structured portfolio management system allows teams to gain control over their project portfolios — to cohesively manage all projects to completion.

In this blog we’ll define exactly what portfolio management is, why it’s so important, and suggest some best practices. We’ll also show you how to leverage portfolio management software like monday work management to maximize efficiency and project success.

What is a project portfolio?

A portfolio describes a grouping of projects, programs, or in some cases, both. Project portfolios are created to house and manage important information across these activities to provide collective oversight.

Think of a project portfolio as a single source of truth to make decisions about resource allocation, forecast performance, and risks, and as a north star for progress and alignment — especially as they relate to goals and strategy.

Investment portfolio management vs. product portfolio management

Portfolio management also commonly refers to managing and optimizing investments—stocks, bonds, and financial assets. The objective of this is to deliver high returns on investments while minimizing risk to reach financial goals.

The concept of portfolio management in investments is different than traditional project portfolio management as it only pertains to investment strategies. General project portfolio management is a broader approach to seamlessly organize and connect projects for overall success.

Read also: Lean portfolfio management and Portfolio management vs project management

A look into the process of effective portfolio management

The process of portfolio management is the selection, prioritization, and control of an organization’s projects and programs. Such centralized management and oversight help establish a standard of governance across the organization.

Put plainly, project portfolio management assigns responsibility, so the organization always has a individual or a group of people closely monitoring the performance of the company’s project investments.

If a project is aligned with the company’s strategies, values, and long-term goals and it’s performing well, then it’s more likely to get funded and prioritized. If it’s risky, underperforming, or misaligned to the company’s greater strategy, then it’s probably going under the microscope to either pivot or get scrapped altogether.

Building portfolio management into your organization puts you back in the driver’s seat, where you can make more educated decisions about how to effectively deliver against your strategy and take charge of your asset allocation.

Some everyday use cases for PPM are:

- Identifying potential project returns

- Forecasting risks

- Facilitating communication

- Obtaining stakeholder buy-in

What’s the difference between portfolio management, project management, and program management?

The relationship and hierarchy between portfolio, program, and project management can be described as the following:

- Portfolio management takes a group of projects and/or programs and manages these collectively as a group, ensuring they’re consistently aligned with the overall strategy

- Program management entails a coordinated approach to managing related projects in a manner that aligns their connected objectives

- Project management typically involves managing temporary or unique endeavors focused on a specific product or service

Simply put, projects are the building blocks that make up a program, while programs and individual projects combined form a portfolio.

4 reasons organized project portfolio management is important

Like most project management processes, thoughtful portfolio management has more than one positive ripple effect on business value. Here are a few of the most important:

1. Strategic alignment

Portfolio management helps organizational and operations leaders see if other large projects are contributing and in line with high-level organizational goals and KPIs, and helps keep everyone in the enterprise aligned. In fact, experts sometimes refer to it as strategic portfolio management, a type of portfolio management that focuses on strategic initiatives.

2. Reduced inefficiency

When all projects are mapped out in one place, it’s easier to see what is of the highest priority, what can be tabled, and so on. It also creates a track record for seeing how similar projects went in the past, so they can be better implemented in the future.

3. Risk management

Clarity into a project portfolio aids risk management by consolidating the most important components of projects in one place for evaluation.

4. Diversification

Having an easily accessible portfolio can also help someone like a PMO assess if the projects being prioritized for the organization have health diversity. Conversely, it can help them see if a project isn’t relevant.

Portfolio management best practices

Much like the day-to-day, portfolio management best practices will naturally vary. Nonetheless, there are tried and true methods that are applicable to most industries.

Perform a hands-on, detailed project inventory

Taking stock of all your projects provides a level of understanding that’s critical to effective portfolio management. Include the project’s title, timeline, estimated costs, business objectives, potential ROI, and how it benefits the business.

This way you can create an instant high-level overview with all the information required to provide investors with updates or make better on-the-spot decisions.

Evaluate projects through a strategic lens

It’s important to prioritize the projects that are most aligned with the company’s strategic objectives. Other factors to consider are how risky a project is and whether the project will involve massive reengineering.

Ultimately, a good portfolio manager will identify overlapping project proposals early and cut off any projects with poor business cases upfront, to ensure strategic alignment between management and stakeholders.

Prioritize, categorize, and fund projects

Once you’ve completed evaluating each project based on strategy alignment, you also will have to prioritize based on available funding and resources.

A thorough scoring and categorization process can come in handy for this because it also helps you see how much work could be done down the line.

Thoroughly review and manage your portfolio

A first-rate evaluation and prioritization process won’t help if your portfolio isn’t actively managed after creating the approved project list.

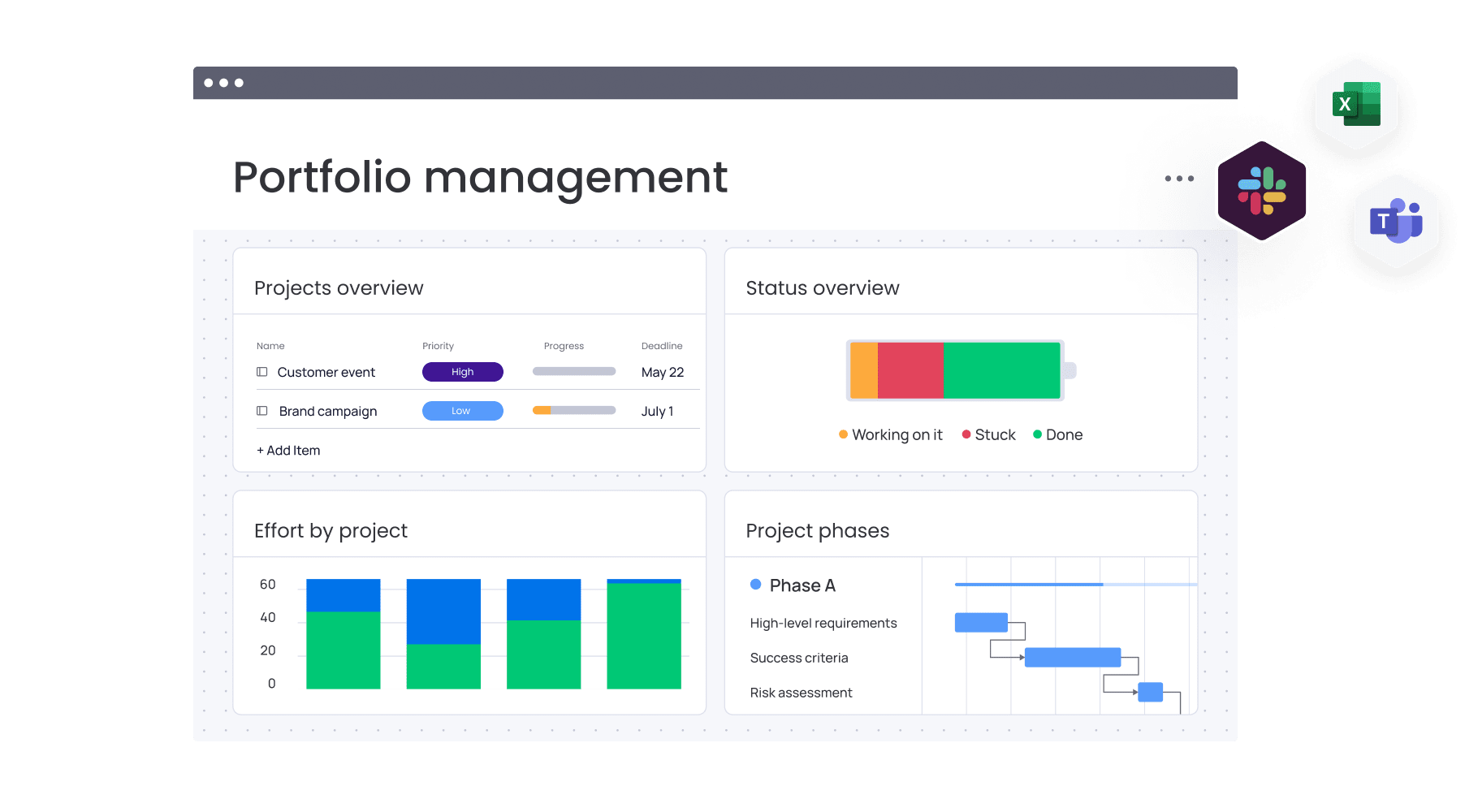

A platform like monday PMO work management streamlines this process by allowing you to oversee the status of each project on a data-driven, yet beautifully designed dashboard.

At a minimum, portfolio managers should be monitoring asset performance at a quarterly level but to truly excel, this should occur more frequently.

During the review process, portfolio managers and stakeholders will often meet to discuss which initiatives require and are worthy of additional funding, which ones to pause, and which to stop altogether.

What are common challenges in portfolio management?

Portfolio management is highly effective, but it requires serious commitment. Here are 5 major challenges.

1. Having a cohesive relationship between managers & stakeholders

Both the portfolio management team and stakeholders have unique motivations and priorities that need to work in tangent. Managing the engagement between the two isn’t always smooth sailing, as investment decisions are scrutinized.

It takes dedication from the bottom to the top and as much transparency as possible to keep projects on course and relationships intact.

2. Time & resource management

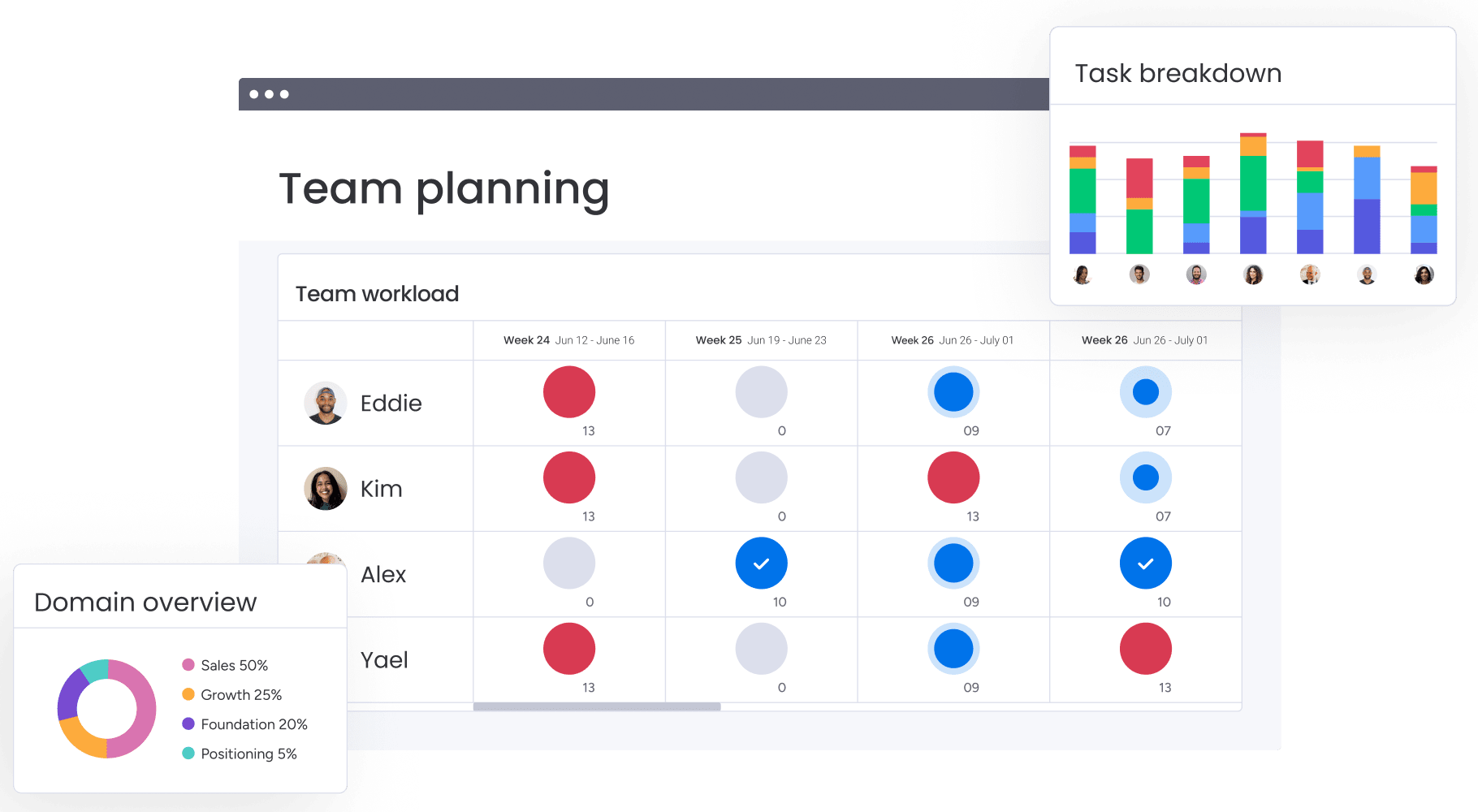

Understanding how much time, capacity, and resources like budget are available across many initiative is tough. On monday PMO work management, you can use a Workload View and Timeline View to provide clear insights.

3. Data visibility

For efficient porfolio management, you need to be able to import and customize the way you or stakeholders see relevant project data.

monday PMO work management lets you use widgets to create custom dashboards — you can set up automations to routinely send reports out. You can also add more than one dashboard view on a board, built exactly how you need it.

4. Inability to operationalize & scale

As your project portfolio grows, it’s safe to say that you need a work management platform that can keep up and cut down on manual work. Excel sheets and email can’t offer automation, calculations, communication, and more all in the same place — which can slow down or prevent organizations from expanding their portfolios.

5. Macroeconomic risks

Even the most perfect portfolio management can be negatively impacted by factors out of an organization’s control, like an economic downturn. However, having an effective platform and project portfolio risk management process in place can help you make better financial decisions before, during, and after a crisis or slow time.

Why you need a portfolio management platform to run successful projects

Keeping track of project status, funding, investment rounds, ownership, and communication is hard enough when people and resources are stretched or limited. Without a portfolio management platform, you might as well be making educated guesses that occasionally meet their mark.

The best tool is one that also considers your project managers’ needs since their data needs to trickle up to higher-level portfolio managers and their corresponding boards and dashboards.

A solution that eliminates manual data transfers or excessive status update meetings should be what you aim for, with the aim of improving your overall processes, impact, and keeping your sanity.

monday PMO work management lets you do just that.

Bridge silos to accelerate goals with monday work management’s portfolio management solution

monday work management is the all-in-one portfolio management solution for teams to gain visibility over all their projects so they can reach strategic goals and deliver results.

With a high-level portfolio view that pulls data across all projects and programs, teams can see the big picture and easily detect bottlenecks. Some top portfolio management features on monday work management include:

- High-level portfolio management boards that easily connect to more granular project views. Keep project managers updated with one source of truth to track project performance, timelines, budgets, and more at a glance.

- Gantt charts to understand project status and details. Visualize tasks, goals and milestones for accurate planning.

- Snapshot views to review the health and overall profitability of your portfolio. Identify risks before they even happen so teams can take immediate action.

- Project intake and approvals to streamline the project intake process. Anyone can submit requests with relevant details, and stakeholders can manage approvals and prioritize better.

- Custom columns to prioritize and categorize projects. For example, the Timeline Column indicates the duration for each task to be completed. The Dependency Column defines the relationship between items and adjusts timelines if a task is delayed.

- Shareable reports and dashboards to align stakeholders and leaders on progress. Gain visual insights on funding rounds, funding status, resources invested, estimated current value, and last evaluation to make data-driven decisions.

You can also connect monday work management to the PMO tools you already use through integrations for a fully unified portfolio project management software. Try monday work management today and empower portfolio and project managers to collaborate at scale, execute with confidence, and report on success across organizations with one holistic tool.

Get startedFAQs

Does monday work management have a portfolio view?

monday work management offers many different options to help you get a high-level overview of projects across teams and departments. Our dashboard view is a customizable location where you can choose custom widgets to stay on top of things like budget, project phases, and more across project boards.

What is the goal of project portfolio management vs project management?

The goal of project portfolio management is to stay on top of project data across departments, teams, and more in order to optimize things like efficiency, resources, and budgets. Project management's goal is to plan, track, execute, and monitor activities in stages in order to achieve a goal and produce a certain outcome.

What features does a good project portfolio management tool offer?

- Dashboards

- Budgeting and reporting

- Seamless, in-platform communication

- Automations

- Import & export

- Enterprise-level security

Get started

Get started