An organization’s operational costs can vary dramatically. If you cannot keep close tabs on all of your outgoing expenses, it can end up sinking your company pretty quickly.

That’s why solid finance management is going to be absolutely critical to your success.

Finance management is the strategic planning, directing, and controlling of an organization’s money. It’s all overseen by a finance manager.

In this article, we spell out what a finance manager is, what a finance manager does, the qualifications you need to be a finance manager, and how managers can control their finances using monday.com.

What does a finance manager do?

Over the last decade, loads of businesses have been accumulating more cash than ever before on their balance sheets — particularly in overseas markets.

To effectively manage those cash inflows to help the business thrive, companies have got to think strategically about what to do with their money. That’s where finance managers come in handy.

When we talk about finance managers, we’re specifically referring to those responsible for maintaining their organization’s financial health.

If you work for a company, chances are that you’ve already got a finance manager. But your finance manager might go by a different job title.

It’s important to bear in mind that “finance manager” is a responsibility that straddles many different roles. Finance managers often work with a range of teams and act as advisors to the C-level.

The finance manager at your organization might go by the title of:

- Treasurer

- Finance officer

- Financial controller

- Cash manager

- Credit manager

- Insurance manager

- Risk manager

That’s just for starters, too. The truth is, your business can call your finance manager whatever they want to make their title — but whatever the name, this role is in high demand.

There’s been a surge in hiring for finance managers, with demand among U.S. companies expected to grow by 15% by 2029.

Finance managers often create financial reports, develop financial plans, and compile reports on cash positions, investment activities, and more.

There are also a few statutory responsibilities finance managers have got to oversee.

One of the biggest responsibilities a finance manager must deal with is preparing financial statements, business forecasts, and activity reports.

A finance manager is an individual that digs out data and transforms those boring hard numbers into visual and easily digestible reports that non-finance team members will be able to understand.

Likewise, a finance manager will then need to review market trends and reports, like the organization’s financial month-end reports, to find ways to cut costs or streamline operations to make things more efficient.

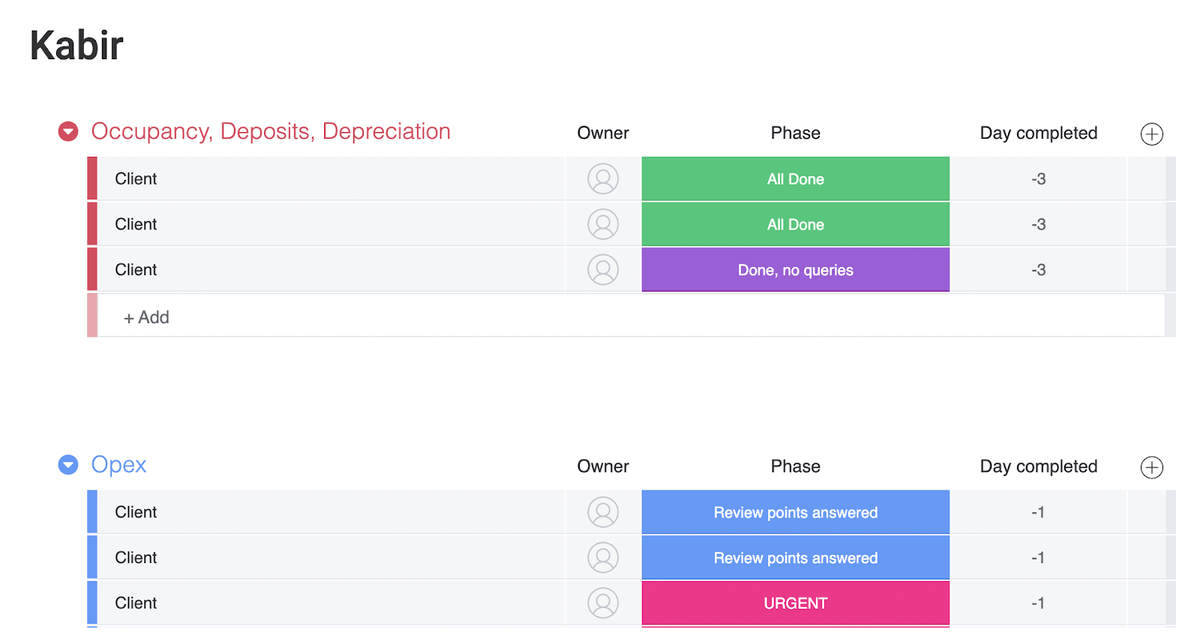

If you’re not familiar with month-end reports, here’s a financial month-end reports template one of our clients made with monday.com:

Next, a finance manager plays a major role in regulatory compliance.

They’ve got to monitor all of a company’s financials to ensure the company meets legal requirements and business operations are 100% compliant with the law.

Finally, it’s important to note that a finance manager doesn’t normally limit their management to numbers.

Finance managers are also typically responsible for supervising employees or entire teams that assist them in financial reporting, accounting, and budgeting operations. In turn, your finance manager will then go to management to guide them in making informed financial choices.

What qualifications do you need to be a finance manager?

If you’ve been reading this and thinking that it sounds pretty great to be a finance manager, you’re not wrong. But if you want to become a finance manager, there are some basic qualifications you’ll need to get first.

Your average finance manager has at least a bachelor’s degree in a finance-related subject. That might include accounting, economics, or even a degree in business administration.

That being said, a lot of employers will be looking to take those qualifications a step further by hunting for a finance manager with a master’s degree in finance, accounting, or an MBA.

But the qualifications you need to be an amazing finance manager normally extend beyond academic degrees.

There are also many professional certifications and industry qualifications that finance managers will pursue to gain employment or continue their professional development.

For example, you can get a Certified Government Financial Manager (CGFM) designation from the Association of Government Accountants (AGA).

This certification is typically given to government financial managers or those who work with public bodies at the local, state, or even federal level.

To get a CGFM certification, you’ve got to have a bachelor’s degree and pass multiple exams. You’ll also be asked to demonstrate professional-level experience in a government financial management role.

If you don’t work for the government, that’s no problem. You may also want to check out the CFA Institute’s Chartered Financial Analyst (CFA) certification.

This award is designed for investment professionals. To get it, you’ll need to have either a bachelor’s degree, 4 years of work experience, or a combination of the 2. You’ve then got to pass 3 CFA exams to get your certification.

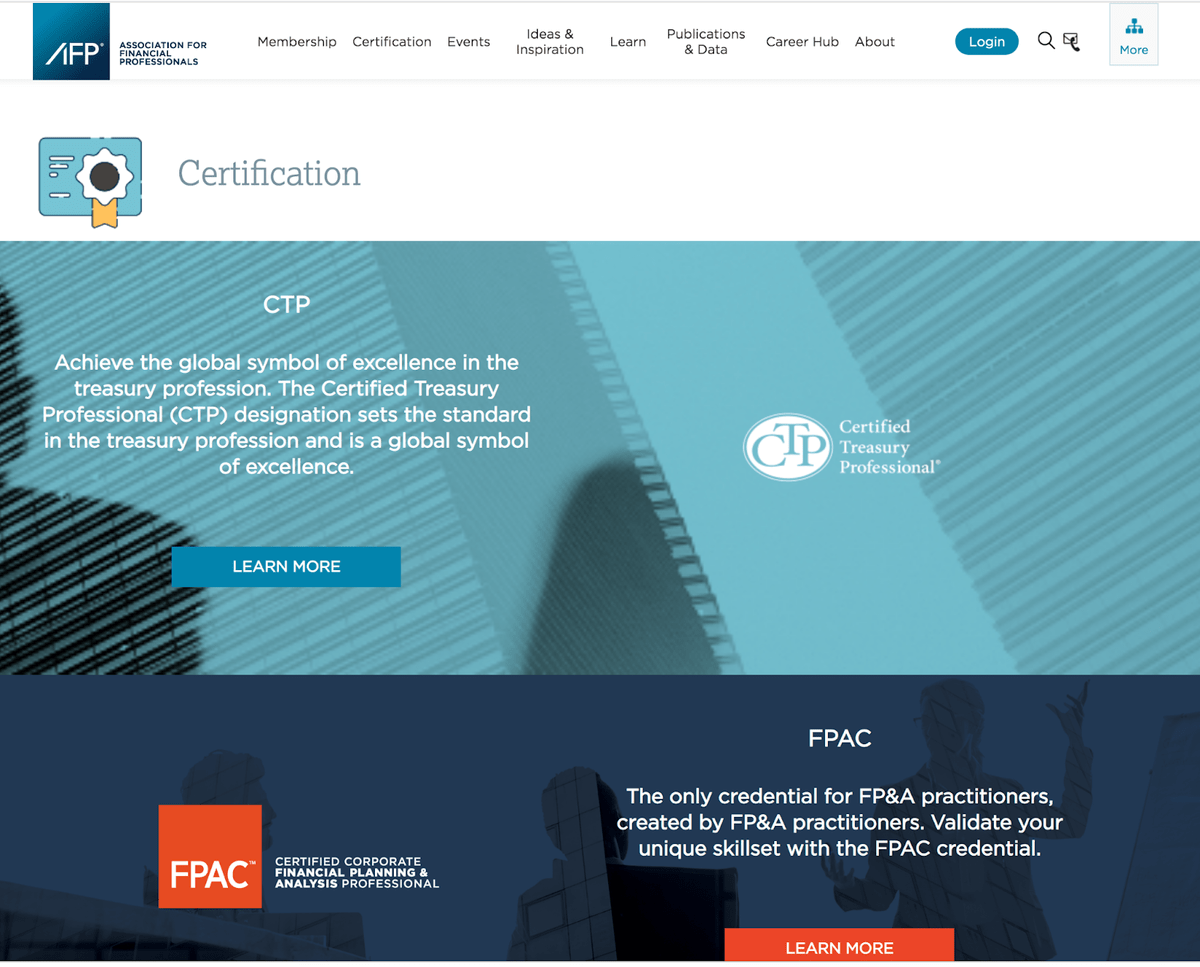

Likewise, the Association for Financial Professionals (AFP) provides a Certified Treasury Professional (CTP) credential that many finance managers pursue.

To get a CTP credential, you’ve got to have a minimum of 2 years of experience in the industry or 1 year of experience alongside a master’s degree in finance or business.

The CTP isn’t the AFP’s only credential on offer for finance managers. The body also awards the Certified Corporate Financial Planning Analysis Professional (FP&A).

This is for aspiring finance managers with a bachelor’s degree in a relevant field or those currently enrolled in a college program with a finance major who will be graduating in the next 2 years.

Both AFP credentials will require you to pass a test.

Finally, another finance manager qualification worth checking out is the Certified Public Accountant (CPA) license.

This is handed out by each U.S. state’s board of accountancy. To get it, you’ve got to pass an exam overseen by the American Institute of Certified Public Accountants (AICPA).

But being a stellar finance manager isn’t just about getting good grades and loads of qualifications. To succeed and enjoy the role, you’ll need to have a few foundational skills.

The skills every finance manager should have include:

- Analytical skills

- Mathematical skills

- Organizational skills

- Communication skills

- People management skills

But again, no 2 companies are alike, so no 2 finance managers will be 100% alike, either.

You may end up having to pursue a range of qualifications and professional accreditations throughout your career as a finance manager.

Finance managers and project management

A couple of decades ago, finance managers and project managers pretty much just stayed in their own lanes. The finance people stuck with numbers, and the project people stuck with logistics. But that’s started to change over the past couple of years.

In fact, finance management and project management have got a lot in common — and more importantly, successful projects demand a firm grasp of how a company’s finances work.

Just think about it, if you’re a project manager, not only do your team projects need to come in on time and on budget, but chances are your projects are also going to be expected to generate some sort of shareholder value. Your work also needs to contribute to the long-term financial success of your organization.

To do that, you’ve got to understand your company’s cash cycle and how the key stages and tasks within each project can fit into it.

If cash cycles are new to you, they’re actually pretty simple.

The cash cycle has 4 basic phases:

- Financing

- Investing

- Operating

- Returning

The financing phase involves getting the funds your business needs.

Investing is all about deciding where to make that money go to work.

Operating is carrying out the tasks or functions you’ve invested in.

And returning is the phase in which you pay back all the money you owe to stakeholders or creditors.

But it works both ways. Financial managers now need to understand all the basics of how projects are run and maintained to know how to budget and forecast for each aspect of those projects.

In a lot of organizations, finance managers and project managers are 2 very different jobs — and the people filling those roles need to work closely with one another. But some teams have a specific role that almost fuses the 2 roles in the form of a finance project manager.As you might have guessed by the job title, a finance project manager is responsible for developing and overseeing enterprise-wide projects that relate to a company’s finances.

The role combines the financial responsibilities of a finance manager with the leadership and coordination skills of a project manager.

Typical duties include project planning, gathering data, cash flow monitoring, financial reporting, managing finance and project teams, and everything in between,

Want to learn more about finances and project management? We’ve got you covered.

How can monday.com help finance managers?

Let’s be honest; managing finances can get complicated when you work multiple teams and many different projects into the equation. That’s where monday.com comes to the rescue.

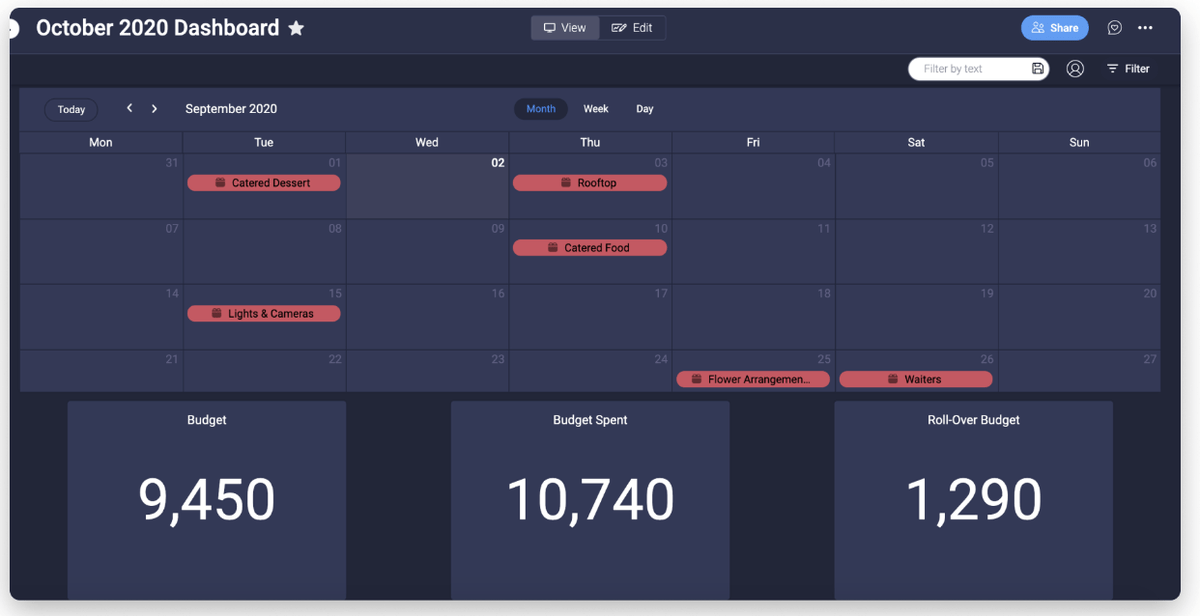

In fact, monday.com has been specifically designed to factor in the budgeting part of project management and automate other duties to make finance management simpler.

There are 3 steps you’ll need to take, which are:

- Set up your board: this is where you create a group and workflow for each project you’re planning. Then, add some items. Each one of those items represents a single process, task, or activity. You can add columns to represent the team member responsible, status, and deadlines.

- Create a numbers column: add a number column, and you can place the budget associated with each individual process within it. Everything in the column then gets automatically added up to provide a total budget for the project. It’s also worth adding a second numbers column, so you can place your actual spend alongside your budget.

- Add formulas: fancy making your workflow simpler? Add some formula columns to show whether you’re within your cost estimate, how much cash you’ve got left, and anything else that’s important to the project.

Believe it or not, that’s it. Budgeting with monday.com is that simple.

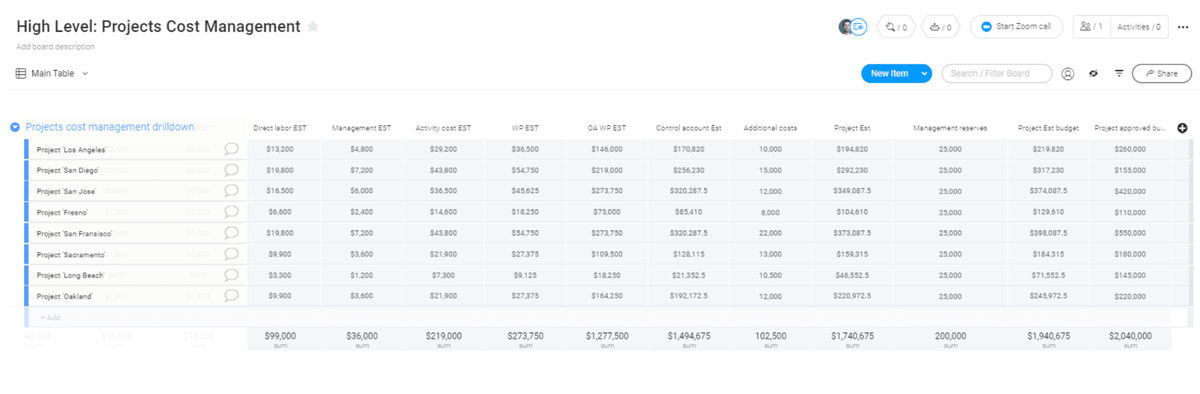

But if you want to look beyond budgets and create a more holistic finance management experience, check out our Project Cost Management Template.

Want to learn more about using monday.com to manage your finances? Let us walk you through it.

Embark on a career as a finance manager

Financial management is one of the most important jobs on a team. After all, it’s the finance manager who’s ultimately responsible for a company’s financial well-being.

They’re the ones allocating funds, budgeting, creating reports with financial data, and doing everything to make sure your business is following the zillion-and-one finance and accounting laws out there.

This is where project managers need to take note — because, to deliver added value to an organization, projects have got to be on time, on budget, and fit in with each company’s respective cash cycle.

Ordinarily, this would be easier said than done. However, if you’ve got monday.com on your side, you’ll be able to succeed using our supercharged Work OS. It enables you to keep track of budgets and control costs to keep projects powering forward.

Ready to stop talking and start managing? Try monday.com free for 14 days now.