Financial project managers (PMs) work in an environment where every decision carries weight. A single budgeting error or capacity miscalculation can disrupt profitability, trigger compliance challenges, or slow down critical initiatives. When teams are spread across regions, currencies, and regulatory frameworks, spreadsheets and disconnected systems introduce risk instead of clarity.

Modern finance organizations need resource management software built for real operational complexity. That means platforms that handle shifting budgets, multi-currency reporting, evolving compliance rules, and the constant demand for accurate, real-time visibility. With the right system in place, finance teams can track capacity with precision, manage budgets proactively, maintain audit-ready documentation, and make confident allocation decisions.

This article highlights the platforms that meet the demands of financial projects in 2026, focusing on the capabilities that matter most for accuracy, compliance, profitability, and operational control. It also examines how leading finance teams evaluate, implement, and scale resource management tools to drive measurable improvements in delivery and financial outcomes.

Key takeaways

Finance project managers operate in environments where accuracy, visibility, and control determine project success. These essential takeaways highlight what matters most when choosing resource management software for financial operations.

- Unified financial workflows: connect budget tracking, resource planning, and project delivery in one platform instead of relying on spreadsheets and disconnected systems.

- Real-time budget and capacity visibility: monitor spending and resource allocation instantly to prevent overruns and improve profitability.

- Proactive portfolio management: use AI-powered insights to identify risks early, standardise processes, and keep financial projects aligned with organisational goals.

- Fast deployment: implement multi-currency tracking, compliance workflows, and ERP integrations in weeks rather than months.

- Transparent reporting: deliver consistent dashboards and audit-ready documentation through structured processes in monday work management.

What makes project managers choose monday work management for financial resource management?

Generic project tools collapse under the weight of finance requirements. Try tracking five currencies across three regulatory frameworks with approval chains that change quarterly: you’ll quickly hit walls with standard platforms.

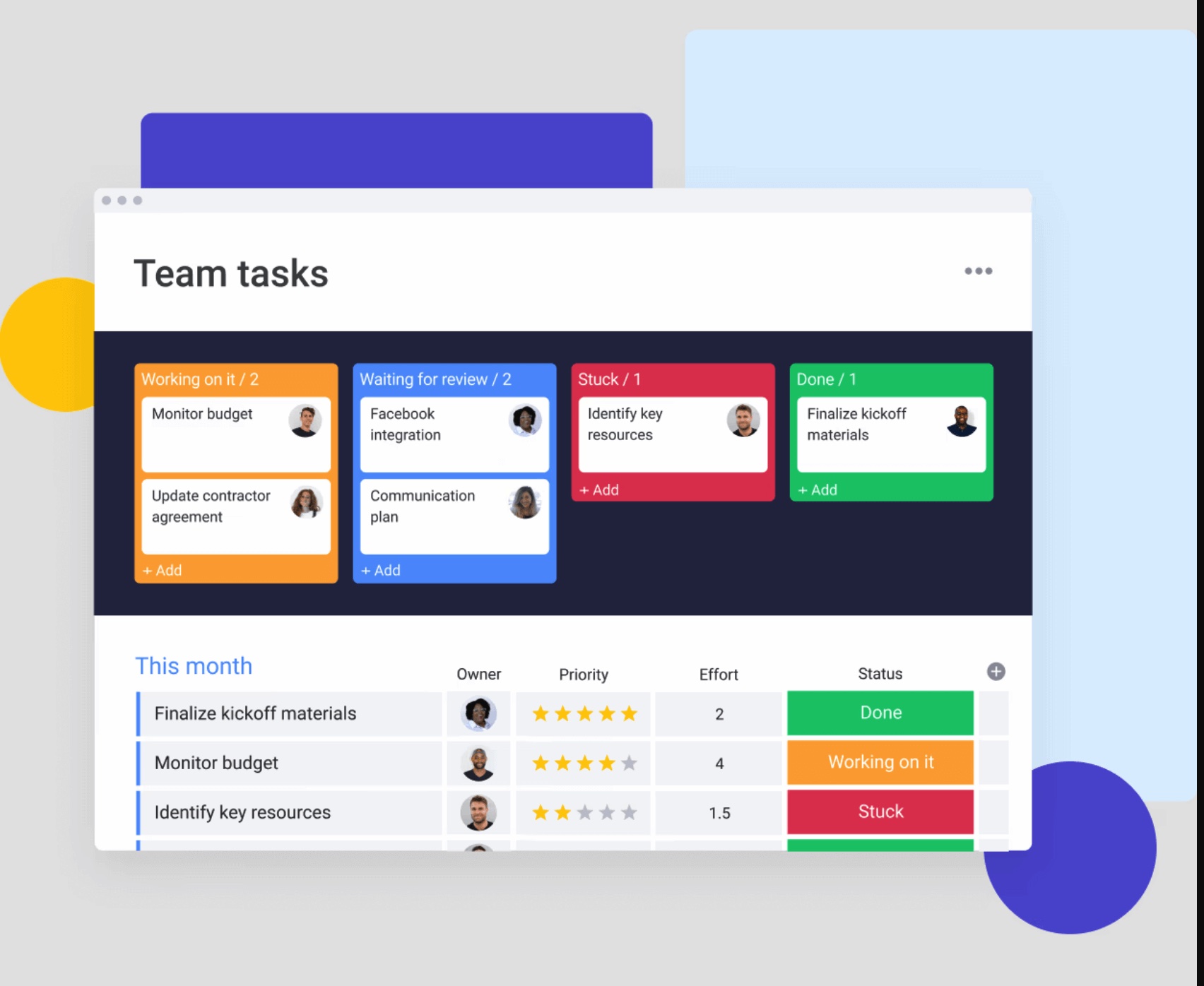

Project managers in finance choose monday work management because it transforms fragmented financial workflows into a unified system. The platform’s enterprise capabilities provide three critical advantages that directly impact financial project success:

- Leadership visibility: executives monitor resource allocation across hundreds of projects simultaneously, with AI-powered risk insights flagging budget overruns before they impact profitability.

- Standardization and alignment: consistent financial reporting across all projects through managed templates and cross-project dependencies.

- Resource optimization: finance PMs allocate both human and financial resources based on real-time capacity data and skill matching.

WIth platforms like monday work management you don’t have to choose between power and usability. Your team gets the financial controls they need without the six-month implementation headache. Finance teams can build custom workflows that match their exact compliance requirements without heavy IT involvement.

monday work management top features for financial resource management

Let’s look at exactly what monday work management delivers for finance teams—and how these features solve your specific resource challenges. These aren’t standalone features—they’re built to work together, giving you both the speed you need and the compliance trails your auditors demand.

Real-time budget tracking and cost allocation

Budget surprises kill financial projects. You need to spot variances the moment they happen, not when you’re running month-end reports. monday work management provides real-time budget tracking that automatically updates as resources are allocated and costs are incurred.

The platform’s dashboards display budget vs. actual spending with drill-down capabilities into individual cost hubs. You can track both direct costs like contractor fees and indirect costs like overhead allocation, all within customizable views that match your organization’s financial reporting structure.

Resource capacity planning with workload views

Understanding team capacity is essential for profitable project delivery in finance. The Workload View gives project managers instant visibility into how resources are allocated across the entire portfolio.

Finance PMs can quickly identify:

- Overallocation: spot when team members are exceeding capacity.

- Underutilization: find available bandwidth for upcoming projects.

- Future needs: forecast resource requirements based on the project pipeline.

- Skills and certifications: reference the Resource Directory to match people to work accurately.

This clarity helps prevent burnout, maximise billable hours, and ensure resources are assigned with precision.

Portfolio management for financial projects

Managing financial projects at scale requires a clear view of how initiatives connect, evolve, and impact one another. The platform’s portfolio management tools consolidate project data into structured, executive-ready dashboards.

Project managers gain insights into:

- Portfolio-wide performance: review trends across hundreds of projects.

- Risk indicators: use AI-generated summaries to surface emerging issues early.

- Dependencies and bottlenecks: rely on Portfolio Gantt views to see how delays affect downstream work.

- Strategic alignment: ensure resources and timelines support financial and compliance goals.

Customizable dashboards and financial reporting

Every financial institution has unique reporting requirements. The platform offers over ten customizable dashboard widgets that can be configured to match your specific KPIs and compliance needs.

Create dashboards that track project profitability, resource utilization rates, budget variance, and custom financial metrics specific to your organization. These dashboards update in real-time and can be shared with stakeholders at different permission levels.

Automated approval workflows

Financial projects often require multiple layers of approval for budget changes, resource allocation, and project milestones. monday work management’s automation capabilities eliminate manual approval bottlenecks.

Set up custom approval chains that route requests to the right stakeholders based on project value, risk level, or resource type. Automated notifications keep approvers informed while maintaining a complete audit trail of all decisions.

Time tracking for accurate cost allocation

Accurate time tracking is fundamental for project profitability analysis and client billing in financial services. The platform’s built-in time tracking features capture actual hours worked at the item level.

Team members log time directly within their workflow, eliminating the need for separate timekeeping systems. This data automatically feeds into project cost calculations, helping you understand true project profitability.

Integration with financial systems and ERP platforms

Financial project managers thrive when they work in a connected, unified environment. monday work management integrates with over 200 platforms including major ERP systems, financial software, and banking platforms.

Connect your existing SAP, Oracle, or Microsoft Dynamics instances to maintain data consistency across systems. Bi-directional sync ensures that resource costs, project budgets, and financial data flow seamlessly between platforms.

Multi-currency support and cost tracking

Global financial institutions need resource management platforms that handle multiple currencies seamlessly. The platform supports multi-currency tracking across projects, automatically updating exchange rates and converting costs for consolidated reporting.

Track resource costs in local currencies while maintaining portfolio-level visibility in your reporting currency. Custom fields can be configured to capture currency-specific compliance requirements or regional cost variations.

How a project manager in finance benefits from monday work management

Finance project managers see immediate, measurable improvements when they adopt monday work management. These benefits strengthen over time as teams build consistent, reliable processes on the platform.

Operational efficiency

Automated workflows remove hours of manual reporting, status tracking, and resource allocation tasks. Finance PMs gain time for strategic planning, stakeholder alignment, and portfolio oversight instead of administrative work.

Proactive risk management

AI-powered insights scan project updates in real time, identifying potential budget overruns, resource conflicts, and timeline risks before they escalate. This early visibility allows teams to act quickly and prevent costly surprises.

Enhanced stakeholder confidence

Executive dashboards provide clear visibility into utilization, budget performance, and project status across the portfolio. Managed templates ensure consistent reporting, giving leadership the transparency needed for confident decision-making.

The platform’s strong adoption rate ensures data stays accurate and complete, creating a dependable foundation for financial planning and ongoing resource optimization.

How to implement effective resource management in finance

Strong financial resource management depends on more than choosing the right platform. It requires a structured setup that supports accurate allocation, consistent reporting, and clear visibility across every project.

These steps outline the approach used by the most successful finance teams to build a reliable, scalable foundation in monday work management.

Step 1: set up your resource directory and team profiles

Getting resource management right in finance isn’t just about the software—it’s about how you implement it. Here’s the roadmap our most successful finance customers follow. The foundation of successful resource management starts with comprehensive team data that enables intelligent allocation decisions.

Start by establishing your resource directory with complete team member profiles including skills, certifications, cost rates, and availability. This centralized repository becomes the foundation for intelligent resource allocation across all your financial projects.

Step 2: create standardized project templates

Next, create standardized project templates that include your required financial fields, approval workflows, and reporting structures. These managed templates ensure consistency across all projects while allowing flexibility for project-specific requirements.

Templates should include standard budget categories, compliance checkpoints, and approval gates that match your organization’s financial governance requirements. This standardization reduces setup time for new projects while maintaining regulatory compliance.

Step 3: configure portfolio dashboards for stakeholder visibility

Configure your portfolio dashboards to provide the exact visibility your stakeholders need. Set up views for executives showing high-level financial performance, detailed views for PMs tracking resource utilization, and specialized dashboards for compliance reporting.

Dashboard configuration should reflect your organization’s reporting hierarchy and decision-making processes. Different stakeholder groups need different levels of detail and different metrics to make effective decisions about resource allocation.

Step 4: implement cross-project dependencies and capacity management

Implement cross-project dependencies to understand how resource allocation in one project impacts others. The capacity manager provides a live view of resource availability across your entire portfolio, enabling smart decisions about new project intake and resource reallocation.

This step connects individual project resource needs to your overall portfolio capacity, preventing overallocation and ensuring realistic project timelines based on actual resource availability.

Try monday work management

Comparison table: monday work management vs competing platforms

Let’s compare monday work management against other competitors on the features that actually matter for finance teams:

| Feature | monday work management | Smartsheet | Wrike | Asana |

|---|---|---|---|---|

| Multi-currency support | Native support with automatic conversion | Limited to 5 currencies | Requires add-on | Manual entry only |

| SOX compliance features | Built-in audit trails and controls | Partial compliance | Full compliance | Limited support |

| ERP integration | 200+ integrations including SAP, Oracle | SAP only | Multiple ERPs | Limited integrations |

| Real-time budget tracking | Live dashboards with drill-down | Daily updates | Weekly updates | Real-time with delays |

| AI-powered risk insights | Proactive risk identification | No AI features | Basic AI | Rule-based only |

| Approval workflow automation | Unlimited custom workflows | 10 workflow limit | Pre-built only | Manual approvals |

| Resource capacity planning | Visual workload management | Spreadsheet view | Calendar only | Basic capacity view |

| Financial reporting customization | Fully customizable dashboards | Fixed reports | Some customization | Limited options |

| Time to implementation | 2-4 weeks average | 3-6 months | 2-3 months | 4-8 weeks |

| User adoption rate | Highest in industry per G2 | Average | Below average | Average |

How Playtech's PMO department transformed their project management

Playtech, a global fintech leader, struggled to manage resources across a rapidly growing project portfolio. Their PMO faced fragmented tools, inconsistent reporting, and limited visibility into how teams and budgets were allocated across departments. monday work management helped them rebuild their operations into a unified, scalable system.

Key improvements achieved with monday work management

- Unified data visibility: Playtech consolidated scattered project information into one workspace, giving teams real-time insight into resource utilization, project status, and cross-department dependencies.

- Standardized delivery processes: managed templates enabled the PMO to create consistent delivery frameworks while still adapting workflows for different financial products. This removed process variance and improved execution quality.

- Executive portfolio oversight: automated dashboards now provide leadership with instant visibility across hundreds of active projects. High team adoption ensures reliable data, improving forecasting accuracy and supporting smarter resource planning.

Together, these changes strengthened governance, increased delivery speed, and gave Playtech’s PMO the control needed to support an expanding, highly regulated portfolio.

It's time to transform your financial resource management

Your reality as a finance PM? Tighter budgets, faster timelines, and compliance requirements that never stop growing. It’s a tough spot. The right resource management platform makes the difference between reactive firefighting and proactive portfolio optimization.

monday work management provides the comprehensive capabilities finance teams need to excel. From AI-powered risk insights that prevent budget overruns to automated workflows that eliminate manual reporting, the platform transforms how financial organizations manage their most valuable resources.

When you can see exactly where your money’s going, automate the compliance steps that slow you down, and put the right people on the right work — that’s when your finance projects really take off. Finance teams gain the operational efficiency they need while maintaining the regulatory compliance that’s essential in financial services.

The content in this article is provided for informational purposes only and, to the best of monday.com’s knowledge, the information provided in this article is accurate and up-to-date at the time of publication. That said, monday.com encourages readers to verify all information directly.

Try monday work managementFrequently asked questions

How long does it take to implement resource management software in a finance department?

Implementation of resource management software in a finance department typically takes two to four weeks with monday work management. This includes initial setup, data migration, workflow configuration, and team training, though complex organizations with multiple compliance requirements may need additional time for customization.

What's the typical ROI for resource management software in financial services?

The typical ROI for resource management software in financial services ranges from 200-400% within the first year. Organizations report savings through reduced project overruns, improved resource utilization, decreased manual reporting time, and faster project delivery cycles.

Can resource management software handle SOX compliance requirements?

Yes, resource management software can handle SOX compliance requirements when properly configured. monday work management provides built-in audit trails, approval workflows, access controls, and documentation features that support SOX compliance for financial project management.

How does resource management software integrate with ERP systems?

Resource management software integrates with ERP systems through APIs, webhooks, or pre-built connectors. monday work management offers native integrations with major ERP platforms like SAP and Oracle, enabling bi-directional data sync for resource costs, project budgets, and financial reporting.

What's the difference between project management and resource management software for finance?

Project management software focuses on task scheduling and milestone tracking, while resource management software for finance emphasizes capacity planning, cost allocation, and budget optimization. Finance teams need both capabilities integrated, which platforms like monday work management provide in a unified solution.

How much should finance teams budget for resource management software?

Finance teams should budget between $30-75 per user per month for enterprise resource management software. Total costs depend on user count, required features, integration needs, and support levels, with most organizations seeing positive ROI within 4-6 months.

Get started

Get started