You’re managing a quarterly budget review when your CFO asks for real-time visibility into three major system implementations, two compliance initiatives, and next quarter’s resource allocation. You have 30 minutes to pull together status updates from five different departments, each using their own combination of spreadsheets, email threads, and project tracking systems. Sound familiar?

Project managers in finance face a unique challenge that generic project management software can’t solve. Financial projects demand real-time budget tracking, seamless integration with existing financial systems, and complete audit trails for compliance — all while coordinating cross-functional teams across tight deadlines and shifting priorities. The best project management software for finance teams goes beyond basic task management to provide the specialized capabilities that financial operations require.

In this practical article, we’ll break down the essential features finance PMs need in their project software, compare how top platforms stack up for financial work specifically, and show you what real transformation looks like when you find the right fit. We’ll also cover essential capabilities like budget tracking and compliance documentation, examine real implementation examples, and provide a practical framework for evaluating platforms.

Key takeaways

Project management in finance comes with pressures that generic tools are not built to handle. Tight regulatory controls, constant budget scrutiny, and cross-functional dependencies mean finance PMs need clarity, control, and speed at the same time. These takeaways highlight what matters most when choosing project management software for finance in 2026.

- Finance-first visibility: real-time budget tracking, approvals, and portfolio dashboards are essential for keeping projects aligned with financial reality.

- Built-in compliance control: audit trails, approval workflows, and permission controls reduce risk and simplify internal and external audits.

- Connected financial systems: seamless integrations with ERP and accounting tools prevent double entry and keep project data accurate.

- Operational efficiency at scale: automation and AI help finance PMs identify risks early and manage complex initiatives without adding overhead.

- Flexible control with monday work management: finance teams centralize projects, budgets, and approvals in one platform that balances governance with adaptability.

What makes project managers choose monday work management for financial project management?

Project managers in Finance choose monday work management because it solves their most critical challenge: work scattered across multiple tools. Instead of juggling spreadsheets, email threads, and disconnected project management systems, teams gain a single source of truth where all financial projects, budgets, timelines, and stakeholder communications live together.

For project managers in PMO departments within financial services organizations, this centralization transforms how they work. The platform enables you to manage complex financial projects with cross-functional teams while maintaining the visibility and control that financial operations demand. Customizable workflows adapt to your specific financial processes — whether you’re managing budget approvals, compliance initiatives, or system implementations — without forcing you to change how your team works.

Financial institutions trust monday work management because it delivers both flexibility and governance. The platform’s managed templates standardize workflows while maintaining the agility to respond to rapidly changing requirements. This approach has helped organizations save thousands of manual actions per month while ensuring every transaction meets compliance standards.

monday work management top features for financial project management

Let’s dive into the features that solve real problems finance PMs face every day — from tracking budget variances to documenting approval chains for your next audit.

Centralized workflow management

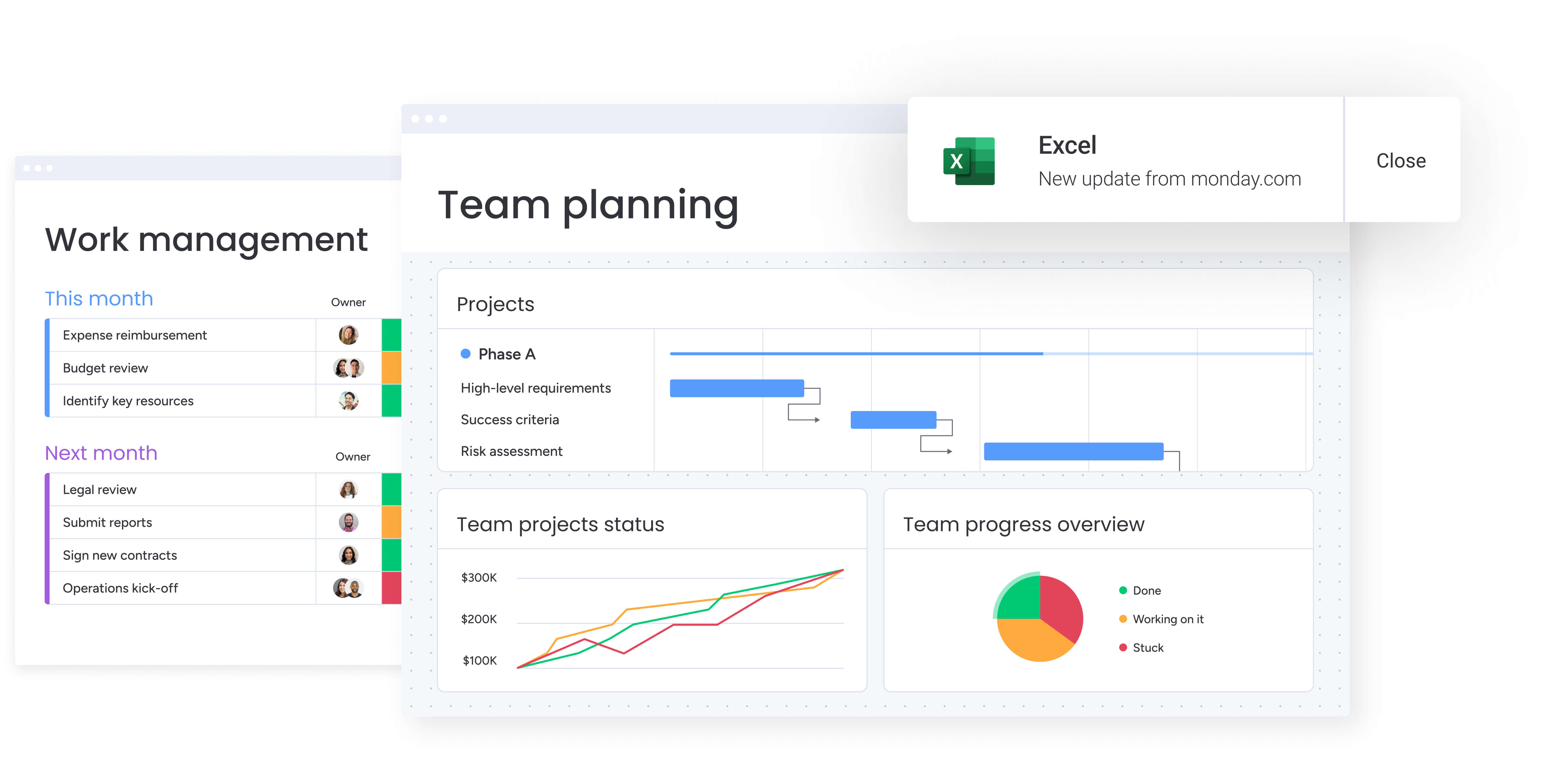

monday work management consolidates all your financial projects, tasks, communications, and documents into one unified workspace. This eliminates information silos and ensures every detail is tracked and accounted for.

For finance PMs, centralization means the end of the spreadsheet scavenger hunt. You’ll see budget approvals, compliance milestones, and team dependencies all in one place —no more digging through email chains to find who approved what. When something changes, the platform alerts everyone who needs to know — cutting those 30-email threads down to zero.

Real-time budget tracking and financial reporting

The platform provides built-in budget tracking capabilities that let you monitor project costs against approved budgets in real time. You can set budget thresholds, track actual spending, and receive automated alerts when projects approach budget limits. Custom dashboards display financial metrics in visual formats that make it easy to spot trends and identify issues before they become problems.

This feature is essential for project managers who need to prevent budget overruns and demonstrate financial accountability. Most project platforms treat your budget as just another number. monday work management gets that finance is different — you need to track CapEx vs OpEx allocations, phase-specific spending, and generate reports your CFO will actually accept.

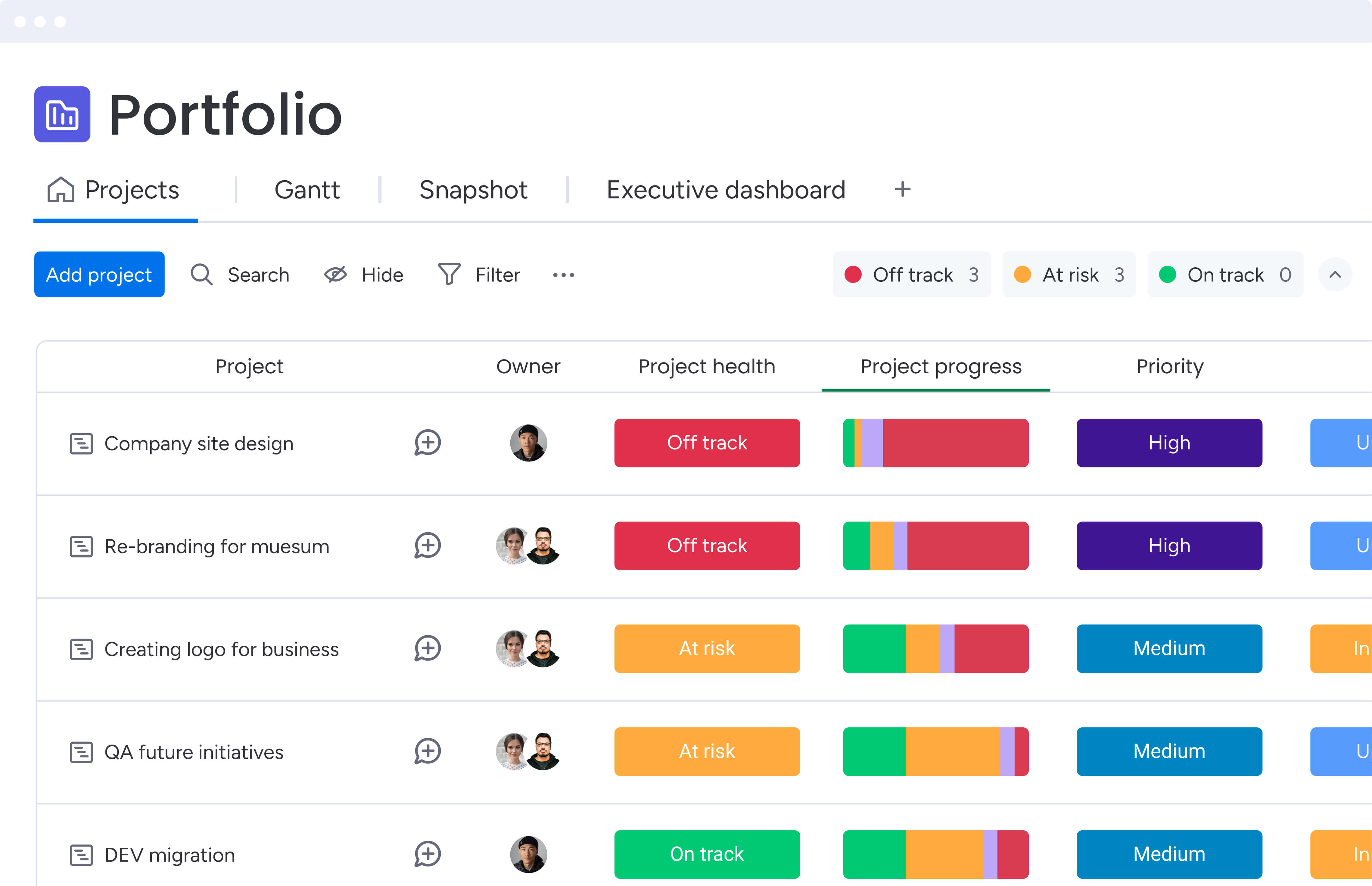

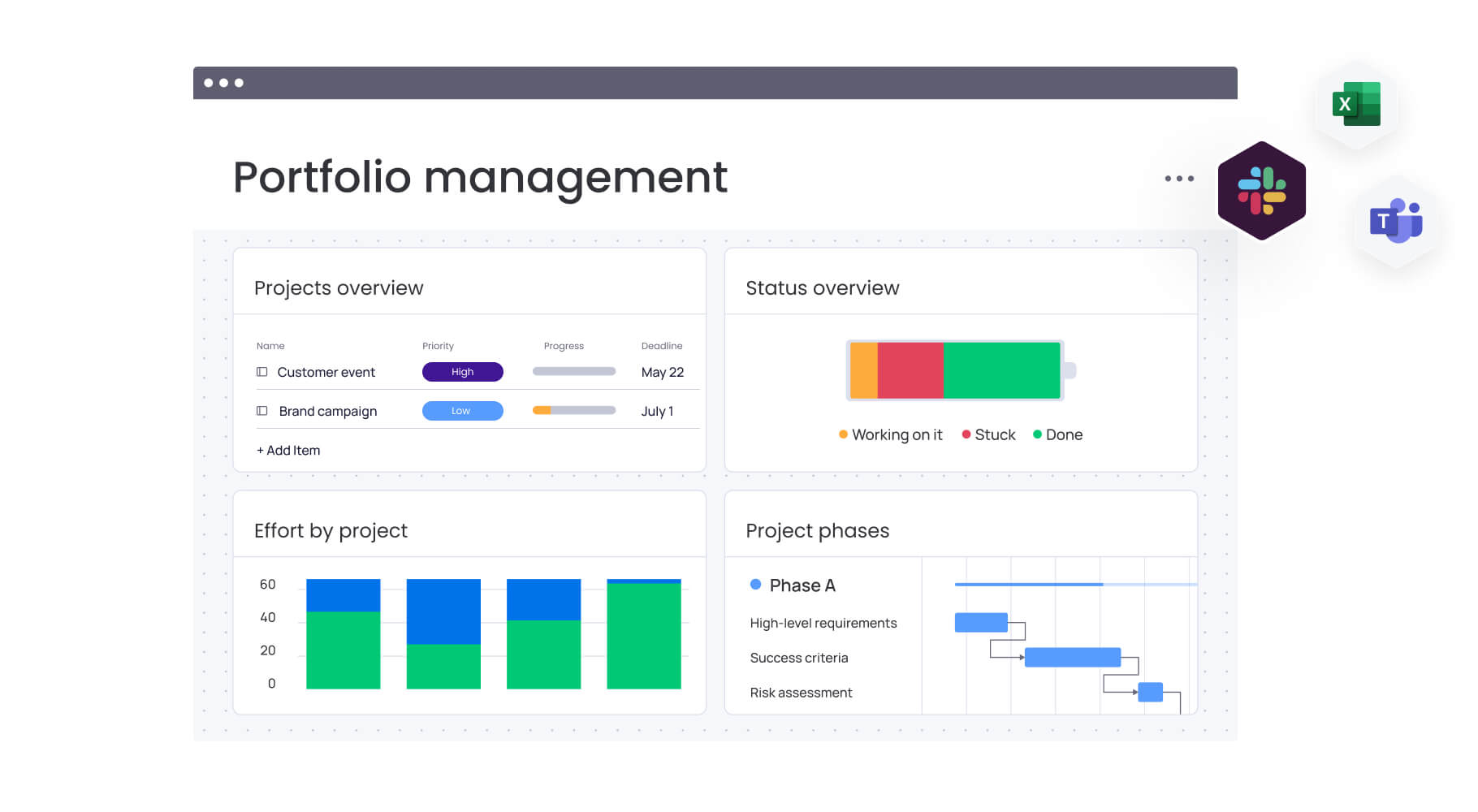

Customizable dashboards and reporting

monday work management offers pre-built and custom dashboards that aggregate data from multiple projects to give you portfolio-level insights. You can create executive dashboards that show high-level financial metrics, operational dashboards that track day-to-day progress, and specialized dashboards for compliance, resource allocation, or risk management. All dashboards update in real time as your teams work.

These dashboards eliminate those frantic end-of-week report compilations. Your CFO gets the real-time budget variance data they need, while your team leads see exactly where their deliverables stand — no more emergency status meetings. You can filter data by project, department, budget category, or any custom field relevant to your financial operations.

Compliance and audit trail capabilities

The platform automatically maintains detailed audit trails of all project activities, changes, and approvals. Every update is timestamped and attributed to specific users, creating the documentation trail that financial audits require. You can configure approval workflows that enforce segregation of duties and ensure all financial decisions follow your governance policies.

This functionality is critical for project managers in finance who must demonstrate compliance with SOX, GDPR, or industry-specific regulations. When the auditors come knocking, you’ll have everything they need: Jane approved the $50K budget increase on March 15th at 2:30pm, with the full risk assessment document attached to her approval. No scrambling, no guessing.

Integration with financial systems

monday work management integrates with major financial and accounting systems including QuickBooks, SAP, Oracle, and custom ERP platforms. These integrations enable bidirectional data flow, so project budgets, actual costs, and resource allocations sync automatically between your project management workspace and your financial systems of record.

For project managers managing financial transformation initiatives or system implementations, these integrations eliminate double-entry and ensure data consistency. You can pull financial data into monday work management for project planning, then push project actuals back to your accounting system for financial reporting — all without manual data transfers.

Try monday work managementHow a project manager in finance benefits from monday work management

Implementing monday work management delivers benefits you’ll feel immediately — and your leadership will see in the numbers. Finance PMs don’t just get more efficient project tracking; they transform how teams execute, report, and deliver.

- Time savings: become immediately apparent. Teams eliminate hours of wasted time each week caused by work scattered across tools and lack of project visibility. The platform takes over your administrative busywork — sending reminders, updating statuses, syncing data — so you can focus on what actually matters: preventing budget overruns and keeping stakeholders aligned.

- Cost efficiency: improves through early identification of budget overruns and optimized resource allocation across your portfolio. The platform’s AI-powered risk insights scan hundreds of projects simultaneously, flagging potential issues before they impact delivery. This proactive approach helps teams reduce project costs while maintaining quality standards.

- Compliance and accuracy: strengthen with complete audit trails that automatically document every financial project activity. All financial projects meet regulatory requirements without manual oversight, reducing risk and ensuring accountability at every level.

6 steps to solve financial project management with monday work management

Let’s walk you through exactly how to set up monday work management for financial projects. Follow these six steps and you’ll have a system that delivers both the flexibility your teams want and the controls your auditors demand.

Step 1: centralize your financial project portfolio

Import all active financial projects into monday work management and create a master portfolio view. Use the platform’s import tools to bring in data from spreadsheets, legacy systems, or other project management tools. Organize projects by department, budget category, or strategic initiative to match your financial reporting structure.

Step 2: configure budget tracking and financial controls

Set up budget columns for each project and define spending categories that align with your chart of accounts. Configure automated alerts to notify you when projects approach budget thresholds. Create custom formulas to calculate variance between planned and actual costs.

Step 3: build approval workflows

Set up multi-level approvals for budget changes, scope modifications, and resource allocations. Configure the platform to require specific approvals before projects can move to the next phase. This ensures your organization’s financial controls are enforced automatically.

Step 4: connect to your financial systems

Configure data synchronization to ensure project budgets and actuals flow between systems automatically. Set up integrations with your calendar and communication tools to capture all project-related activities. This eliminates manual data entry and ensures consistency across platforms.

Step 5: create dashboards for stakeholder visibility

Build executive dashboards that show portfolio-level financial metrics, project health indicators, and resource utilization. Create operational dashboards for your team that display daily priorities, upcoming deadlines, and budget status. Configure automated dashboard sharing so stakeholders receive updates on the schedule that works for them.

Step 6: establish templates for recurring projects

Create project templates for common financial initiatives like quarterly closes, audit preparations, or budget planning cycles. Include all standard tasks, approval workflows, and budget structures in your templates. This standardization ensures consistency across projects and accelerates project initiation.

Comparison table: monday work management vs competing platforms for financial project management

When evaluating a project management software list for finance teams, it’s essential to compare platforms based on features that directly impact financial project success.

| Feature | monday work management | Microsoft Project | Smartsheet | Asana |

|---|---|---|---|---|

| Built-in budget tracking | Yes, with real-time alerts | Limited, requires Project Plan 3+ | Basic, via formulas | No, requires integrations |

| Financial system integrations | 200+ including QuickBooks, SAP, Oracle | Microsoft ecosystem only | Limited third-party | Limited third-party |

| Audit trail and compliance | Complete automated audit trail | Basic activity log | Basic activity log | Basic activity log |

| Customizable approval workflows | Unlimited custom workflows | Limited workflow options | Limited workflow options | Basic approval routing |

| Resource capacity planning | Visual workload management | Requires Project Plan 5 | Basic resource views | Limited resource features |

| Implementation time | Less than 4 months to full value | 3-6 months typical | 2-4 months typical | 1-3 months typical |

| Price per user/month | From $10 (billed annually) | From $10 (limited features) | From $12 (min 3 users) | From $13.49 |

| Multi-currency support | Yes, with custom fields | Yes, in higher tiers | Via formulas | No |

| Mobile app functionality | Full feature parity | Limited mobile features | Limited mobile features | Good mobile features |

How Playtech transformed their financial project delivery

Playtech’s project managers relied on spreadsheets, email, and notepads to manage countless client projects across their global gaming software operations. As the industry underwent digital transformation, clients demanded more frequent updates and faster results. The scattered tools made it increasingly difficult to track project costs, maintain visibility into resource allocation, and demonstrate progress to stakeholders.

Playtech implemented monday work management to bring their established project methodology to life in a single platform. They created standardized project templates that captured all phases from initiation to closure, built custom boards for project approvals and budget tracking, and integrated with Jira to connect technical development work with business project management.

The platform’s formula columns enabled automatic cost calculations, while the portfolio view gave leadership real-time visibility into all running projects.

The results transformed their PMO department. They achieved significant improvements across all key performance indicators:

- 26% increase in efficiency: across the PMO department.

- 49% increase in collaboration: and transparency with stakeholders.

- 23% increase in meeting KPIs: and project delivery targets.

- 3 hours saved per person per week: through automated workflows.

The platform functioned like resource management software, eliminating resource booking errors by separating preliminary discussions from active projects. Most importantly, Playtech achieved week-by-week cost visibility that enabled proactive budget management.

Ready to transform your financial project management function?

Financial project management demands more than generic tools — it requires a platform that understands the unique challenges of managing budgets, compliance, and cross-functional coordination at scale. monday work management brings together the visibility, control, and automation that finance teams need to deliver projects successfully while maintaining the regulatory standards your organization requires.

The platform’s enterprise capabilities provide a new layer of visibility and control where teams already work. AI-powered portfolio reports instantly generate executive-level summaries with trends and risks, while managed templates standardize entire workspaces across hundreds of projects while maintaining flexibility.

Join thousands of organizations who trust monday work management to centralize their workflows and deliver projects on time and within budget. With our 14-day free trial, you can experience centralized financial project management with no risk.

Try monday work managementFrequently asked questions

How does monday work management ensure financial data security?

monday work management provides enterprise-grade security with SOC 2 Type II certification, ISO 27001 compliance, and GDPR adherence. The platform offers IP restrictions, two-factor authentication, multiple SSO options, BYOK (Bring Your Own Key) encryption, and tenant-level encryption. Role-based permissions let you control exactly who can view or edit sensitive financial data, while complete audit trails track every access and modification for compliance purposes.

What is the typical implementation timeline for finance teams?

Most finance teams achieve full value from monday work management in less than four months. Initial setup and basic workflows can be operational within days, while more complex integrations with financial systems and custom workflow development typically complete within six to eight weeks. The platform's intuitive interface means team members become productive quickly, with most users comfortable within two to four weeks.

Can monday work management replace our existing financial tools?

Don't worry — we're not asking you to rip out your financial systems. monday work management connects to your existing ERP and accounting software, adding the project management layer these systems desperately need without disrupting your financial backbone. This approach lets you maintain your systems of record while gaining the project visibility and collaboration capabilities that traditional financial systems don't provide.

How do you calculate ROI for project management software in finance?

Calculate ROI by measuring time savings from centralized workflows, cost avoidance from early budget overrun detection, and productivity gains from improved resource allocation. Typical metrics include hours saved per employee per week, reduction in project delays, decrease in budget overruns, and improvement in on-time delivery rates.

What training is required for finance professionals to use the platform?

monday work management requires minimal training due to its intuitive interface. Most finance professionals become productive within their first week using the platform. monday.com provides comprehensive training resources including the monday Academy, live webinars, documentation, and 24/7 support. For enterprise implementations, dedicated onboarding specialists help configure the platform to match your financial workflows and train your team on best practices.

How does the platform handle multi-currency and international projects?

monday work management supports multi-currency financial tracking through custom currency columns and formula fields. You can set project budgets in different currencies, track exchange rates, and consolidate financial reporting across international projects. The platform's flexibility lets you create custom fields for any financial data structure your organization requires, including multi-entity consolidation and inter-company transactions.