Finance PMOs don’t get the luxury of slow mistakes. You’re running portfolios where one late dependency can blow a quarter’s budget, where every project ties directly to regulatory obligations, and where executives expect crystal-clear visibility at all times. When your work is spread across spreadsheets, emails, PDFs, and status meetings, you’re not managing a portfolio — you’re putting out fires with a teaspoon.

The best portfolio management software changes that story instantly. It turns scattered project data into real-time intelligence, automates the reporting that normally eats half your week, and surfaces risks long before they show up in a steering committee meeting. Instead of reacting to problems, finance PMOs finally get to operate strategically — optimizing budget, capacity, compliance, and outcomes with confidence.

If you’re ready to replace chaos with clarity, eliminate manual reporting, and give your executives a portfolio they can trust at a glance, you’re exactly where you need to be. Let’s unlock the solutions built for the high-stakes, no-nonsense reality of financial project management.

Key takeaways

Choosing the right portfolio management platform doesn’t just make finance PMOs more organized — it fundamentally elevates how your organization plans, governs, and delivers strategic work. Here’s what the top solutions empower you to do.

- Shift to proactive portfolio control: real-time dashboards replace manual updates and reveal risks early.

- Strengthen compliance automatically: built-in audit trails and approvals keep every project regulation-ready.

- Optimize resources intelligently: capacity insights and skills-based allocation prevent overloading teams.

- Leverage monday work management’s AI: automated risk detection surfaces issues before they impact budgets or timelines.

- Integrate seamlessly with finance systems: native and API connections eliminate data silos and manual reconciliation.

What makes portfolio management software essential for finance PMOs?

Portfolio management software serves as the central nervous system for finance project managers overseeing multiple initiatives. Unlike basic project tracking tools, these platforms provide comprehensive visibility across your entire portfolio — from budget health and resource allocation to risk identification and strategic alignment.

When you understand exactly why you need portfolio management software, you’ll make smarter choices about which platform to select and how to roll it out. The following capabilities demonstrate how these platforms address the unique challenges finance teams face when managing complex project portfolios.

Key benefits for project managers in finance:

- Unified visibility: see all projects, budgets, and resources in one place instead of juggling disconnected spreadsheets.

- Automated compliance: maintain audit trails and documentation automatically for regulatory requirements.

- Real-time insights: monitor portfolio health with live dashboards that surface risks before they escalate.

- Resource optimization: balance team capacity across projects to prevent burnout and maximize utilization.

The distinction between portfolio vs project management becomes clear when you’re managing dozens of concurrent initiatives. While project management tools handle individual projects well, portfolio management platforms excel at orchestrating complexity across departments, providing the governance and visibility finance organizations require.

Critical features finance project managers need

Finance teams need specific features that others don’t. Let’s focus on the capabilities that actually solve your biggest challenges when managing financial projects at scale — so you can prioritize what truly matters for your team.

Portfolio-level dashboards and reporting

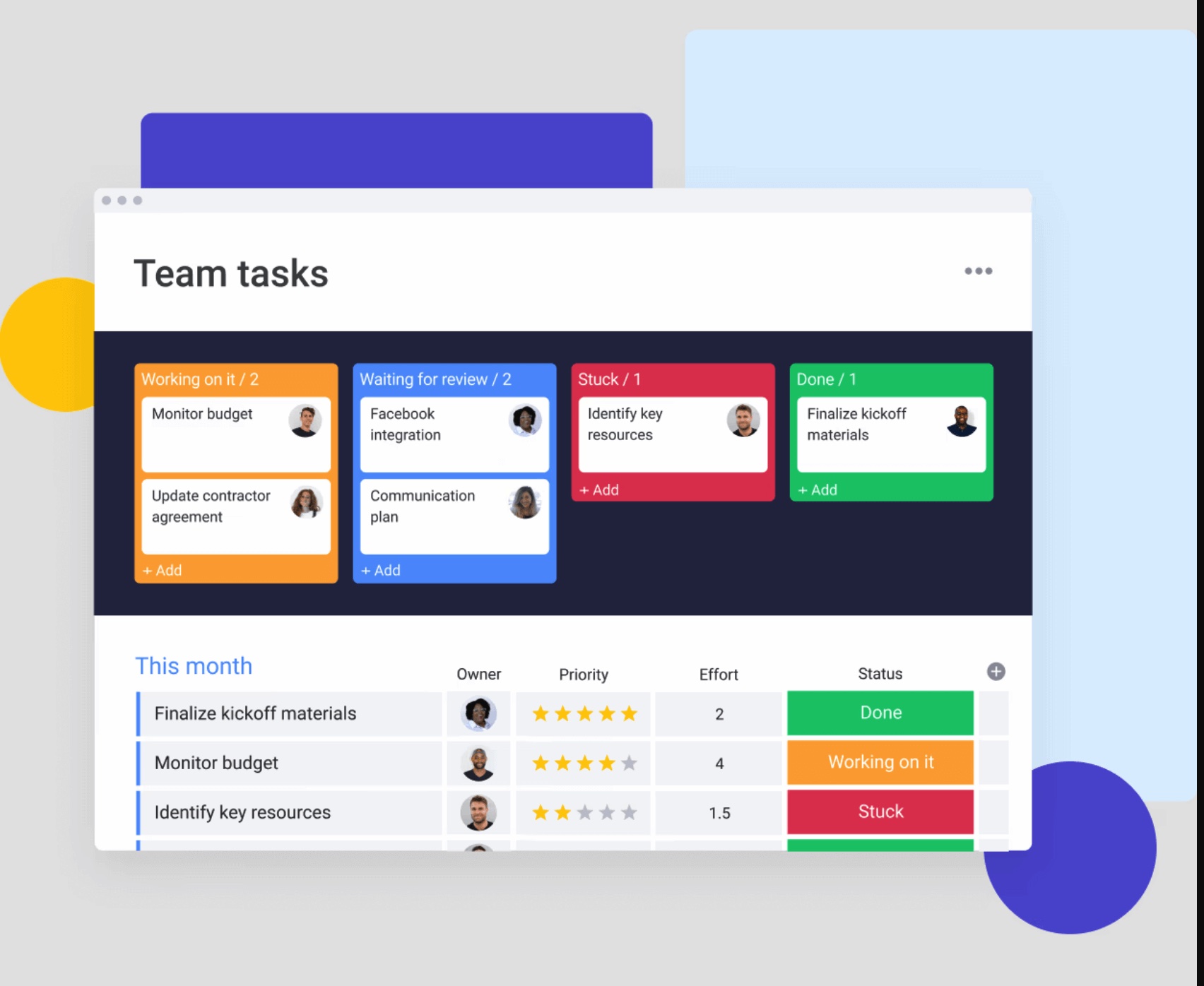

Real-time dashboards transform how project managers handle stakeholder communication. Instead of manually compiling data from multiple sources, you gain instant visibility into critical portfolio metrics.

Essential dashboard capabilities:

- Budget variance: track planned versus actual spend across all projects.

- Timeline status: monitor which initiatives are on track, at risk, or delayed.

- Resource utilization: see team capacity and allocation at a glance.

- Risk indicators: identify potential issues before they impact delivery.

These dashboards serve as your team’s single source of truth — giving executives the real-time updates they need while saving you from spending every Friday afternoon cobbling together status reports.

Financial tracking and budget management

Finance-specific portfolio management requires robust budget tracking capabilities that go beyond basic cost logging. These features ensure you maintain financial control while meeting compliance requirements.

Core financial management features:

- Multi-currency support: track global projects with automatic conversion.

- Cost allocation: assign expenses to specific departments or cost centers.

- Forecast accuracy: compare projected costs against actuals to improve future estimates.

- ROI tracking: demonstrate project value with clear financial metrics.

When these capabilities integrate directly with your workflows, you maintain financial visibility without duplicate data entry or reconciliation headaches.

Resource management and capacity planning

Effective resource management prevents the double-booking and capacity conflicts that derail financial projects. The right platform provides comprehensive visibility into how your team’s time and skills are allocated across your portfolio.

Key resource management capabilities:

- Skills-based allocation: match team members to projects based on expertise.

- Capacity forecasting: predict future resource needs based on pipeline projects.

- Cross-project visibility: see how resources are distributed across your portfolio.

- Workload balancing: identify and resolve over-allocation before it impacts delivery.

This visibility helps you make data-driven staffing decisions and justify resource requests to leadership.

Compliance and audit capabilities

Financial services organizations face strict regulatory requirements that generic project tools can’t address. These specialized features ensure your portfolio management practices meet industry standards while reducing administrative overhead.

Essential compliance features:

- Automated audit trails: track every change with timestamps and user attribution.

- Permission controls: manage access at granular levels for data security.

- Document management: centralize compliance documentation with version control.

- Approval workflows: enforce review processes that meet regulatory standards.

These capabilities ensure your portfolio management practices meet industry regulations while reducing the administrative burden on your team.

Top portfolio management platforms for finance teams

Choosing the right portfolio management platform starts with understanding how each solution supports the realities of financial project work. Below is a clear breakdown of the leading tools — what they do well, where they fall short, and which finance PMO challenges they’re best suited to solve.

1. monday work management

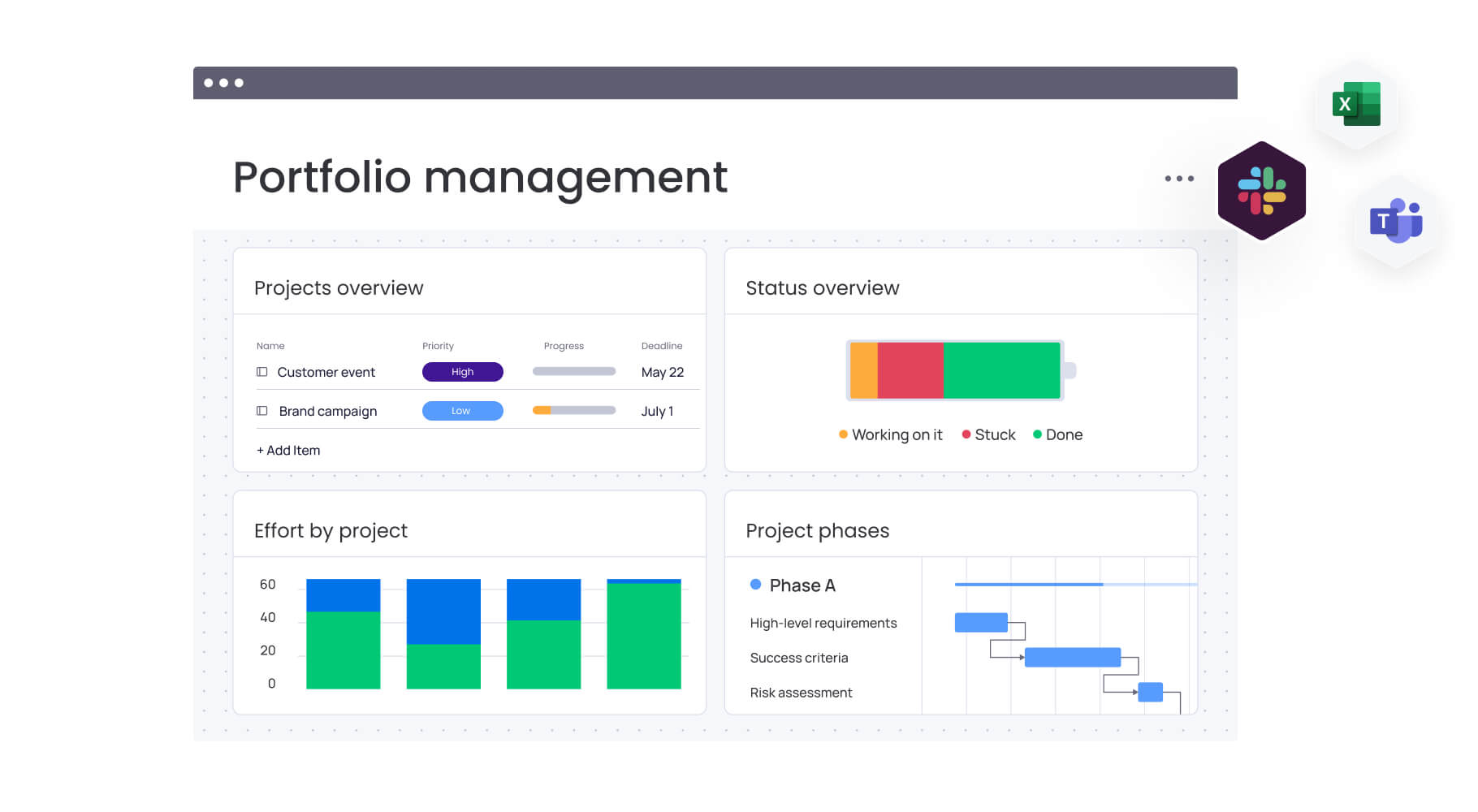

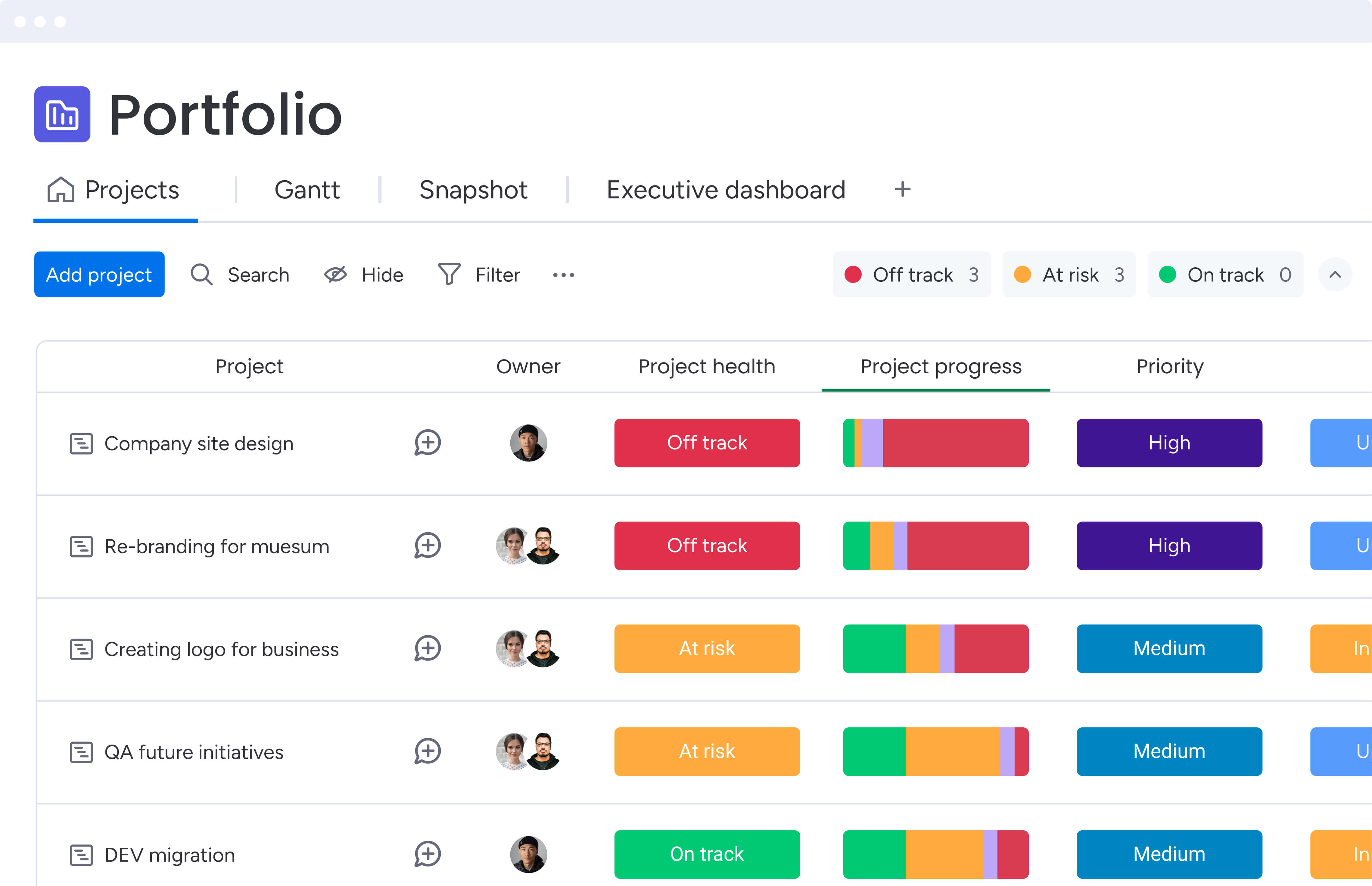

monday work management stands out for finance PMOs through its combination of intuitive design and enterprise-grade capabilities. The platform addresses the core challenge of fragmented project data by providing a single source of truth where PMs track multiple financial projects, monitor budget health, and coordinate resources without switching between tools.

Key strengths for finance teams:

- Portfolio management: connect projects across your organization into unified portfolio views, gaining clarity to optimize dependencies and identify risks.

- AI-powered risk identification: proactively surface risks across projects with AI that analyzes patterns and flags potential issues.

- Resource management: gain visibility into workloads and allocate resources based on skills and availability.

- Automated reporting: generate portfolio-level reports automatically, saving hours on stakeholder updates.

- Integration ecosystem: connect with QuickBooks, Excel, SAP, and 200+ other tools.

Organizations using monday work management report significant efficiency gains. For instance, teams achieve 26% increases in efficiency and save 3+ hours per person weekly through automated workflows and centralized tracking.

2. Smartsheet

Smartsheet appeals to finance teams familiar with spreadsheet interfaces but needing more robust project capabilities. The platform bridges the gap between Excel and full portfolio management.

Key strengths:

- Familiar grid interface reduces learning curve.

- Strong reporting and dashboard capabilities.

- Good integration with Microsoft ecosystem.

- Formula support for complex calculations.

Limitations:

- Resource management requires expensive add-ons.

- Less intuitive for non-spreadsheet users.

- Limited AI capabilities compared to newer platforms.

3. Wrike

Wrike offers comprehensive project and portfolio management with particular strength in workflow automation and collaboration features.

Key strengths:

- Robust workflow automation.

- Strong collaboration tools.

- Good mobile experience.

- Custom request forms.

Limitations:

- Steeper learning curve reported by users.

- Resource management only in higher tiers.

- Can become complex for smaller teams.

4. Microsoft Project

Microsoft Project remains popular in enterprises already invested in the Microsoft ecosystem, offering deep integration with other Microsoft tools.

Key strengths:

- Seamless Office 365 integration.

- Powerful Gantt chart capabilities.

- Familiar interface for Microsoft users.

- Strong desktop application.

Limitations:

- Limited flexibility for custom workflows.

- Requires significant training.

- Less collaborative than modern alternatives.

5. Asana

Asana focuses on team collaboration and task management with portfolio features added for enterprise customers.

Key strengths:

- User-friendly interface.

- Strong team collaboration features.

- Good mobile apps.

- Workflow builder.

Limitations:

- Portfolio features are available in higher-tier plans.

- Limited financial tracking capabilities.

- Less robust for complex project dependencies.

Comparison table: a quick snapshot of the leading finance portfolio tools

Now that you’ve explored how each platform performs in practice, this table brings everything together in one place. Use it as a fast reference to compare strengths, limitations, and best-fit scenarios across the top portfolio management solutions for finance PMOs.

| Platform | Best For | Key Strength | Main Limitation |

|---|---|---|---|

| monday work management | Finance PMOs seeking intuitive, AI-powered portfolio management | Rapid implementation with enterprise capabilities | - |

| Smartsheet | Teams comfortable with spreadsheet interfaces | Familiar grid-based design | Resource management requires add-ons |

| Wrike | Organizations prioritizing workflow automation | Robust automation capabilities | Steeper learning curve |

| Microsoft Project | Microsoft-centric enterprises | Deep Office 365 integration | Limited workflow flexibility |

| Asana | Teams focused on collaboration | User-friendly interface | Portfolio features only in higher tiers |

How to choose the right portfolio management platform for your finance PMO

With dozens of tools claiming to “optimize portfolios,” finance PMOs need a clearer way to separate real value from noise. The steps below give you a practical, finance-specific framework for evaluating platforms — focusing on what truly impacts adoption, visibility, compliance, and long-term scalability.

Step 1: evaluate portfolio management software for your finance PMO

Choosing the right platform isn’t about features alone—it’s about finding what works for your specific team. Use this framework to evaluate what really matters: will your team actually use it, and will it solve your biggest headaches?

Step 2: assess implementation timeline and complexity

Consider how quickly you need the platform operational. Some solutions require months of configuration and training, while others like monday work management enable teams to achieve full value in less than four months.

Key implementation factors:

- Setup requirements: how much configuration is needed before launch?

- Data migration: can you easily import existing project data?

- Training needs: how long before teams become proficient?

- Phased rollout options: can you pilot with one team before scaling?

Step 3: review integration requirements

Your portfolio management platform must connect seamlessly with existing financial systems. Poor integration leads to data silos and manual workarounds that undermine efficiency gains.

Critical integration considerations:

- Native integrations: does it connect directly with your ERP, accounting, and reporting tools?

- API capabilities: can you build custom integrations for proprietary systems?

- Data synchronization: how does information flow between systems?

- Security protocols: do integration methods meet your compliance requirements?

Step 4: calculate total cost of ownership

Look beyond subscription fees to understand the true investment. Hidden costs often emerge during implementation and scaling phases.

Cost components to evaluate:

- License costs: per-user pricing and minimum commitments.

- Implementation services: configuration, training, and onboarding support.

- Add-on features: which capabilities require additional purchases?

- Ongoing support: premium support tiers and their associated costs.

Step 5: verify scalability and flexibility

Make sure your platform can grow as you do — you don’t want to outgrow your solution in 18 months and face the nightmare of migrating hundreds of projects to a new system.

Scalability factors:

- User limits: can it handle your current and projected team size?

- Project capacity: how many projects can it manage effectively?

- Customization options: can you adapt workflows without developer resources?

- Performance at scale: will it maintain speed with thousands of projects?

How to implement portfolio management software in your finance PMO

Choosing a platform is only half the battle — the real impact comes from how you roll it out. These five steps give finance PMOs a proven path to successful adoption, ensuring teams embrace the new system and see measurable value from day one

Step 1: launch with a pilot program for finance portfolio management

Getting portfolio software up and running isn’t just about the technical stuff. These proven practices will help your finance teams actually embrace the platform—so you’ll see real results, not just another tool gathering digital dust.

Step 2: start with a focused pilot program

Launch with a focused group before organization-wide rollout. This approach reduces risk while building internal expertise and momentum for broader adoption.

Pilot program essentials:

- Select a representative team: choose a department managing diverse project types.

- Define success metrics: establish clear goals for the pilot phase.

- Document lessons learned: capture feedback for broader implementation.

- Build internal champions: identify power users who can support expansion.

Step 3: standardize without stifling flexibility

Create consistency while allowing teams to work effectively. The right balance ensures governance without bureaucracy.

Standardization strategies:

- Develop templates: build reusable project structures for common initiatives.

- Establish naming conventions: ensure consistent project and resource identification.

- Define approval workflows: standardize review processes while allowing exceptions.

- Create governance guidelines: document when flexibility is appropriate.

Step 4: focus on change management

The most powerful platform delivers value only when your team embraces it. Put as much energy into helping people adapt as you do into configuring the software itself.

Change management priorities:

- Communicate the “why”: help teams understand benefits beyond compliance.

- Provide role-specific training: tailor learning to different user needs.

- Celebrate early wins: share success stories to build momentum.

- Address resistance directly: understand and resolve adoption barriers.

Step 5: measure and iterate continuously

Continuous improvement ensures long-term success. Regular assessment helps you optimize processes and maximize platform value over time.

Measurement and improvement activities:

- Track adoption metrics: monitor login frequency and feature usage.

- Gather regular feedback: schedule quarterly reviews with key users.

- Refine processes: adjust workflows based on real-world experience.

- Expand gradually: add capabilities as teams become proficient.

Unlock stronger financial portfolio performance with monday work management

Portfolio management software selection shapes how effectively your PMO delivers value. The right platform transforms scattered projects into coordinated execution, manual reporting into automated insights, and resource conflicts into optimized allocation.

For finance PMOs, monday work management offers a compelling combination of intuitive design, enterprise capabilities, and rapid time-to-value. Its AI-powered risk identification, comprehensive resource management, and seamless integrations address the specific challenges of financial project portfolios. Organizations report achieving portfolio visibility within weeks, not months, while saving hours weekly on manual reporting.

Whether you choose monday work management or another platform, prioritize solutions that balance powerful capabilities with user adoption. The most sophisticated features deliver no value if teams won’t use them. Focus on platforms that make portfolio management easier, not just more comprehensive.

Next steps for your PMO:

- Evaluate platforms: against your specific requirements using the framework outlined above.

- Pilot with a focused team: to validate capabilities and build internal expertise.

- Build momentum: through early successes and user feedback.

- Scale gradually: while maintaining focus on adoption and value realization.

Ready to transform how your PMO manages financial portfolios? The right portfolio management software doesn’t just track projects — it enables your organization to execute strategy with confidence and deliver measurable business value.

The content in this article is provided for informational purposes only and, to the best of monday.com’s knowledge, the information provided in this article is accurate and up-to-date at the time of publication. That said, monday.com encourages readers to verify all information directly.

Frequently asked questions

How long does it take to implement portfolio management software in a finance PMO?

The time it takes to implement portfolio management software in a finance PMO varies, but most finance teams achieve full value in less than four months. Organizations report team members becoming comfortable with platforms like monday work management within two weeks to one month, with the intuitive interface and pre-built templates accelerating adoption.

What's the typical ROI for portfolio management software in financial services?

You'll see real ROI from portfolio software in weeks, not months — many PMOs consistently report getting hours back in their week and catching problems before they blow up budgets. Organizations also report saving $50,000+ monthly through improved resource allocation, reducing manual reporting time by hours per person weekly, and achieving 26% increases in team efficiency.

Can portfolio management software handle multi-currency projects?

Yes, leading portfolio management platforms support multi-currency tracking and reporting. You can track budgets in different currencies, set up automatic conversion rates, and generate reports that consolidate financial data across global projects while maintaining accuracy for compliance requirements.

How does portfolio management software integrate with existing financial systems?

Leading platforms offer multiple integration approaches, including native connectors for QuickBooks, SAP, and Excel, API access for custom integrations, and automated data synchronization. For example, monday work management provides 200+ integrations, allowing you to maintain your existing financial tools while gaining centralized portfolio visibility.

What security features should finance PMOs prioritize?

Finance PMOs should look for enterprise-grade security including SOC 2 compliance, role-based access controls, comprehensive audit trails, data encryption, and IP restrictions. These features ensure your portfolio data meets regulatory requirements while maintaining the flexibility teams need to collaborate effectively.

How do you ensure team adoption of new portfolio management software?

Successful adoption starts with choosing an intuitive platform that teams actually want to use. Begin with a pilot program, provide role-specific training, and demonstrate quick wins through automated reporting and reduced manual work. Platforms with high user adoption rates like monday work management typically see teams becoming proficient within weeks rather than months.