Financial project management plays by different rules. Miss a regulatory deadline? That’s a compliance violation. Go over budget? Your project fails. Generic platforms treat these make-or-break requirements as nice-to-haves — leaving you to build critical financial initiatives on shaky ground.

Great Gantt chart software for finance teams doesn’t just show timelines — it connects your budget numbers, regulatory deadlines, and financial reporting in one place where everyone actually works. These specialized platforms connect project schedules directly to financial impact, automate compliance deadline tracking, and provide executive-ready dashboards that eliminate manual reporting overhead. The result is faster project delivery, accurate budget management, and zero compliance oversights.

In this insightful guide, you’ll discover what makes financial project platforms different from the generic tools most teams use. We’ll dig into the features finance teams actually need, share real examples of transformation, and give you a framework for finding software that handles both project execution and financial compliance.

Key takeaways

Financial project managers operate under tighter controls, higher risk, and stricter deadlines than most teams. The most important points to take from this guide focus on the capabilities that actually support accurate, compliant project delivery:

- Connect timelines to financial outcomes: real-time Gantt charts link project schedules directly to budgets, regulatory deadlines, and financial impact.

- Eliminate compliance risk: automated reminders and escalation paths keep audit requirements and filing deadlines on track without manual oversight.

- Replace manual reporting with live dashboards: access instant financial KPIs, budget variance insights, and portfolio health metrics without assembling spreadsheets.

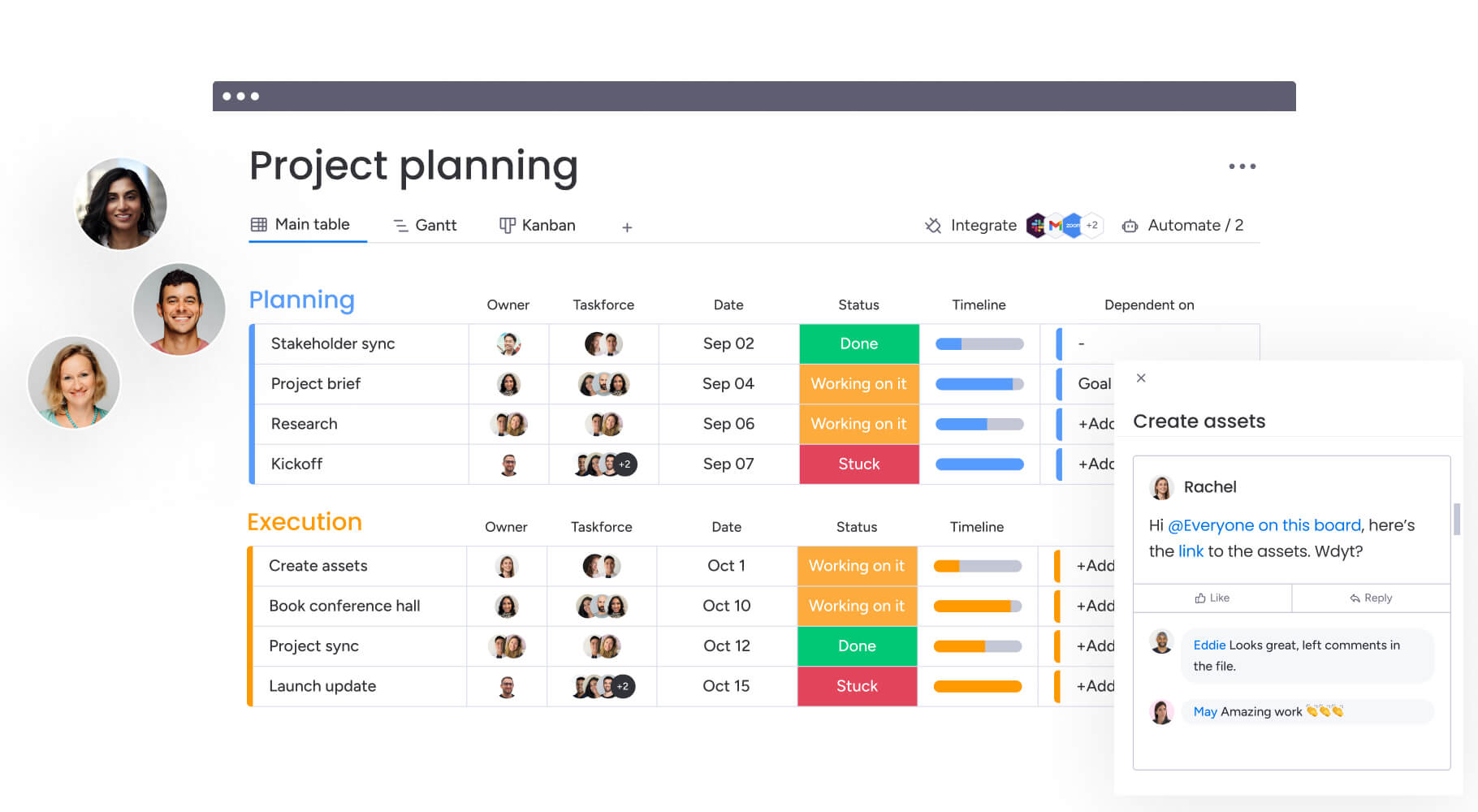

- Centralize financial project data: monday work management unifies timelines, budgets, documentation, and compliance workflows in one trusted source of truth.

- Integrate with your financial systems: seamless connections to ERP and accounting platforms sync budget data automatically and reduce errors.

What makes project managers choose monday work management for financial project delivery?

Financial project management requires more than basic timeline tracking. You essentially need a platform that understands the intricate relationship between project schedules, budget constraints, and regulatory deadlines.

The following capabilities demonstrate why finance teams consistently choose specialized solutions over generic project management platforms.

Centralized workflows replace fragmented financial data

Financial projects cross department lines and touch multiple systems. When your data is scattered across spreadsheets, buried in emails, and trapped in different tools, it’s difficult to track dependencies, which puts regulatory deadlines at risk.

Put your budgets, timelines, and compliance docs in one place, and suddenly everyone can see what matters: current status, financial health, and upcoming regulatory deadlines. You’ll stop jumping between tools and hunting people down for updates.

Real-time visibility across budgets, timelines, and compliance

Most project tools bolt on budget tracking as a feature. But in finance? Budget variance isn’t just a metric — it’s often the difference between success and failure.

When you connect your numbers to your timelines, you see planned vs. actual costs right next to project progress. Your dashboards show you exactly how your entire portfolio is performing financial: not just activity-wise. You can monitor burn rates, identify budget risks early, and adjust resource allocation before overruns occur.

This visibility extends to compliance tracking, where automated alerts ensure all regulatory deadlines are consistently met.

Automated stakeholder reporting for board-ready updates

Your finance execs and board want exact numbers, on time, every time. Pulling those reports manually? That’s hours of your week gone — plus the inevitable spreadsheet errors.

Automating report generation pulls real-time data from across projects to create executive-ready dashboards. These automated reports include financial KPIs, timeline status, and risk assessments. Stakeholders access live dashboards showing project health, budget utilization, and compliance status without waiting for manual updates or scheduled meetings.

Seamless integration with ERP and financial systems

Financial project data rarely exists in isolation. Your Gantt chart software must connect with existing ERP systems, accounting platforms, and financial reporting tools.

Native integrations and API connections sync financial data automatically. Budget updates flow directly from your financial systems into project timelines. Cost allocations, invoice tracking, and financial approvals happen within the same platform where you manage project schedules and resources.

monday work management top features for financial project management

Financial project managers need specialized features that address the unique demands of budget management, regulatory compliance, and stakeholder reporting. Here’s how specific capabilities support financial project complexity and deliver measurable value to your organization.

Gantt charts with financial milestone tracking

Gantt charts in monday work management go beyond basic timeline visualization. They incorporate financial milestones directly into project schedules, showing the relationship between project phases and budget releases, audit deadlines, and financial reporting periods.

Advanced Gantt capabilities include:

- Baseline comparison: track schedule variance alongside budget variance.

- Critical path analysis: highlight activities that directly impact financial deadlines.

- Dependency management: ensure regulatory requirements drive project scheduling.

Dependencies for regulatory deadline management

Regulatory compliance creates non-negotiable deadlines that cascade through financial projects. Dependency features map these requirements across project phases, automatically adjusting timelines when changes occur upstream.

Cross-project dependencies become especially valuable when managing portfolio-level compliance initiatives. The platform tracks dependencies between related financial projects, ensuring that delays in one area don’t create compliance risks elsewhere.

Baseline comparison for budget variance analysis

Financial projects require constant monitoring of planned versus actual performance. The baseline feature captures your original project plan, then tracks variance in both timeline and budget dimensions.

This comparison capability extends beyond simple variance reporting: the platform analyzes trends, identifies patterns in budget overruns, and provides early warning when projects drift from financial targets. Project managers can drill down into specific phases to understand where variances originate.

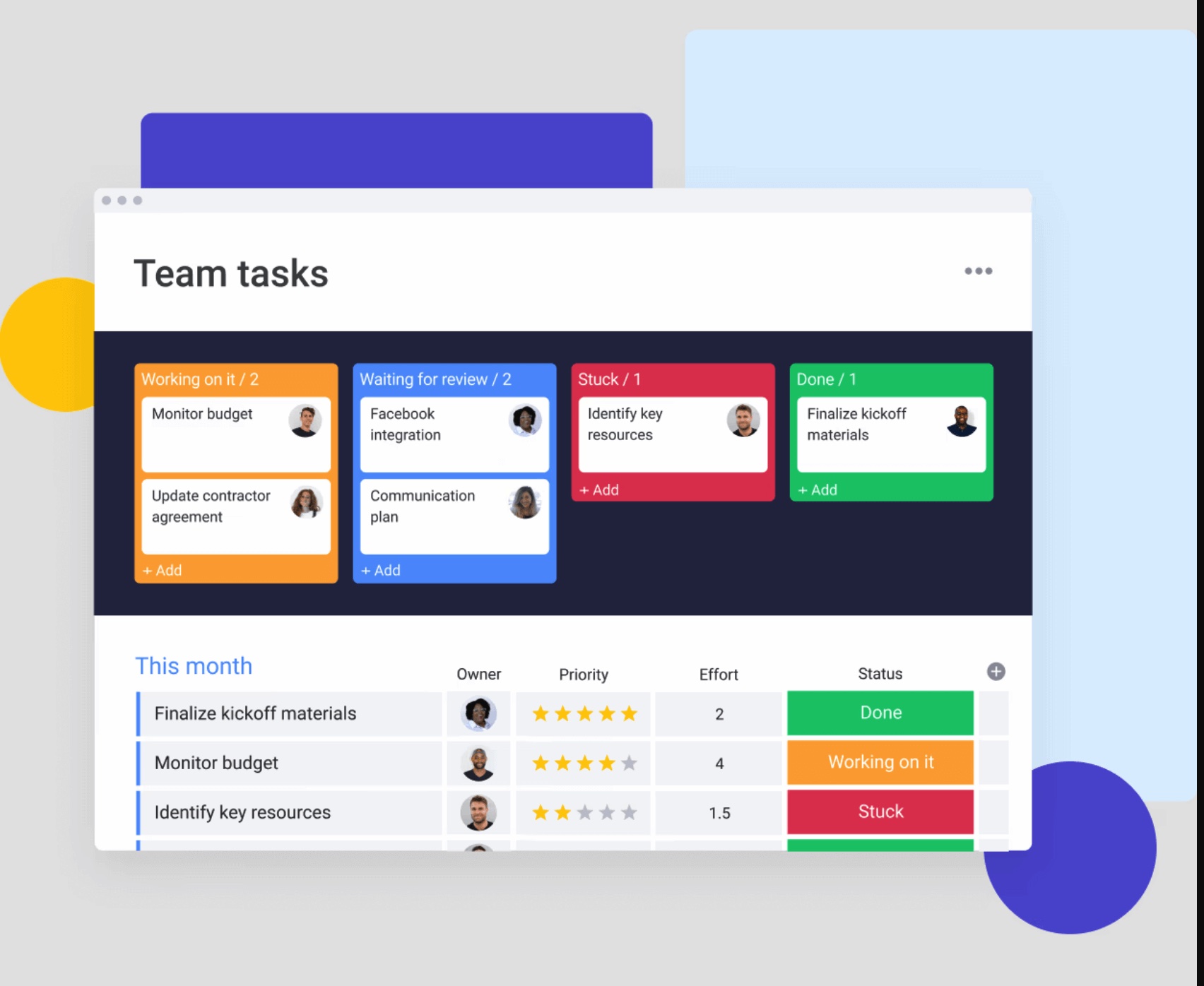

Dashboards and reporting for executive visibility

Executive stakeholders need instant access to portfolio-level financial metrics. Customizable dashboards aggregate data from multiple projects, presenting financial KPIs, timeline status, and risk indicators in real-time.

Your dashboards can show financial data exactly how your stakeholders need to see it:

- Budget burn-down charts: track spending pace against allocated funds

- Cash flow projections: visualize financial impact over time.

- ROI calculations: monitor return on investment metrics.

- Risk heat maps: Identify high-priority issues at a glance.

Updates happen automatically as project data changes. Executives can filter views by department, project type, or financial period without requesting custom reports.

Time tracking integration for cost allocation

Accurate cost allocation requires precise time tracking across project activities. Time tracking integrates directly into project workflows, capturing effort data at the activity level for accurate financial reporting.

This integration enables real-time cost calculations based on actual hours worked. Finance teams can allocate costs to specific cost centers, track billable versus non-billable time, and generate detailed cost reports for audit purposes.

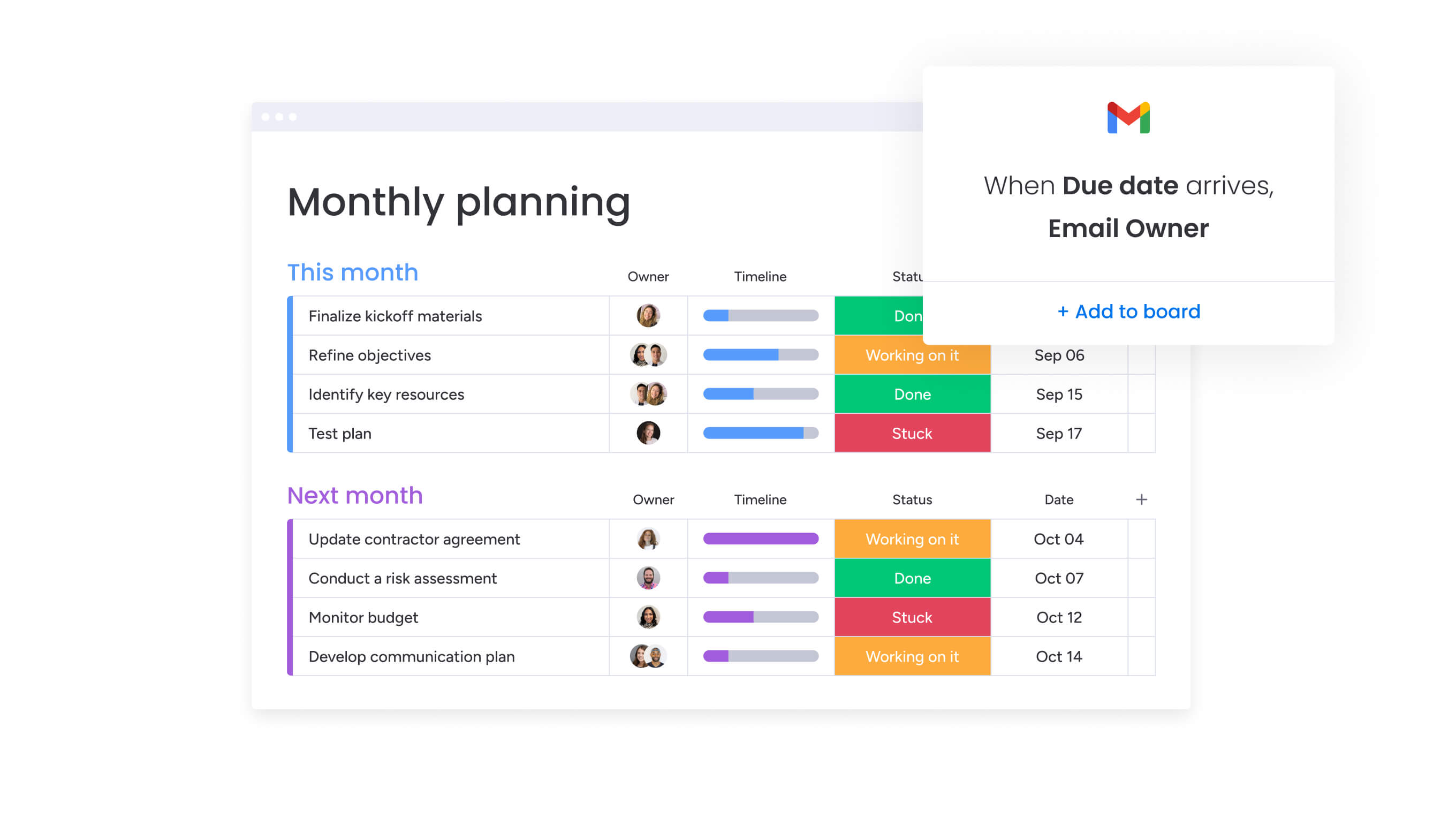

Automations for compliance notifications

Regulatory deadlines don’t wait for manual reminders. The automation engine triggers compliance notifications based on project timelines, helping teams meet all critical filing dates and audit requirements.

These automations extend beyond simple reminders:

- Automatic escalation: notify senior stakeholders when compliance tasks fall behind.

- Audit trail generation: create documentation for regulatory reviews.

- Recurring activities: schedule regular compliance tasks based on regulatory calendars.

Resource management across cost centers

Financial projects often draw resources from multiple cost centers, each with distinct budget constraints. Resource management features track allocation across these boundaries, ensuring accurate cost attribution and preventing budget overruns.

Capacity planning tools help project managers optimize resource utilization while respecting cost center limits. You can visualize resource allocation by financial period, identify underutilized resources, and make data-driven staffing decisions.

Portfolio management for multi-project oversight

Finance departments typically manage multiple concurrent projects with interdependent budgets and shared resources. Portfolio management capabilities provide consolidated views across all financial initiatives.

Portfolio-level dashboards aggregate financial metrics, showing total budget utilization, combined risk exposure, and resource allocation across projects. This bird’s-eye view enables strategic decision-making about project prioritization and resource reallocation.

How a project manager in finance benefits from monday work management

What actually matters isn’t the Gantt chart itself — it’s what it does for your business. Here’s the real impact you’ll see on your projects, your team’s productivity, and your financial accuracy.

Time savings through automated status updates

Automation removes the most time-consuming parts of financial project coordination. Instead of chasing updates or building reports by hand, the platform sends real-time information from your team’s work into the right views and dashboards.

Here is what that looks like in practice:

- Updates flow automatically to the people who need them, without any manual follow-up.

- Reports generate in real time, so teams are not compiling spreadsheets at the end of every week.

- Project managers save five to eight hours each week, reclaiming time for risk planning and stakeholder communication.

- Strategic work becomes the focus, not administrative tasks that slow down delivery.

Cost efficiency with real-time budget tracking

Budget overruns often stem from delayed visibility into spending trends. Real-time budget tracking connects project activities to financial impact immediately.

Financial tracking capabilities help teams identify cost-saving opportunities early. By monitoring burn rates daily rather than monthly, project managers can adjust resource allocation, renegotiate vendor contracts, or modify project scope before budgets are exhausted.

Compliance accuracy via dependency management

Regulatory compliance failures carry significant financial and reputational risks. Dependency management ensures compliance activities remain connected to project timelines, preventing oversight that could lead to penalties.

The platform maintains complete audit trails for all project activities, documenting decision points, approvals, and timeline changes. This documentation proves invaluable during regulatory reviews, reducing audit preparation time and demonstrating compliance rigor.

Productivity improvements from centralized workflows

Centralizing financial project data eliminates the bottlenecks that come from scattered systems and missing information. When everything lives in one place, teams spend less time searching and more time delivering.

The benefits are immediate:

- One workspace for all project information, including documents, budgets, and compliance records.

- No duplicate data entry, which reduces errors and saves hours each week.

- Lower email volume, since updates and conversations stay inside the platform.

- Faster decision-making, because project status and key metrics are always current.

- Quicker project completion, driven by clearer visibility and streamlined coordination.

Output quality through standardized templates

Financial projects require consistency in documentation, reporting, and execution. Managed templates ensure every project follows established best practices while maintaining flexibility for unique requirements.

Standardized templates reduce errors, ensure compliance with internal controls, and accelerate project initiation. New projects launch with pre-configured workflows, automated compliance checks, and standardized reporting structures.

Visibility improvements with executive dashboards

Executive decision-making depends on accurate, timely project information. Executive dashboards provide instant visibility into portfolio health, enabling faster, more informed strategic decisions.

These dashboards eliminate the lag between project events and executive awareness. Leaders can identify troubled projects early, reallocate resources proactively, and adjust strategic priorities based on real-time financial data.

Try monday work managementHow to deliver financial projects on time and on budget with monday work management

Successfully implementing Gantt chart software for financial project management requires a structured approach. These six steps below will guide you through configuring the platform to maximize value for your finance team and ensure consistent project delivery success.

Step 1: centralize project intake and approval workflows

Start by establishing a single entry point for all financial project requests. Create standardized intake forms that capture essential information including budget requirements, compliance considerations, and strategic alignment.

Configure approval workflows that route requests through appropriate stakeholders based on:

- Project size and complexity: larger initiatives require additional approvals.

- Risk level assessment: high-risk projects need senior stakeholder review.

- Financial impact thresholds: budget limits trigger specific approval paths.

Automate notifications to keep approvers informed and establish escalation paths for time-sensitive initiatives. This centralization eliminates duplicate projects and ensures all initiatives align with financial constraints.

Step 2: build Gantt timelines with regulatory milestones

Construct your Gantt charts with regulatory deadlines as fixed anchors. Work backward from compliance dates to establish project phases, ensuring adequate buffer time for reviews and approvals.

Layer financial milestones onto these timelines, marking budget review points, audit dates, and reporting periods. Use color coding to distinguish between flexible project activities and non-negotiable regulatory requirements. This visual hierarchy helps teams prioritize activities that impact compliance.

Step 3: connect budgets to project phases

Link budget allocations directly to project phases within your Gantt charts. Establish cost baselines for each phase and configure alerts when actual spending approaches limits.

Create custom fields to track:

- Committed costs: approved expenses not yet incurred.

- Actual expenses: real-time spending data.

- Remaining budget: available funds by phase.

This granular financial tracking enables early identification of budget risks and supports accurate forecasting throughout project execution.

Step 4: automate compliance deadline notifications

Configure automation rules that trigger notifications well before regulatory deadlines. Set multiple reminder intervals based on task complexity and approval requirements.

Establish escalation protocols that automatically notify senior stakeholders when compliance activities fall behind schedule. Create recurring automations for regular compliance activities like monthly reporting or quarterly reviews. These automated safeguards prevent compliance oversights that could result in penalties.

Step 5: configure executive dashboards for stakeholder reporting

Design dashboards that present financial KPIs in formats familiar to executive stakeholders. Include budget utilization graphs, timeline adherence metrics, and risk heat maps that update in real-time.

Create role-based dashboard views that filter information based on stakeholder needs:

- Board members: portfolio-level financial summaries and strategic metrics.

- Department heads: detailed project metrics and resource allocation.

- Project managers: operational dashboards with task-level visibility.

This targeted information delivery ensures stakeholders receive relevant insights without information overload.

Step 6: track actual vs planned costs in real-time

Implement continuous cost tracking that compares actual expenses against planned budgets daily. Configure variance thresholds that trigger alerts when projects exceed acceptable deviation ranges.

Establish regular checkpoint reviews where teams analyze cost variances and adjust project plans accordingly. Document variance explanations and corrective actions directly within the platform, creating an audit trail for financial reviews.

Comparison table: monday work management vs competing platforms for financial project management

Understanding how different platforms address financial project management needs helps inform your selection decision. This comparison highlights key differentiators across critical evaluation criteria:

| Feature | monday work management | Traditional PPM tools | Generic PM software |

| Financial milestone tracking | Native integration with project timelines | Requires separate financial modules | Limited to basic budget fields |

| Regulatory compliance management | Automated deadline tracking with escalations | Manual configuration required | No specialized compliance features |

| ERP integration | Pre-built connectors and open API | Limited to specific ERP vendors | Basic import/export only |

| Real-time budget variance | Automatic calculation with alerts | Batch processing delays | Manual calculation required |

| Executive dashboard customization | No-code configuration for finance KPIs | IT support needed for changes | Generic templates only |

| Audit trail documentation | Complete activity history with compliance notes | Separate audit log systems | Basic change tracking |

| Resource cost allocation | Multi-dimensional tracking across cost centers | Single cost center focus | Hours tracking only |

| Portfolio financial rollup | Automatic aggregation across projects | Manual consolidation required | Project-level only |

How Playtech's PMO department transformed their project delivery

Want to see what success looks like? Playtech’s story shows exactly what happens when you pick the right platform for financial projects — and gives you a blueprint you can follow.

The challenge

Playtech’s PMO department struggled with fragmented project data across multiple systems. Financial information lived in spreadsheets, project timelines in separate tools, and compliance tracking in email threads.

The fragmentation created multiple operational challenges:

- Manual reporting overhead: project managers spent hours compiling status reports for stakeholders.

- Budget visibility gaps: tracking lagged behind actual spending, leading to frequent overruns.

- Compliance risks: regulatory deadlines managed through individual calendars created oversight risks.

- Decision-making delays: executives made decisions based on outdated information.

The solution

Playtech implemented monday work management to unify their project management approach. The PMO team configured the platform to address their specific financial project needs.

They established standardized project templates incorporating financial milestones and compliance checkpoints. Gantt charts were configured to show dependencies between regulatory requirements and project phases. Automated workflows replaced manual status collection, generating real-time reports for stakeholders.

The team integrated monday work management with their existing financial systems, enabling automatic budget updates and cost tracking. Custom dashboards provided executives with instant visibility into portfolio health and financial metrics.

The results

Playtech’s transformation delivered measurable improvements across multiple dimensions. Communication and coordination with stakeholders improved significantly, as noted by Yossi Shamir, Head of Projects.

Key outcomes included:

- Faster delivery: project completion times decreased through elimination of manual coordination activities.

- Budget accuracy: real-time tracking reduced overruns and improved financial forecasting.

- Zero compliance incidents: automated deadline management eliminated regulatory oversights.

- Executive satisfaction: leaders gained instant access to accurate project information.

- Capacity expansion: the PMO team now manages twice the project volume with the same headcount.

Ready to transform your financial project management?

Financial project management demands precision, compliance rigor, and real-time visibility across budgets and timelines. The right Gantt chart software transforms these challenges into competitive advantages through centralized workflows, automated reporting, and intelligent dependency management.

Intelligent solutions like monday work management deliver the specialized capabilities finance teams need. From regulatory deadline automation to real-time budget variance tracking, the platform connects financial milestones directly to project timelines and provides executive-ready dashboards. Project managers deliver projects on time, on budget, and in full compliance while gaining the strategic visibility needed to drive continuous improvement.

Transform scattered financial project data into streamlined execution that drives measurable business outcomes today. Experience how monday work management enables finance teams to move from reactive project management to proactive strategic execution.

The content in this article is provided for informational purposes only and, to the best of monday.com’s knowledge, the information provided in this article is accurate and up-to-date at the time of publication. That said, monday.com encourages readers to verify all information directly.

Try monday work managementFrequently asked questions

How do Gantt charts improve financial project delivery?

Gantt charts improve financial project delivery by visualizing the relationship between project timelines, budget milestones, and regulatory deadlines in a single view. They enable project managers to identify dependencies, track critical paths, and ensure compliance requirements drive scheduling decisions.

Can Gantt chart software integrate with ERP systems?

Yes, Gantt chart software can integrate with ERP systems through APIs, pre-built connectors, or data synchronization tools. monday work management offers native integrations with major ERP platforms, enabling automatic budget updates, cost tracking, and financial data synchronization without manual data entry.

What security certifications should I look for in Gantt platforms?

Look for Gantt tools with SOC 2 Type II certification, ISO 27001 compliance, and GDPR adherence for financial project management. Additional considerations include encryption at rest and in transit, role-based access controls, audit logging, and single sign-on capabilities.

How much time can finance teams save with Gantt chart software?

Finance teams typically save five to eight hours weekly per project manager through automated reporting, status updates, and workflow standardization. Additional time savings come from reduced meeting requirements, faster decision-making through real-time visibility, and elimination of manual data consolidation tasks.

Is Gantt chart software suitable for regulatory compliance projects?

Gantt chart software is highly suitable for regulatory compliance projects when it includes dependency management, automated notifications, and audit trail capabilities. monday work management specifically addresses compliance needs through automated deadline tracking, escalation workflows, and complete documentation of project activities.

What's the typical learning curve for finance professionals?

Finance professionals typically achieve basic proficiency with intuitive Gantt chart software within one to two weeks, with full adoption occurring within a month. monday work management accelerates this timeline through intuitive interfaces, pre-built finance templates, and no-code configuration that doesn't require technical expertise.