Venture capital relies on strong relationships, efficient operations, and well-executed investment strategies. With high stakes and fast-paced decision-making, a CRM for venture capital simplifies complex processes, aligns teams, and reduces the risk of missed opportunities.

These platforms serve as a centralized source of truth for key data, cutting down on hours spent on repetitive tasks and offering powerful tools for contact management and relationship intelligence. They empower teams to organize, monitor, and refine their deal pipelines while focusing on essential priorities, such as building meaningful connections with limited partners and securing investment opportunities.

Managing workflows and tracking interactions becomes straightforward with these systems. Platforms like monday CRM deliver tools that adapt to the needs of venture capital investors, including customizable dashboards and automation. These features make CRMs an indispensable resource for businesses navigating the unique demands of venture capital.

What is a venture capital CRM?

A venture capital CRM is a customer relationship management platform built to address the specific challenges faced by venture capital businesses. These tools are designed to support the entire investment cycle, from sourcing opportunities to managing portfolio companies and fostering relationships with investors and limited partners.

Unlike general-purpose CRMs, these systems emphasize relationship-driven workflows, enabling venture capital investors to effectively manage interactions with entrepreneurs, co-investors, and stakeholders. They prioritize collaboration and data-driven decisions based on comprehensive venture capital details.

Core capabilities include:

- Pipeline management: Organize and visualize deal pipelines with stages tailored to your investment workflow, providing clarity and helping teams prioritize opportunities effectively.

- Relationship tracking: Centralize key details, past interactions, and follow-ups, allowing firms to nurture investor relationships and strengthen their networks.

- Automation and data enrichment: Minimize manual data entry through automation and enrich contact records to gain valuable insights into potential opportunities and partnerships.

Venture capital CRMs provide the tools needed to track venture capital deals, strengthen relationships with investors, and make informed investment decisions. They help firms remain organized and prepared to act quickly in competitive markets.

Top 5 venture capital CRM solutions

Choosing the right CRM can change how venture capital firms manage relationships, monitor deals, and improve workflows. Below is an overview of five top venture capital CRM platforms, highlighting what each does best and their pricing.

| CRM platform | Best for | Starting price |

|---|---|---|

| monday CRM | Customizable workflows and collaboration | $10/user per month |

| Affinity | Relationship-driven deal sourcing | $125/user per month |

| DealCloud | Tailored investment workflows | Custom pricing |

| Salesforce | Versatile customization for larger firms | $25/user per month |

| Navatar Edge | Financial services and portfolio tracking | Custom pricing |

1. monday CRM

Best for: Customizable workflows and collaboration

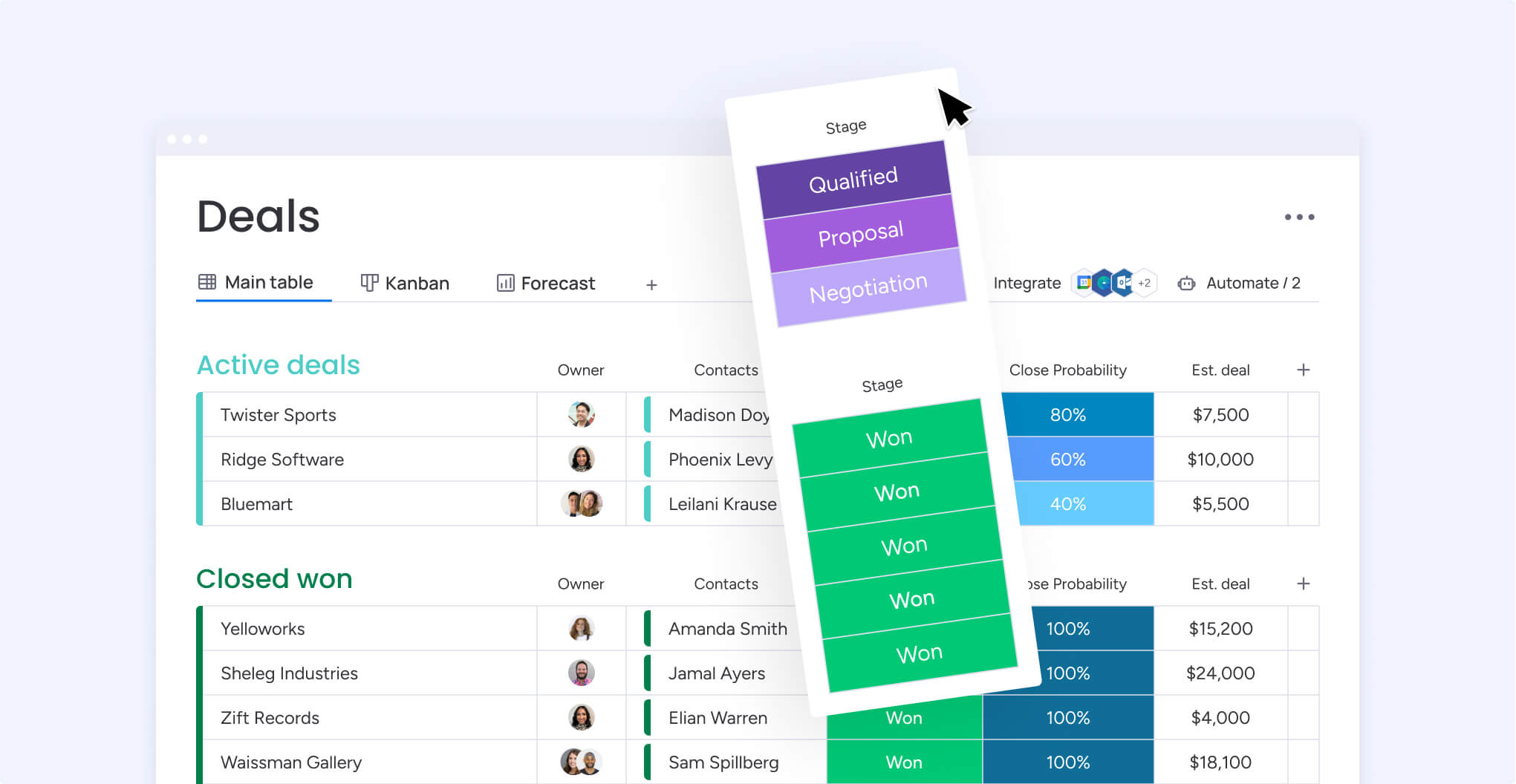

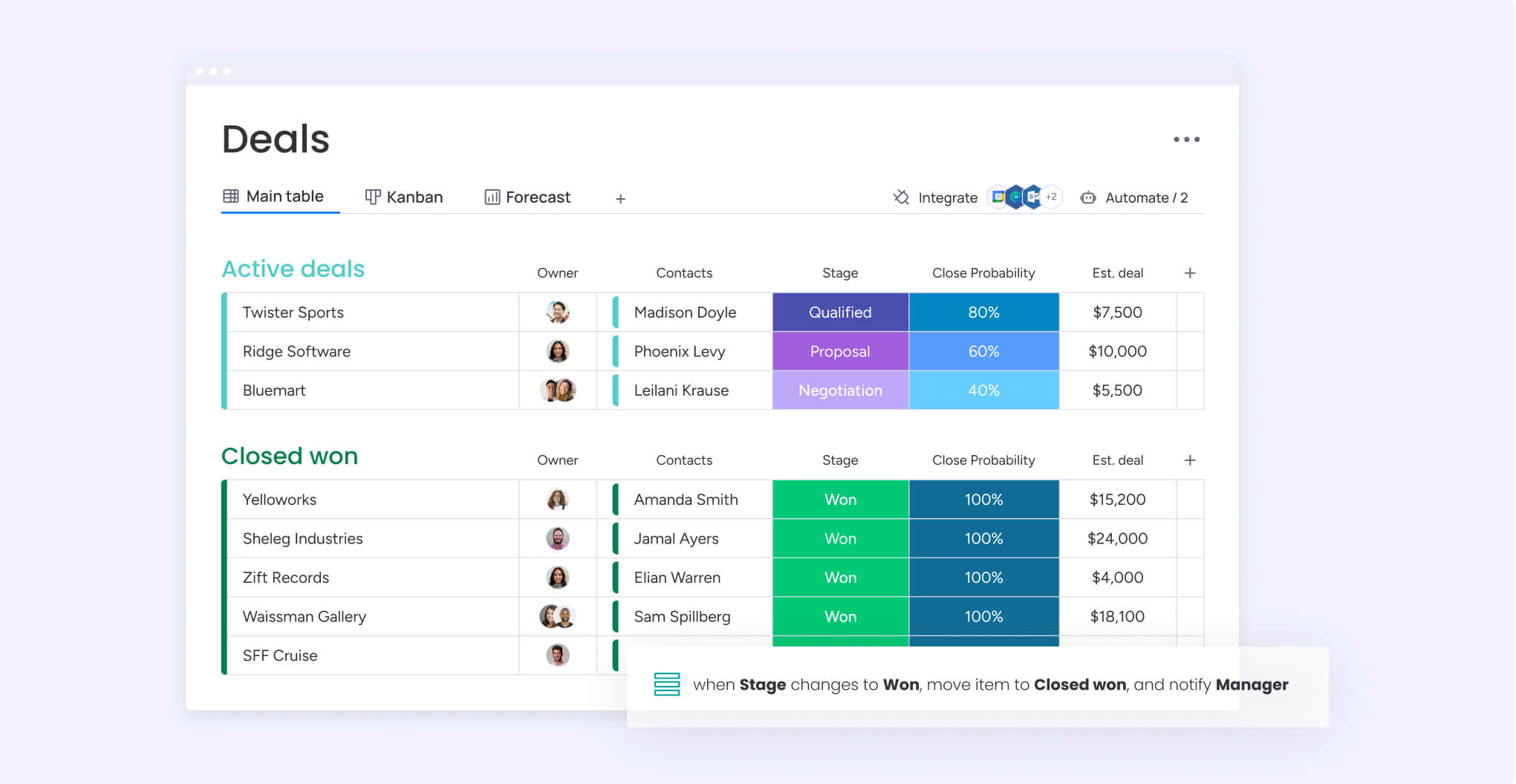

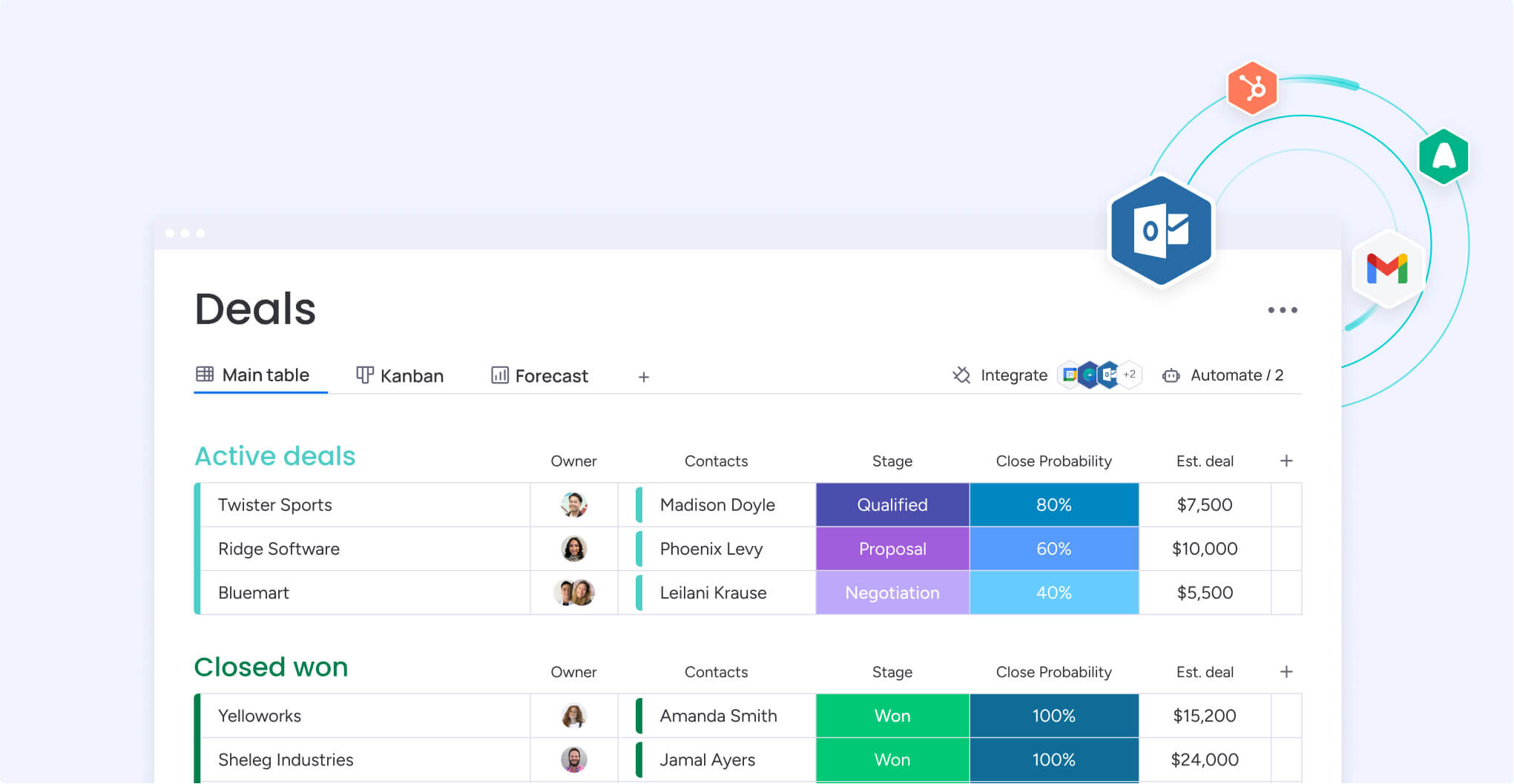

monday CRM is a flexible platform designed to streamline venture capital workflows and promote team collaboration. It supports the entire deal process with customizable pipelines, helping teams visualize progress from sourcing to closing. Drag-and-drop functionality and color-coded labels simplify organization and prioritization.

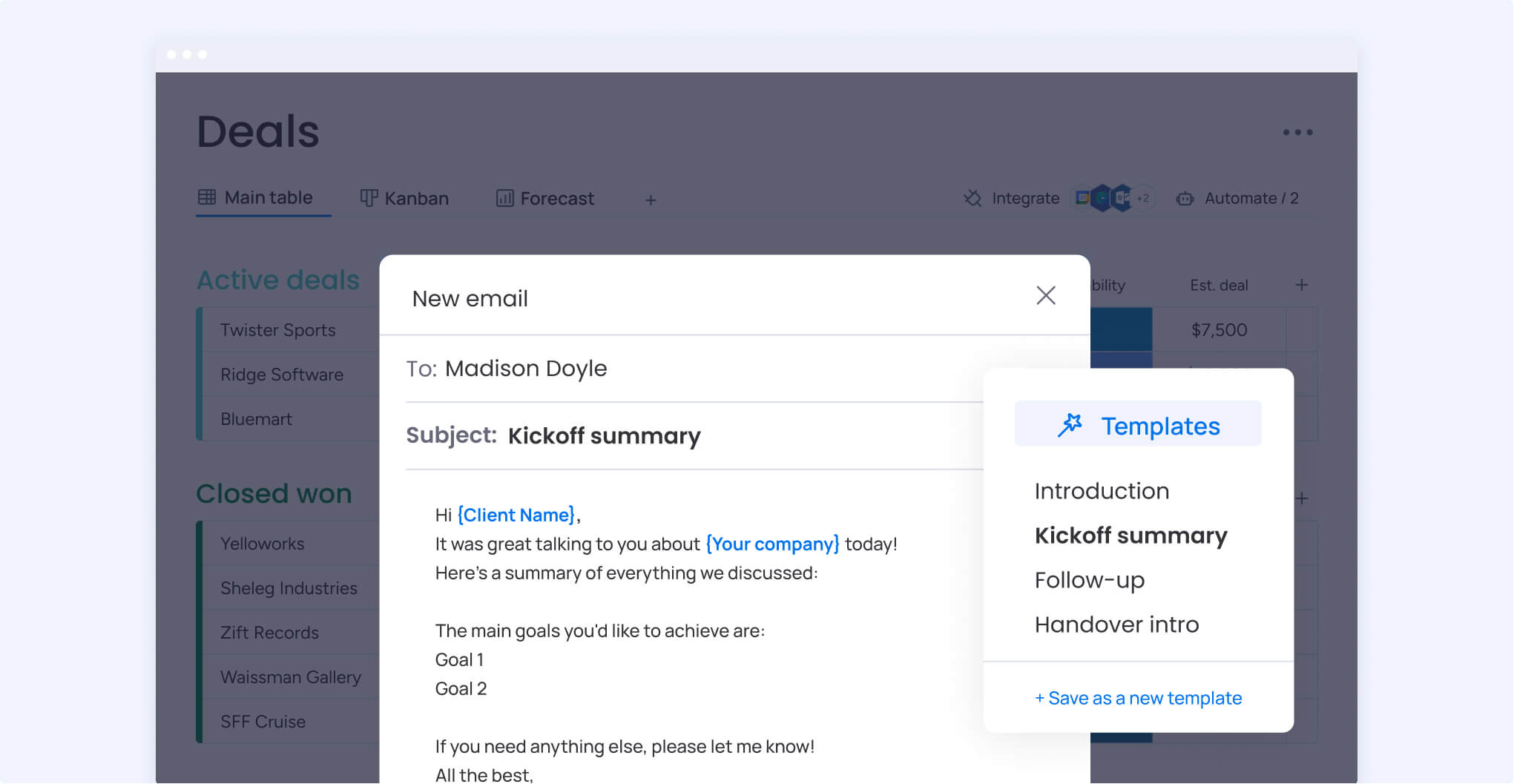

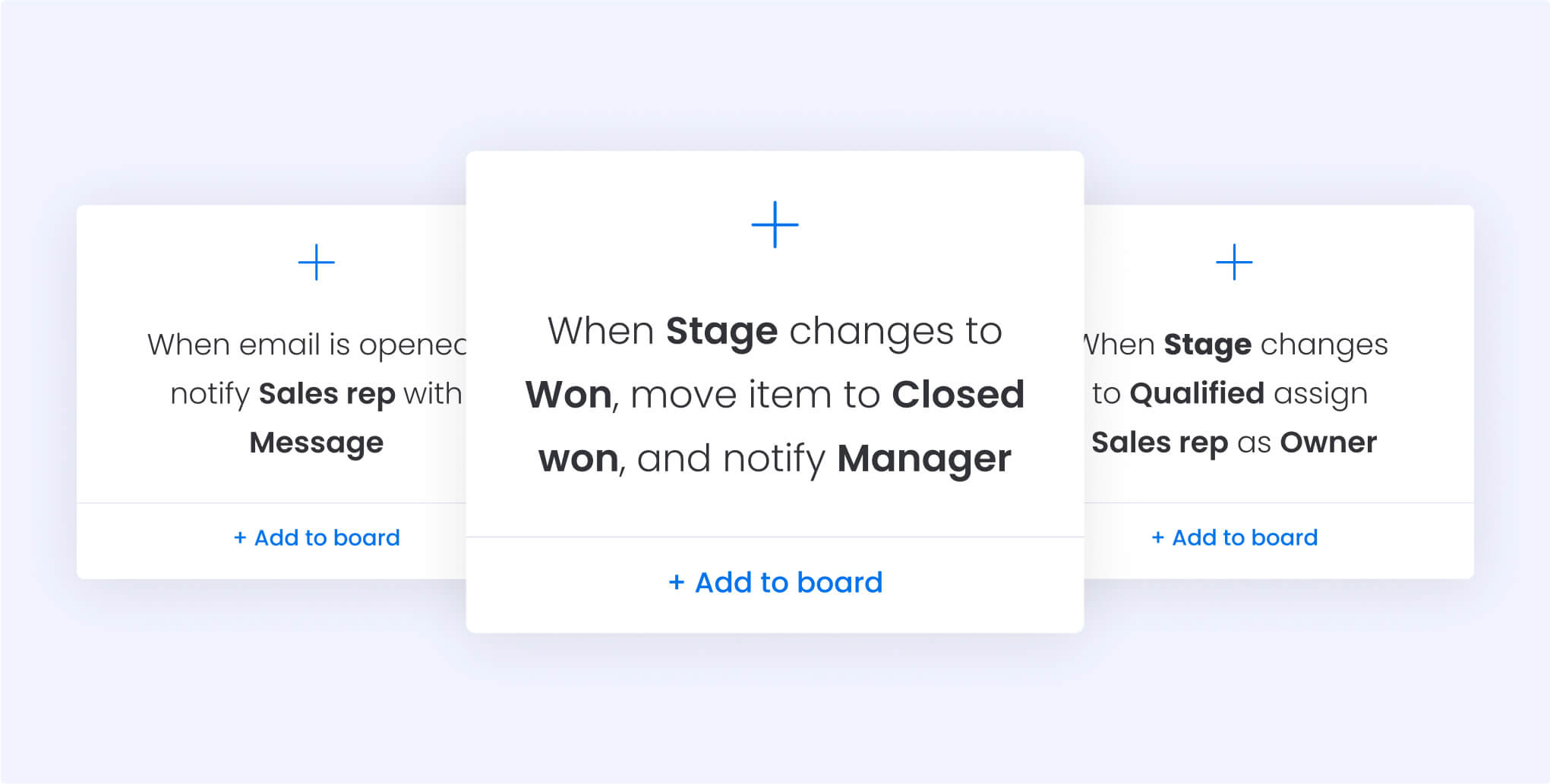

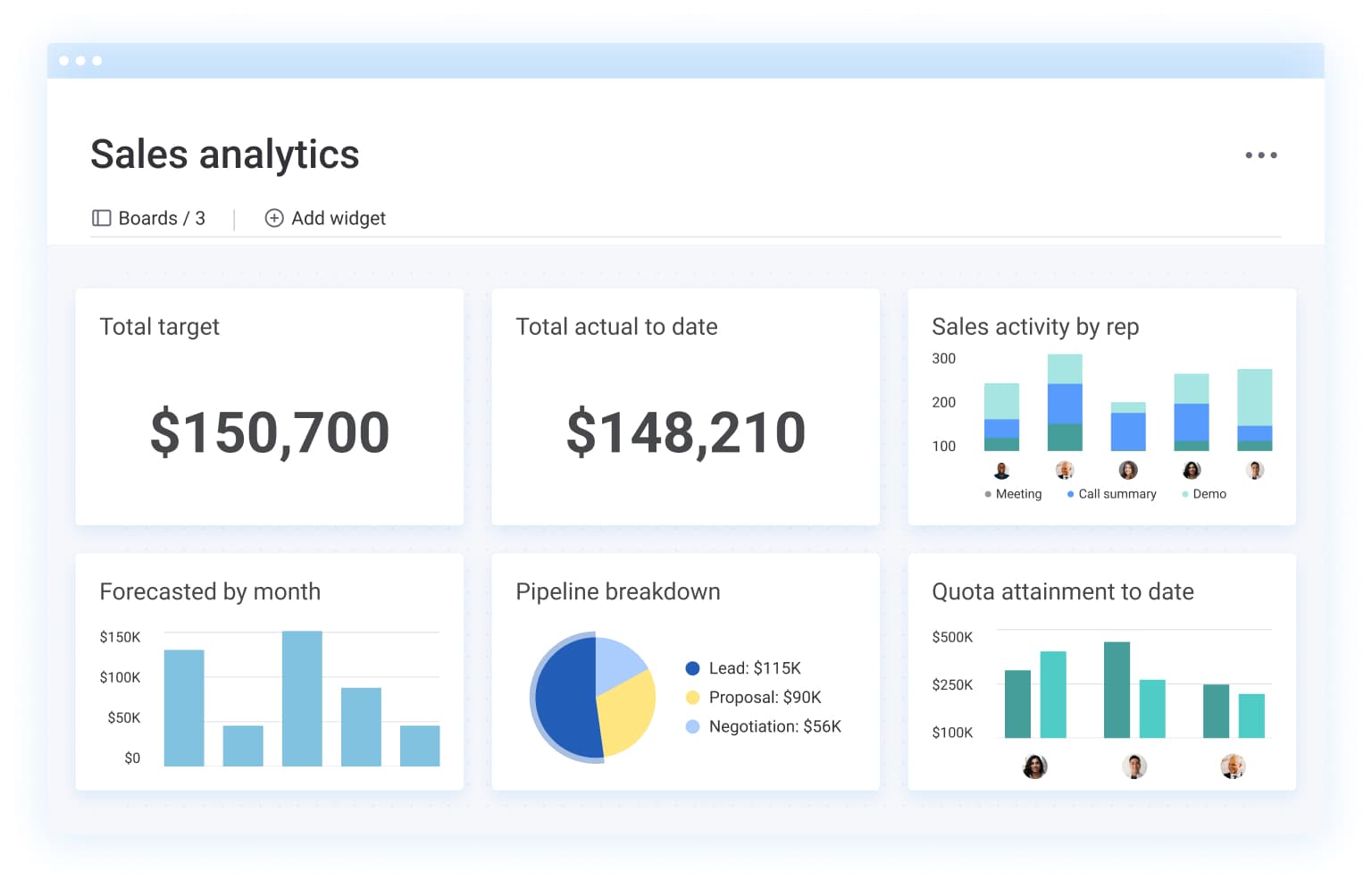

The platform’s automation tools reduce repetitive tasks like data entry and follow-ups, allowing teams to focus on key opportunities. monday CRM also logs all communications automatically, keeping deal records comprehensive and easy to access. Dashboards provide clear metrics on deal progress and team activity, helping firms make data-driven decisions.

monday CRM integrates with tools like Slack and Google Drive, promoting efficient collaboration across teams. The no-code interface makes it simple for teams to adjust workflows, encouraging broad adoption and enabling quick onboarding. Flexible pricing options make the platform accessible for firms of all sizes, with room to scale as teams expand.

Key features:

- Customizable deal pipelines with drag-and-drop functionality

- Automation for data entry, follow-ups, and reporting

- Integrations with tools like Slack and Google Drive

- Dashboards for real-time tracking and analysis

- No-code interface for quick setup and adjustments

Pricing: Starts at $10/user per month, with advanced plans available for larger teams.

2. Affinity

Best for: Relationship-driven deal sourcing

Affinity is an AI-powered CRM specifically designed for relationship-driven industries like venture capital. It supports teams in managing intricate networks and optimizing deal sourcing. The platform’s advanced relationship tools analyze connections across a firm’s network, helping identify the most promising paths for introductions.

Affinity captures data automatically from emails and calendars, reducing the need for manual entry and keeping information accurate and up to date. Its customizable pipeline views allow teams to organize and visualize opportunities according to their specific needs. Comprehensive reporting features provide a clear picture of performance metrics, helping firms make informed decisions and prioritize effectively.

Key features:

- AI-powered relationship scoring and analysis

- Automated data capture from emails and calendars

- Configurable deal pipeline views

- Real-time performance tracking and reporting

- SOC2, GDPR, and CCPA-compliant data security

Pricing: Starts at $125/user per month. Contact for custom pricing.

3. DealCloud

Best for: Tailored investment workflows

DealCloud is a cloud-based CRM developed for capital market professionals, offering specialized tools for managing complex investment processes. It organizes deal, contact, and organizational data in one place, giving teams a centralized hub for all key information.

Customizable dashboards allow firms to track progress across pipelines and generate detailed reports for internal and external stakeholders. Integration with Microsoft Outlook ensures communications are logged automatically, keeping records accurate and eliminating redundant tasks. DealCloud is particularly well-suited for firms seeking tailored solutions to support intricate workflows.

Key features:

- Advanced deal and pipeline management capabilities

- Centralized repository for contacts, organizations, and deals

- Flexible dashboards and comprehensive reporting tools

- Microsoft Outlook integration for automated email logging

Pricing: Custom pricing based on team size and features.

4. Salesforce

Best for: Versatile customization for larger firms

Salesforce is a widely recognized CRM platform known for its extensive customizability and robust capabilities. Although not specifically designed for venture capital, its flexibility and scalability make it a viable option for larger firms with technical resources to configure the platform to their unique needs.

The platform excels in contact and account management, tracking every interaction with multiple stakeholders. Automation features reduce manual tasks, while its extensive library of third-party integrations broadens functionality. Salesforce supports the creation of custom applications and dashboards to analyze deal pipelines, team activity, and overall performance.

Key features:

- Comprehensive tools for contact and account management

- Workflow automation to simplify repetitive tasks

- A wide range of third-party integrations (e.g., Slack, Mailchimp)

- Customizable dashboards and applications for in-depth data analysis

Pricing: Starts at $25/user per month for basic plans, with advanced plans scaling up to $300/user per month.

5. Navatar Edge

Best for: Financial services and portfolio tracking

Navatar Edge is a Salesforce-based CRM created for financial services industries, including venture capital. It combines the reliable Salesforce infrastructure with features tailored to managing deals and portfolios.

Navatar provides secure collaboration workspaces where teams can share documents and updates. Its portfolio tracking tools enable firms to monitor investment performance effectively. Dashboards offer visibility into current and historical data, helping teams make better decisions. Integration with platforms like HubSpot and Google Drive enhances communication and supports data sharing.

Key features:

- Secure collaborative workspaces for deal management

- Tools for portfolio performance tracking and reporting

- Integration with platforms like HubSpot and Google Drive

- Customizable dashboards for detailed analytics

Pricing: Custom pricing available upon request.

Benefits of using a venture capital CRM

Venture capital CRMs are designed to simplify relationship-driven workflows and dynamic deal management. These systems provide the structure and tools needed to support investment strategies, optimize venture capital operations, and maintain strong networks.

Unique requirements of venture capital CRMs

Venture capital businesses require tailored tools to handle intricate workflows and relationships with investors. General-purpose CRMs often fail to address these complexities, making a dedicated CRM essential. A venture capital CRM must:

- Provide pipeline visibility: Offer tools to visually track deal stages and align team priorities throughout the entire investment cycle.

- Focus on relationship intelligence: Highlight valuable insights into key connections, facilitating introductions and strengthening relationships with limited partners and other stakeholders.

- Support custom data fields: Enable detailed tracking of venture capital details unique to the firm’s deals or industries.

- Simplify collaboration: Provide an intuitive interface that integrates with existing tools, encouraging adoption across teams and improving communication.

monday CRM fulfills these needs with a no-code platform that combines powerful tools for contact management, reduced manual data entry, and enhanced organization. It helps firms build relationships with investors, manage their portfolio companies effectively, and succeed in their venture capital operations.

Must-have features in venture capital CRM software

The best venture capital CRM combines robust features with adaptability, serving as a source of truth for modern firms. These tools streamline venture capital operations and support informed investment decisions throughout the diligence process and beyond.

- Pipeline and deal management: Customizable views allow firms to organize venture capital deals at every stage, from initial contact to closing. Logging all communication history ensures transparency and provides a clear record for future reference. This clarity helps teams align on priorities and stay focused on their investment strategy.

- Relationship-focused tools: Advanced tools identify warm leads and evaluate the strength of connections, making it easier to nurture valuable relationships. Capturing and reviewing interactions across the network enables firms to uncover new investment opportunities and build stronger partnerships.

- Automated data capture and enrichment: Automating manual data entry reduces errors and saves time, allowing teams to focus on high-value activities. Enriching contact and organizational data provides a deeper understanding of venture capital deals, equipping firms to make well-informed investment decisions.

- Collaboration tools: Real-time updates and integrations with platforms like Slack and Google Drive keep teams connected throughout the diligence process. A cohesive workflow across departments fosters better communication and smooth venture capital operations.

- Custom analytics and reporting: Dashboards built to track KPIs for deals, partners, and fund performance give firms a clear view of progress and outcomes. Identifying trends and patterns in the data helps refine investment strategies and prioritize future efforts.

These features empower venture capital firms to maintain strong networks, evaluate investment opportunities with precision, and optimize their overall investment strategy. With the right CRM, teams can confidently manage venture capital deals while supporting collaboration and efficient operations.

How monday CRM stands out as a venture capital CRM

Focus on deal flow management

monday CRM provides clear visibility into deal pipelines, helping teams standardize and track deal stages. Its Kanban boards and customizable views simplify how firms manage opportunities. Color-coded statuses make it easy to highlight high-priority deals, while drag-and-drop functionality allows users to move deals between stages efficiently.

Centralized communication logging keeps all emails, calls, and notes connected to specific deals in one place. This feature allows teams to see both a comprehensive view of the entire pipeline and a detailed look at individual deals, helping decision-makers stay organized and aligned.

Ease of use and collaboration

The no-code interface is designed for quick adoption, making it accessible for teams without technical expertise. Integrations with tools like Slack and Google Drive simplify how updates, files, and other information are shared, keeping communication organized and accessible to all team members. Partners and associates can easily collaborate, ensuring everyone stays aligned on priorities and workflows.

Advanced automation and data consistency

monday CRM reduces manual work by automating tasks like communication logging and follow-up reminders. These capabilities help reduce errors and maintain clean, accurate records. Teams can establish and reuse standardized workflows, which simplifies scaling operations as the firm grows.

Customizable analytics and insights

Real-time dashboards let teams monitor key metrics such as deal performance and partner activity. Customizable analytics help users spot trends and make informed decisions based on clear data. These tools allow firms to refine strategies and respond effectively to challenges in fast-moving markets.

Budget-friendly design

Flexible pricing options make monday CRM a practical choice for teams of various sizes. Its intuitive design eliminates unnecessary complexity, helping firms allocate resources efficiently while improving productivity.

Why the right CRM matters for venture capital success

A venture capital CRM is more than a tool—it’s a strategic partner that supports the success of your investment firm. From managing relationships with investors and tracking venture capital deals to streamlining operations and optimizing the entire investment cycle, the right CRM empowers teams to stay organized and make informed investment decisions.

Platforms like monday CRM stand out by offering powerful tools that adapt to your unique workflows, reduce manual data entry, and strengthen collaboration. With the right CRM, venture capital firms can focus on building lasting relationships, seizing valuable opportunities, and driving their investment strategy forward.

FAQs

What is CRM in venture capital?

A CRM in venture capital is a tool designed to manage relationships, track deals, and support workflows for investment firms. It centralizes data, facilitates collaboration, and helps teams make informed decisions.

What is the best CRM for VC fundraising?

The best CRM for VC fundraising depends on a firm’s needs. monday CRM is a great option for teams that value customizable workflows and collaboration, while Affinity specializes in relationship-focused features.

How do venture capital CRMs help VCs manage their operations?

Venture capital CRMs simplify operations by automating repetitive tasks, organizing data, and offering tools for collaboration and reporting. These features keep teams focused on high-priority activities and improve overall efficiency.

What is the best CRM for startups?

Startups benefit from CRMs that are flexible and easy to use. monday CRM is a strong choice for growing teams that need adaptable tools to optimize workflows and scale operations effectively.